Category Archive: 6b.) Acting Man

Crude Oil Has Entered a Seasonal Downtrend

Many market observers are probably expecting crude oil prices to enter a seasonal uptrend due the beginning heating season. After all, the heating season in the Northern hemisphere means that energy consumption will rise. The effect of the heating season on demand is however offset by other factors, such as the use of alternative energy sources and fixed prices agreements made in advance. The question is: what is the actual seasonal trend in crude...

Read More »

Read More »

D-day for Australia’s Real Estate Bubble?

Unknowable Degrees of Bubble Insanity Back in February, we brought you an update on the truly insane real estate bubble in Australia (see: “Australia’s Housing Bubble – In the Grip of Insanity” for details) in the wake of Jonathan Tepper of Variant Perception reporting on an eye-opening fact-finding tour in Sydney.

Read More »

Read More »

Recessions, Predictions and the Stock Market

Only Sell Stocks in Recessions? We were recently made aware of an interview at Bloomberg, in which Tony Dwyer of Cannacord and Brian Wieser of Pivotal Research were quizzed on the recently announced utterly bizarre AT&T – Time Warner merger. We were actually quite surprised that AT&T wanted to buy the giant media turkey. Prior to the offer, TWX still traded 50% below the high it had reached 17 years ago.

Read More »

Read More »

You Didn’t Build That!

Collectivism Across Party Lines “There is nobody in this country who got rich on his own — nobody.” – Elizabeth Warren, campaign speech 2011. “If you’ve got a business – you didn’t build that. Somebody else made that happen.”

Read More »

Read More »

Governments Will Lose Their War on the Markets

DELRAY BEACH, Florida – The markets continue to dawdle. Not much conviction in either direction. We’ve already looked at the War on Poverty, the War on Drugs and the War on Terror. So let’s move on – using our new lens to look at another of the feds’ fake wars. No war was ever officially declared against the markets.

Read More »

Read More »

Donald, the “Maestro” and the Politically Controlled Fed

The Crazies, Former Federal Reserve Chairman Alan Greenspan, who was once laudably referred to as “Maestro” for his supposed astute stewardship of U.S. monetary policy, commented last week on the nation’s current political and economic climate.

Read More »

Read More »

US Stock Market – a Spanking May be on its Way

The stock market has held up quite well this year in the face of numerous developments that are usually regarded as negative (from declining earnings, to the Brexit, to a US presidential election that leaves a lot to be desired, to put it mildly). Of course, the market is never driven by the news – it is exactly the other way around.

Read More »

Read More »

Evacuate or Die…

BALTIMORE – Last week, we got a peek at the End of the World. As Hurricane Matthew approached the coast of Florida, a panic set in. Gas stations ran out of fuel. Stores ran out of food. Banks ran out of cash.

Read More »

Read More »

Australian property bubble on a scale like no other

Bubble trouble. Whether we label them bubbles, the Australian economy has experienced a series of developments that potentially could have the economy lurching from boom to bust and back. In recent years these have included: The record run up in commodity prices and subsequent correction. The associated boom in mining investment and current reversal. Record low bond yields. The boom in housing construction. Specifically apartments, that was spurred...

Read More »

Read More »

The Dying Middle Class

As expected, Ms. Yellen smiled last week, announcing no change to the Fed’s extraordinary policies. For the last eight years, she has been aiding and abetting the largest theft in history. Thanks to ZIRP (zero-interest-rate policy) and QE (quantitative easing), every year, about $300 billion is transferred from largely middle-class savers to largely better-off speculators, financial asset owners, and the biggest borrowers during that period –...

Read More »

Read More »

Credit Crisis in Waiting

Clowns in the Coliseum DUBLIN – The presidential debate began long after our bedtime, here in Ireland. So we got up this morning, rubbed our eyes, and watched the highlights. “Lowlights” is perhaps a better way to describe it:

Read More »

Read More »

The Fed and the Everything Bubble

John Hussman on Recent Developments We always look forward to John Hussman’s weekly missive on the markets. Some people say that he is a “permabear”, but we don’t think that is a fair characterization. He is rightly wary of the stock market’s historically extremely high valuation and the loose monetary policy driving the surge in asset prices.

Read More »

Read More »

Politics and Violence

Elizabeth received a strange letter from her congressman. “We have to be on guard against our enemies… and not be afraid to name them.” A brave, forthright stand? But wait, he didn’t name the enemies. That left us wondering: Who are our enemies? Muslims, Jews, Arabs… Russians, Iranians, North Koreans… capitalists, the Deep State, Yankees… liberals, conservatives?

Read More »

Read More »

Donald’s Electoral Struggle

Wicked and Terrible After touting her pro-labor union record, the Wicked Witch of Chappaqua rhetorically asked, “why am I not 50 points ahead?” Her chief rival bluntly responded: “because you’re terrible.”* No truer words have been uttered by any of the candidates about one of their opponents since the start of this extraordinary presidential campaign!

Read More »

Read More »

A Different Candidate?

French for Trump OUZILLY, France – There are two ways you can destroy a country: pull down its money or build up its military. Usually, they go hand in hand – one hand ruining the economic body, the other attacking the soul.

Read More »

Read More »

Why the Deep State Is Dumping Hillary

Join me in offering solutions by becoming a $1/month patron of this wild and crazy site via patreon.com.

Read More »

Read More »

Great Causes, a Sea of Debt and the 2017 Recession

NORMANDY, FRANCE – We continue our work with the bomb squad. Myth disposal is dangerous work: People love their myths more than they love life itself. They may kill for money. But they die for their religions, their governments, their clans… and their ideas.

Read More »

Read More »

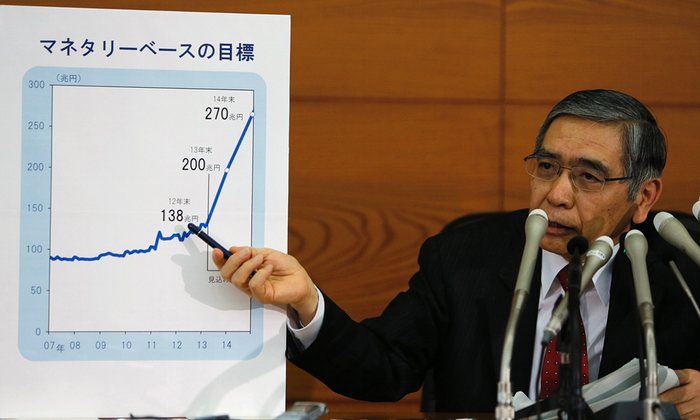

Don’t Bet on Deflation Lasting Forever

Japan’s stock market crashed in 1989. Since then, the no-luck Japanese have had sluggish growth, recession, and on-again/off-again deflation. For more than a quarter-century, the gears of Japan, Inc. have turned slowly. But will it last forever?

Read More »

Read More »

Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed ...

Read More »

Read More »