Category Archive: 6b.) Debt and the Fallacies of Paper Money

The Donald Saves the Dollar

The world is full of bad ideas. Just look around. One can hardly blink without a multitude of bad ideas coming into view. What’s more, the worse an idea is, the more popular it becomes. Take Mickey’s Fine Malt Liquor. It’s nearly as destructive as prescription pain killers. Yet people chug it down with reckless abandon.

Read More »

Read More »

The FOMC Meeting Strategy: Why It May Be Particularly Promising Right Now

As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. A study published by the Federal Reserve Bank of New York in 2011 examined the effect of FOMC meetings on stock prices. The study concluded that these meetings have a substantial impact on stock prices – and contrary to what most investors would probably tend to expect, before rather than after...

Read More »

Read More »

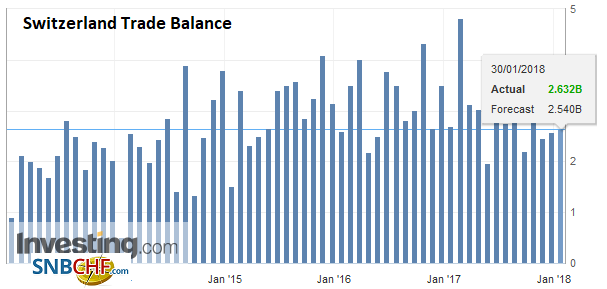

Swiss Trade 2017: Exports at all-time high

Last year, Swiss foreign trade accelerated yet again relative to 2016: exports rose by 4.7% to reach a new record high. Imports grew by 6.9%, posting their strongest growth rate since 2010. Aside from the improved economic situation worldwide, the weakening of the Swiss franc and price trends played a decisive role in both directions of trade. With a surplus of CHF 34.8 billion, the balance of trade closed the year 6% (or CHF 2.1bn) lower than the...

Read More »

Read More »

Tax Reform and Trump’s Chinese Trade Deficit Conundrum

Most things come easier said than done. Take President Trump’s posture on trade with China. Trump doesn’t want a bigger trade deficit with China. He wants a smaller trade deficit with China. In fact, reducing the trade deficit with China is one of Trump’s promises to Make America Great Again.

Read More »

Read More »

As the Controlled Inflation Scheme Rolls On

American consumers are not only feeling good. They are feeling great. They are borrowing money – and spending it – like tomorrow will never come. On Monday the Federal Reserve released its latest report of consumer credit outstanding. According to the Fed’s bean counters, U.S. consumers racked up $28 billion in new credit card debt and in new student, auto, and other non-mortgage loans in November.

Read More »

Read More »

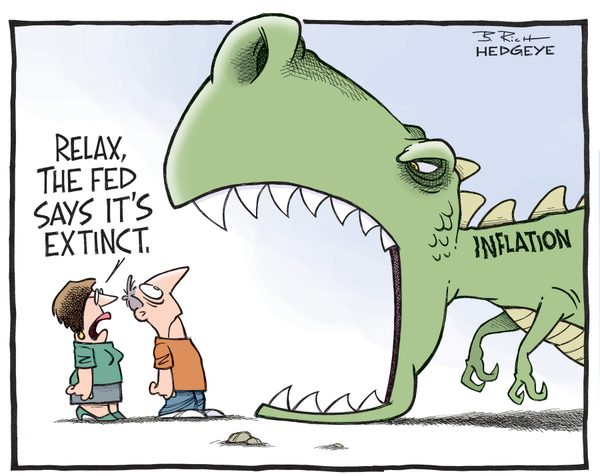

Punch-Drunk Investors & Extinct Bears, Part 2

For many years we have heard that the poor polar bears were in danger of dying out due to global warming. A fake photograph of one of the magnificent creatures drifting aimlessly in the ocean on a break-away ice floe was reproduced thousands of times all over the internet. In the meantime it has turned out that polar bears are doing so well, they are considered a quite dangerous plague in some regions in Alaska.

Read More »

Read More »

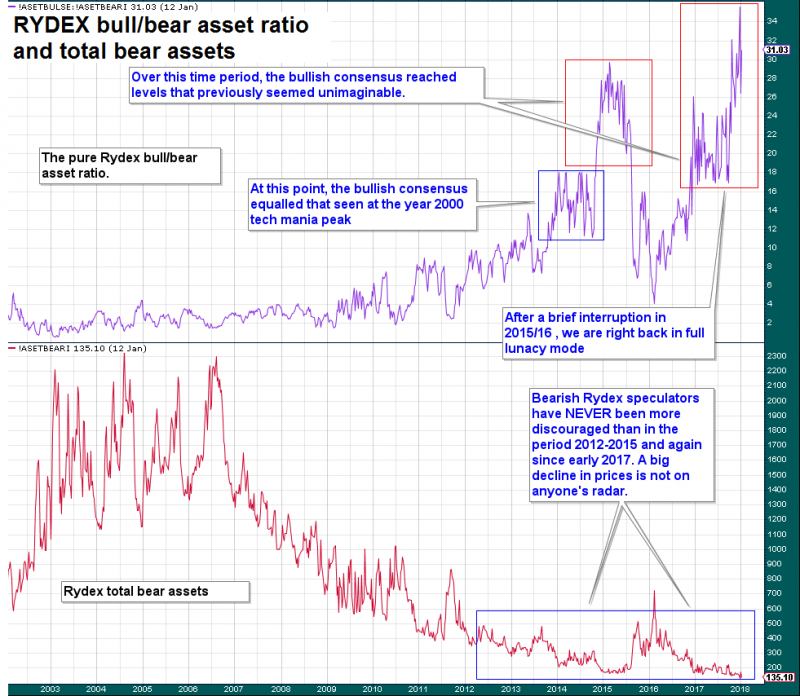

Punch-Drunk Investors & Extinct Bears, Part 1

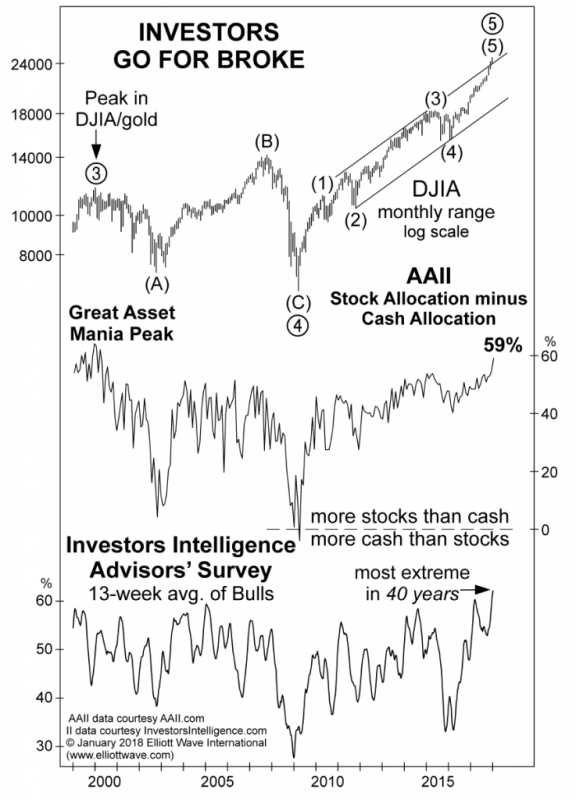

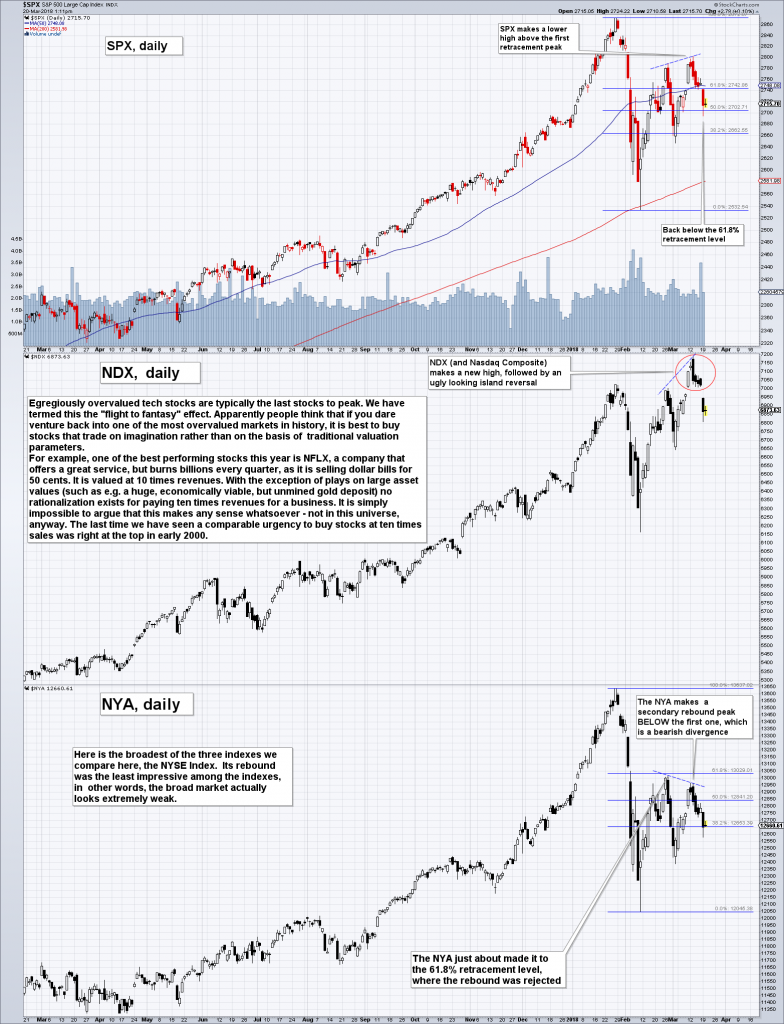

We didn’t really plan on writing about investor sentiment again so soon, but last week a few articles in the financial press caught our eye and after reviewing the data, we thought it would be a good idea to post a brief update. When positioning and sentiment reach levels that were never seen before after the market has gone through a blow-off move for more than a year, it may well be that it means something for once.

Read More »

Read More »

2018: The Weakest Year in the Presidential Election Cycle Has Begun

Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency.

Read More »

Read More »

Several Simple Suppositions and Suspicions for 2018

The New Year is nearly here. The slate’s been wiped clean. New hopes, new dreams, and new fantasies, are all within reach. Today is the day to make a double-fisted grab for them. Without question, 2018 will be the year in which everything happens exactly as it should. Some things you will be able to control, others will be well beyond your control.

Read More »

Read More »

Why Monetary Policy Will Cancel Out Fiscal Policy

Good cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas?

Read More »

Read More »

Season’s Greetings

A Difficult, but Also Exciting Year… Dear Readers, Another year is coming to a close, and the team at Acting Man wishes you and your loved ones a Merry Christmas / Happy Holidays and all the best for the new year. You have probably noticed that your main scribe was a lot less prolific this year than he normally tends to be; unfortunately, we were held back by health-related issues.

Read More »

Read More »

How the Asset Bubble Could End – Part 2

There is just one more positioning indicator we want to mention: after surging by around $126 billion since March of 2016, NYSE margin debt has reached a new all time high of more than $561 billion. The important point about this is that margin debt normally peaks well before the market does. Based on this indicator, one should not expect major upheaval anytime soon. There are exceptions to the rule though – see the caption below the chart.

Read More »

Read More »

How the Asset Bubble Could End – Part 1

We recently pondered the markets while trying out our brand-new electric soup-cooling spoon (see below). We are pondering the markets quite often lately, because we believe tail risk has grown by leaps and bounds and we may be quite close to an important juncture, i.e., the kind of pivot that can generate both a lot of excitement and a lot of regret all around.

Read More »

Read More »

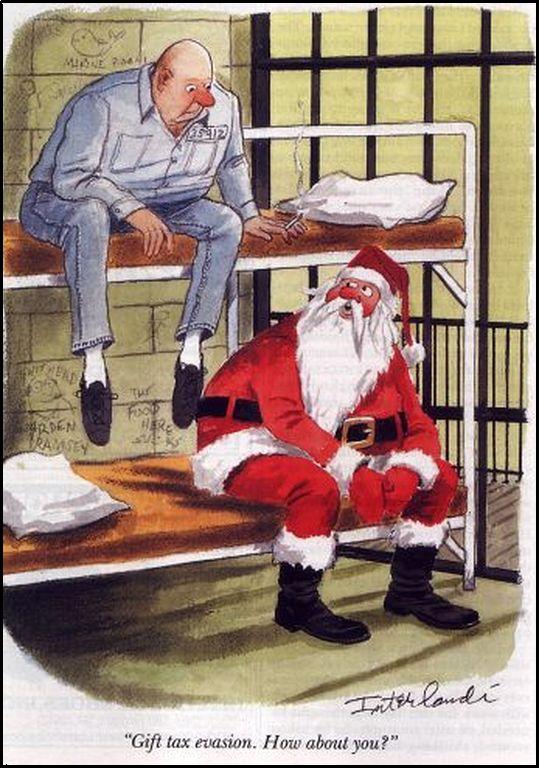

The Santa Claus Rally is Especially Pronounced in the DAX

Every year a certain stock market phenomenon is said to recur, anticipated with excitement by investors: the Santa Claus rally. It is held that stock prices typically rise quite frequently and particularly strongly just before the turn of the year. I want to show you the Santa Claus rally in the German DAX Index as an example. Price moves are often exaggerated in the German stock market, which leads to quite pronounced – and hence profitable –...

Read More »

Read More »

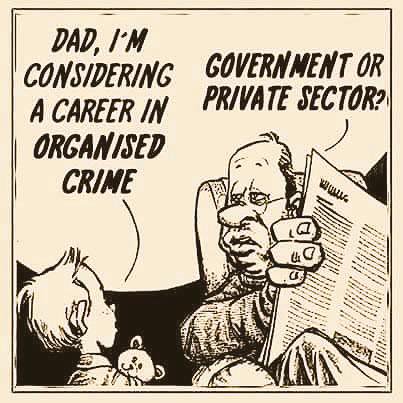

The Party of Spend More vs. the Party of Tax Less

The Senate just passed a 500-page tax reform bill. Assuming it lives up to its promise, it will cut taxes on corporations and individuals. Predictably, the Left hates it and the Right loves it. I am writing to argue why the Right should hate it (no, not for the reason the Left does, a desire to get the rich).

Read More »

Read More »

The Complete Idiot’s Guide to Being an Idiot

There are many things that could be said about the GOP tax bill. But one thing is certain. It has been a great show. Obviously, the time for real solutions to the debt problem that’s ailing the United States came and went many decades ago. Instead of addressing the Country’s mounting insolvency, lawmakers chose expediency without exception. They kicked the can from yesterday to today.

Read More »

Read More »

Japan: It isn’t What the Media Tell You

For the past few decades, Japan has been known for its stagnant economy, falling stock market, and most importantly its terrible demographics. For almost three decades, Japan’s GDP growth has mostly been less than 2%, has been negative for several of these years, and has often hovered close to zero. The net result is that its GDP is almost at the same level as 25 years ago.

Read More »

Read More »

Lessons from Squanto

Governments across the planet will go to any length to meddle in the lives and private affairs of their citizens. This is what our experiences and observations have shown. What gives? For one, politicians have an aversion to freedom and liberty. They want to control your behavior, choices, and decisions. What’s more, they want to use your money to do so.

Read More »

Read More »

How Uncle Sam Inflates Away Your Life

“Inflation is always and everywhere a monetary phenomenon,” economist and Nobel Prize recipient Milton Friedman once remarked. He likely meant that inflation is the more rapid increase in the supply of money relative to the output of goods and services which money is traded for.

Read More »

Read More »