Category Archive: 6b) Austrian Economics

Deflation Is Not a Problem: Reversing It Is

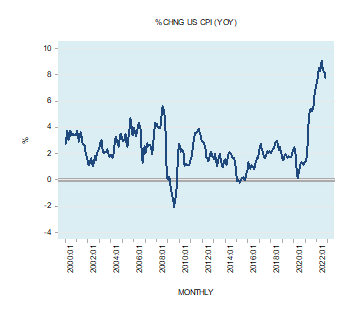

The yearly growth rate of the Consumer Price Index (CPI) fell to 7.7 percent in October from 8.2 percent in September. Note that in October 2021 the yearly growth rate stood at 6.2 percent. Some experts are of the view that it is quite likely that the momentum of the CPI might have peaked.

Read More »

Read More »

On Secession and Small States

The international system we live in today is a system composed of numerous states. There are, in fact, about two hundred of them, most of which exercise a substantial amount of autonomy and sovereignty. They are functionally independent states. Moreover, the number of sovereign states in the world has nearly tripled since 1945.

Read More »

Read More »

The way forward:

A practical roadmap to reclaiming individual and financial sovereignty – Part II of II

Essential ingredients

There have always been people with a passion for liberty. Since the earliest historical records, we can find questioners, dissenters, “trouble makers”, contrarians and all kinds of free and inquisitive minds. In this day and age, however, technology has played a decisive role in the influence they can have. Sure, the “bad guys” might...

Read More »

Read More »

Who Really Owns Big Digital Tech?

By now it should be perfectly clear that the most prominent Big Digital companies are not strictly private, for-profit companies. As I argued in Google Archipelago, they are also state apparatuses, or governmentalities, undertaking state functions, including censorship, propaganda, and surveillance.

Read More »

Read More »

The Statist Victory on Trump’s Tax Returns

The mainstream media is celebrating big time over a recent ruling by the Supreme Court that forces the Treasury Department to deliver President Trump’s income-tax returns to Congress. A good example is the Washington Post, which published an editorial last week praising the ruling.

Read More »

Read More »

Who Pays Wealth Tax: The Rich or the Poor?

The Spanish government’s announcement that it plans to introduce a new “solidarity tax” on the wealth of those who possess over €3 million has again brought to the fore the debate about taxes levied on wealth and capital. The issue is not merely that the announcement is highly politicized in what is already, de facto, a preelection period, nor that it could disrupt the fiscal autonomy of Madrid, Andalusia, and Galicia.

Read More »

Read More »

The way forward:

A practical roadmap to reclaiming individual and financial sovereignty – Part I of II

Those who are familiar with my ideas and my writings undoubtedly know that one the issues I’m most passionate about is individual freedom, on all levels. I believe that free-thinking people know what’s best of them and they need no “guardians”, no “nannies” and certainly no bailiffs and enforcers, to limit or to dictate their choices “for their own good”. As...

Read More »

Read More »

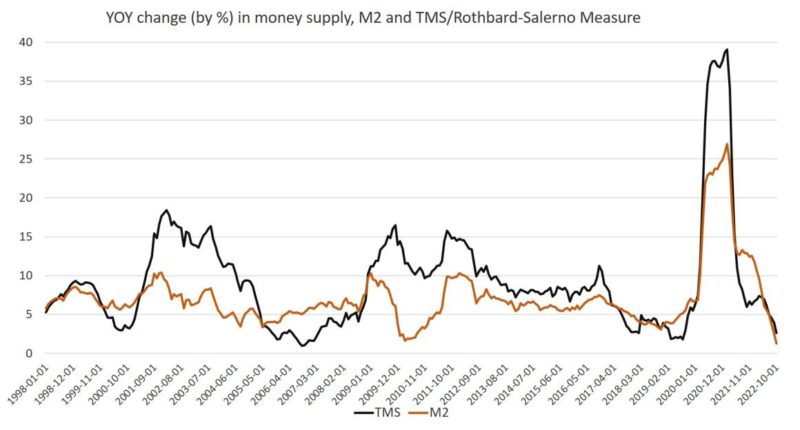

Money-Supply Growth in October Fell to a 39-Month Low. A Recession Is Now Almost Guaranteed.

Money supply growth fell again in October, dropping to a 39-month low. October's drop continues a steep downward trend from the unprecedented highs experienced during the thirteen months between April 2020 and April 2021. During that period, money supply growth in the United States often climbed above 35 percent year over year, well above even the "high" levels experienced from 2009 to 2013.

Read More »

Read More »

Vortrag in Regen am 17.12.2022

Https://www.regentreff.de/vortrag-dezember-2022/

Vortrag von Claudio Grass am Samstag, 17. Dezember 2022 in Regen

Der «Great Reset»

und was es wirklich bedeutet

Claudio Grass stellt die «geistigen Täter» der heutigen Gesellschafts- und Systemkrise vor und erklärt, was hinter dem Schlachtruf «der lange Marsch durch die Institutionen» steckt. Er beleuchtet die Geschichte des Geldes und des heutigen Bankensystems. Was bedeutet Inflation...

Read More »

Read More »

College Loans and Hazlitt’s Lesson: Ignoring the Larger Picture

As of 2022 the national student debt reached $1.6 trillion with the average student loan debt at about $28,000. Many former college students are discovering it is difficult to pay back such a large amount of debt. This is especially true of students that graduate with fruitless degrees like sociology, for example.

Read More »

Read More »

The Great Gold Robbery of 1933

[Originally published August 13, 2008]

It's been 75 years since the federal government, on the spurious grounds of fighting the Great Depression, ordered the confiscation of all monetary gold from Americans, permitting trivial amounts for ornamental or industrial use.

Read More »

Read More »

The Near Collapse of the UK Pension Sector Exposes Failures by Financial Regulators

In an earlier article, I explained that the collapse in the long-dated UK government bond (or gilts) market on September 28 that followed the ill-fated Kwarteng “mini budget” of a few days earlier had exposed a hitherto underappreciated problem: UK pension schemes were massively exposed to changes in long-dated gilts rates.

Read More »

Read More »

The REAL Solution to the Coming Economic Crisis

My previous article demonstrated how the free market solves a boom-bust crisis and is the only solution, its effectiveness depending upon the magnitude of the crisis and, more importantly, how much the government intervenes in response. The bigger the problem created by the Fed, the greater the crisis and the more government intervenes, and the slower the economy recovers.

Read More »

Read More »

Relying on Experts: A Proven Path to Failure

The warning lights on the dashboard of your car suddenly light up. You naturally take it to a mechanic to diagnose and repair. Cars are complex. You don’t have the time or accumulated expertise to figure out what is happening or to fix it.

We rely on experts daily.

Read More »

Read More »

Fallacious Rightwing Justifications for Immigration Socialism

This is our end-of-year fundraising drive. Your support today will help us advance liberty in the year head. We could never do our work without those of you who help us out in a bigger way. If you are already an FFF donor, we hope you will renew your support with a generous end-of-year donation.

Read More »

Read More »

Der Etatismus beruht in Wirklichkeit auf einem Non sequitur

Dieser Artikel ist bereits am 23. März 2022 bei Mises.org unter dem Titel erschienen «The Statist ‘Sollution’ Really Is a Non Sequitur». Übersetzt von Johannes Beifuss.

Read More »

Read More »

The Housing Boom Is Already Over. Get Ready for Even Higher Prices.

As mortgage rates have risen this year, the demand for home purchases has fallen. That has spelled trouble for the home construction business. Homebuilder confidence dropped for the 10th straight month in October.

Read More »

Read More »

What I Learned from my Grandfather about Money

When I was a child, my mother and I would take the Long Island Railroad to Brooklyn to see relatives a few times a year. My grandfather was always outside in front of the apartment house in Park Slope, where he and my aunts and uncles lived. Upon seeing him, I would run down the sidewalk to greet him, but before I could say “Hi, Grandpa!,” he would without fail press a shiny silver dollar into my hand.

Read More »

Read More »

World War I: The Great War Was also the Great Enabler of Progressive Governance

Commentaries about World War I frequently discuss causes and consequences but almost never mention the enablers. At best, they might mention them approvingly, as if we were fortunate to have had the Fed and the income tax, along with the ingenuity of the liberty bond programs, to finance our glorious role in that bloodbath.

Read More »

Read More »

Why “Greedflation” Isn’t Real

Even as price inflation slows and we move past June’s peak, progressives continue to push the concept of “greedflation”—that this year’s price inflation is caused by corporate greed and price gouging. This is inaccurate, based on bad economics, and it blames a consequence of the problem rather than the problem itself.

Read More »

Read More »