Category Archive: 4.) Marc to Market

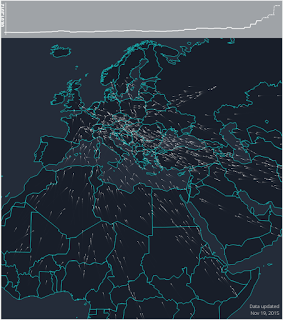

Great Graphic: Visualizing the Refugee/Asylum Seekers in Europe

The Greek crisis that dominated the European discussion in the first half of the year was barely ending when attention turned to the refugee problem. While it often seemed that all of Europe was united against Greece, the refugee problem is si...

Read More »

Read More »

BOJ Surprises, but Substance Minor

The Bank of Japan was the fourth major central bank to meet this week. Sweden and Norway kept policy unchanged. The Fed hiked. The BOJ was not expected to do anything. Governor Kuroda surprised the market with largely operational tweaks to what Japan calls Qualitative and Quantitative Easing. Initially, and perhaps with the help of …

Read More »

Read More »

Odds Improving for IMF Governance Reforms

For five years, governance reforms at the IMF have been stymied by the refusal of the US Congress to accept a new and higher quota (money) to the IMF. This has frustrated efforts to integrate the developing countries, especially the large ones, like China, better into the global economy. It may have also helped spur …

Read More »

Read More »

The World Survives Fed Hike

Asia extended the US dollar's post-Fed gains while Europe has seemed content to consolidate the move, perhaps waiting for US leadership.

Much of the commentary about the Fed's action have noted that the FOMC statement used the word "gradual" no...

Read More »

Read More »

We have Lift-Off

The Federal Reserve delivered a hawkish hike. The dot plot reflects expectations for four rate hikes in 2016. There were no dissents. This is important. It underscores the decisiveness of the decision. There have been three voting Fed mem...

Read More »

Read More »

Great Graphic: US Bill Yields and Fed Hikes

There are many investors and observers who do not think the Fed ought to raise interest rates today. The Fed's targeted inflation measure, the core PCE deflator, stood at 1.3%, well below the 2% target. They see the fresh sell-off in oil prices and are more concerned disinflation than inflation. Over the past week or so, …

Read More »

Read More »

Fe Fi Fo Fed

The much awaited Fed meeting is here. A 25 bp increase in the Fed funds range to 25-50 bp is widely expected. The near certainty of this contrasts to the high uncertainty of the immediate impact stocks, bonds, and the dollar. There are five components of the Fed's decision that will command attention. First, is … Continue reading...

Read More »

Read More »

Great Graphic: US Equities in December

This Great Graphic shows how different measures of US equities perform in December by day for the past 20 years. I got it as a tweet from Urban Carmel, who got it from the Stock Almanac. Today is eleventh session of the month. Equities typically rallied starting now in December. Since 1994, the S&P … Continue reading...

Read More »

Read More »

While Waiting for the Fed, Don’t Forget Fiscal Policy

The focus of most investors is the rate decision by the Federal Reserve tomorrow. Since the central bank completed its asset purchase program at the end of last year, a rate hike has been understood as a matter of time.

Expectations for a Ju...

Read More »

Read More »

Corrective Forces Dominate

The euro made marginal news highs near $1.1060 while sterling and the yen have been confined to yesterday's ranges. European equities are bouncing off ten-week lows. The dollar-bloc is firm; the upbeat RBA meetings provided only a short-lived...

Read More »

Read More »

Great Graphic: Large Yuan Devalution in 2016?

Following the mini-devaluation in August, the yuan appreciated in September and October. It began depreciating again in November and this has continued through the first half of December. The dollar finished the local session at new multi-year highs against the yuan. Many observers see in the pre-weekend announcement about monitoring the yuan against a basket …

Read More »

Read More »

Emerging Markets: Week Ahead Preview

Indonesia reports November trade Tuesday. Exports are expected at -11.5% y/y, while imports are expected at -21.3% y/y. Bank Indonesia then meets Thursday and is expected to keep rates steady at 7.5%. We believe an easing bias is in place, given ...

Read More »

Read More »

Outlook for Spain’s Election

The pace of reform in Spain has slowed, with electoral considerations likely playing a role. A new center-right government may resume efforts to reform the labor market, even if leading a government costs Rajoy his job. Representation of Podemos i...

Read More »

Read More »

Great Graphic: Euro Forecast by Global Banks

The dollar-euro is the most actively traded currency pair in the world. It is often what is meant when people ask where is the dollar trading. Dollar bullish sentiment prevailed in 2015, but many large banks doubt that it will continue in 2016. This Great Graphic from the Wall Street Journal shows the euro forecasts … Continue...

Read More »

Read More »

Slow Start to Important Week, though Rand Jumps Back

The US dollar is firmer against the euro, sterling and yen, but within the ranges seen before the weekend. The greenback is softer against the dollar-bloc currencies after early gains were unwound. The biggest mover has been the South African rand, which is up a little more than 5%, retracing nearly half of last week's … Continue reading...

Read More »

Read More »

After ECB’s Hawkish Cut, Is the Fed about to Deliver a Dovish Hike?

After much hemming and hawing since mid-year, the Federal Reserve is finally poised to raise rates for the first time in nearly a decade. Indeed, given the speeches by the leadership and the economic data, especially the labor market readings, the failure to raise rates would likely be more destabilizing at this juncture than lifting them. …

Read More »

Read More »

Weekly Speculative Position Limited: Adjustment Warns USD Correction may not be Over

1. Activity increased during the Commitment of Traders reporting week ending 8 December. There were four significant (10k+ contracts) gross currency adjustments by speculators. Given that this period covers the second largest gain in the euro's history, it is surprising that it did not meet the threshold. It is astounding that only that speculators added only …

Read More »

Read More »

Technical Condition of the Greenback on the Eve of Lift-Off

The US dollar turned in a mixed performance in the week following the ECB's surprise and the healthy US jobs report. In some ways, the greenback was like a fulcrum, not the driver.

The dollar-bloc currencies and the Norwegian krona were on ...

Read More »

Read More »

Emerging Markets: What has Changed

1) South African President Jacob Zuma fired Finance Minister Nene and replaced him with little-known ANZ lawmaker David Van Rooyen

2) S&P revised the outlook on South Africa’s BBB- rating from stable to negative

3) People’s Bank of Chi...

Read More »

Read More »