Category Archive: 4.) Marc to Market

FX Daily, November 18: Balancing Pandemic Surge with Optimism about Vaccine

News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600 continues to gyrate within Monday's range.

Read More »

Read More »

FX Daily, November 17: Greenback Remains Under Pressure

Overview: Moderna's announcement did not spur nearly the magnitude of the disruption caused by Pfizer's similar announcement a week ago. Still, in the US, the NASDAQ underperformed the other indices, and the US Dow Industrials saw record highs.

Read More »

Read More »

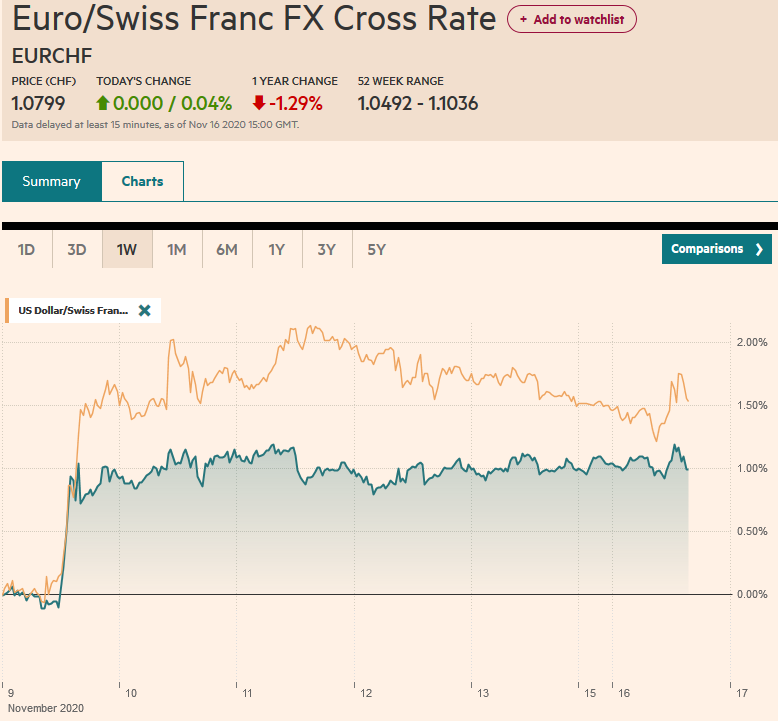

FX Daily, November 16: Risk-On Despite Surging Pandemic

Despite the surging pandemic and new restriction measure, risk-appetites appear strong to start the week. Led by 2% gains in the Nikkei and Taiwan's Taiex, all of the Asia Pacific region's equity markets advanced. European markets have followed suit and the Dow Jones Stoxx 600 is knocking on last week's eight-month high.

Read More »

Read More »

FX Daily, November 13: Greenback Pares this Week’s Gains while the Turkish Lira Continues to Squeeze Higher

Overview: The largest bourses in the Asia Pacific region followed the US equity market lower, with the Nikkei posting its first loss in nine sessions. China, Hong Kong, and Australia moved lower as well. On the week, the MSCI Asia Pacific Index gained about 1% after rising 6.3% in the prior week.

Read More »

Read More »

FX Daily, November 12: Nervous Calm in the Capital Markets

There is a nervous calm in the capital markets today. The equity rally in the Asia Pacific region stalled to end an eight-day rally, though the Nikkei's rally remains intact.

Read More »

Read More »

FX Daily, November 11: Reduced Risk of Negative Policy Rates Lifts Sterling and the Kiwi

Overview: Investors are trying to figure out the impact of the likelihood of a vaccine. One thing that has happened is that the market perceives less chance that the UK or New Zealand will adopt negative rates, and their respective currencies are adjusting higher. Meanwhile, the equity rally is continuing in Asia and Europe.

Read More »

Read More »

FX Daily, November 10: Markets Remain Unsettled

Overview: Pfizer's vaccine announcement eclipsed the US election as the key market driver. It spurred the unwinding of Covid trades in terms of sectors and yields. Emerging market currencies and the majors that benefit from world growth outperformed the perceived safe-havens, like the yen and the Swiss franc.

Read More »

Read More »

FX Daily, November 9: Markets are not Waiting for Official Closure in the US

The new week has begun with robust risk appetites, driving stocks and stocks higher and sending the dollar broadly lower. Nearly all the equity markets in the Asia Pacific region gained more than 1%, except Malaysia and Indonesia.

Read More »

Read More »

FX Daily, November 6: A Pause that Refreshens?

Investors have piled into risk assets this week, seemingly undeterred by the US elections' lack of a clear outcome. The coronavirus is still surging, and a new complication has emerged. A mutation of the virus, originating in minks (Denmark), could pose a challenge in developing a vaccine. MSCI Asia Pacific Index rose for the fifth consecutive session today to end its best week since April.

Read More »

Read More »

FX Daily, November 5: The Dollar Slides and the Yuan Jumps

Overview: The markets did not wait for the final vote count and took stocks and bonds higher while pushing the greenback lower. While it appears Biden will be the next US President, investors seemed to like the fact that his agenda will be checked by a Senate that may remain in Republican hands. Stocks are on a tear.

Read More »

Read More »

FX Daily, November 4: Indecision Keeps Investors on Edge, but the Dollar Rides High

Initially, the markets built on Tuesday's price action, but as soon as a few counties in Florida indicated that it was not going to be the "blue wave," risk came off, and it was most evident in the bond and currency markets. Equities rallied in the Asia Pacific area, and all but Hong Kong, Australia, and Indonesia advanced.

Read More »

Read More »

FX Daily, November 3: Risk Appetites Return as the US Goes to the Polls

More than 95 mln Americans voted before today, and many observers warn of a cliffhanger that could be decided in the courts. The polls sand surveys show strong odds in favor of a Democratic sweep. Looking at the capital markets, nothing looks amiss.

Read More »

Read More »

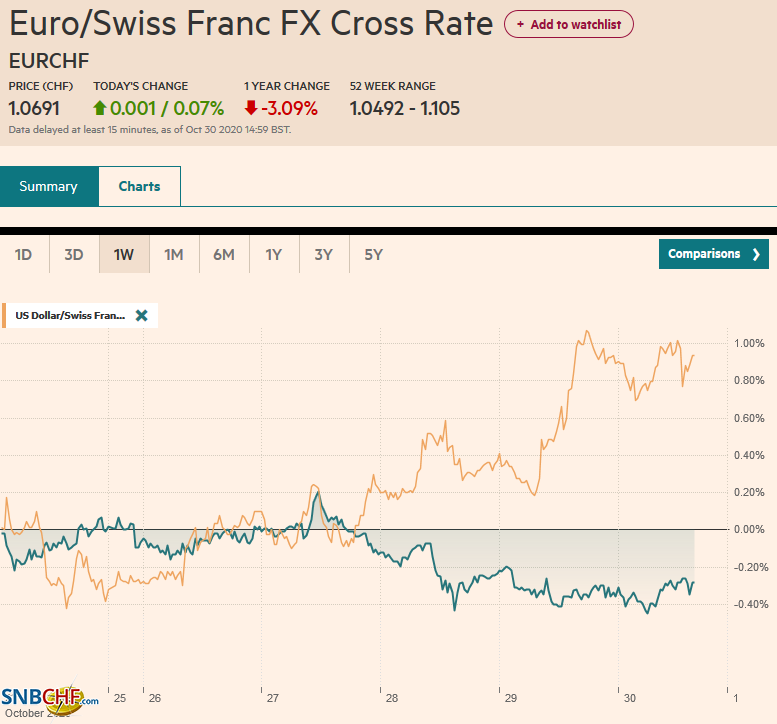

FX Daily, October 30: Investors Scared Before Halloween

Investors punished US tech giants for not delivering perfection as prices apparently had discounted, and the subsequent sell-off coupled with month-end dynamics has rocked global equities. Asia Pacific bourses were a sea of red, led by a 2.5% decline in the tech-heavy South Korean Kospi, but most major markets were off more than 1%.

Read More »

Read More »

FX Daily. October 29: Markets Continue to Struggle

The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region.

Read More »

Read More »

Introducing the Bannockburn World Currency Index

The Dollar Index is a popular way to think about and trade "the dollar." However, it has become less relevant as a reflection of the dollar's performance or representative of trade, capital flows, market capitalization.

Read More »

Read More »

FX Daily, October 28: Animal Spirits Called in Sick

Sickened by the surging virus, animal spirits are bed-ridden today. Several European countries are experiencing the most fatalities and illnesses in several months, and policymakers are responded with national restrictions.

Read More »

Read More »

FX Daily, October 27: Markets Take Collective Breath and Beijing Tweaks Fixing Mechanism

The surging pandemic sapped the risk-taking appetites as some investors hunker down for what could be a volatile period ahead. The S&P 500 lost nearly 3% at its lows before rebounding 1% in late dealings.

Read More »

Read More »

FX Daily, October 26: Troubling Start of the Important Week

The surging virus ravaging large parts of Europe and the United States is fanning concerns over the economic implications as new social restrictions and curfews are announced in several countries. US additional fiscal support remains elusive as aid for states and local governments remains a bone of contention.

Read More »

Read More »

FX Daily, October 23: Disappointing PMIs may Sharpen ECB’s Dovishness but the Euro Remains Firm

The US dollar is finishing the week on a soft note, falling against all the major currencies. On the week, it is off by at least one percent against most of them, with the Australian and Canadian dollars and Japanese yen, laggards, rising 0.5%-0.75%.

Read More »

Read More »

FX Daily, October 22: Greenback Stabilizes

Two sets of talks have riveted attention, and both appeared to have made progress yesterday. After some words, the EC, recognizing the importance of UK sovereignty, UK Prime Minister Johnson signaled a resumption of trade talks.

Read More »

Read More »