Category Archive: 1) SNB and CHF

SNB Sight Deposits: increased by 1.7 billion francs compared to the previous week

The sight deposits at the SNB increased by 1.7 billion francs compared to the previous week.

Read More »

Read More »

SNB Brings Back Zero Percent Interest Rates

With interest rates in developed economies falling but still significantly higher than their respective troughs in 2021-2022, some pundits are claiming that we are entering a new interest rate regime. Gone, they say, are the days of near-zero or even negative interest rates. The Swiss National Bank (SNB) may lead some pundits to rethink their logic. On June 19, 2025, the SNB reduced its policy rate by 25 basis points to 0.00%. Here are some reasons...

Read More »

Read More »

2/2025 – Business cycle signals: SNB regional network

Report submitted to the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment

Read More »

Read More »

2025-06-25 – Quarterly Bulletin 2/2025

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly monetary policy assessment of June 2025

Read More »

Read More »

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

Emmanuel Macron, le président qui avait décrété « la fin de l’abondance » de l’eau potable en août 2022, est également aux avant-postes du développement de « l’hydrogène vert ». Et c’est bien naturel, puisque l’imposant projet de réseau de « pipelines à hydrogènes » de l’UE servira en réalité à pomper des millions de m3 d’eau potable des régions montagneuses […]

Read More »

Read More »

Hold-up sur l’eau potable (1/2) : la fin de l’abondance. Par Vincent Held

Alors que l’écologie officielle déclare la guerre aux paysans et à leurs « méga-bassines », de formidables quantités d’eau potable sont tout tranquillement exportées hors d’Europe (et notamment de France) par tanker, à coups de centaines de milliers de mètres cubes.

Read More »

Read More »

Swiss interest rate cut to zero

On 19 June 2025, the Swiss National Bank (SNB) cut its policy rate by 25 basis points to 0%, effective June 20th. The Bank said the move follows a sustained decline in inflation, which turned negative in May for the first time since 2021.

Read More »

Read More »

ICYMI – Swiss National Bank cut interest rates by 25 basis points to 0%

Swiss National Bank news from Thursday ICYMI:SNB brings back zero rates in June monetary policy decision, as expectedSNB chairman Schlegel: We are now on the verge of negative interest rate territorySNB chairman Schlegel: We don't take decision on negative interest rates lightlyThe cut comes as Swiss inflation turned int deflation in recent months, from 0.3% in February to -0.1% in May.

Read More »

Read More »

SNB chairman Schlegel: We don’t take decision on negative interest rates lightly

We can never exclude any measure on interest ratesWe have discussed many optionsNegative rates have side effectsWe set monetary policy, don't have a goal for exchange rateHave not changed policy implementation with rates at 0% (Tschudin)Swiss banks can continue to operate at 0% rates (Martin)He's trying to sound like they're not that desperate yet to resort to negative rates.

Read More »

Read More »

Was kann die Schweizerische Nationalbank tatsächlich bewirken?

Geldpolitik - Die Schweizerische Nationalbank will die Inflation und die Wechselkurse beeinflussen. Fraglich ist, inwieweit ihr das gelingt.

Read More »

Read More »

Swiss National Bank Trials Blockchain to Modernise MDB Financial Processes

The Swiss National Bank, together with the Bank for International Settlements (BIS) Innovation Hub and the World Bank, has successfully developed a proof-of-concept (PoC) platform aimed at improving the management of financial commitments in Multilateral Development Banks (MDBs).

Read More »

Read More »

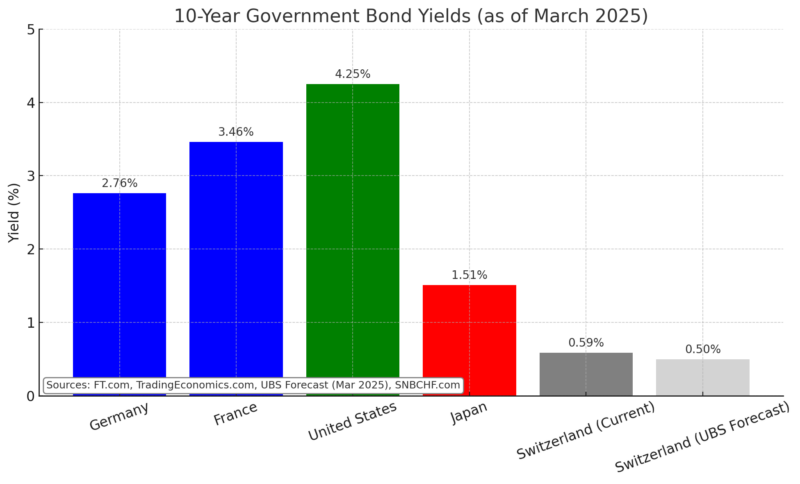

SNB Monetary Assessment March 2025

Swiss National Bank (SNB) Policy Update Policy Rate Cut: SNB lowered its policy rate from 0.50% to 0.25% due to low inflationary pressure and rising downside risks. 2025 Outlook: The policy rate is expected to remain at 0.25% for the rest of the year.

Read More »

Read More »

2025-03-20 – Martin Schlegel / Antoine Martin / Petra Tschudin: Introductory remarks, news conference

Required: These cookies (e.g. for storing your IP address) cannot be rejected as they are necessary to ensure the operation of the website. These data are not evaluated further.Analytics: If you consent to this category, data such as IP address, location, device information, browser version and site visitor behaviour will be collected. These data are evaluated for the SNB's internal purposes and are kept for two years.Third-party: If you consent to...

Read More »

Read More »

2025-03-18 – Publication of 2024 Annual Report

Required: These cookies (e.g. for storing your IP address) cannot be rejected as they are necessary to ensure the operation of the website. These data are not evaluated further.Analytics: If you consent to this category, data such as IP address, location, device information, browser version and site visitor behaviour will be collected. These data are evaluated for the SNB's internal purposes and are kept for two years.Third-party: If you consent to...

Read More »

Read More »

2025-03-03 – Annual result of the Swiss National Bank for 2024

Required: These cookies (e.g. for storing your IP address) cannot be rejected as they are necessary to ensure the operation of the website. These data are not evaluated further.Analytics: If you consent to this category, data such as IP address, location, device information, browser version and site visitor behaviour will be collected. These data are evaluated for the SNB's internal purposes and are kept for two years.Third-party: If you consent to...

Read More »

Read More »