Category Archive: 4) FX Trends

Cool Video: The implication of CNY7.0+

President Trump's tweets last week announcing the end of the tariff truce signaled a new phase in the US-Chinese tensions. China responded as did investors. I was fortunate to have been invited to the Bloomberg set to discuss the issues of the day.

Read More »

Read More »

Calling China a Currency Manipulator Is a Toothless Move, Says Bannockburn’s Chandler

Aug.05 — Marc Chandler, chief market strategist at Bannockburn Global Forex, discusses the U.S. calling China a currency manipulator and China’s possible reaction. He speaks on “Bloomberg Markets: China Open.”

Read More »

Read More »

Market Expects U.S. Retaliation, Escalation as Yuan Weakens: Chandler

Aug.05 — Marc Chandler, chief market strategist at Bannockburn Global Forex, discusses the market implications of China letting the yuan slip to its lowest level in more than a decade. He speaks with Bloomberg’s Caroline Hyde on “Bloomberg Surveillance.”

Read More »

Read More »

FX Daily, August 5: China Strikes Back

Overview: Chinese officials took the US tariff hike quietly last week but struck back today. The PBOC fixed the dollar higher (CNY6.90), which it has not done, and will halt imports of US agriculture. The dollar shot through CNY7.0 to finish the mainland session a little above CNY7.03 and CNH7.07 for the offshore yuan.

Read More »

Read More »

FX Weekly Preview: The Dog Days of August are Upon Us

The die is cast. To defend the uneven expansion and ward off disinflationary forces, monetary authorities will provide more accommodation. The Federal Reserve delivered its first rate cut in more than a decade and stopped unwinding its balance sheet two months earlier than it previously indicated (worth $100 bln of additional buying of Treasuries and Agencies).

Read More »

Read More »

August Monthly

After falling against all the major currencies in June, the US dollar rebounded in July. The Dollar Index finished the month at new two-year highs with the Fed’s suggestion it was engaged in a mid-course correction rather than a sustained easing cycle. The dollar also appeared buoyed by the extent of the dovishness by the ECB and the heightened risks that the UK leaves the EU at the end of October without an agreement.

Read More »

Read More »

Brexit Update

The October 31 deadline for the UK to leave the EU is less than 100 days away. The new Prime Minister is beginning to convince others that that UK will, in fact, leave at the end of October. PredictIt.Org shows the odds of the UK leaving has risen to almost 50% from about a 33% chance a month ago. Here is a summary of where the situation stands and some key dates going forward.

Read More »

Read More »

What’s the trade after Trump’s surprise China tariffs

Adam Button from Forexlive.com talks about the outlook for markets after US President Donald Trump shocked markets by announcing a 10% tariff on all untariffed Chinese goods effective Sept 1. Just minutes after the announcement, Button appears on BNNBloomberg to talk about what's next. Aired Aug 1, 2019.

Read More »

Read More »

What’s the trade after Trump’s surprise China tariffs

Adam Button from Forexlive.com talks about the outlook for markets after US President Donald Trump shocked markets by announcing a 10% tariff on all untariffed Chinese goods effective Sept 1. Just minutes after the announcement, Button appears on BNNBloomberg to talk about what’s next. Aired Aug 1, 2019.

Read More »

Read More »

FX Daily, August 2: End of Tariff Truce Trumps Jobs

Overview: The market was finding its sea legs after being hit with wave and counter-wave following the FOMC decision, and more importantly, Powell's attempt to give insight into the Fed's thinking. Trump's tweet than signaled an end to the tariff truce with a 10% levy on the $300 bln of imports from China that have not been subject to action previously.

Read More »

Read More »

FX Daily, August 1: Mid-Course Correction Sends Greenback Higher

Overview: The Federal Reserve delivered the first rate cut since the Great Financial Crisis but couched it in terms of a mid-course correction rather than the start of a larger easing cycle. By doing so, Fed chief Powell cast the cut in less dovish terms than the market expected and the reaction function of the market has been clear.

Read More »

Read More »

FX Daily, July 31: Sterling Steadies, Attention Shifts to FOMC

Overview: After a shellacking in recent days, sterling has stabilized though there is not much of a bounce to speak of, suggesting the adjustment to the risk of a no-deal Brexit may not be complete. After the S&P 500 posted back-to-back declines, Asia Pacific equities struggled. Hong Kong shares led the regional decline.

Read More »

Read More »

FX Daily, July 30: Sterling Pounded

Overview: The prospect of a no-deal Brexit continues to pound sterling lower. A little more than two months ago, it was testing $1.32. Two weeks ago it was around $1.25. Today it traded near $1.2120 before stabilizing. On the other hand, the 10-year Gilt yield is below 65 bp, a new multiyear low, while the international-laden FTSE 100 is holding its own in the face of heavier equity prices in Europe.

Read More »

Read More »

Uptick in site deposits puts the spotlight on SNB intervention in the franc

Has the SNB started to intervene. The weekly site deposit data from the Swiss National Bank showed a small uptick but with some perspective, it's a notable turn. Bloomberg highlights the bump and what looks like a bid to keep EUR/CHF above 1.10.

Read More »

Read More »

FX Daily, July 29: Prospects of a No-Deal Brexit Weigh on Sterling

Unrest in Hong Kong and disappointing earnings reports from South Korea weighed on local equity markets, and the MSCI Asia Pacific Index fell for the third consecutive session. European equities are edging higher in tentative trading. The Dow Jones Stoxx 600 is firmer for the sixth session of the past seven. US shares are little changed after record-high closes before the weekend.

Read More »

Read More »

FX Weekly Preview: The FOMC and US Jobs Headline the Week Ahead

There is little doubt that the Federal Reserve will ease monetary policy at the conclusion of the FOMC meeting on July 31. We never thought the chances of a 50 bp move were anything but negligible, though even at this late stage, the market appears to be pricing in about a one-in-five chance.

Read More »

Read More »

Seven Points on the ECB and the Price Action

As soon as it was clear that the ECB was not easing today, the euro began to recover, after making a marginal new low for the year (just above $1.11). Draghi made it clear that easing was going to be delivered in September and on several fronts including rates (with mitigating measures like tiering) and new asset purchases (not decided on instruments, which plays into speculation of equity purchases—though I strongly doubt this will materialize).

Read More »

Read More »

FX Daily, July 26: Markets Consolidate as the Dollar Index Extends its Advance for the Sixth Consecutive Session

Investors are happy for the weekend. Between the ECB, Brexit, and next week's FOMC, BOJ, and BOE meetings, the markets are mostly in a consolidative mode ahead of the weekend. The first look at Q2 US GDP is the last important data point of the week, though it is unlikely to impact next week's Fed decision.

Read More »

Read More »

FX Daily, July 25: ECB Takes Center Stage

The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are lower. The Turkish lira is weaker ahead of its central bank meeting, which is expected to deliver a large cut (~250 bp).

Read More »

Read More »

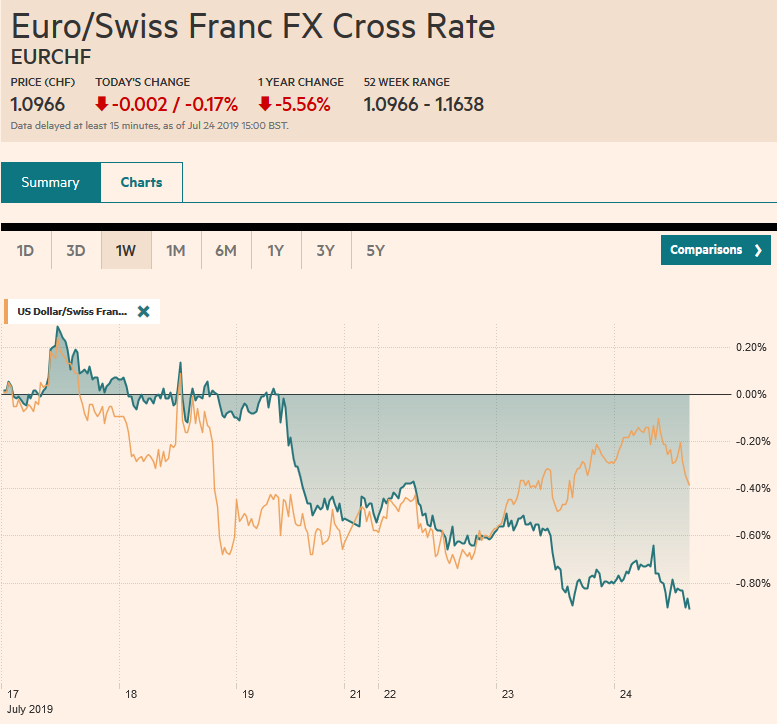

FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow's ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and Spanish 10-year benchmark yields are off four-six basis points, while core bond yields are off two-three basis points.

Read More »

Read More »