Category Archive: 4.) Marc to Market

FX Daily, January 24: Dollar Takes Another Leg Lower

North American session sold into the dollar's upticks and Asia followed suit, taking the greenback to new multi-year lows against the euro and sterling while pushing it below the JPY110 level for the first time since last September. US trade action has become latest element of the narrative the seeks to explain the dollar's slide and the decoupling of the greenback from interest rates.

Read More »

Read More »

Great Graphic: Is Aussie Cracking?

The Australian dollar bottomed in early December $0.7500 after having tested $0.8100 a couple of times in September. Since early December, however, the Australian dollar appreciated by nearly 6.5%. As it tested the $0.8000 area, the momentum faded.

Read More »

Read More »

FX Daily, January 23: Dollar Stabilizes Near Recent Lows

The US dollar has come back better bid in late Asian activity. The session highlight was the BOJ meeting. BOJ maintained forecasts and policy. There was a small tweak to the inflation assessment, noting that prices were skewed to the downside, and said there was no change in inflation expectations. Last time it has said expectations were weakening. It also reiterated that there was no policy implication to the bond operations.

Read More »

Read More »

FX Daily, January 22: Dollar Remains Heavy

The US dollar closed last week on a firm note, but it has been unable to build on its gains to start the new week. News that Germany's SPD agreed to enter formal negotiations with Merkel's CDU/CSU alliance saw the euro open in Asia around a half a cent higher. However, sellers emerged near $1.2275 but seemed to lose their nerve as the pre-weekend low near $1.2215 was approached.

Read More »

Read More »

FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore.

Read More »

Read More »

FX Daily, January 19: Dollar Crushed as Government Shutdown Looms

The US dollar is broadly lower as the momentum feeds on itself. Asia is leading the way. The Japanese yen, Taiwanese dollar, Malaysian Ringgit, and South Korean won are all around 0.45% higher. Asian shares also managed to shrug off the weakness seen in the US yesterday. The MSCI Asia Pacific Index advanced 0.7%. It is the sixth consecutive weekly gain. The dollar's drop comes as US yields reach levels now seen in year. The 10-year yield is at its...

Read More »

Read More »

FX Daily, January 18: Currencies Consolidate After Chop Fest

The US dollar rallied in the North American afternoon yesterday and the timing coincided with the release of the Fed's Beige Book that saw several districts report wage and price pressures. The US 10-year yield moved toward toward 2.60%, and helped by speculation that as US companies repatriate earnings kept abroad that they may have to liquidate the investments, some of which are thought to be in Treasuries.

Read More »

Read More »

China and US Treasuries

The US Treasury market was consolidating yesterday's 7.5 basis point jump in 10-year yields when Bloomberg's headline hit. The claim was that Chinese officials are "wary of Treasuries". Yields rose quickly to test 2.60% and the dollar moved lower. It is difficult to determine the significance of the claim as the Bloomberg story does not quote anyone.

Read More »

Read More »

FX Daily, January 17: Dollar Stabilizes After Marginal New Lows

After a shallow bounce in Asia and Europe yesterday, the dollar slipped lower in North American yesterday. Asia was happy to extend those dollar losses, and the greenback was pushed to marginal new lower in Asia, but has come back in the European session. The next result is a choppy but flattish consolidation compared with last week's closing prices.

Read More »

Read More »

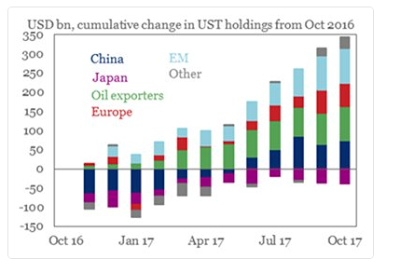

Great Graphic: Treasury Holdings

The combination of a falling dollar and rising US interest rates has sparked a concern never far from the surface about the foreign demand for US Treasuries. Moreover, as the Fed's balance sheet shrinks, investors will have to step up their purchases.

Read More »

Read More »

FX Daily, January 16: Dollar Given a Reprieve

After extending its recent slide yesterday, which the US markets were on holiday, the dollar is firmer against all the major currencies and most of the emerging market currencies. There does not seem to be macroeconomic developments behind the dollar's stabilization, and the gains are quite minor, suggesting a pause in the downtrend rather than a reversal at this juncture.

Read More »

Read More »

FX Weekly Preview: Drivers and Views

It is not easy to recall another week in which there were so many potential changes to the broad investment climate. The relatively light economic calendar in the week ahead may allow investors to continue to ruminate about some of those developments. Here we provide thumbnail assessments of the main drivers.

Read More »

Read More »

Great Graphic: Euro Monthly

The euro peaked in July 2008 near $1.6040. It was a record. The euro has trended choppily lower through the end of 2016 as this Great Graphic, created on Bloomberg, illustrates. We drew in the downtrend line on the month bar chart. The trend line comes in a little below $1.27 now and is falling at about a quarter cent a week, and comes in near $1.26 at the end of February.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

Is the BOJ Tapering?

The G3 central banks are in flux. The Federal Reserve is gradually raising rates and allowing the balance sheet to shrink by not fully reinvesting the maturing proceeds. The ECB will purchase half as many bonds in the first nine months of 2018 as it did in the last nine months of 2017.

Read More »

Read More »

FX Daily, January 11: Capital Markets Calmer, Greenback Consolidates

As market participants were just getting their sea legs back after the start of the year, it was hit by a one-two punch of ideas that BOJ policy was turning less accommodative and that Chinese officials were wary of adding to their Treasury holdings. Then late yesterday, a news wire reported that Canada suspected the US was going to withdraw from NAFTA.

Read More »

Read More »

Cool Video: Bloomberg TV Clip on Central Banks

I joined Alix Steel and David Westin on the Bloomberg set earlier today. Click here for the link. In the roughly 2.5 minute clip, we talk about the US and and the monetary cycle in Europe. In the US, Q4 was another quarter of above trend growth. The Atlanta Fed says the economy is tracking 2.7%, while the NY Fed puts it at 4.0%.

Read More »

Read More »

FX Daily, January 10: Yen Short Squeeze Extended

Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00. It fell to about JPY112.35 yesterday, near the 50% retracement of the greenback's bounce from the late-November lows near JPY110.85.

Read More »

Read More »

FX Daily, January 09: Dollar Correction Extended

The US dollar's upside correction that began before the weekend has been extended in Asia and Europe today. The main exception is the Japanese yen. The yen's modest gains have been registered despite the firmness in US rates and continued advance in equities; both factors associated with a weaker Japanese currency.

Read More »

Read More »

Marc Chandler on Global Monetary Policy

Jan.08 -- Marc Chandler, global head of markets strategy and FX at Brown Brothers Harriman, discusses monetary policy from the Federal Reserve and other central banks. He speaks on "Bloomberg Daybreak: Americas."

Read More »

Read More »