After today's uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of "helicopter money" is about to be unveiled in Japan by the world's most experimental central bank. However, as Nomura's Richard Koo warns, central banks may get much more than they bargained for, because helicopter money "probably marks the end of the road for believers in the omnipotence of monetary policy who have continued to press for further...

Read More »

Category Archive: 8.) Richard Koo and Sector Balances

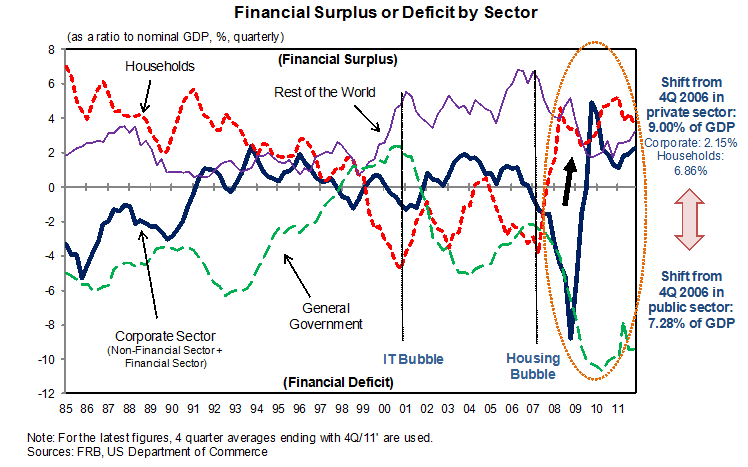

Michael Pettis: Abenomics is just a measure to enforce higher household savings

This article by Michael Pettis remains one of the most important contributions on Abenomics. If anybody wondered by GDP contracted in 2014. It is not only the sales tax but even more the weak yen that forces people to save more.

Both companies and finally also consumers are savings more. Companies do not invest.

Read More »

Read More »

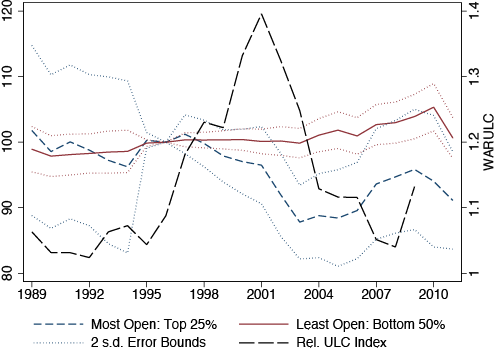

Weak Yen, Is it Really a Currency War?

Some journalists, like Ambrose Evans-Pritchard of the U.K.'s Telegraph and Michael Casey of the Wall Street Journal, have already claimed this to be a shot in the currency wars. Casey focuses exclusively on the BOJ activity and does not even mention GPIF.

Read More »

Read More »

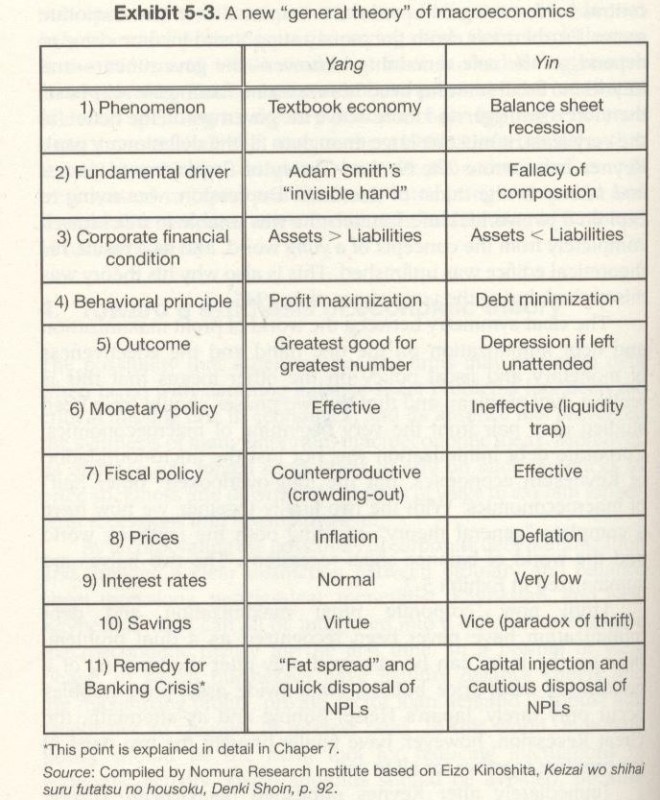

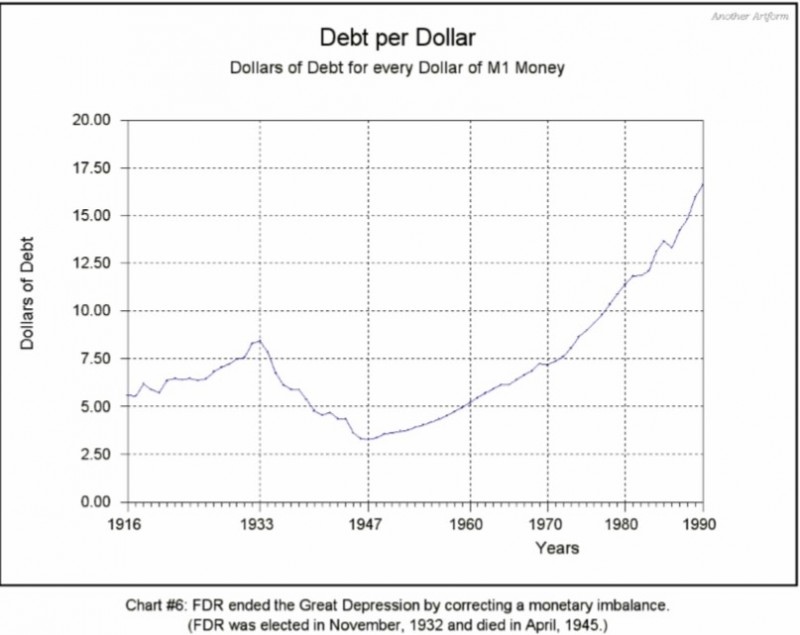

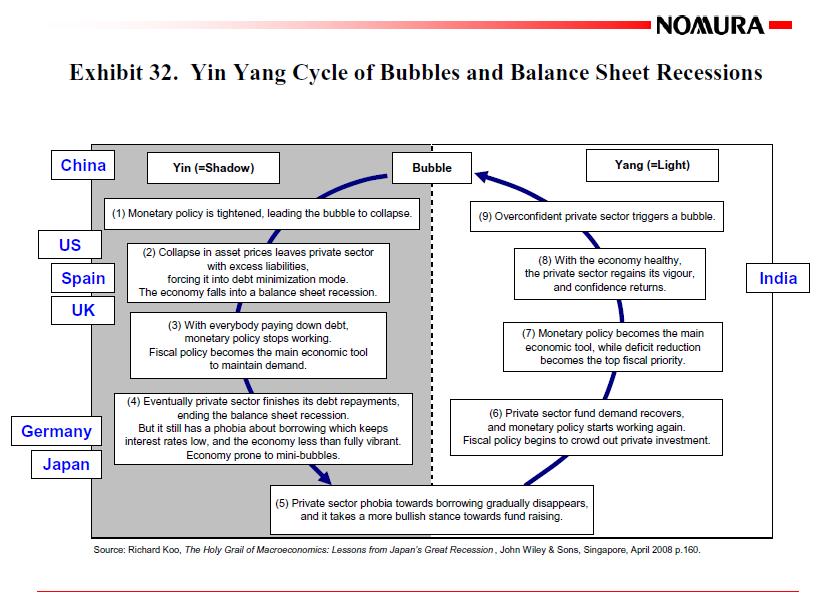

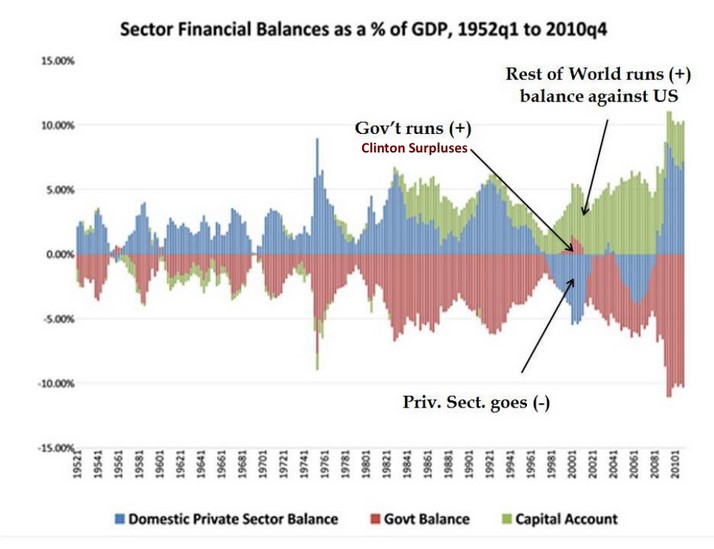

7d) Richard Koo’s and other Sector Balances

A list of long-term sector balances and related provided by Nomura's research institute and its chief economist Richard Koo.

Read More »

Read More »

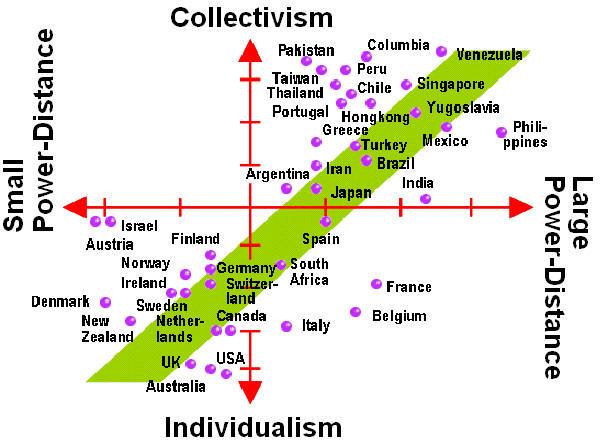

Cultural Reasons for Japan’s Deflation: Can the U.S. Go into a Balance Sheet Recession?

The power distance between employer and employee enforces the importance of the leader, the entrepreneur. Moreover, the collectivite Asian society does not want unemployment, employees prefer to renounce to salary hikes in favor of the collective. These cultural reasons can qualify as drivers of the Japanese balance sheet recession.

Read More »

Read More »