Category Archive: 4.) Marc to Market

Bond Yields, Inflation, and More

Falling oil prices pushing down inflation expectations and lowering bond yields is the conventional narrative. It ignores that survey-based measures of inflation expectations are stable. It ignores a host of other demand factors.

Read More »

Read More »

FX Daily, June 23: Dollar Pares Gains Ahead of the Weekend

The US dollar is trading lower against all the major currencies today, which pares its earlier gains. The greenback is holding on to small gains for the week against most of them, except the New Zealand dollar, Swiss franc and Norwegian krone.

Read More »

Read More »

Great Graphic: Fed, ECB, and BOJ Balance Sheets

This Great Graphic composed on Bloomberg shows the balance sheets of the Federal Reserve, the European Central Bank, and the Bank of Japan as a proportion of GDP.

Read More »

Read More »

FX Daily, June 22: Greenback Goes Nowhere Quickly, While Yen Remains Bid

The summer doldrums begin early. The US dollar is little changed against most of the major currencies. Bond yields are mostly one-two basis points lower, and equity markets are mixed but with a downside bias. Oil prices slump more than 2% on Tuesday and again on Wednesday. This is weighing on bond yields and equities.

Read More »

Read More »

Great Graphic: Selected GDP Performance since 2008 and Policy

This Great Graphic was tweeted by Martin Beck, and it comes from Oxford Economics, using Haver Analytics database. It shows the relative economic growth since 2008 for the US, UK, Japan, and EMU.

Read More »

Read More »

FX Daily, June 21: Heavy Oil Weighs on Yields and Lifts Yen

The US dollar is narrowly mixed against the major currencies. The drop in oil prices (3.3% this week) is seen as one of the factors that may be underpinning the appetite for fixed income, and this, in turn, is lifting the yen. The greenback had approached JPY112 yesterday, but with the drop in oil prices and yields has seen it retreat toward JPY111.00.

Read More »

Read More »

FX Daily, June 20: Officials Fill Vacuum of Data to Drive FX Market

The light economic calendar has cleared the field to allow officials to clarify their positions. Yesterday it was NY Fed President Dudley and Chicago Fed Evans who argued that economic conditions continued to require a gradual removal of accommodation. The Fed's Vice Chairman Fischer did not address US monetary policy directly but did note that housing prices were elevated and that low interest rates

contributed.

Read More »

Read More »

FX Daily, June 19: Dollar Mixed while Equities Recover to Start Eventful Week

The US dollar is mixed against the major currencies, and while it is firmer against the euro and yen, it is within last week's ranges. The success of Macron's new party in France, and the majority is secured, was well anticipated by investors and is having little effect on today's activity in the capital markets.

Read More »

Read More »

FX Weekly Preview: Events Not Data Key in Week Ahead

Light economic data calendar, but look for downtick in eurozone flash PMI. Soft Canadian retail sales (volume) and softer CPI (base effect) could take some of the sting from the recent BoC official comments. MSCI decision on China, Argentina, Saudi Arabia, and South Korea may have the broadest and long-lasting impact of the five key events we highlight.

Read More »

Read More »

Great Graphic: Value vs Growth

This Great Graphic, created on Bloomberg show the performance of growth and value stocks since the start of December 2016. The yellow line is the Russell 1000 Growth Index. The white line is the Russell 1000 Value Index. The outperformance of the former is clear.

Read More »

Read More »

FX Daily, June 16: Dollar Slips In Consolidation, but Extends Recovery Against the Yen

As the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday's ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of the week and pushed through JPY111 in late in the Tokyo morning. The greenback is above its 20-day moving average against the yen for the first time in a month.

Read More »

Read More »

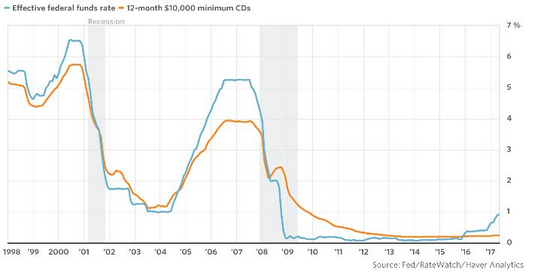

Great Graphic: Sticky Pass Through

This Great Graphic was posted by Steve Goldstein at MarketWatch. The blue line shows the effective Fed funds rate. The orange line depicts the average interest rate on a $10,000 one-year CD.

Read More »

Read More »

FX Daily, June 15: Dollar Trades Higher in Wake of the FOMC

The US dollar gains scored yesterday in response to what appeared to be a more hawkish FOMC than expected have been extended today. The euro and the Swiss franc have recorded new lows for the month.

Read More »

Read More »

FX Daily, June 14: FOMC and upcoming SNB

The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow.

This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen.

It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates.

Read More »

Read More »

FX Daily, June 13: Dollar Softens Ahead of Start of FOMC Meeting

The US dollar is trading with a heavier bias against all the major currencies save the Japanese yen. The Scandis and Canadian dollar are leading the move. Sweden reported a 0.1% rise in the headline and underlying inflation while the median expected a decline of the same magnitude. The year-over-year pace slowed but not as much as expected.

Read More »

Read More »

FX Daily, June 12: Ahead of Central Bank Meetings, Politics Dominates

The US dollar is trading within its pre-weekend range against the major currencies as participants await the central bank meeting starting in the middle of the week. The Federal Reserve, Bank of England, and the Bank of Japan meet.

Read More »

Read More »

FX Weekly Preview: Politics and Economics in the Week Ahead

FOMC, BoE, and BOJ meet next week; only the Fed is expected to change policy. High frequency data may be less important than the central bank meetings and politics in the week ahead. UK political situation is far from resolved, and US drama continues, while several hot spots in the EMU are emerging.

Read More »

Read More »

FX Daily, June 09: Sterling Shocked, Dollar Broadly Firmer

What looked like a savvy move in late April has turned into a nightmare. Collectively, voters have denied the governing Conservative party a parliamentary majority. The uncertainty today does not lie yesterday with the known unknown, but with the shape of the next government and what it means for Brexit.

Read More »

Read More »

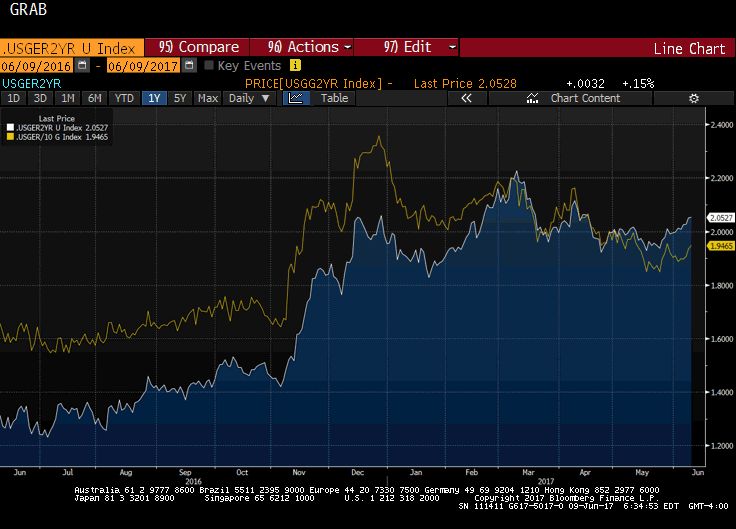

Great Graphic: Another Look at US-German Rate Differentials

This Great Graphic, created on Bloomberg, depicts the interest rate differential between the US and Germany. The euro-dollar exchange rate often seems sensitive to the rate differential. The white line is the two-year differential and the yellow line is the 10-year differential.

Read More »

Read More »

FX Daily, June 08: Thursday’s Show

Today has an anti-climactic feel to it. Yesterday's leak of what is purported to be the ECB staff forecasts point to small downward revisions to inflation forecasts and an ever small upward tweak to growth. This would be in line with only mild changes in the forward guidance language. The clear indication is that inflation is still not the conditions of a self-sustaining path toward the target.

Read More »

Read More »