Category Archive: 4) FX Trends

FX Daily, May 21: Markets Pull Back after Flirting with Breakouts

Overview: New two and a half month highs in the S&P 500 yesterday failed to have much sway in the Asia Pacific region and Europe today as US-China tensions escalate and profit-taking set in. Perhaps it is a bit of "buy the rumor sell the fact" type of activity on the back of upticks in the preliminary PMI reading and hesitancy about pushing for what appeared to be breakouts.

Read More »

Read More »

FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Overview: Another late sell-off of US equities, ostensibly on questions over Moderna's progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split.

Read More »

Read More »

FX Daily, May 19: Optimism Burns Eternal

Overview: Hopes for a vaccine and a German-French proposal to break the logjam at the EU for a joint recovery effort helped propel equities higher yesterday. There was strong follow-through in the Asia Pacific region, where most markets advanced by more than 1% today. However, the bloom came off the rose, so to speak, in Europe. After a higher opening, markets reversed lower, and the Dow Jones Stoxx 600 is off about 0.75% in late morning turnover.

Read More »

Read More »

BBH’s Marc Chandler Calls Bitcoin ‘Inefficient’

PUMA TRADE BOT NULLED https://www.sendspace.com/file/xkngjr https://easyupload.io/cv780k https://bit.ly/2y6yXy4 BITCOIN HARVESTER PRIVATE NULLED https://www.sendspace.com/file/0b4ref https://bit.ly/2ybRV6C https://easyupload.io/ntvcz4 COVID-19 PRIVATE HIDDEN MONITOR https://www.sendspace.com/file/wkz9ya https://bit.ly/2LBUD8g https://easyupload.io/r82d2q

Read More »

Read More »

FX Daily, May 18: Yuan Slumps as US-Chinese Tensions Rise

Overview: Despite somber warnings that the US economic recovery can stretch to the end of next year, investors have begun the new week by taking on new risks. Most equity markets in the Asia Pacific region rose, with Australia leading the large bourses with a 1% gain. India was an outlier, suffering a 2.4% loss, and Taiwan's semiconductor sector was hit, and the Taiex fell 0.6%.

Read More »

Read More »

FX Daily, May 15: Much Talk but Little Action

Overview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week's losses. Australia's 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week.

Read More »

Read More »

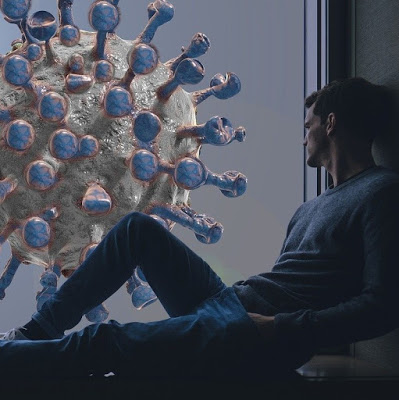

Political Economist Marc Chandler on the Economic Impact of Coronavirus

Marc Chandler, a political economist and currently managing partner at Bannockburn Global Forex, joined the podcast to provide his assessment of the coronavirus impact on the global economy. Listen to the full episode here: https://contrarianpod.com/content/podcasts/season2/assessing-economic-damage-from-coronavirus-crisis-and-plotting-a-way-forward/

Read More »

Read More »

FX Daily, May 14: Risk Appetites Wane

Overview: Risk appetites have been gradually waning this week. US equity losses mounted yesterday after Tuesday's late sell-off. Asia Pacific equities were off, with many seeing at least 1.5% drops. Europe's Dow Jones Stoxx 600 is off a little more to double this week's decline and leaves it in a position to be the biggest drop since panicked days in mid-March.

Read More »

Read More »

FX Daily, May 13: Will Powell have any more Luck Pushing against Negative Rate Expectations in the US?

Overview: Another late sell-off in US shares, this one perhaps related to the sobering assessment by the leading medical adviser for the Trump Administration about the risks of opening too early, failed to deter investors in the Asia Pacific region. Although Japanese shares slipped, most other markets rose. India led the way (~2%) after a fiscal stimulus program was announced.

Read More »

Read More »

FX Daily, May 12: Markets Tread Water, Looking for New Focus

Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly higher after the Dow Jones Stoxx 600 slipped 0.4% yesterday.

Read More »

Read More »

FX Daily, May 11: Quiet Start to New Week

Overview: The new week begins slowly in the capital markets. Many markets in the Asia Pacific region, including Japan, Hong Kong, and Australia, gained over 1%, but European and US shares are heavier. Benchmarks off all three regions rallied by 3.4%-3.5% over the past two weeks. Bond markets are also little changed, with the US 10-year benchmark just below 70 bp ahead of this week's record refunding.

Read More »

Read More »

FX Daily, May 8: Jobs and Negative Fed Funds Futures

Overview: The S&P 500 closed near its session lows for the third day running yesterday but failed to deter the bulls in Asia-Pacific, where most markets rose by more than 1%. Taiwan, Korea, and Australia lagged a bit though closed higher. Europe's Dow Jones Stoxx 600 is firm, and the modest gains (~0.5%) would be enough to ensure a higher weekly close if it can be maintained.

Read More »

Read More »

FX Daily, May 7: China Reports an Unexpected Jump in Exports, While Norway Surprises with a Rate Cut

Overview: There is a sense of indecision in the air today. There have been several developments, but investors seem mostly reluctant to extend positions. China reported a surge in exports in April and an increase in the value of reserves. Australia reported a rise in exports in March. The Bank of England left policy steady, but clearly signaled it was prepared to boost its asset purchases.

Read More »

Read More »

Cool Video: TD Ameritrade-Stocks, the Dollar and the Trap Laid by the German Court

Here is a nine-minute clip of a chat I had with Ben Lichtenstein at TD Ameritrade. Ben captures futures traders' energy and breadth of vision. Often in institutional settings, one develops a specialization, but in my experience, futures traders are more likely to look across the markets and asset classes. It is one of the lasting lessons learned early in my career on the floor of the CME.

Read More »

Read More »

FX Daily, May 6: The Euro is Knocked Back Further

Overview: The late sell-off in US stocks yesterday has not prevented gains in Asia and Europe. Most of the equity markets, including the re-opening of China, gain more than 1%. Australia was a notable exception, falling about 0.4%, and Taiwan was virtually flat. European bourses opened higher but made little headway before some profit-taking set in, while US shares are trading higher.

Read More »

Read More »

FX Daily, May 5: German Court Adds to the Euro’s Woes

Overview: The S&P 500 recovered yesterday after dipping trading below the 20-day moving average for the first time in a month. The key area is the gap between the April 30 low (~2892.5) and the May 1 high (~2869). Oil reversed higher as well. June crude was off nearly 9% in the US morning and closed 7% higher on the day and above $21 for the first time since April 21, the day of negative oil prices.

Read More »

Read More »

New Month, New Trends?

The dollar fell against all the major currencies and most of the emerging market currencies last week. The Dollar Index fell by 1.3%, the biggest loss since the last week of March, and posted its lowest close in nearly three weeks ahead of the weekend. There seemed to be a change in the market after key equity benchmarks, like the MSCI ACWI Index of both emerging and developed markets put in a recovery high in the middle of last week.

Read More »

Read More »

Traders Summit April 29th 2020: Mark Chandler

ForexAnalytix, sponsored by IG and Forest Park FX and the CMT Association, have put together an exceptional line-up of world-class speakers, making each presentation an unmissable event.

Our speakers include market analysts, technicians and strategists, who cover a broad range of asset classes and instruments. They are all elite individuals who are ready to share their insights and extended market knowledge during their allotted 40-minute...

Read More »

Read More »

FX Daily, May 4: Monday Blues

Overview: The constructive mood among investors in April has given way to new concerns as May gets underway. Japan and China are still on holiday, but most of the other markets in Asia fell, led by 4.5%-5.5% declines in Hong Kong and India, and more than 2% in most other local markets. Australia bucked the trend a gained 1.4% after shedding 5% before the weekend.

Read More »

Read More »

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »