Category Archive: 4) FX Trends

Great Graphic: CRB Index Hits 2017 Down Trendline

The CRB Index gapped higher today and it follows a gap higher opening on Tuesday, which has not been filled. Today's gains lift the commodity index to a trendline drawn off the January and February highs and catches the high from late May. It intersects today near 181.35 and the high has been a little over 181.17.

Read More »

Read More »

Dollar View: Discipline or Stubbornness

Fundamental driver, divergence is still intact. The dollar's losses have barely met the minimum retracements of a bull market. Sentiment may be exaggerating the positive developments in Europe and the negative developments in the US.

Read More »

Read More »

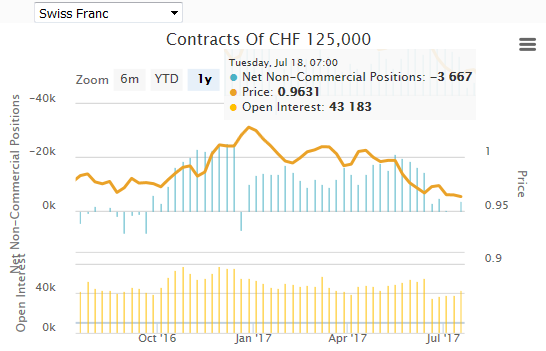

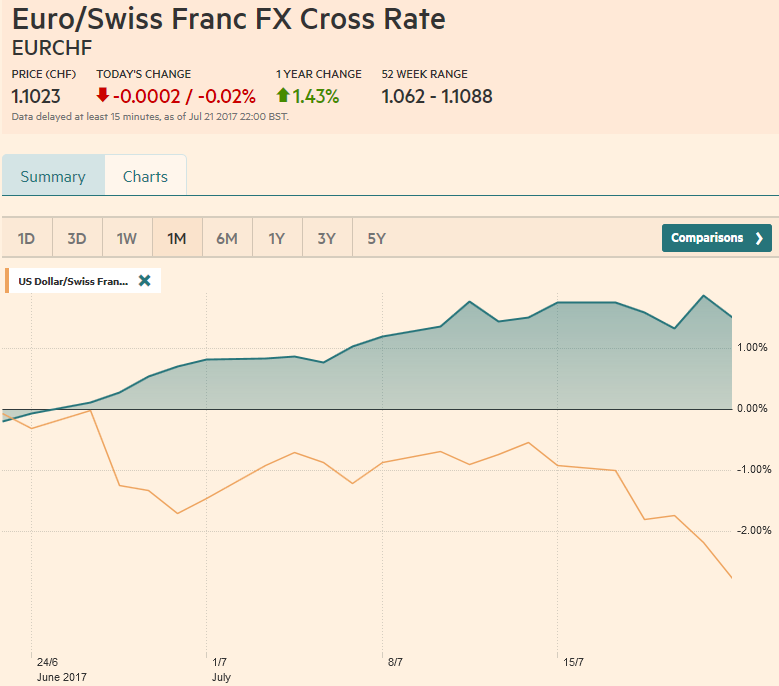

Great Graphic: What Is the Swiss Franc Telling Us?

Swiss franc weakness is a function of the demand for euros. SNB indicates it will lag behind the other major central banks in normalization process. Easing of political anxiety in Europe is also negative for the franc.

Read More »

Read More »

FOMC Sticks to Script: Balance Sheet Unwind to Begin “Relatively Soon” and USD Retreats

Little new in FOMC statement. Seems consistent with a Sept announcement to begin reducing the balance sheet in Oct. USD sold off as if reflecting sentiment held in bay until the statement was out of the way.

Read More »

Read More »

Bitcoin isn’t a currency (and why that doesn’t matter)

Bitcoin isn’t the future of money but trading it is a way to make some money. Adam Button from ForexLive talks about why cryptocurrency prices are only scratching the surface of what’s possible. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Linkedin ► https://ca.linkedin.com/company/forexlive-com Homepage ►...

Read More »

Read More »

FX Daily, July 28: Dollar and Equities Closing Week on Heavy Note

The US dollar is mostly lower, though one of the features of recent days has been the dramatic slide of the Swiss franc, and that is continuing today. The franc is off another 0.5% today, to bring its weekly loss to a sharp 2.5%. The euro finished last week near CHF1.1030 and is now near CHF1.1370; its highest level since the cap was lifted in mid-January 2015.

Read More »

Read More »

Great Graphic: Surprise-S&P 500 Outperforming the Dow Jones Stoxx 600

Many asset managers have been bullish European shares this year. European and emerging market equities are among the favorite plays this year. Surveys of fund managers find that the allocation to US equities is among the lowest in nearly a decade. The case against the US is based on overvaluation and being a crowded trade. Many are concerned about too hawkish of a Federal Reserve (policy mistake) or the lack of tax reform.

Read More »

Read More »

FX Daily, July 27: Dollar Remains on the Defensive

The US dollar is narrowly mixed after selling off following the FOMC statement. Sometimes the narrative explains the price action, and sometimes the price action explains the narrative. This seems to be the case of the latter. The dollar and interest rates fell, and so the Fed was dovish.

Read More »

Read More »

Progress in St. Petersburg

Expectations going into the OPEC monitoring meeting in St. Petersburg were low. The OPEC agreement to reduce output appeared to be fraying. June output appeared to have increased in several countries, and private sector estimates suggest output rose further in July. Russia expressed reluctance to extend the agreement further.

Read More »

Read More »

FX Daily, July 26: Quiet Fed Day without Yellen

By definition, the Federal Reserve Open Market Committee meeting is the highlight of the day. Without a press conference, and following last month's rate hike, there is practically no chance of a new policy initiative either on the balance sheet or the Fed funds target.

Read More »

Read More »

FX Daily, July 25: Summer Markets Ahead of FOMC

The global capital markets are subdued today; a dearth of fresh news and tomorrow's FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European morning is +/- 0.15%. The exception is the Norwegian krone and Swedish krona, which is about 0.25% stronger.

Read More »

Read More »

FX Daily, July 24: Euro Recovers from Softer Flash PMI

The euro made a marginal new high in early Asia, but participants rightly drew cautious ahead of the flash eurozone PMI. The flash PMI was softer than expected, and although the composite fell to six monthly lows, it is more a reflection of how steady it has been at elevated levels.

Read More »

Read More »

Weekly Speculative Positions (as of July 18): Speculators short CHF against USD again

The net speculative CHF position has changed from -0.2K long to 3.7K contracts short (against USD). Since the beginning of May the Canadian dollar has been the strongest of the major currencies. However, until the most recent CFTC reporting week ending July 18, speculators in the futures market were net short.

Read More »

Read More »

FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume.

Read More »

Read More »

FX Weekly Review, July 17 – July 22: Euro and CHF move upwards against Dollar

Both Swiss Franc and Euro were moving upwards against the dollar. So CHF gained 3% versus the dollar in the last month. CHF losses against the euro are smaller, around 1.3%.

Read More »

Read More »

FX Daily, July 21: Dollar Licks Wounds as News Stream Doesn’t Improve

The euro has depreciated by 0.13 to 1.1043 CHF. ECB President Draghi did not argue forcefully enough at yesterday's press conference to dampen the enthusiasm for the euro. The initial dip was quickly bought and the euro chased above last year's high near $1.1615, and the gains have been extended to nearly $1.1680 today. The next target is the August 2015 near $1.1715 is near.

Read More »

Read More »

FX Daily, July 20: ECB Game Day

The US dollar is enjoying a firmer tone against the major currencies today. It does not appear to be simply position adjustments ahead of the ECB meeting. Consider that Australia reported strong employment data, and after making new highs, reaching almost $0.8000, it has reversed to toy with yesterday's low. A convincing break of that area (~$0.7910), especially on a closing basis, could be the kind of technical reversal that momentum traders take...

Read More »

Read More »

Oil Update

OPEC meets on July 24. Nigeria and Libya may be pressured to cap output although they were exempt from quotas. US exports and refining appear to be the driving force behind the 13.8 mln barrel decline in inventories. Mexico has reportedly made two large oil finds.

Read More »

Read More »

FX Daily, July 19: Dollar Stabilizes on Hump Day, Awaits Thursday’s BOJ and ECB Meetings

After being shellacked to start the week, the US dollar is being given a small reprieve today as investors await tomorrow's BOJ and ECB meetings. The US may also report a bounce back in housing starts (residential investment) after a three-month slide.

Read More »

Read More »

Sterling, McCafferty, and BOE Policy

BOE hawk is arguing for a sooner unwind of QE. He did not favor the renewed asset purchases after the referendum. Sterling has been meeting resistance near $1.30 for past two months.

Read More »

Read More »