Category Archive: 4.) Marc to Market

FX Daily, July 25: ECB Takes Center Stage

The euro remains stuck in its trough below $1.1150 ahead of the ECB meeting. The US dollar is firmer against most of the major currencies. The yen continues to resist the draw of the greenback. Most emerging market currencies are lower. The Turkish lira is weaker ahead of its central bank meeting, which is expected to deliver a large cut (~250 bp).

Read More »

Read More »

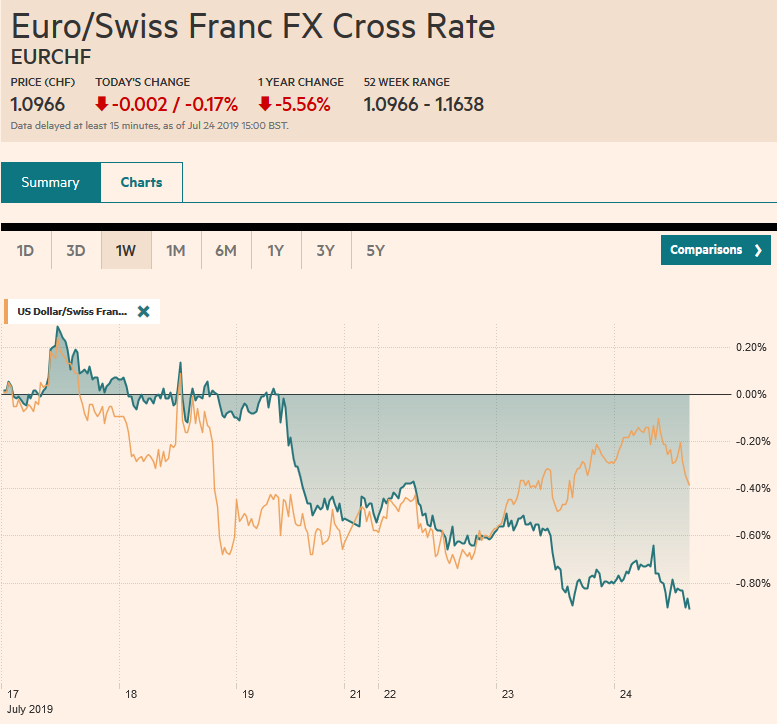

FX Daily, July 24: Poor PMI Weighs on Euro Ahead of ECB

Overview: Disappointing flash PMI pushed an already offered euro lower ahead of tomorrow's ECB meeting. European bonds rallied and equities, amid a rash of earnings, is trying to extend the advance for a fourth consecutive session. Italian and Spanish 10-year benchmark yields are off four-six basis points, while core bond yields are off two-three basis points.

Read More »

Read More »

FX Daily, July 23: Debt Deal Help Lifts the Dollar

The gains in US equities and the apparent US budget agreement has underpinned equities today and the US dollar. Asia Pacific equities recouped yesterday's losses, and Europe's Dow Jones Stoxx is posting gains for the third consecutive session, helped by some earning beats, to probe two-week highs. US shares are firmer. Benchmark 10-year yields are mixed with the Asia Pacific softer and European firmer.

Read More »

Read More »

FX Daily, July 22: Greenback is Mostly Firmer to Start New Week, while the Euro is Pinned near $1.12

What promises to be an eventful two weeks has begun quietly. The ECB, Fed, BOJ, and BOE will meet over the next fortnight. The central banks of Turkey and Russia meet this week and are expected to cut rates. The UK will have a new Prime Minister.

Read More »

Read More »

FX Weekly Preview: Highlights in the Week Ahead

Three events that will capture the market's attention next week: The consequences of the Japanese election, the first look at US Q1 GDP, and the ECB meeting. The central banks of Turkey and Russia also meet. Both are expected to cut interest rates, following rate cuts in the middle of last week by South Korea, Indonesia, and South Africa.

Read More »

Read More »

FX Daily, July 19: Dollar Pares Losses as Market Partly Corrects Confusion of Magntiude and Timing of Fed

Overview: Comments underscoring the importance of acting preemptively by two Fed officials sent the dollar reeling and helped lift equities after the S&P fell to a two and a half week low. The decline in rates and the US shooting down of an Iranian drone in the Gulf helped spur gold to new six-year highs. There was some attempt to clarify the (NY Fed's) comments and the dollar has pared yesterday's losses.

Read More »

Read More »

FX Daily, July 18: Dollar on Back Foot as Equities Slide

Overview: Profit-taking continues to weigh on global equities earnings concerns saw the biggest drop in the S&P 500 in three weeks. The MSCI Asia Pacific Index fell for the fourth consecutive session. The Nikkei gapped lower for the second straight session and has now retraced half of the gains scored since early June. The Shanghai Composite is at its lowest level in a month.

Read More »

Read More »

FX Daily, July 17: Back to the Well Again

Overview: After slapping punitive tariffs on structural from China and Mexico last week, US President Trump threatened to end the tariff truce with China because it is not stepped up its purchases of US agriculture products. Trump said the tariff freeze was in exchange for ag purchases, but at the time it seemed as if granting licenses to US companies to sell to Huawei was the quid pro quo.

Read More »

Read More »

FX Daily, July 16: Sterling Weakness Punctures Subdued Session

Overview: Summer in the northern hemisphere contributing to the subdued activity in the global capital markets. The MSCI Asia Pacific index stalled after a four-day advance, with Japanese, Chinese, and Australian equities offsetting gains in Taiwan, South Korea, and India. Europe's Dow Jones Stoxx 600 is flattish, struggling to extend its three-day rally.

Read More »

Read More »

FX Daily, July 15: Marking Time on Monday

Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed today, but equities were mostly firmer in the Asia Pacific regions, markets in China, Hong Kong, Taiwan, and India firmed.

Read More »

Read More »

FX Weekly Preview: What to Watch if Fed and ECB are Committed to Easing

There is little doubt after the Federal Reserve Chairman Powell's testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB's move is more debatable, an adjustment at the July 25 meeting appears to have increased.

Read More »

Read More »

FX Daily, July 12: Greenback Limps into the Weekend

Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in response, and Spanish and Portuguese bonds bore the burden in Europe.

Read More »

Read More »

FX Daily, July 11: Powell Spurs Equity and Bond Market Rally, While the Greenback Falls Out of Favor

Overview: Fed's Powell confirmed a Fed rate cut at the end of this month by warning that uncertainties since the June FOMC had "dimmed the outlook" and that muted price pressures may be more persistent. It ignited an equity and bond market rally (bullish steepening) while the dollar was sold.

Read More »

Read More »

FX Daily, July 10: North American Focus: Poloz and Powell

Overview: The US Treasury market is retreating for the fourth consecutive session ahead of Fed Chairman Powell's testimony before Congress. It is the longest losing streak in six months, and the 10-year yield has risen 15 bp over the run. This is helping drag up global yields, and today Asia Pacific yields mostly rose 2-3 basis points while core European bond yields are 5-7 bp higher and peripheral yields up a little less.

Read More »

Read More »

FX Daily, July 9: No Turn Around Tuesday, as Equities Extend Losses and the Greenback Remains Firm

Overview: Global equity benchmarks are headed for their third consecutive loss today as caution prevails at the start of Q3 after a strong first half. Ten-year benchmark yields are edging higher after a soft start in Asia. Italian bonds continue to outperform. Greek bonds have been set back as the new government reiterated its commitment to ease fiscal commitments as if Tsipras did not try, and got a similar rebuff.

Read More »

Read More »

FX Daily, July 8: Macro Monday

Overview: The capital markets have begun the week in a mixed note. Asia Pacific equities tumbled, led by 2%+ losses in China and South Korea, but European shares are edging higher, and a positive close would be the seventh in the past eight sessions. The S&P is little changed. Asia Pacific bond yields moved higher, as anticipated after the jump in US yields after the jobs data.

Read More »

Read More »

FX Weekly Preview: In Bizzaro Beauty Contest, the US is Still the Least Ugly

Our hypothesis that the market had reached peak dovishness toward the Fed remains intact after the employment data. Job growth was the strongest since January. The participation rate and the unemployment rate ticked up. Average hourly earnings edged 0.2% higher, and, with revisions, maintained a 3.1% year-over-year pace, which is a bit disappointing.

Read More »

Read More »

FX Daily, July 05: Dollar is Bid Ahead of Jobs Report

Overview: The dovish response to news that Lagarde was nominated to replace Draghi was extended by the dismal German factory order report that has pushed the euro to new two-week lows and kept bond yields near record lows. The focus ahead of the weekend is squarely on the US employment data, where a second consecutive poor report will fan expectations for a large Fed cut to initiate an easing cycle.

Read More »

Read More »

FX Daily, July 03: Yields Extend Decline

Overview: Interest rates are lurching lower. The US 10-year yield is at new two-year lows, but the driver is European bonds where peripheral yields are 6-7 bp lower, though Italy's benchmark is off 12 bp, while core yields are down 2-3 bp to new record lows. The German benchmark is almost minus 40 bp, while the Swiss 10-year is beyond minus 100 bp. Italy's two-year is breaking more convincingly below zero.

Read More »

Read More »

FX Daily, July 2: Post-G20 Euphoria Fades, Stuck with Same Reality

Overview: The euphoria that greeted the resumption of US-China and US-North Korea talks has subsided. Global equities have turned mixed after yesterday's surge. Hong Kong played catch-up, and despite ongoing demonstrations, the Hang Seng rallied over one percent, and the Hong Kong Dollar strengthened beyond its band midpoint for the first time in nine months.

Read More »

Read More »