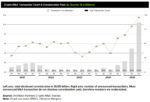

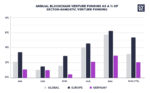

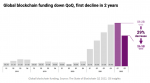

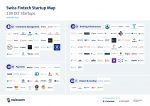

In 2025, the cryptocurrency and blockchain sector attracted some of the largest venture capital (VC) rounds in the fintech industry, reflecting investors’ optimism about the space’s potential to create new financial infrastructure, and deliver high‑growth returns, according to new data released by market intelligence platform CB Insights.

Of the 10 largest VC rounds of Q4 2025, four went to companies operating in digital assets, trading infrastructure, and crypto-enabled financial services, the data show. These transactions involved:

Kalshi, a US-based prediction market platform which secured US$1 billion in a Series E in December to support further consumer adoption, integration with additional brokerages, partnerships with news organizations, and expansion of product offerings;

Ripple,