Category Archive: 4) FX Trends

FX Daily, January 13: Dismal Data Undercuts Sterling and Boosts Chances of a Rate Cut

Overview: There are two big stories today. The first is the large scale protests in Iran after the government admits to accidentally shooting down the commercial airliner amid the fog of war. The market impact seems minimal but fueling speculation that this, coupled with the economic hardship related to the US embargo, could topple the regime. Second, the UK reported that the economy unexpectedly contracted in November.

Read More »

Read More »

FX Weekly Preview: Back to Macro?

The US-China trade conflict and then US-Iran confrontation distracted investors from the macroeconomic drivers of the capital markets. It is not that there is really much

closure with the exogenous issues, but they are in a less challenging place, at least on the surface.

Read More »

Read More »

FX Daily, January 10: Jobs Friday: Asymmetrical Risks?

Overview: The first full week of 2020 is ending on a quiet note, pending the often volatile US jobs report. New record highs US equities on the back of easing geopolitical anxiety is a reflection of greater risk appetite that is evident across the capital markets. Asia Pacific equities mostly rose today, though Chinese shares and a few of the smaller markets saw small losses.

Read More »

Read More »

FX Daily, January 9: Animal Spirits Roar Back

Overview: The S&P 500 recovered from a 10-day low to reach a new record high, which set the tone for the Asia Pacific and European markets today. The MSCI Asia Pacific Index jumped by the most in a month with the Nikkei's 2% advance leading the way. More broadly, the markets in Taiwan, South Korea, Hong Kong, India, and Thailand all rose more than 1%.

Read More »

Read More »

FX Daily, January 8: Hopes of De-Escalation Help Markets Stabilize

The Iranian retaliatory missile strike on Iraqi-bases housing US forces initially sparked a dramatic risk-off response throughout the capital markets. The muted response by the US coupled with signals from Tehran that it had "concluded" its proportionate measures saw the markets retrace the initial reaction. It was too late for equities in the Asia Pacific region, and several markets (Japan, China, Korea, Malaysia, and Thailand) fell more than 1%.

Read More »

Read More »

FX Daily, January 7: Geopolitical Angst Eases, Helps Equities and Underpins the Greenback

Overview: Without fresh escalation, investors cannot maintain a heightened sense of geopolitical anxiety. The recovery of US shares yesterday set the tone for today's rebound in Asia and Europe. All the equity markets in the Asia Pacific region rallied today, led by a 1.6% rally in Japan and a nearly 1.4% advance in Australia, with the exception of Taiwan.

Read More »

Read More »

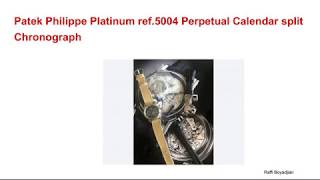

Raffi Boyadjian — Rolex Cellini 50509 — View offers on Chrono24 | #RaffiBoyadjian

Raffi Boyadjian — Let’s start with the classic dinner party. Obviously, this isn’t the time or place for a massive pilot’s watch or a professional diving watch with a helium escape valve. A classy dinner party calls for a classic dress watch. Of course, you aren’t here to read the obvious. You’re probably wondering what model would best suit the occasion. Let’s get a bit more specific: In my opinion, a watch that embodies the term ‘dress watch’...

Read More »

Read More »

Raffi Boyadjian | The Best Watches to Wear on New Year’s Eve | #RaffiBoyadjian

Raffi Boyadjian — The Best Watches to Wear on New Year’s Eve

Raffi Boyadjian — One of the draws of mechanical timepieces is the memories of special moments, days, and events they carry with them. New Year’s Eve and ringing in the new year are two such moments.

Raffi Boyadjian- People around the world celebrate the start of the new year in various ways: In Tokyo, the chiming of bells fills the night air. In Spain, everyone eats twelve grapes. In...

Read More »

Read More »

FX Daily, January 6: Markets Struggling to Stabilize to Start the New Week

Overview: The global capital markets have yet to stabilize amid heightened geopolitical tension. Even though the US stock market finished last week off its lows, the sell-off continued in the Asia Pacific region. Japan's markets re-opened after an extended holiday, and the yen, at three-month highs, saw the Nikkei sell-off nearly 2%. Several markets in the region lost over 1%, including Taiwan, India, Thailand, and Indonesia. Europe's Dow Jones...

Read More »

Read More »

FX Weekly Preview: High-Frequency Data may Underscore Four Thematic Points

Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China's CPI. The UK reports December PMIs, November GDP, and industrial output figures.

Read More »

Read More »

FX Daily, January 03: Geopolitics Saps Risk Appetite

Iran's Ayatollah Ali Khamenei has threatened "severe retaliation" for the US attacked that killed an important head of a force within the Islamic Revolutionary Guard. At the same time, reports indicate that North Korea's Kim Jong Un is no longer pledging to halt its nuclear weapons testing and has threatened to unveil a new weapon. Meanwhile, Turkish forces have reportedly entered Libya.

Read More »

Read More »

Two charts to watch for the pulse on global growth

The global economy slowed in mid-2019 on the combination of higher interest rates and the trade war. Since then the Fed and others have lowered rates and now we have a ceasefire in the trade war.

Some things like real estate have quickly turned around and stock markets are clearly pricing in more of the same, yet manufacturing is still soft. A few manufacturing surveys were out today and the theme was a continue flatline.

A good spot to watch is...

Read More »

Read More »

Two charts to watch for the pulse on global growth

The global economy slowed in mid-2019 on the combination of higher interest rates and the trade war. Since then the Fed and others have lowered rates and now we have a ceasefire in the trade war. Some things like real estate have quickly turned around and stock markets are clearly pricing in more of the … Continue...

Read More »

Read More »

FX Daily, January 02: Equities Start New Year with a Pop

Overview: Equities have begun New Year like, well, last year, with most Asia Pacific markets advancing, led by more than 1% gains in China, Hong Kong, and Thailand. Only South Korea and Indonesian markets fell. In Europe, the Dow Jones Stoxx 600 is up almost 1% in late morning turnover. US shares are trading higher as well, and the S&P 500 is up nearly 0.6%.

Read More »

Read More »

The Turn

The year is winding down quietly, and the last week of 2019 is likely to be more of the same. The general mood of the market is quite different than a year ago. Then investors had marked down equities dramatically amid fears of what was perceived as a synchronized downturn. Now with additional monetary easing in the pipeline and renewed expansion of the Federal Reserve and European Central Bank's balance sheets, risk appetites have been stoked.

Read More »

Read More »

FX Daily, December 27: Equities Rally While the Dollar Slumps into the Weekend

Overview: Equities are finishing the holiday-shortened week on a firm note, encouraged by strong holiday internet sales in the US. Most markets in the Asia Pacific region advanced except China and Thailand, while Japanese markets were mixed after weak industrial output and retail sales. The MSCI Asia Pacific Index rose for the fourth consecutive week.

Read More »

Read More »

FX Weekly Preview: Economic Data in the Holiday-Shortened Week

The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018.

Read More »

Read More »

Why the pound has fallen since election night

The pound surged on election night but the next day it all fell apart. Why? Adam Button from ForexLive explains in this interview. He also talks about Presidential impeachment and the outlook for the Canadian dollar in 2020.

LET'S CONNECT!

Facebook ► http://facebook.com/forexlive

Twitter ► https://twitter.com/ForexLive

Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

Why the pound has fallen since election night

The pound surged on election night but the next day it all fell apart. Why? Adam Button from ForexLive explains in this interview. He also talks about Presidential impeachment and the outlook for the Canadian dollar in 2020. LET’S CONNECT! Facebook ► http://facebook.com/forexlive Twitter ► https://twitter.com/ForexLive Forexlive Homepage ► http://www.forexlive.com/

Read More »

Read More »

Raffi boyadjian | New Rolex Watchs | #RaffiBoyadjian

Raffi boyadjian | New Rolex Watchs | #RaffiBoyadjian

1. Raffi Boyadjian | Rolex Watch Raffi Boyadjian Raffi Boyadjian

2. The Top Watch Trends of 2019 Raffi Boyadjian | Similar to 2018, 2019 was a busy year for the watch industry. We saw new releases, a few microbrands emerged from Kickstarter and Indiegogo, and there were some changes made at Baselworld and SIHH. Buyers and sellers on Chrono24 are very sensitive to these types of changes and tend...

Read More »

Read More »