Category Archive: 4) FX Trends

FX Weekly Preview: Three on a Match: US Tax Reform, ECB and Bank of Canada Meetings

Busy week of economic data and central bank meetings, and reaction to Spanish developments and Japan and Czech elections. Focus below is on the Bank of Canada and ECB meetings and tax reform in the US. The biggest challenge to tax reform is unlikely on the committee level but on the floor votes, especially in the Senate, in a similar way the stymied health care reform. US and German 2-year rates are diverging the most since the late 1990s and...

Read More »

Read More »

Abe’s Third Arrow

Abe's political gamble appears likely to pay off. The third arrow of structural reforms continues. The FSA is continuing to push for shareholder value. Foreign investors have gone on a three-week buying spree that appears to be the largest in years, and the Nikkei is leading G7 bourses higher this month.

Read More »

Read More »

FX Daily, October 20:Tax Prospects Lift Rates and Dollar Ahead of Weekend

The US Senate approved a budget resolution that is a necessary step toward using a parliamentary maneuver that prevents the Democrats to block tax reform by filibuster. This has helped spur dollar gains against all the major currencies and nearly all the emerging market currencies.

Read More »

Read More »

FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

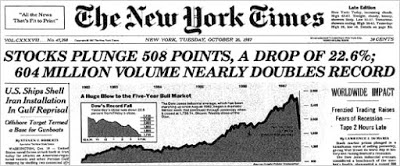

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely.

Read More »

Read More »

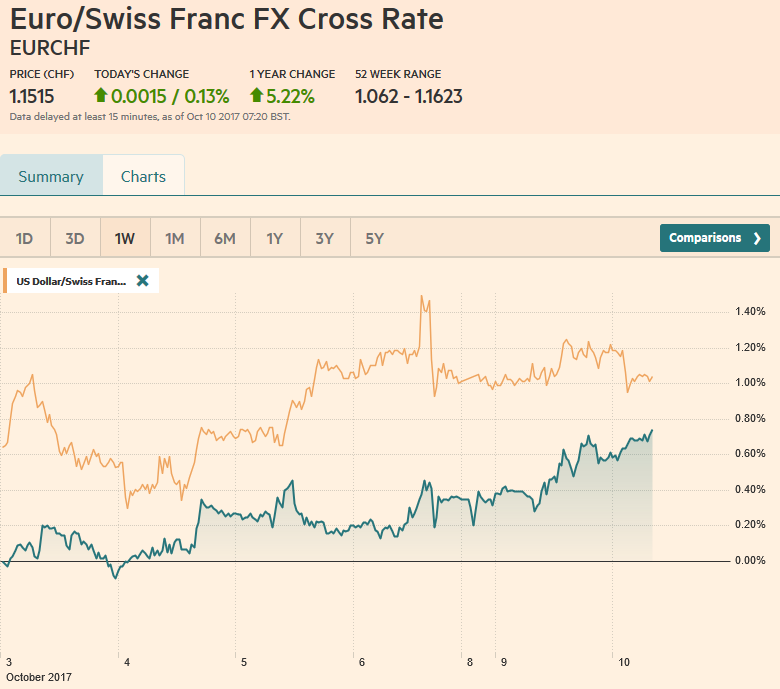

Great Graphic: The Euro’s Complicated Top

Euro looks like it is carving out a top. The importance also lies in identifying levels that the bearish view may be wrong. Widening rate differentials, a likely later peak in divergence than previously anticipated, and one-sided market positioning lend support to the bearish view.

Read More »

Read More »

Central Bank Chiefs and Currencies

Market opinion on the next Fed chief is very fluid. BOE Governor Carney sticks to view, but short-sterling curve flattens. New Bank of Italy Governor sought. A second term for Kuroda may be more likely after this weekend election.

Read More »

Read More »

NAFTA Worries Take Toll, Yellen’s Best Guess Supports Greenback

Risk that NAFTA collapses weighs on CAD and MXN. Yen is slightly firmer despite US yields edging higher and weekend polls suggesting LDP could nearly secure a 2/3 majority of its own. The sterling is consolidating after sharp moves at the end of last week.

Read More »

Read More »

FX Weekly Preview: The Markets and the Long Shadow of Politics

Rise in paper asset prices, including so-called cyber currencies, reflects the abundance of capital. Have we forgotten what Minski taught again? Political considerations may dominate ahead of the ECB meeting later this month.

Read More »

Read More »

Political Focus Shifting in Europe

There was a huge sigh of relief among investors when it became clear that the populist-nationalist wave that ostensibly led to Brexit and Trump's election was not going to sweep through Europe. The euro gapped higher on April 24, and it has not looked back. We have suggested that with the outcome of the German election, European politics shift from tailwind to headwind.

Read More »

Read More »

Brief Thoughts on the Euro

Euro peaked a month ago. The reversal before the weekend marks the end of the leg lower. ECB meeting is next big focus. ECB may focus on gross rather than net purchases.

Read More »

Read More »

Don’t dig yourself in a hole in your life or in your trading.

I recently did some hiking with some friends in the Grand Canyon. The experience reminded me of the parallel between life and trading. More specifically how we can dig ourselves in some pretty deep holes. The good news is we can avoid digging those holes that get us into so much trouble.

Read More »

Read More »

FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

The EU's leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling's recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying...

Read More »

Read More »

Dollar Dropped like Hot Potato After Core CPI Disappointed

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower.

Read More »

Read More »

The one trading mantra I can’t stand

I love trading mantras, slogans and sayings. There is a bit of folksy, timeless wisdom for almost every forex trade but there is one trading mantra that drives me insane. It’s the kind of thing a forex trader says right before making a big mistake. It’s also the sign of a weakened mindset. LET’S CONNECT! … Continue...

Read More »

Read More »

FX Daily, October 12: Discipline Argues Against Consensus Narrative

Following the release of the FOMC minutes from last month's meeting, the consensus narrative that has emerged says that it was dovish because there is a growing worry the reason inflation fell is not simply due to transitory factors. This explains, according to the narrative the dollar's losses and the stock market rally.

Read More »

Read More »

FX Daily, October 11: Markets Looking for a New Focus

The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday's ranges against the major currencies, the euro has made a marginal new high, briefly trading through the $1.1830 area noted yesterday.

Read More »

Read More »

FX Daily, October 10: Dollar Pullback Extended

The US dollar's advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish...

Read More »

Read More »

FX Weekly Preview: Forces of Movement

Over the past few weeks, the markets have come to accept the likelihood of a December Fed hike. US interest rates have adjusted. The pricing of December Fed funds futures contract is consistent with around an 80% chance of a hike. The two-year yield is trading at the upper end of what is expected to be the Fed funds target range at the end of the year, after slipping below the current range a month ago. The Dollar Index formed a bottoming pattern.

Read More »

Read More »

Cool Video: Double Feature Courtesy of Bloomberg

Tom Keene and Francine Lacqua gave me a most appreciated opportunity to present my dollar views on Bloomberg TV earlier today. They also let me opine about current events, like Catalonia's push for independence and May's troubled speech at the Tory Party Conference. Bloomberg made two clips of the discussion available. The first is about the dollar's outlook broadly. I suggest a combination of technical and fundamental factors point to a strong Q4...

Read More »

Read More »