Instant payments are scheduled for rollout in Switzerland in the summer 2024, opening up new opportunities in payment transactions, digital commerce and customer experiences. But the new standard will also put pressure on banks’ lucrative card businesses and will cost financial institutions a stiff amount in implementation, industry experts warn.

Starting August 2024, all banks operating in Switzerland and processing over 500,000 payments per year will be required to implement the new standard and be able to receive instant payments, the Swiss National Bank (SNB) has mandated. In an initial phase, these real-time transfers will be capped at CHF 20,000.

The second phase will require all participants in the Swiss Interbank Clearing (SIC) network to be able to receive and execute real-time transfers by the end of 2026.

In addition to priority introduction at banks, instant payments will also be implemented as an account-to-account (A2A) payment method in retail, as well as e-commerce.

For customers, the new system means immediate processing and settlement of payments around the clock, every day of the week. SIC, the Swiss infrastructure provider of payment services, has set a time-limit of 10 seconds on end-to-end payments processing.

This will represent a significant improvement from Switzerland’s current interbank payment system where money transferred can take several days before arriving in the recipient’s account.

Impact of real-time payments in Switzerland

Already, industry experts and observers are speculating on the possible impact of the introduction of real-time payments in Switzerland.

According to Alain Schmid, head of business banking at Credit Suisse, most fintech solutions today rely heavily on card technology, which comes with fees for merchants. The introduction of instant payments could put pressure on these fees.

Echoing Schmid, David Frei, Deloitte Switzerland’s payments lead and a director in the business operations consulting in Zurich, told Finews.com in a statement that he expects transaction costs for retail merchants to drop by factors thanks to real-time payments.

Over the medium term, Frei believes that the card business, which has been highly profitable for some banks, will reach an inflection point. If instant payments and A2A transactions prove popular among consumers, the fee income resulting from card transactions for banks will ultimately decrease, he said.

But it’s not all doom and gloom for banking incumbents. Sergio Cruz, the lead partner of Deloitte’s business operations practice in Zurich, wrote in a 2022 blog post that savings are expected from reduced operating costs due to the enhanced automation of payment processes.

He added that instant payments will also provide opportunities for banks to tap into customer data gathered from these to understand their customers’ behavior through data analytics of anonymized aggregated data.

In the broader market, Cruz is confident that the introduction of the new system will impact the types of fintech solutions offered in the market, encouraging fintech companies to build A2A payment offerings and possibly enabling the creation of new, innovative digital banking solutions.

Ultimately, instant payments will help improve customer experience, he claims, enhancing the usability of online banking solutions, enabling new offerings and optimizing costs.

But still, the adaptation of the infrastructure and processes to comply with the new instant payment requirements will require numerous changes that will affect banks. First, the implementation will lead to up-front costs.

To provide an idea of what that cost might be, Frei said that the changeover to the previous payment standard, SIC4, as well as the new payment slip with QR code, which was completed in 2022, costed banks an estimated CHF 600 million. He projects high costs for the change to the new system, SIC5, as well as, in addition to the associated introduction of real-time payments. “Considerable expense for the banking is to be expected,” he told Finews.com.

Switzerland lags behind international counterparts

Real-time payments are just one of the many new or improved functionalities part of the next and fifth generation of the Swiss central bank payment system. The new system, also referred to as SIC5, will introduce capabilities, such as a new settlement algorithm and higher processing performance.

The SNB, which helped launched the SIC5 project back in 2020, has said that the initiative was a testament of the central bank’s commitment to ensuring that “the cashless payment system in Switzerland remains efficient, secure and ‘future-proof’.”

The planned rollout of real-time payments in Switzerland starting next year makes the country a laggard compared to some of its international peers.

Singapore, for example, launched its FAST infrastructure back in 2014, enabling participating banks as well as non-financial institutions to link into a transfer network that enables real-time payments 24/7 365 days a year across the country.

India introduced its Unified Payments Interface (UPI) system in 2016, allowing consumers to make interbank peer-to-peer (P2P) and person-to-merchant (P2M) transactions seamlessly.

The Philippines launched its InstaPay electronic fund transfer service in 2018, while Vietnam has had its real-time payments infrastructure since 2020.

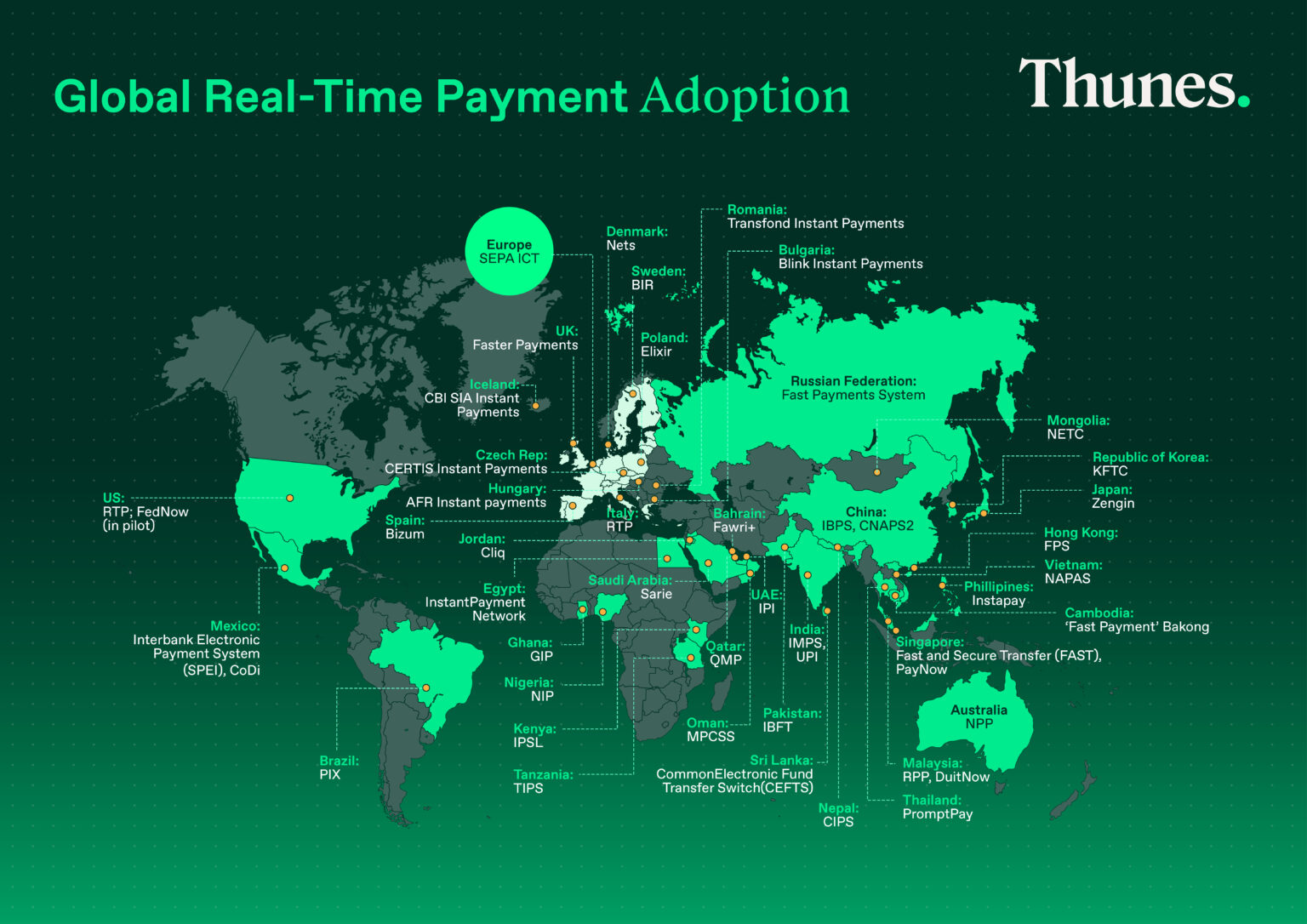

According to Fidelity National Information Services (FIS Global), an American multinational corporation which offers financial products and services, only 17 countries were live with real-time payments in 2014. As of 2022, up to 72% of the world had a live real-time payment infrastructure or was planning to launch one soon.

Global real-time payment adoption, Source: Thunes, 2022

To take a deep dive into this topic about SIC5, Fintech News Switzerland will be organizing a webinar featuring speakers from SIX, Yapeal Bank and Bottomline as they highlight the new banking trends and initiatives for 2023, the best strategy for digital payments transformation in Switzerland and how banks can develop new offerings for cross-border & domestic payments. Register here to gain more insights.

Featured image credit: Edited from Freepik

The post With SIC5 Around the Corner, Experts Weigh in on Possible Impact of Instant Payments in Switzerland appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter