1. Activity increased during the Commitment of Traders reporting week ending 8 December. There were four significant (10k+ contracts) gross currency adjustments by speculators. Given that this period covers the second largest gain in the euro's history, it is surprising that it did not meet the threshold. It is astounding that only that speculators added only 1.8k contracts to their gross long position

2. The bears covered 11.7k short yen contracts, leaving them 94.5k. Both the bulls and bears were emboldened in the Canadian dollar. The bulls added 10.4k contracts (to 48.8k) and the bears added 11.6k contracts (to 88.9k contracts). Lastly, 13.4k gross short Australian dollar futures contracts were covered, leaving 81.2k contracts.

3. The largest speculative position remains by more than a 2:1 margin the short euro position of 252.7k contracts. This means that the rally from $1.0525 to $1.0980 did not correct the imbalance. It is consistent with our technical analysis warning that the euro's upside correction may not be over. Note too that the gross long euro position of 80.4k contracts is also the largest speculative long position, more than the gross long yen and sterling positions put together.

4. The general pattern was to reduce gross short currency positions. The Canadian dollar (cited above) was the only exception. Gross long adjustments were equally mixed among the eight currencies.

5. The net long light sweet crude oil futures position in speculative hands fell by 10.6k contracts. At 197.8k contracts, it is the smallest net long position since late-2012. However, the gross long positions increased by 4.5k contracts to 480.1k. The culprit was the 15.1k increase in the gross short position to 282.2k contracts

6. The net speculative position in 10-year US Treasury futures swung back favoring the bears. The 24.5k contract net short position (from 15.5k net long position) was a function of the bulls cutting 24.6k long contracts (leaving them with 435.5k contracts) and the bears adding 15.4k contracts (lift their gross short position to 460.1k contracts).

| 8-Dec | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -172.3 | -182.8 | 80.4 | 1.6 | 252.7 | -8.9 |

| Yen | -68.1 | -74.9 | 26.4 | -4.8 | 94.5 | -11.7 |

| Sterling | -23.9 | -28.3 | 41.6 | 3.2 | 65.5 | -1.1 |

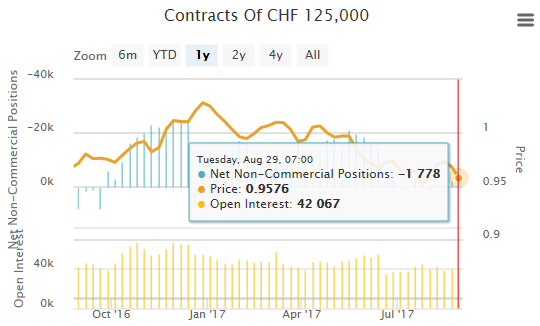

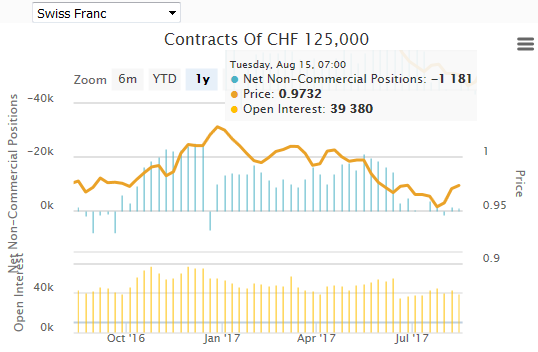

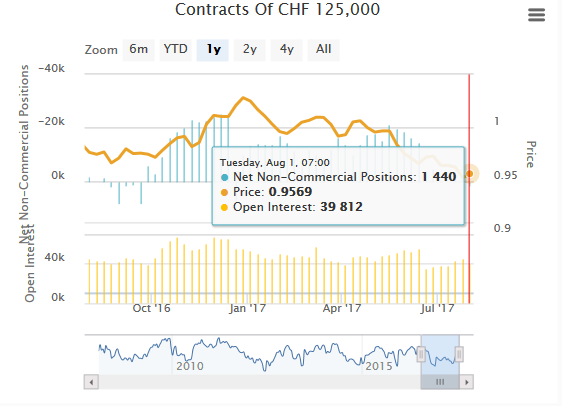

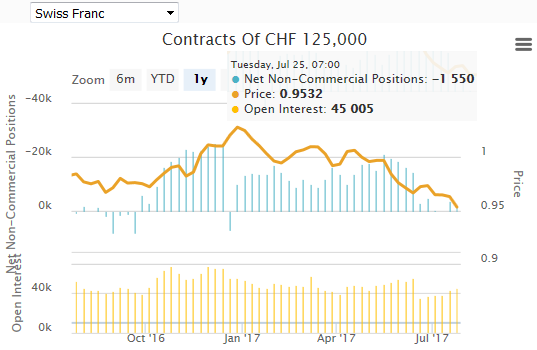

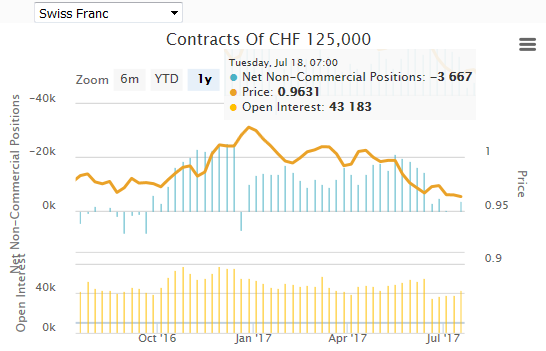

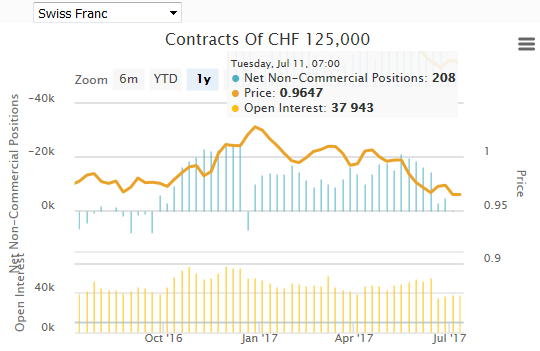

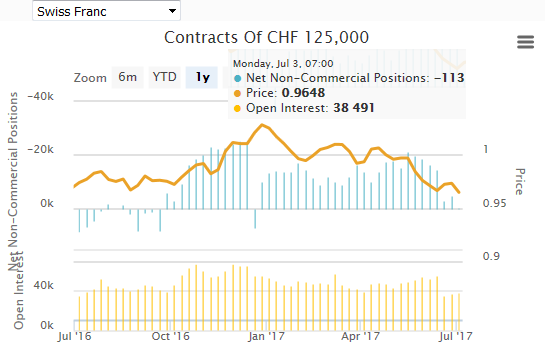

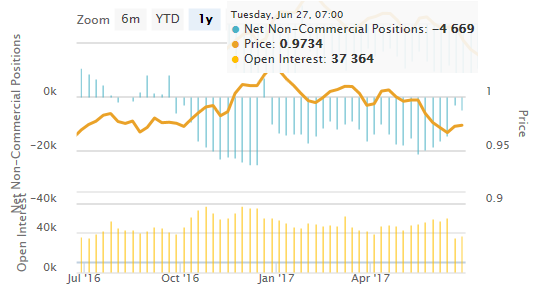

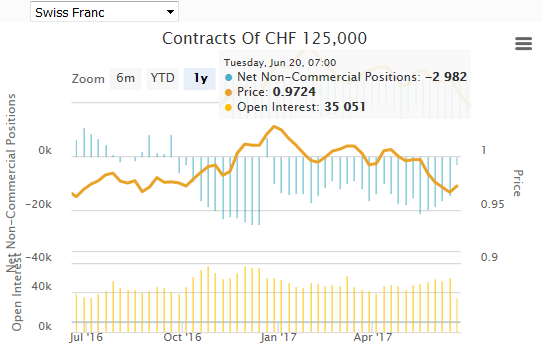

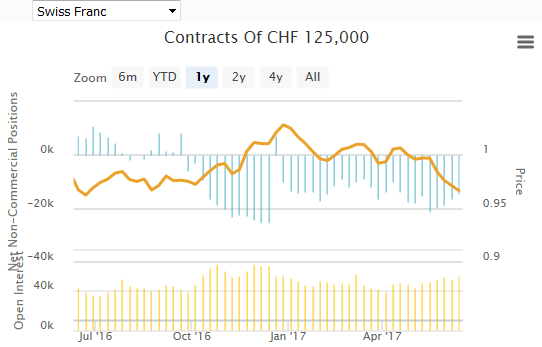

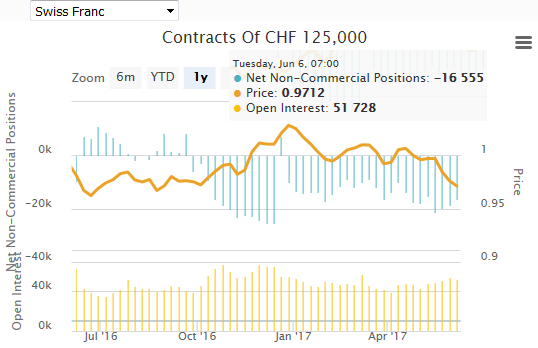

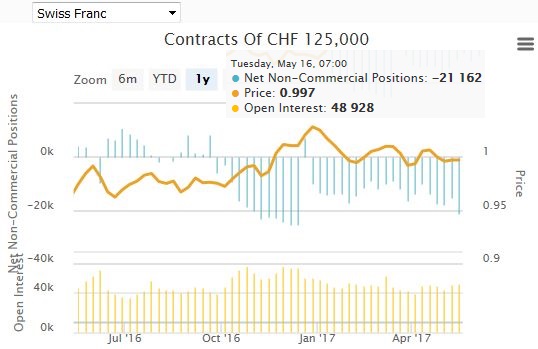

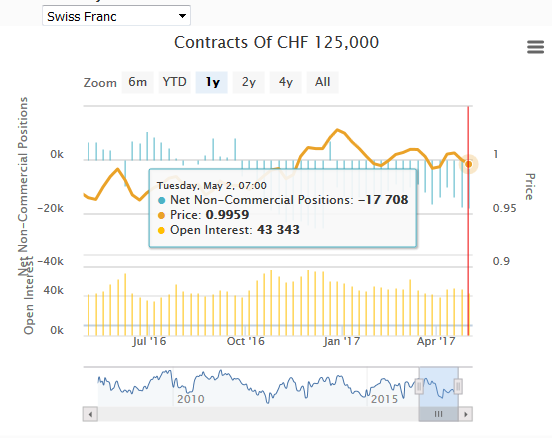

| Swiss Franc | -25.5 | -24.8 | 11.5 | -6.8 | 37.1 | -6.0 |

| C$ | -40.1 | -39 | 48.8 | 10.4 | 88.9 | 11.6 |

| A$ | -33.6 | -46.6 | 47.7 | -0.4 | 81.2 | -13.4 |

| NZ$ | 8.9 | 4.8 | 24.5 | 1.6 | 15.6 | -2.6 |

| Mexican Peso | -24.4 | -25.5 | 45.2 | -3.7 | 69.6 | -4.8 |

| (CFTC, Bloomberg) Speculative positions in 000's of contracts |

||||||

Tags: Commitments of Traders,Speculative Positions