Category Archive: 6b.) Acting Man

Does the UK Need Even More Stimulus?

“We are all Keynesians now, so let’s get fiscal.” This is one view according to Ambrose Evans-Pritchard from The Telegraph who believes the time is right for the UK government to loosen its fiscal stance. He suggests that the “Bank of England has done everything possible under the constraints of monetary orthodoxy to cushion the Brexit shock. It is now up to the British government to save the economy, and the sooner the better,” — argues the...

Read More »

Read More »

The Deep State’s Catch-22

What happens if the Deep State pursues the usual pathological path of increasing repression? The system it feeds on decays and collapses. Catch-22 (from the 1961 novel set in World War II Catch-22) has several shades of meaning (bureaucratic absurdity, for example), but at heart it is a self-referential paradox: you must be insane to be excused from flying your mission, but requesting to be excused by reason of insanity proves you're sane.

Read More »

Read More »

Retail Snails

Second Half Recovery Dented by “Resurgent Consumer”. We normally don’t comment in real time on individual economic data releases. Generally we believe it makes more sense to occasionally look at a bigger picture overview, once at least some of the inevitable revisions have been made. The update we posted last week (“US Economy, Something is Not Right”) is an example.

Read More »

Read More »

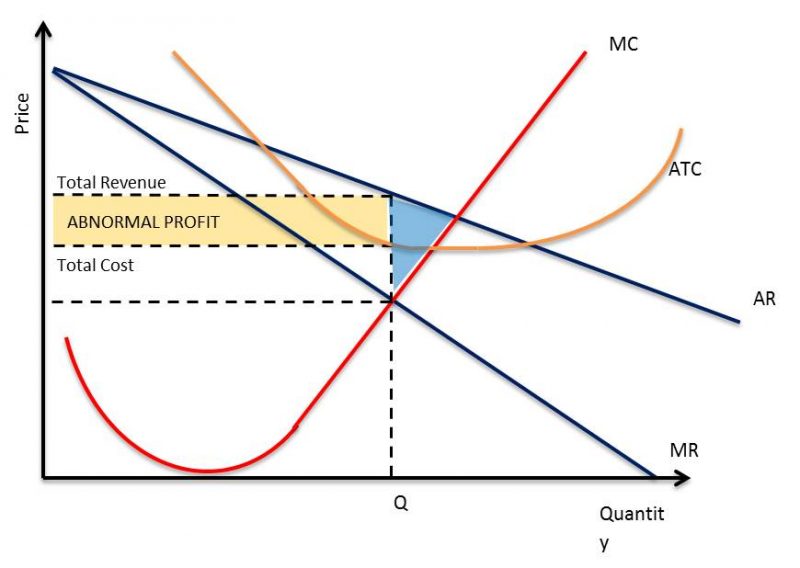

The Great Stock Market Swindle

Finding and filling gaps in the market is one avenue for entrepreneurial success. Obviously, the first to tap into an unmet consumer demand can unlock massive profits. But unless there’s some comparative advantage, competition will quickly commoditize the market and profit margins will decline to just above breakeven.

Read More »

Read More »

Insanity, Oddities and Dark Clouds in Credit-Land

Insanity Rules Bond markets are certainly displaying a lot of enthusiasm at the moment – and it doesn’t matter which bonds one looks at, as the famous “hunt for yield” continues to obliterate interest returns across the board like a steamroller.

Read More »

Read More »

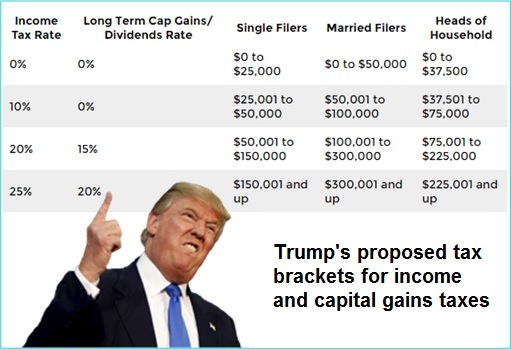

Trump’s Tax Plan, Clinton Corruption and Mainstream Media Propaganda

OUZILLY, France – Little change in the markets on Monday. We are in the middle of vacation season. Who wants to think too much about the stock market? Not us! Yesterday, Republican presidential candidate Donald Trump promised to reform the U.S. tax system.

Read More »

Read More »

Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball. For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his successor to take the blame).

Read More »

Read More »

US Economy – Something is not Right

Another Strong Payrolls Report – is it Meaningful? This morning the punters in the casino were cheered up by yet another strong payrolls report, the second in a row. Leaving aside the fact that it will be revised out of all recognition when all is said and done, does it actually mean the economy is strong?

Read More »

Read More »

States Must Help Restore Sound Money in America

Control the money, and you control the people. Over the last hundred years, the federal government and the Federal Reserve, a privately owned bank cartel conceived of in secret, have waged a war on sound money in America. They’ve ended the free circulation of gold (and, for a time, criminalized its ownership), while imposing taxes on those who trade with it.

Read More »

Read More »

Trump is Right About Stocks

It is not often that you get investment advice from a presidential candidate. It is even rarer that you get good advice.

Read More »

Read More »

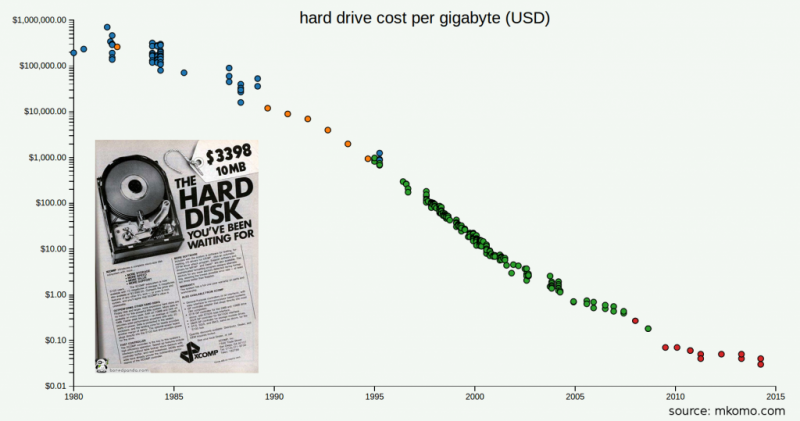

Deflation Is Always Good for the Economy

“Experts” Assert that Inflation is an Agent of Economic Growth. For most experts, deflation, which they define as a general decline in prices of goods and services, is bad news since it generates expectations for a further decline in prices.

Read More »

Read More »

Jailing Banksters Will Not Resolve the Economic Crisis

Meet the scapegoats! Three Irish bankers sent to jail: former finance director at the failed Anglo Irish Bank, Willie McAteer (42 months); former Irish Life and Permanent Bank Chief Executive Denis Casey (33 months); and former head of capital markets at the Anglo Irish Bank, John Bowe (24 months).

Read More »

Read More »

Why Americans Get Poorer

OUZILLY, France – Both our daughters have now arrived at our place in the French countryside. One brought a grandson, James, now 14 months old. He walks along unsteadily, big blue eyes studying everything around him. He adjusted quickly to the change in time zones. And he has adjusted to the French culture, too – he likes gnawing on a piece of tough local bread. But when she has trouble getting the little boy to sleep, our daughter asks Grandpa for...

Read More »

Read More »

Should the Government Give Us Infrastructure?

“Bad” Monopolies? An argument against absolutely free markets comes up often. What about so-called natural monopolies? So-called infrastructure projects (e.g. sewage plants) have high barriers to entry, and are a challenge to true competition.

Read More »

Read More »

Visions of Tomorrow from the Permanently High Plateau

Mad as a Hatter. Somewhere, someone first said “bull markets don’t die of old age.” We suppose this throwaway phrase was first uttered in a time and place much like today. That is, in the midst of a protracted bull market where stock prices had detached from the assets and earnings of companies their shares represent claim to.

Read More »

Read More »

Props to Armani!

Champion of the Downtrodden? “Democracy is the theory that the common people know what they want, and deserve to get it good and hard.” – H.L. Mencken. A mass e-mail has been making the rounds lately, and it is quite possible that many of our readers have already seen this. For those who haven’t, we wanted to share this moment of hilarity provided to us by Deep State candidate Hillary Clinton.

Read More »

Read More »

“Indian/China Gold Update” – Jayant Bhandari

Jayant gives us an update on the demand for gold in India and China since our interview at PDAC March 2016….let’s see what he has to say. Based in Singapore, Jayant is constantly traveling the world to look for investment opportunities, particularly in the natural resource sector. He advises institutional investors about his finds. Earlier, …

Read More »

Read More »

A Fully Automated Stock Market Blow-Off?

About one month ago we read that risk parity and volatility targeting funds had record exposure to US equities. It seems unlikely that this has changed – what is likely though is that the exposure of CTAs has in the meantime increased as well, as the recent breakout in the SPX and the Dow Jones Industrial Average to new highs should be delivering the required technical signals.

Read More »

Read More »

BullionStar Perspectives: Jayant Bhandari – Gold Disparity in India

Jayant Bhandari (www.jayantbhandari.com) shares with us his views on gold disparity in India and some of the geopolitical cause and effects.

Read More »

Read More »

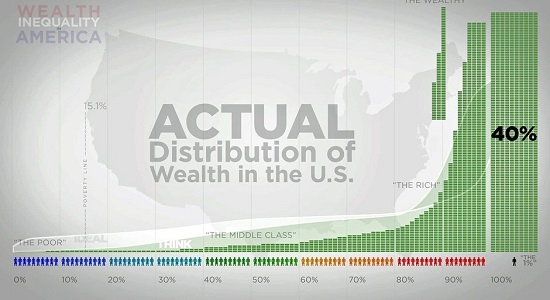

The Real Reason the “Rich Get Richer”

Time the Taskmaster DUBLIN – “Today’s money,” says economist George Gilder, “tries to cheat time. And you can’t do that.” It may not cheat time, but it cheats far easier marks – consumers, investors, and entrepreneurs. Tempus fugit – every action...

Read More »

Read More »