Category Archive: 4) FX Trends

FX Daily, July 18: Dollar Dumped on Doubts on US Economic Agenda

News of the defection of two more Republican Senators doomed the Senate attempt to replace and repeal America's national health care. The failure to replace the system dubbed Obamacare, despite the Republican majority in both legislative chambers and the executive branch raises questions about the broader strategy of the Administration and raises serious questions about the rest of its legislative agenda.

Read More »

Read More »

FX Daily, July 17: Markets Mark Time, Dollar Consolidates Losses

After falling to new lows for the year against several major currencies in response to disappointing retail sales and uninspiring CPI before the weekend, the US dollar has begun the new week on a more stable note. It is firmer against nearly all the major currencies, though is mixed against the emerging market currencies.

Read More »

Read More »

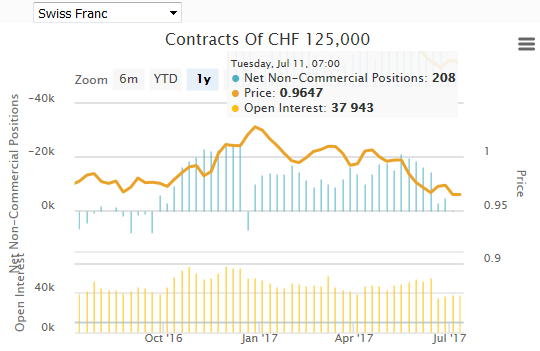

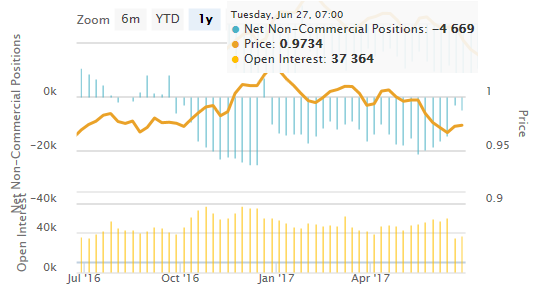

Weekly Speculative Positions (as of July 11): Speculators Switch to CHF Long against USD

The net long CHF position has risen from 0.1K short to 0.2K contracts short (against USD). Speculators are long EUR against both USD and CHF. We wonder how long this will be the case, given that we expect Euro zone inflation to fall under 1% from December 2017 onward.

Read More »

Read More »

FX Weekly Preview: Focus Shifts from Fed to ECB

Market has downgraded chances of a September hike from low to lower, but the chances of a December hike are higher than the day after the June hike. ECB meeting is the most important event of the week. A small change in the risk assessment is likely. The US and Europe have been more disruptive to the global capital markets this year than China.

Read More »

Read More »

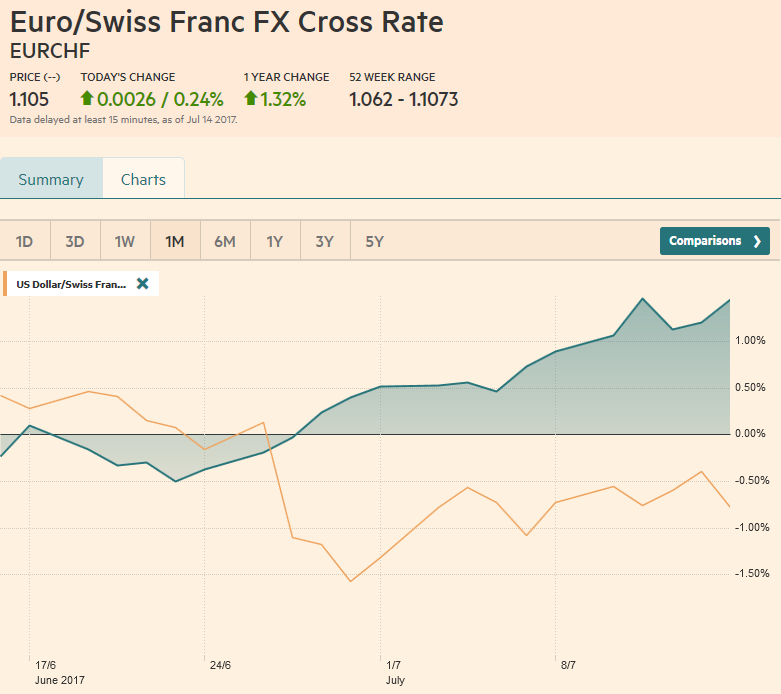

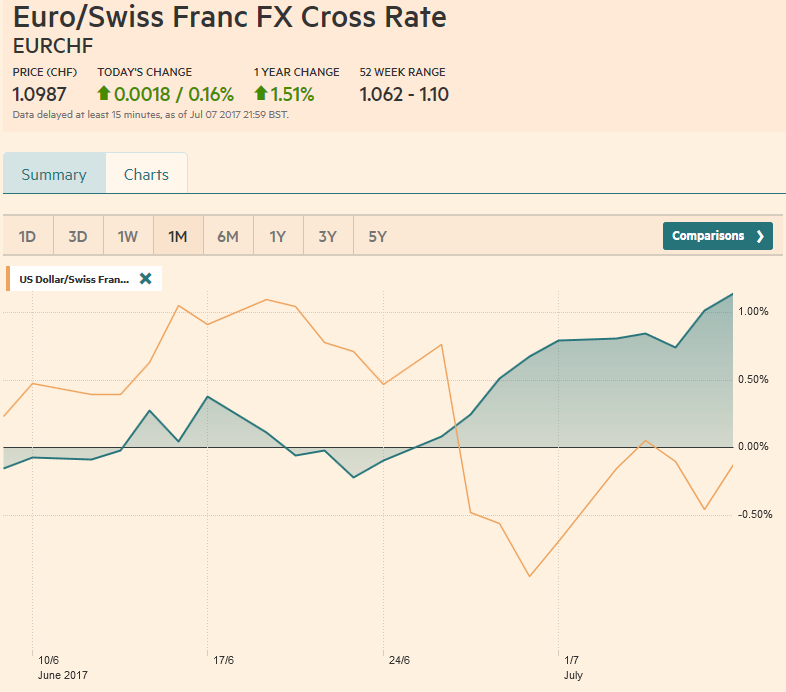

FX Weekly Review, July 10 – July 15: CHF Winning against USD, but losing vs. Euro

The Euro remained the strongest among EUR, CHF and USD during the last month.

The Swiss lost against EUR 1.5%, while it gained versus the dollar 0.75%.

Read More »

Read More »

Great Graphic: Dollar Index Bottoming?

The Dollar Index set the year's high on January 3 a little above 103.20. Today it made a marginal new lows for the year at 95.464. The previous low, set at the end of last month was 95.47.

Read More »

Read More »

FX Daily, July 14: Aussie Scales New Highs for the Year, as the Greenback Remains on the Defensive

The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week's gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is up 1.1% this week, in comparison.

Read More »

Read More »

FX Daily, July 13: Sterling and Antipodeans Trade Higher

The US dollar is mostly consolidating yesterday's move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month's MPC meeting.

Read More »

Read More »

FX Daily, July 12: Currencies Stabilize, but Yen Strengthens

The US dollar and sterling have stabilized after being sold off yesterday. The yen, which had begun recovering from a four-month low, is the strongest of the major currencies today, gaining around 0.5% against the dollar (@~JPY113.40).

Read More »

Read More »

Great Graphic: Aussie is Approaching 15-month Trendline

This Great Graphic, made on Bloomberg, depicts the Australian dollar since April 2016. We drew in the trendline from that April high, through the November high and the March 2017 high. It nearly catches last month's high as well. It comes in now near $0.7725.

Read More »

Read More »

FX Daily, July 11: Markets Looking for Next Cue

Investors await fresh policy clues as the Bank of England's Broadbent is seen as a key vote on a closely balanced MPC, while the Fed's Brainard, is also seen as a bellwether, will speak shortly after midday in NY. Broadbent has not spoken since the election, and his current views are not known.

Read More »

Read More »

FX Daily, July 10: Firm Dollar Tone may be Challenged by Softer Yields

The US dollar has begun the new week on a firm note, but the decline in yields limit the gains. The US 10-year yield is pulling back from the 2.40% area, which is it not been able to sustain gains above since Q1. European bond yields are also 1-3 basis points lower today after jumping last week.

Read More »

Read More »

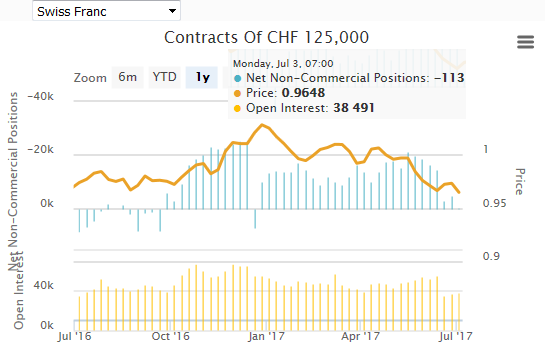

Weekly Speculative Positions (as of July 04): Speculators Still Dollar Negative

The net short CHF position has fallen from 4.7k short to 0.1k contracts short (against USD). Speculators in the futures market made several significant position adjustments in the CFTC reporting week ending July 4, despite it being a holiday-shortened week.

Read More »

Read More »

FX Weekly Preview: Bank of Canada, US CPI, and UK Labor Update Featured

Yellen will unlikely deviate from general tone of post-FOMC meeting remarks. FOMC minutes were clear, most members see the decline in inflation due to transitory developments. Bank of Canada is expected to hike rates and will likely leave the door open to another rate cut in Q4. UK wage growth has continued to slow.

Read More »

Read More »

FX Weekly Review, July 03 – July 08: Second Euro appreciation phase

The ECB appears to be preparing investors for a further adjustment of its risk assessment and a reduction of its asset purchases as they are extended into next year.

This assessment has marked a new phase of an appreciating EUR/CHF rate. It followed the previous phase, the one with and after the French elections.

Read More »

Read More »

FX Daily, July 07: Taper Tantrum 2.0 Dominates

Taper Tantrum 2.0, emanating from Europe rather than the United States continues to overshadow other developments. Yesterday, the yield on the 10-year German Bund pushed through the 50 bp mark that has capped the occasional rise in yields in recent months. The record of the ECB meeting was understood as indicating that the official assessment had surpassed the actual communication in order try to minimize the impact.

Read More »

Read More »

FX Daily, July 06: Stocks and Bonds Mostly Heavier, while Dollar Hovers Little Changed

The US dollar is narrowly mixed against the major currencies after being confined to tight ranges through the Asian session and European morning. Equities are nursing small losses, and interest rates are pushing higher. The yield on the 10-year German Bund reached 50 bp for the first time since early 2016. Oil prices have steadied after yesterday's slide.

Read More »

Read More »

FX Daily, July 05: Dollar Firm as Investors Await Fresh Directional Cues

The US dollar is enjoying a firm tone today. Yesterday's two weakest major currencies, the Australian dollar and Swedish krona are the strongest currencies, but little changed on the session. After a strong rebound in the greenback to start the week, it mostly consolidated yesterday.

Read More »

Read More »

FX Daily, July 03: Dollar Bounces to Start H2

The beleaguered US dollar is enjoying a respite from the selling pressure that pushed it lower against all the major currencies in the first six months of 2017. A measure of the dollar on a trade-weighted basis fell about 5% in the first half after appreciating nearly 8% in Q4 16.

Read More »

Read More »

Weekly Speculative Positions (as of June 27): Speculators Scramble to Cover Short Canadian Dollar and Mexican Peso Futures

The net short CHF position has risen from 3k short to 4.7k contracts short (against USD). Speculators bought back previously sold Canadian dollar and Mexican peso futures positions in dramatic fashion in the CFTC reporting week ending June 27.

Read More »

Read More »