Category Archive: 4) FX Trends

Great Graphic: Has the Dollar Bottomed Against the Yen?

The US dollar appears to be carving a low against the yen. After a significant fall, investor ought to be sensitive to bottoming patterns. The first tell was the key reversal on March 26. In this case, the key reversal was when the dollar made a new low for the move (~JPY104.55) and then rallied to close above the previous session high.

Read More »

Read More »

FX Daily, April 06: Trade Trumps Jobs

Trade and equity market volatility, which are not completely separate, continue to dominate investors' interest. Many had come around to accept that while trade tensions were running high, it was likely to be mostly posturing. This conclusion may have helped lift the S&P 500 around 3% over the past three sessions.

Read More »

Read More »

Why the Canadian dollar should be higher right now

Adam Button from ForexLive talks with BNN about the outlook for NAFTA talks and why the market isn’t giving the Canadian dollar enough love. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

FX Daily, April 05: Investors Find Comfort in Brinkmanship Blinks

Global equity markets are higher, following the stunning recovery in the US yesterday, where the S&P 500 rallied 76 points or 3% from its lows to it highs, near where it finished. The outside up day is seeing following through today. Without China and Hong Kong, which are on holiday, the MSCI Asia Pacific Index snapped a three-day down draft and closed 0.55% higher.

Read More »

Read More »

FX Daily, April 04: Trade Specificities Rattle Markets

Late yesterday, the US announced that specific tariffs and goods that would be targeted for intellectual property violations. China had warned of a commensurate response and earlier today made its announcement. This sent reverberations through the capital markets, driving down equities, corn and soybean prices (subject to Chinese tariffs). The US dollar was sold, especially against the yen, euro, and sterling.

Read More »

Read More »

Weekly Technical Analysis: 02/04/2018 – Gold, WTI Oil Futures, GER30 Index, USD/JPY

The USDCHF pair attempted to breach 0.9581 level yesterday but it returns to move below it now, which keeps the bearish trend scenario valid until now, supported by stochastic move within the overbought areas, waiting to head towards 0.9488 as a first target.

Read More »

Read More »

FX Daily, April 03: Markets in Search of Footing

The sell-off in US tech shares dragged the market lower. The S&P 500 fell for the sixth session of the past eight and closed below the 200-day moving average for the first time in a couple of years. The sell-off in Asia and Europe is more muted. The MSCI Asia Pacific Index slipped less than 0.1%. The Hang Seng, an index of H-shares, and Korea's KOSDAQ managed post gains.

Read More »

Read More »

Cool Video: Bloomberg Double Feature

Many are still celebrating the Easter holiday today, but not Tom Keene and Lisa Abramowicz and the Bloomberg team. They hosted me on Bloomberg TV today. As is often the case, the discussion was broad, covering the pressing economic and financial issues.

Read More »

Read More »

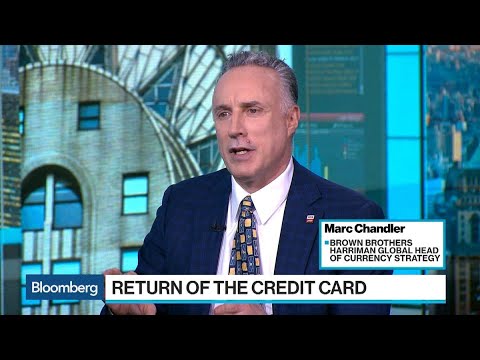

Marc Chandler Says Dollar Is Trading Down Like Buckets

Apr.02 -- Marc Chandler, Brown Brothers Harriman global head of currency strategy, discusses the rising dollar and using the yield curve as an indicator for economic expansion. He speaks with Bloomberg's Tom Keene and Lisa Abramowicz on "Bloomberg Surveillance."

Read More »

Read More »

Brown Brothers Harriman’s Chandler Says U.S. Economy Is Late in the Cycle

Apr.02 — Marc Chandler, global head of currency strategy at Brown Brothers Harriman, discusses consumer debt and what it signals for the overall U.S. economy. He speaks with Tom Keene and Lisa Abramowicz on “Bloomberg Surveillance

Read More »

Read More »

FX Daily, April 02: Monday Blues

The US dollar drifted a little lower in Asia to start the week while equities had a slightly heavier bias. The MSCI Asia Pacific Index slipped 0.1%. European bourses are mostly closed for the extended Easter holiday, while the S&P is set to start the new quarter about 0.3% lower. Although the subdued price action may not reflect it, there have been several new economic reports and developments.

Read More »

Read More »

Marc Chandler Says Dollar Is Trading Down Like Buckets

Apr.02 — Marc Chandler, Brown Brothers Harriman global head of currency strategy, discusses the rising dollar and using the yield curve as an indicator for economic expansion. He speaks with Bloomberg’s Tom Keene and Lisa Abramowicz on “Bloomberg Surveillance.”

Read More »

Read More »

FX Weekly Preview: The Start of Q2

The chief uncertainty has shifted from monetary policy and macroeconomics to the increase of volatility in the stock markets and the prospects of a trade war. Some of the major benchmarks, including the S&P 500, the MSCI Asia Pacific Index, the MSCI Emerging Markets Index, and Shanghai Composite held above the February lows in the retreat during the second half of March.

Read More »

Read More »

Great Graphic: EMU Inflation Not Making it Easy for ECB

The Reserve Bank of New Zealand is credited with being the first central bank to adopt a formal inflation target. Following last year's election, the central bank's mandate has been modified to include full employment. To be sure this was a political decision, and one that initially saw the New Zealand dollar retreat.

Read More »

Read More »

Central banks adding euros to their FX reserves

Central banks are looking beyond the dollar to grow their foreign exchange reserves for the first time in a decade. Rising trade tensions, and a recovering European economy bode well for the euro making a stronger case for central banks to diversify into the monetary union's currency.

Read More »

Read More »

FX Daily, March 29: Bonds and Stocks are Firm, While the Greenback Consolidates Upticks

The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday's gains, and bonds are mostly firmer.

Read More »

Read More »

FX Daily, March 28: Three Developments Shaping Month-End

Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity market sell-off, bond market rally, and the continued rise in LIBOR.

Read More »

Read More »

FX Daily, March 27: Global Equities Follow US Lead, Dollar Steadies

We argued that the talk of trade war was exaggerated. The confrontation, strong demands and a climb down is the Art of the Deal, and is part of the way the Trump Administration negotiates. We see striking parallels between the policymakers and tactics with the Reagan Administration's attempt to pry open Japanese markets.

Read More »

Read More »

Weekly Technical Analysis: 26/03/2018 – USD/JPY, EUR/USD, GBP/USD, AUD/JPY, GBP/JPY, USD/CHF

The USDCHF pair provided negative trades after 0.9488 proved its strength against the recent positive attempts, to keep the bearish trend scenario valid efficiently in the upcoming period, supported by the EMA50 that pushes negatively on the price, waiting to test 0.9373 initially.

Read More »

Read More »

FX Daily, March 26: Equity Meltdown Aborted, Dollar Eases

After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week's losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week's close. European markets followed suit. They did not have to take out last week's lows. The Dow Jones Stoxx 600 is up about 0.4% in late morning turnover.

Read More »

Read More »