Category Archive: 4) FX Trends

Great Graphic JPY Struggles at Trendline

This Great Graphic is a weekly bar chart of the dollar-yen exchange rate. It shows a three-year downtrend line (white line). The US dollar had popped above it last month, but this proved premature and has not closed about it for a month. The trendline is found near JPY111.55 now.

Read More »

Read More »

FX Daily, August 15: Lira Rallies on Cut in Swaps, but Fails to Dent Dollar Demand

The Turkish lira is extending yesterday's recovery today on the back of actions by officials that are aimed at limiting foreign access to the lira to short. Without introducing new capital controls, regulators halved the amount of swap transactions banks can do to 25% of shareholder equity. This is meant to make it more difficult to access lira in the offshore swaps market, which is an important channel.

Read More »

Read More »

Cool Video: CNBC Discussion on Turkey

I had the opportunity to join Professor Hanke to discuss the crisis in Turkey. The professor sketched out his view expressed in a recent op-ed piece in the Wall Street Journal, arguing that Turkey is best served by adopting a currency board, anchoring the lira to hard currency, like the euro or dollar, or gold.

Read More »

Read More »

FX Daily, August 14: Brief Respite but Little Relief

Corrective pressures grip the capital markets today, helped by the easing of the selling pressure on Turkey, but its more a respite than a relief as no new policy initiatives are behind the lira's upticks. The implication of this is that it is unlikely to last. In fact, the dollar's low in early Europe a just above TRY6.41 after trading a little above TRY7.23 yesterday may be about the most that can reasonably be expected.

Read More »

Read More »

Great Graphic: Possible Head and Shoulders Top in Euro

The euro appears to have carved out head and shoulder top. As this Great Graphic depicts, the euro was sold through the neckline at the end of last week and is 1% below it today. It is not unusual for the neckline to be retested. It is found near $1.15. It also dovetails with our near-term caution given that the euro is likely to close below its Bollinger Band for the second consecutive session (~$1.1440).

Read More »

Read More »

FX Daily, August 13: Turkey Drives Risk-Off, but Pressure Abating

The failure of Turkey to grab the bull by the horns, so to speak, and come to grips with the situation saw the dollar soar above TRY7.23(from TRY6.43 at the end of last week) and to ZAR15.55 (from ZAR14.09). The Mexican peso, the strongest currency this year, and which has been partially protected by prospects of a new NAFTA agreement has suffered as well.

Read More »

Read More »

FX Weekly Preview: Testing the Dollar’s Breakout

The US dollar surged last week, with the Dollar Index rising 1.25%, the most since April. The dollar is being boosted by two drivers. The first is the policy mix and interest rate divergence. The other is the intensification of pressure on emerging market. Turkey has a disastrous combination of more fundamentals, large short-term foreign currency debt obligations, unorthodox policies, and the lack of credibility.

Read More »

Read More »

The Yin and Yang of the US-China Relationship

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China's rise over the last 40 years has been predicated on Deng Xiaoping's political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States.

Read More »

Read More »

FX Daily, August 10: The Dollar Muscles Higher as Turkey Melts Down

The US dollar has surged. The main impetus comes from the dramatic slide in the Turkish lira. After moving above TRY5.0 yesterday, it reached TRY6.30 today before stabilizing a little below TRY6.0 as the European morning progressed. The trigger seemed to be the lack of credibility of the government's response as investors await officials to elaborate on the outline of the "new economic model" provided yesterday.

Read More »

Read More »

FX Daily, August 09: Sterling Remains Under Pressure, while the Greenback Firms Broadly

The global capital markets are mostly quiet. US sanctions on Turkey and Russia are pressuring their respective currencies, and the New Zealand dollar has slumped nearly 1.5% on the back of a dovish hold by the central bank. The Kiwi is at 2.5-year lows near $0.6650.

Read More »

Read More »

US-Japan Trade Talks

The withdrawal of the US from the Trans-Pacific Partnership trade agreement lift it exposed on two fronts. First, the TPP was going to modernize the NAFTA. Without, the US remains locked in protracted negotiations. A breakthrough in talks with Mexico has been reportedly imminent for weeks.

Read More »

Read More »

FX Daily, August 08: Sterling Can’t Get Out of Its Own Way, While Dollar and Yen Catch a Bid

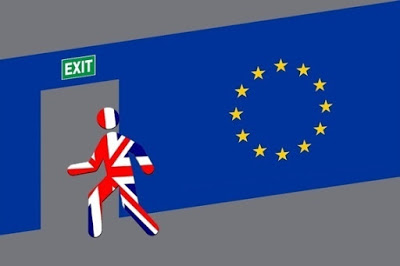

Fears that the UK could leave the EU in a little over six months without an agreement continues to drag sterling lower. Recall that over the weekend, the UK's International Trade Minister Fox suggested there was a 60% chance of a no-deal Brexit.

Read More »

Read More »

Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought.

Read More »

Read More »

FX Daily, August 07: Turn Around Tuesday for the Greenback

The US dollar is pulling back today after yesterday's advance. All the major currencies are higher and even the Turkish lira, which plunged nearly 5% yesterday to cap a six-day slide, is trading firmer today ([email protected]). The dollar's losses are modest and appear corrective in nature.

Read More »

Read More »

FX Daily, August 06: Sterling’s Drop Paces Dollar Gains

The US dollar edged higher against most of the major currencies, and emerging market currencies are heavier. Sterling's quarter percent drop makes it the weakest of the majors in slow turnover and it was sufficient to record a new 11-month low.

Read More »

Read More »

FX Weekly Preview: Dog Days of August Begin

With most of the major central bank meetings and important economic data out of the way, the dog days of August are upon us. In terms of drivers, it means that players will have to look elsewhere for inspiration and it means that market liquidy is likely not at its best.

Read More »

Read More »

Great Graphic: Is Something Important Happening to Oil Prices?

Oil prices are weaker for the third straight day and are off in four of the past five sessions, the poorest run in two months. Supply considerations may threaten a year-old trend line. OPEC and non-OPEC, essentially Saudi Arabia and Russia are making good on their commitment to boost output, and US oil inventories unexpectedly rose.

Read More »

Read More »

FX Daily, August 03: Greenback Remains Firm Ahead of Jobs, JGBs Stabilize, Italian Debt Moves into Spotlight

The US dollar is trading at the upper end of its recent ranges against the euro and sterling. The euro finished below $1.16 yesterday for the first time since the end of June and has not been able to resurface that level so far today.

Read More »

Read More »

Fed Looks to September

There was little doubt in the market's collective mind that the Federal Reserve, which hiked rates in July, would stand pat today. It did not disappoint. The statement itself was almost identical. Growth was said to be "strong" instead of "solid," for example, a nuance to be lost on most observers. It recognized that the unemployment rate stabilized after falling.

Read More »

Read More »

The case for Canadian dollar strength

Why a NAFTA deal is closer than many think and why the Canadian dollar could be headed higher. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Google+ ► https://plus.google.com/+Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »