Category Archive: 1) SNB and CHF

La stratégie de la BNS pénalise toujours le pays et la population

33,7 milliards de francs suisses. Voici le montant du bénéfice, réalisé par la BNS à fin septembre, dont se félicitent nos médias. Le problème est qu’un chiffre sorti de son contexte ne sert à rien. Si votre patron vous augmente de 100 et qu’en parallèle, votre loyer augmente de 200, à la fin de l’année vous êtes en déficit de 100 n’est-ce pas? Dans un ménage, une entreprise ou un Etat, il convient de garder une vision globale.

Read More »

Read More »

The good years have started, increasing SNB Profits

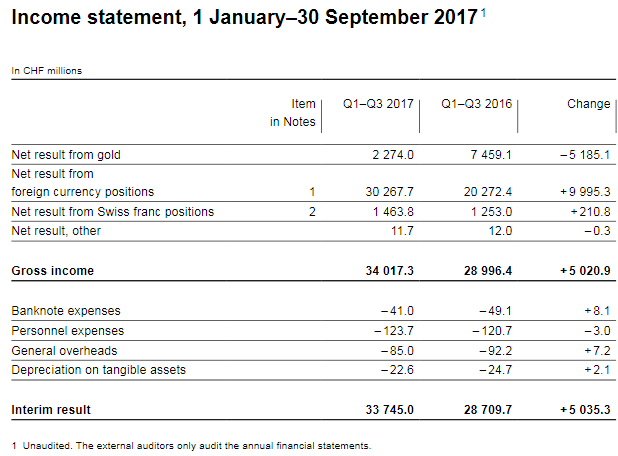

The Swiss National Bank (SNB) reports a profit of CHF 33.7 billion for the first three quarters of 2017. But in 2017, the picture is changed. Assuming a "biblical" cycle of seven good years and seven bad years, the SNB could now increase profits every year - thanks to a weaker franc and the seven good years.

Read More »

Read More »

Swiss industry has learned to live with strong franc

The recent appreciation of the Swiss franc has sent shockwaves through Swiss firms, resulting in job losses and lower research budgets. But viewed long-term, Switzerland’s export-driven economy has adapted remarkably well to a strong currency.

Read More »

Read More »

10 Franc Note: Banknote App Updated

The Swiss National Bank (SNB) is releasing an updated version of ‘Swiss Banknotes’, an app for mobile devices designed to help the public familiarise themselves with the new banknotes.The popular app, which has been downloaded over 70,000 times, now also showcases the new 10-franc note. It can be downloaded free of charge from the Apple (itunes.apple.com) and Google Play (play.google.com) app stores.

Read More »

Read More »

The new 10 Swiss franc note hand mystery

The third in a series of gorgeous new Swiss franc bank notes will be released by the Swiss National Bank (SNB) on October 18th. The 10-franc note keeps its yellow colour, but most everything else in the design and construction is different. What’s most remarkable about the new bank note? Not the 40 centimes or so it takes to make each note, nor that each note is projected to last only about a year. Not the sophisticated security measures, including...

Read More »

Read More »

Swiss National Bank Releases New 10-franc note

The Swiss National Bank (SNB) will begin issuing the new 10-franc note on 18 October 2017. Following the 50-franc and 20-franc notes, it is the third of six denominations in the new banknote series to be released. The current eighth-series banknotes will remain legal tender until further notice.

Read More »

Read More »

Die neue 10-Franken-Note – Impressionen von der Präsentation

Dieser Film zeigt Impressionen von der Präsentation der neuen Schweizer 10-Franken-Note am 11. Oktober 2017 in Bern. Fritz Zurbrügg, Vizepräsident des Direktoriums der Schweizerischen Nationalbank, und Thomas Wiedmer, stellvertretendes Mitglied des Direktoriums der Schweizerischen Nationalbank, stellen die wichtigsten Gestaltungsmerkmale und Sicherheitselemente der neuen Banknote vor.

Read More »

Read More »

Rappel: Que sont devenus les excédents de la balance courante de la Suisse

Le professeur Tille, membre du conseil de banque de la BNS nous présente un graphique ci-dessous avec une courbe verte qui est l’accumulation des excédents de la balance courante de la Suisse. Rappelons que les soldes de TARGET2 sont précisément les soldes -excédents/déficits- de la balance courante. Les excédents de l’Allemagne serviraient à combler les déficits des autres, en échange bien évidemment de reconnaissances de dettes...

Read More »

Read More »

Liquidités et dirigisme des banquiers centraux.

En 2013, puis en 2014 lorsque les questions du Taper et de la normalisation de la politique monétaire ont été évoquées, les grands noms de la Banque mondiale , les patrons de JP Morgan, Citi , Goldman se sont émus. Ils ont évoqué avec un bel ensemble le problème de la liquidité des marchés, en particulier obligataires. Ils l’ont évoquée pour se plaindre bien entendu de son insuffisance; les marchés sont trop étroits et trop peu profonds disaient...

Read More »

Read More »

Second Karl Brunner Distinguished Lecture, 21.09.2017

Second Karl Brunner Distinguished Lecture, 21.09.2017 00:00 Lino Guzzella, President, ETH Zurich 03:45 Thomas Jordan, Chairman of the Governing Board, Swiss National Bank 14:50 John B. Taylor, Mary and Robert Raymond Professor of Economics, Stanford University

Read More »

Read More »

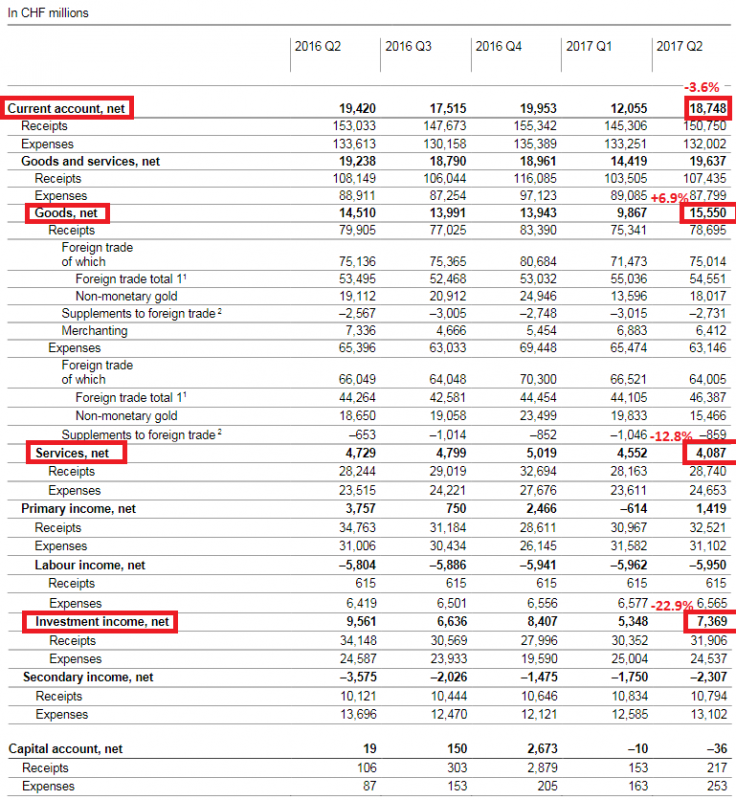

Swiss Balance of Payments and International Investment Position: Q2 2017

Key figures, Current Account: -3.6% against Q2/2016 to 18,748 bn. CHF, Trade Balance: +6.5% to 15,550 bn, Services Balance: -12.8% to 4,087 bn, Investment Income: -22.9% to 7,369 bn.

Read More »

Read More »

Is The Swiss National Bank A Fraud?

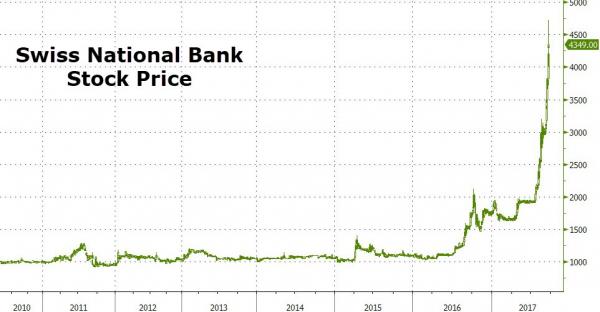

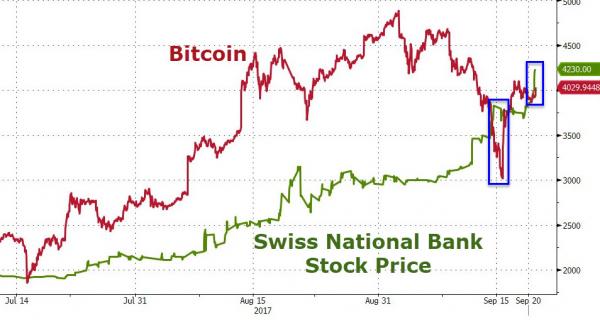

The price of shares in The Swiss National Bank is up 11 days in a row, soaring 150% in the last two months. That sounds like a 'tulip' bubble-like 'fraud'... The SNB is up over 120% in Q3 so far - more than double 'bubble' Bitcoin...

Read More »

Read More »

Fed’s Asset Bubbles Now At The Mercy Of The Rest Of The World’s Central Bankers

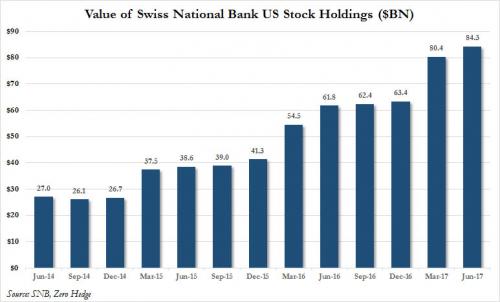

"Like watching paint dry," is how The Fed describes the beginning of the end of its experiment with massively inflating its balance sheet to save the world. As former fund manager Richard Breslow notes, however, Yellen's decision today means the risk-suppression boot is on the other foot (or feet) of The SNB, The ECB, and The BoJ; as he writes, "have no fear, The SNB knows what it's doing."

Read More »

Read More »

Swiss National Bank Bubble Regains Lead Over Bitcoin

But as Bitcoin rebounded from its China challenges, it overtook The SNB once again as bubbliest bubble. However, a 13% spike in the share price of The Swiss National Bank today has put an end to that leaving the central bank back in first place among the melter-uppers...

Read More »

Read More »

Digital-Currency Milestone: Somebody Just Bought A House With Bitcoin

A day after Bridgewater Associates Founder Ray Dalio claimed that bitcoin was “definitely in a bubble” partly because he said the digital currency was too difficult to spend, CoinTelegraph is reporting that the first-ever bitcoin-only real-estate transaction has been completed in Texas.

Read More »

Read More »

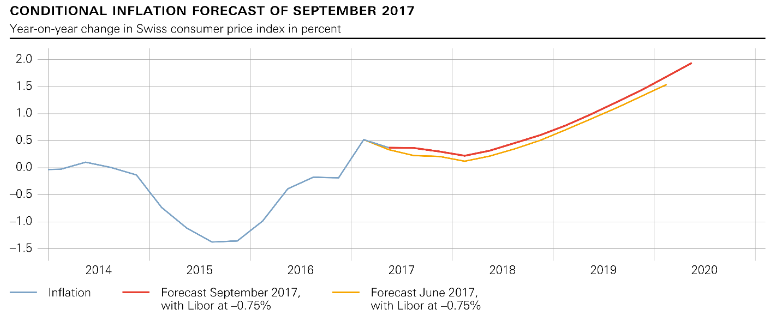

SNB Monetary Policy Assessment September 2017 and Comments

The SNB projects that she will reach her inflation target, shortly under 2% in the medium term, i.e. in 2019/2020. One reason might be the weakening of the Swiss Franc. But she does not prepare for a normalization of her policy: From the history we know that - once the franc is weakening - inflation may rise very quickly.

Read More »

Read More »

Forget Tulips & Bitcoin – Here’s The Real Bubble

While the broader market for Swiss stocks has risen modestly this year, one 'entity' has outperformed its peers by such a staggering margin, it has left bamboozled market experts struggling for an explanation. And that company is…the Swiss National Bank. The price of a share in Swiss National Bank in August rose above 3,000 francs ($3,143) for the first time, more than double the level of a year ago, and up 50% since mid-July, as the Financial...

Read More »

Read More »

Les banques centrales deviennent omnipotentes sur les marchés financiers.

Tel Atlas soutenant le monde, les banques centrales portent sur leurs épaules le marché financier. Cette réalité demeure largement occultée, mais elle détermine pourtant massivement l’avenir de nos économies. Nous avions déjà évoqué ce sujet l’année dernière (Les banques centrales commencent-elles à nationaliser l’économie ?). Il importe d’y revenir car de nouveaux chiffres confirment cette bizarrerie, puisque selon Goldman Sachs, elles détiennent...

Read More »

Read More »

Zuerst verdirbt die SNB unsere Jugend mit Irrlehren, dann lässt sie sie fallen

„Und sie dreht sich doch“ murmelte Galileo Galilei, nachdem ihn die Inquisitoren gezwungen hatten, dem kopernikanischen Weltbild abzuschwören. Dieses widerlegte die damalige heliozentrische Astronomie: Die Sonne drehe sich nicht um die Erde, sondern umgekehrt: Die Erde dreht sich um die Sonne. Eine kopernikanische Wende erleben wir zurzeit in der Geldtheorie: Die Volkswirtschaften drehen sich nicht um die Zentralbanken. Umgekehrt: Die Zentralbanken...

Read More »

Read More »