Category Archive: 6b) Austrian Economics

A crack-up boom in the making

The great Ludwig von Mises first described the concept of a crack-up boom as part of the Austrian business cycle theory, based on real life events that to an unsuspecting bystander might have appeared unconnected, or perhaps even quite bizarre and counterintuitive. Indeed, such a bystander might think the same of today’s economy and would likely have trouble making sense of the picture painted by stock markets, by our monetary and fiscal policies...

Read More »

Read More »

Interest Rates Are Rising, but the Fed Continues to Be Reckless

The crushing issue of high inflation caused by central banks can no longer be downplayed. Public displeasure at the increasing currency devaluation has now forced monetary policy makers to act. The US Federal Reserve (Fed) has raised its key interest rate to 1 percentage point.

Read More »

Read More »

Market Success Is about Giving People What They Want

Economists are often examining the variables that lead to prosperity, but surprisingly, intelligence is rarely featured in this literature, despite its high replicability in research. Intelligence is a robust predictor of well-being, job performance, and other social outcomes.

Read More »

Read More »

The Five Stages of Totalitarianism

Fears of a growing totalitarian tendency in the US have swelled during 2020–22. But how close are we really to a totalitarian state? How have such regimes come about historically and what are the warning signs? This article will answer these questions by examining totalitarian regimes in the eighteenth and twentieth centuries and the pattern by which they came to power.

Read More »

Read More »

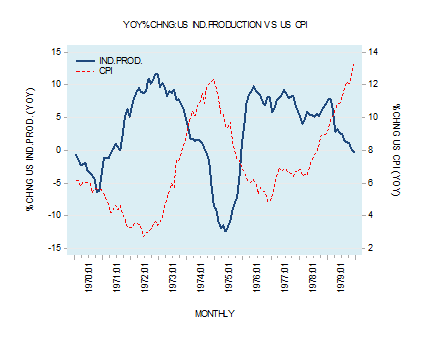

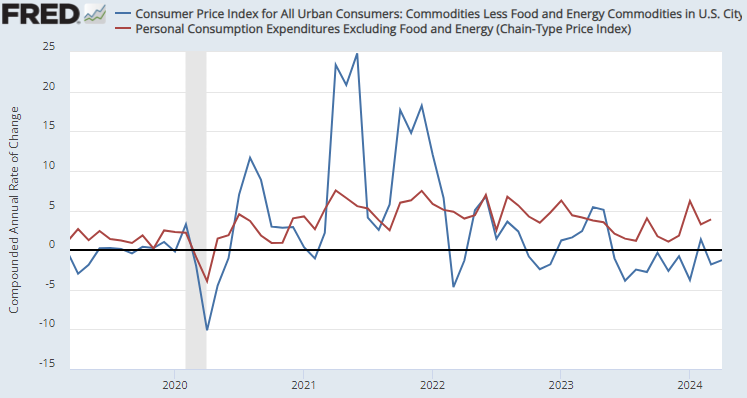

What Is Stagflation and What Causes It?

The occurrence of stagflation is associated with a situation of general strengthening in the momentum of prices while at the same time the pace of economic activity is declining. A famous stagflation episode occurred during the 1974û75 period, as year-on-year industrial production fell by nearly 13 percent in March 1975 while the yearly growth rate of the Consumer Price Index (CPI) jumped to around 12 percent.

Read More »

Read More »

What Is Wrong with the Fed’s Inflationist Policy?

Christopher Leonard’s book brings to mind the familiar line from Faust: “Two souls, alas! dwell in my breast.” Leonard offers a penetrating criticism of the Fed’s vast expansion of the money supply, which has won for him praise from the noted hard-money advocate and friend of the Mises Institute James Grant.

Read More »

Read More »

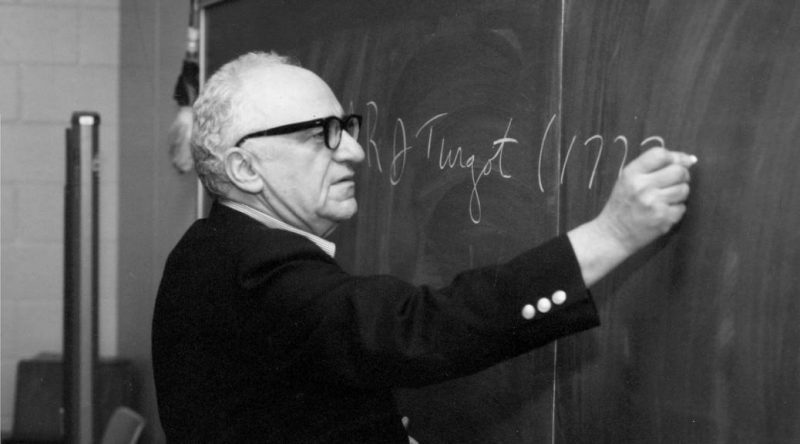

Rothbard vs. the Religion of Progressivism

Our main text for the Rothbard Graduate Seminar this week is Murray Rothbard’s Power and Market: Government and the Economy, which contains a systematic treatment of one area of economic theory, interventionism.

Read More »

Read More »

Respect the Fed? No, End the Fed

President Joe Biden has unveiled a three-part plan to fight inflation — or at least make people think he is fighting inflation. One part of the plan involves having government agencies “fix” the supply chain problems that have led to shortages of numerous products.

Read More »

Read More »

Degradation and Nationalization: The Inevitable Ways of Russian Autocratic Economic Policy

As Russian political scientist Gleb Pavlovsky has quite rightly said, one should not consider the five-thousand-plus sanctions imposed against the Russian Federation as of this writing as sanctions in the normal diplomatic and economic sense.

Read More »

Read More »

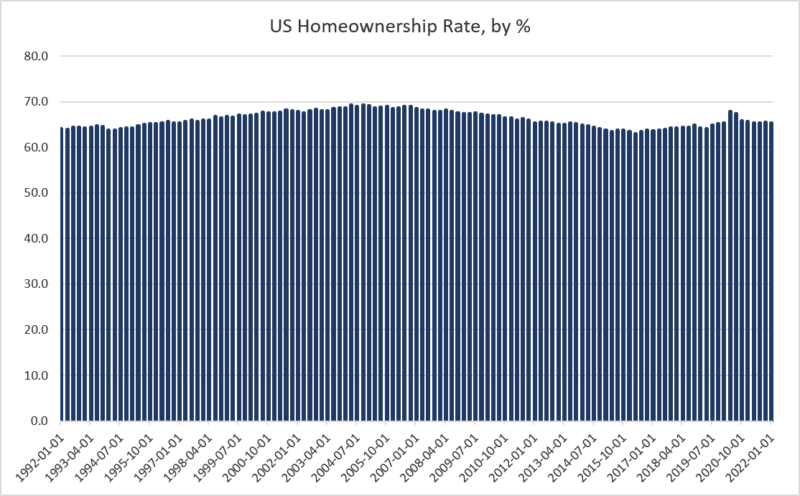

Are Today’s Homeownership Rates Sustainable?

There is scattered evidence that home prices are finally starting to slow down. But, if the phenomenon is system-wide, we’re still waiting to see the evidence in numbers. Last week, the most recent Case-Shiller national data, for example, showed that home prices in March rose an eye-popping 20 percent, year over year.

Read More »

Read More »

What If the U.S. Had Invaded Ukraine?

Let’s engage in a thought experiment. Suppose that Ukraine was headed by a pro-Russia regime. After repeated failed attempts at assassination by the CIA, the Pentagon finally decides to invade Ukraine for the purpose of bringing about regime change — i.e., ousting the pro-Russia regime from power and replacing it with a pro-U.S. regime.

Read More »

Read More »

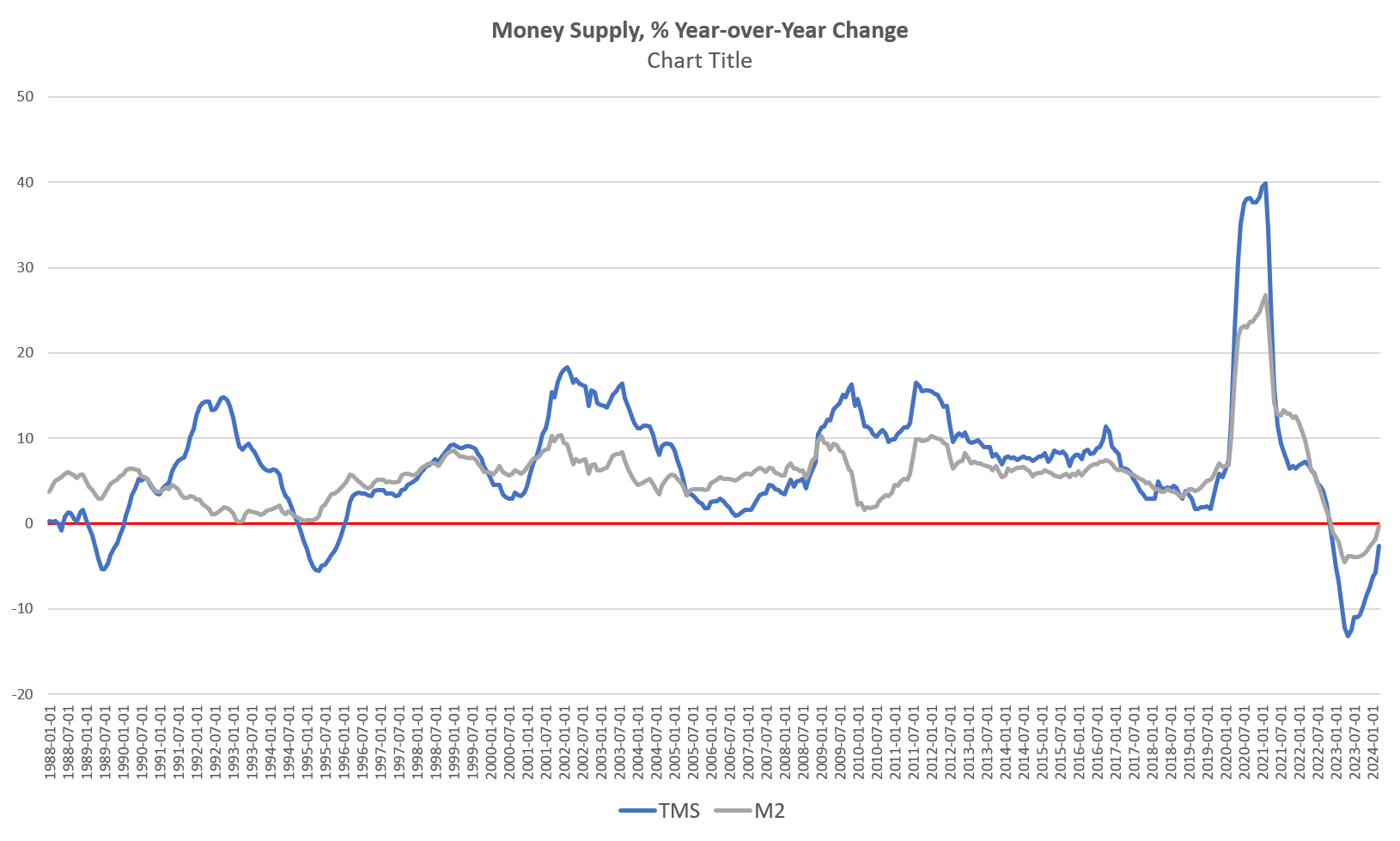

The Fed, and No One Else, Is Responsible for Inflation

According to commentators in the mainstream press and various federal officials, inflation is like the coronavirus. It spreads around the world, hitting different countries in different ways. Sometimes a country will experience only mild symptoms and sometimes more severe symptoms, like what happens with Covid.

Read More »

Read More »

Let’s Boycott Them!

Tom Woods’ bestseller Meltdown placed the blame for the financial debacle of 2008–09 on the government’s counterfeiter, the Federal Reserve. It was the Fed’s policies that created the problems, although most economists and economic talking heads didn’t see it that way. The Fed’s loose monetary policies funded the meltdown and became the “elephant in the living room” most pundits couldn’t see.

Read More »

Read More »

Does Capitalism Make Us More Materialistic?

There was a time when the advocates of socialism argued that it would lead man to material abundance, whereas free-market capitalism would lead only to increasing misery and would ultimately collapse under its own internal stresses. You don't hear that too much these days, and for good reason.

Read More »

Read More »

Finland and Sweden in NATO: Disregarding the Benefits of Neutrality

Finland and Sweden’s recent decision to apply for North Atlantic Treaty Organization membership is a major win for the military alliance, but a far more dubious one for these two countries. NATO badly needs a success at this moment, since neither the economic war on Russia nor the conflict in Ukraine seems to be going the West’s way.

Read More »

Read More »

Greenspan Would Be Proud: A Lesson in Fed Speak

It has become a familiar sight over the past decade and a half: a supposedly venerable member of the financial elite tells us with utmost calm that what we think we are seeing isn’t really all that bad. The Fed already knows all about it and has already taken all necessary steps. Further, they are monitoring the situation closely and are ready to make any necessary adjustments with ease and alacrity.

Read More »

Read More »

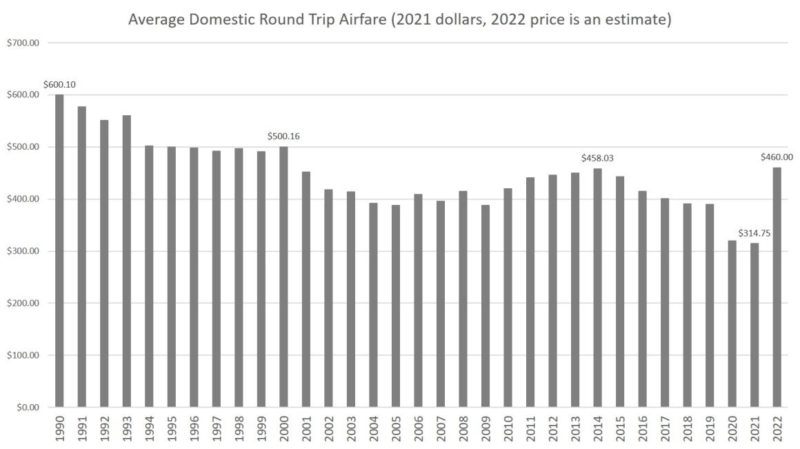

Debt-Fueled Demand and Oil Price Inflation Brings Airfares Roaring Back

If you’ve purchased any airline tickets lately, you’ve probably noticed that prices are up. It’s quite a reversal from the days of covid lockdowns, when airline tickets could be had for half the price of 2019 fares. Or even lower, in many cases.

Read More »

Read More »

Bastiat Predicted the Baby Formula Crisis 170 Years before It Happened

The current baby formula shortage in the United States is a pressing crisis, and many in the media have been rushing to explain how such a thing could have happened. But on close analysis, it appears to share the same root as virtually every other crisis experienced in the modern world: a government promised benefits without costs.

Read More »

Read More »

Why Russia’s Authoritarian Regime Continues to Enjoy Public Support

One of my areas of research in institutional economics is the social behavior of people under different political regimes, what Thomas Schelling called micromotives and macrobehavior. Of course, this topic is directly related to many disciplines, from behavioral economics and political theory to the neurobiology of decision-making and the theory of biological markets.

Read More »

Read More »

Don’t Be Fooled: The World’s Central Bankers Still Love Inflation

The Bank of Canada on Wednesday increased its policy interest rate (known as the overnight target rate) from 1.0 percent to 1.5 percent. This was the second fifty–basis point increase since April and is the third target rate increase since March of this year. Canada's target rate had been flat at 0.25 percent for twenty-three months following the bank's slashing of the target rate beginning in March 2020.

Read More »

Read More »