Category Archive: 4) FX Trends

US Banking Crisis Swamps Other Considerations

Overview: The US banking crisis has overwhelmed other

market drivers. The strong measures announced as Asia Pacific trading got under

way was embraced by the market even though moral hazard issues and gaps in the

Dodd-Frank regulatory framework were exposed. The dollar is trading heavily. The

prospect of a 50 bp Fed hike next week has evaporated and some are doubting

that a 25 bp increase will be delivered. Rate hike expectations for the ECB

this...

Read More »

Read More »

Dow Jones technical analysis: Targeting a contrarian long.

I'm letting others follow the news and seeking to target a contrarian Long on the Dow Jones futures, conditional to price action on a lower timeframe. I explain why and where in the video.

Some technical analyses may have future updates in their comments sections. See

https://www.forexlive.com/technical-analysis/dow-jones-technical-analysis-at-forex-live-contrarian-long-opportunity-for-traders/ for this one.

Visit ForexLive.com for additional...

Read More »

Read More »

Market Prices in a Fed Cut in Q4 Ahead of CPI, While ECB to may Deliver a 50 bp Hawkish Hike

Three macro events

highlight the week ahead. The US February CPI will be reported on March 14. The

UK's Chancellor of the Exchequer Hunt will deliver the spring budget on March

15. The ECB meets the following day. A 50 bp hike is discounted not only for this

meeting, but that is the bias for the May meeting as well. It seems that

US interest rate adjustment that began early February (jobs data and strong

gains in the service ISM) and helped fuel...

Read More »

Read More »

The US jobs report is out, the USD is down. It more than jobs as banking concerns increase

In times of uncertainty, the charts help to guide the storylines. Find out the key levels in play now for the EURUSD, USDJPY, GBPUSD and USDCAD

Read More »

Read More »

Concerns Over US Banks Rival Today’s Jobs Report

Overview: The unexpectedly large rise in US weekly

jobless claims, the largest since the end of last September and concerns about

the impact of the sharp rise in interest rates on the liquidity and value of

assets (bonds) owned by small and medium-sized banks saw the market unwind the

effect of Fed Chair Powell's comments. The yield on the US two-year note

slumped almost 20 bp to 4.87% yesterday and fell to 4.75% today before

stabilizing (~4.82%)....

Read More »

Read More »

S&P 500 technical analysis for 10 March, 2023

CORECTION: There is a mistake in the March 3rd label on the video. This is an update for 10 March.

In this video, we provide an update regarding the mistake in the label for our previous video. We then focus on the area of double support and its significance for swing and buy-and-hold traders. We outline the line in the sand for a bullish reversal and potential bearish trends and provide our thoughts on the current market conditions.

Read More »

Read More »

S&P 500 technical analysis and key price areas bulls must protect to maintain their premise.

As I mentioned in previous videos, I will be maintaining a bullish outlook and seeking a bounce, but changing my mind ONLY IF 2 consecutive daily candles CLOSE below 3900. We are not there yet, so I am still targeting a bullish reversal and will be watching the prices mentioned in the video.

Trade the S&P 500 at your own risk and visit ForexLive.com for additional views.

Read More »

Read More »

One more day. The US jobs report is one more day away. What about today?

Get the latest forex technical report before the US jobs report release. In this video, we take a quick look at the EUR/USD, USD/JPY, and GBP/USD currency pairs and outline the levels to watch for as the clock ticks closer to the report. Stay informed and make informed trading decisions.

Read More »

Read More »

Yen Jumps Despite Poor GDP Ahead of Tomorrow’s BOJ Outcome

Overview: Seeing the drama he inspired on Tuesday,

the Fed chair tried soft-pedaling the idea that he was signaling a 50 bp hike

in March. The market did not buy it. And the odds, discounted by the Fed funds

futures rose a little above 70% from about 62% at Tuesday's close. The two-year

note yield solidified its foothold above the 5% mark. With the Bank of Canada

confirming its pause, the Reserve Bank of Australia does not seem that far

behind, and...

Read More »

Read More »

Technical analysis of TSLA, HD, PYPL: Large block trades made by institutions (last 7 days)

Discover how to identify bullish or negative signals in the market by monitoring large block trades made by institutions in the options market. In this video, we discuss the current leaderboard for the last 7 days and reveal interesting trends in options trading. We also conduct a technical analysis of the top 3 stocks: Tesla Motors Inc. (TSLA), Home Depot Inc. (HD), and Paypal Holdings Inc. (PYPL). Learn about potential entry and exit points for...

Read More »

Read More »

The effective technical analysis tip for CRM, INTU and CDNS (when to buy)

Discover the top three software/application industry stocks worth considering for investment. In this video, we analyze Salesforce, Intuit, and Cadence Design Systems, three companies with strong market capitalization, positive earnings growth, and potential for long-term growth. Plus, we provide an effective technical analysis tip to help investors make informed investment decisions. Watch the video now!

Read More »

Read More »

S&P 500 technical analysis: Bulls protecting the PoC

Join me in this video as we discuss the current market sentiment, which appears to be bearish, and my bullish outlook. We'll be keeping an eye on the key levels to watch for the S&P 500, with a focus on the level at 3925, which will indicate a trend reversal if 2 consecutive daily candles close below it. However, as long as we stay above the point of control (PoC), I'm still bullish and targeting 4150 by the end of the month.

Read More »

Read More »

The day after. The Fed Chair sent the USD higher yesterday. What are the charts saying?

In this trading update, we analyze the recent moves in the USDJPY, EURUSD, GBPUSD, and USDCAD in early US trading. The USDJPY tests a key corrective level, while the EURUSD and GBPUSD show modest moves to the upside but remain below key targets. Meanwhile, the USDCAD keeps its gains as the Bank of Canada is expected to keep rates unchanged.

Read More »

Read More »

Powell Sends the Two-Year Yield above 5% and Ignites Powerful Dollar Rally

Overview: Federal Reserve Chair Powell's comments to

the Senate Banking Committee were seen as hawkish by the market, even though it

has been clear to most observers that the 5.10% median terminal rate that the

Fed projected in December would be increased. Also, it seemed well appreciated

a few Fed officials support a 50 bp hike at the February 1 FOMC meeting, two

days before a "hot" jobs report that showed over 500k jobs were

filled. It...

Read More »

Read More »

While the focus was on Powell Tuesday there were also remarks from the ECB and SNB

Swiss National Bank Chair Jordan threatened FX intervention!

A couple of posts from Tuesday ICYMI while Powell was hogging the spotlight:

ECB Knot: ECB can be expected to keep raising rates for quite some time after March

ECB can be expected to keep raising rates for quite some time after March

And, SNB Chairman: We cannot rule out that we will have to tighten monetary policy again

We can use interest rates but also sell foreign...

Read More »

Read More »

As the market awaits the Fed Chair Testimony, the technical levels are being defined.

The markets are on edge as they wait for the Fed Powell testimony, and in this report, we analyze the key risk and buy levels for major currency pairs, including the EURUSD, USDJPY, GBPUSD, and AUDUSD (post RBA rate hike). Stay ahead of the curve and watch the video for valuable insights.

Read More »

Read More »

US Dollar is Better Bid Ahead of Powell, while Aussie Sells Off on Dovish Hike by the RBA

Overview: The US dollar is trading with a firmer bias against

nearly all the G10 currencies ahead of Federal Reserve Chairman Powell's

semi-annual testimony before Congress. Speaking for the Federal Reserve, the

Chair is likely to stay on message which is higher rates are necessary to cool

the overheating economy. This comes on the heels of the Reserve Bank of

Australia's 25 bp hike and indication that it is not pre-committing to an April

hike. The...

Read More »

Read More »

S&P 500 technical analysis, 7th March 2023

In this video, we discuss the current market situation and the impact of Powell's upcoming speech on price action. The price is still above the bull channel but may retest it during a choppy period. We provide our technical analysis and trading insights to help you stay ahead of the market. Don't miss out on the latest updates and visit ForexLive.com for additional views.

There may be possible updates on...

Read More »

Read More »

Nasdaq futures technical analysis 7th March, 2023

Yesterday's failed breakout is still lingering as the market waits for more information from Powell later this week. Watch for a possible breakout up, but also be cautious of bears taking control if two consecutive 4-hour candles close below 12233. Learn more about the technical analysis of the NASDAQ and S&P 500 in this video and visit ForexLive.com for additional views and updates.

There may be possible updates on:...

Read More »

Read More »

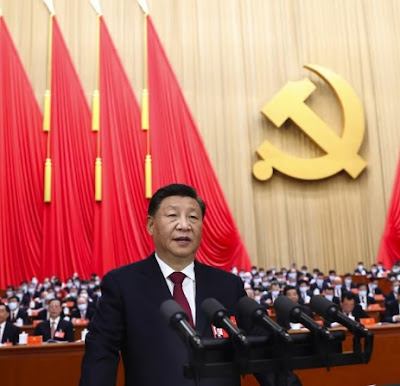

Yields Pull Back to Start the New Week

Overview: The modest economic goals announced as

China's National People's Congress starts was seen as a cautionary sign after

growth disappointed last year. It seemed to weigh on Chinese stocks, though

others large bourses in the region advanced, led by Japan's Nikkei and South

Korea with gains of more than 1%. Europe's Stoxx 600 is little changed after

rising for the past two sessions. US index futures are slightly softer. Strong

gains were seen...

Read More »

Read More »