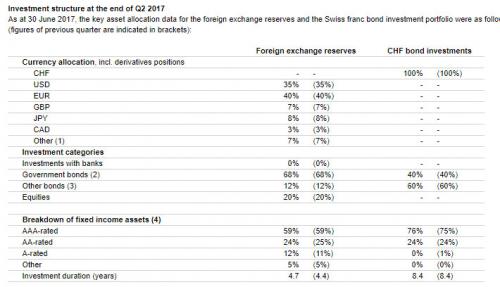

| Overnight, the Swiss National Bank disclosed the composition and breakdown of its FX reserves as of June 30. There were no notable changes, as the central bank kept most of its asset allocations unchanged from the previous quarter, with equities, government bonds and “other bonds”, at 20%, 68% and 12% respectively. There were also no shifts in the currency composition as shown in the table below.

There was one notable – and unexpected – development, and it had to do with the SNB’s -0.75% deposit rate. As Reuters writes, Swiss banks paid 970 million Swiss francs ($1 billion) in negative interest rate charges in the first half of 2017, a 40% surge from the previous year, as clients continued to hoard even more cash despite every possible action undertaken by the central bank to force savers to spend, or better yet, invest the funds. The Swiss National Bank has been charging a 0.75% fee on large deposits at the central bank since January 2015, a core policy aimed at weakening the Swiss franc and boost the velocity of money. The negative rate has been a burden for banks, especially at a time when wealthy clients are still keeping more than a fifth of their holdings in cash despite buoyant financial markets, recent earnings at the biggest private banks show. |

Investment Structure at the end of Q2 2017 |

As Reuters adds, parsing through commercial bank data, the amount of cash rich clients have parked with local banks has come down from the record-high level seen during the financial crisis but is declining only gradually.

In its call last week, UBS, the world’s biggest private bank, said cash holdings at its flagship wealth management division came down in Q2 to 21% of invested assets from 21.5% in the previous quarter. Overall, UBS Wealth Management has CHF1.04 trillion in invested assets.

Credit Suisse, the fourth-largest private bank in the world by assets, said cash holdings across its money managing units held steady in the three months to end-June at around 30%, which is a damning assessment of central banker policies which have tried everything to punish savers, and have so far failed.

Similarly, cash holdings at Julius Baer, Switzerland’s third-biggest private bank, declined only fractionally to 22% from 23%.

Quited by Reuters, Julius Baer CFO Dieter Enkelmann said last week. “It’s interesting to compare right after the crisis in 2008, cash levels were at 34 percent, and the low we have experienced in 2007, pre-crisis. There the cash was around 16 percent,”

“So there would be still room to go down if the markets would continue to do well.”

Alternatively, with global markets at all time highs, and with cash levels stubbornly refusing to go down, the most likely outcome is that at the first whiff of trouble, cash holdings will surge right back up to crisis level, forcing the SNB to unveil even more draconian negative rates, or to abandon its NIRP policy altogether and join the rest of the world in pursuing “hawkish” policies. How that will impact the recently plunging Swiss Franc is unclear.

Full story here Are you the author? Previous post See more for Next postTags: Banking,Banking in Switzerland,Business,Credit Suisse,economy,Finance,Financial crises,Financial crisis of 2007–2008,Great Depression,money,newslettersent,Reuters,Swiss Banks,Swiss Franc,Swiss National Bank,UBS