Category Archive: 4.) Marc to Market

2015 Draws to a Close

Many financial centers in Asia and Europe are on holiday today, and those that are open, are experiencing a minimum of activity. Turnover may pick up briefly in the North American morning, but conditions will remain thin and only those who need to transact will. The US reports weekly jobless claims and the Chicago PMI. … Continue reading...

Read More »

Read More »

Yen is Lower for Fourth Year, Euro for Second

The US dollar will finish 2015 higher against both the euro and yen. Sometimes those of us who follow the economic and financial news closely can get caught up with the short-term fluctuations. As traders that is what we do. . Investors, however, can take a longer look at developments. Taking a step back, … Continue reading »

Read More »

Read More »

Quiet but Choppy Markets as Activity Winds Down

The foreign exchange market is becalmed, leaving the US dollar narrowly mixed in uneventful and light turnover. The euro has been confined to less than a third of a cent range. Yesterday it briefly dipped below its 20-day moving average for the first time since the ECB met earlier this month. It remains in the … Continue reading »

Read More »

Read More »

US-European Threat Perceptions Diverge

The trajectories of the monetary policy at the Federal Reserve and the European Central Bank are diverging. It is the keystone of our anticipation of further euro weakness in the year ahead. In addition to this monetary divergence, there is a...

Read More »

Read More »

Cool Video: Big Picture Dollar View and Comparative Inflation

I had the privilege of talking with Scarlet Fu and Joe Weisenthal on Bloomberg TV. They gave me an opportunity to discuss my big picture view of the dollar and the Obama dollar rally. While the Reagan dollar rally was driven by the policy mix, and the Clinton dollar rally was driven by the tech … Continue reading »

Read More »

Read More »

Stocks and Commodities Higher, Bonds and Dollar Mostly Lower

Emerging market currencies are mostly lower, though the South African rand is slightly firmer. The Russian ruble's decline has been extended into the fourth sessions and brings its loss this month to 8.5%, the worst performing emerging market currenc...

Read More »

Read More »

Three Rate Differentials to Note

During this holiday period, participation is light and order-driven activity can push prices more than usual. Investors should not let the noise and gyrations obscure the bigger picture. We continue to place the divergence of monetary policy at the center of our narrative. Barring a significant negative surprise from the labor market, we expect the …

Read More »

Read More »

Weaker Commodities and Stocks, Firm Bonds, Mixed Dollar

News Japanese data disappointed. November industrial output fell 1.0%, twice what the consensus expected. It was the first decline in three-months. However, due to base effect, the year-over-year rate improved to 1.6% from -1.4% in October. The in...

Read More »

Read More »

Good Holiday Reads

1. Outlook for 20162. Interesting comparative look at consumer inflation (US, UK, Japan, and EMU)3. Great Graphic illustrating the refugee/asylum migration to Europe4. Great Graphic depicting how US stocks trade in December for past two decades5. The behavior of cartels and the outlook for oil

Read More »

Read More »

Hump Day Update

The thinness of the order-driven capital markets is making price action that seems more inexplicable than usual. The US dollar is mixed. It has recouped all the ground it lows against the euro yesterday, as the single currency briefly dipped below $1.09 in the North American morning. It was unable to build on yesterday's gains that … Continue reading...

Read More »

Read More »

Tuesday’s Highlights

1. China's Central Economic Work Conference is responsible for setting the annual GDP target. Although it was not formally announced, President Xi previously indicated that the goal for the economy to expand by around 6.5% a year through 2020. More telling than the GDP target is the intentions expressed in the new slogan: flexible monetary policy, …

Read More »

Read More »

A Few Takeaways

1. The election in Spain did not lift the uncertainty but re-redoubled it. Given the outcome, it is difficult envision a majority government. Purely looking at the numbers, a coalition between the Popular Party and the Socialists is simplest...

Read More »

Read More »

Measuring Inflation

(co-authored with my colleague Sam Waters)

Inflation or indeed its opposite has driven monetary policy among the largest high income economies. With nominal rates thought to be bounded by zero, the US, UK, and Japan engaged in operations to inc...

Read More »

Read More »

Four Drivers of the Investment Climate in 2016

The broad interpretative framework we developed since late 2014, one that centers the de-synchronization of the major economies, will retain its usefulness into the New Year and beyond. The first phase of divergence was characterized by the Fe...

Read More »

Read More »

Weekly Speculative Positions: Significant Position Adjustment Ahead of FOMC Meeting

Speculative position adjustments in the currency futures were minimal in the immediate aftermath of the ECB's December 3 meeting and US employment data the following day. However, activity dramatically increased in the days ahead of the FOMC meeting on December 16. In most Commitment of Traders reports the gross position adjustment of 10k or more …

Read More »

Read More »

Near-Term Dollar Outlook: May the Force be With You

The dollar rose against all the major currencies over the past week. The divergence meme we have emphasized has continued to unfold. The ECB eased policy at the start of the month. Less than 48 hours after the Fed hiked rates, the BOJ tweaked its asset purchase program to sustain it. Holiday-thin markets make for more … Continue reading...

Read More »

Read More »

Emerging Markets: What has Changed

In the EM equity space, Poland (+5.6%), Colombia (+5.6%), and China (+4.4%) have outperformed over the last week, while Brazil (-2.1%), Qatar (-0.8%), and Russia (+0.1%) have underperformed. To put this in better context, MSCI EM rose 2.3% over the ...

Read More »

Read More »

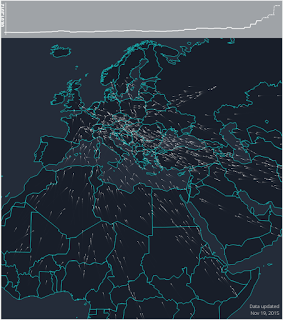

Great Graphic: Visualizing the Refugee/Asylum Seekers in Europe

The Greek crisis that dominated the European discussion in the first half of the year was barely ending when attention turned to the refugee problem. While it often seemed that all of Europe was united against Greece, the refugee problem is si...

Read More »

Read More »