Impossible BillsBALTIMORE – The tweet was never sent and never received: “Lying Otto von Bismarck set us up for bankruptcy! What was he thinking? Sad!!” Instead, Mr. Trump said last weekend that, far from trying to curb the promises and cut the costs of the welfare state, he was nearly ready to unveil a plan to replace Obamacare with something better: a plan that would provide “insurance for everybody.” The “iron chancellor” Otto von Bismarck, wearing the type of helmet one shouldn’t leave lying around on a chair. Bismarck was responsible for the unification of Germany, which he achieved by engineering several wars as prime minister and foreign minister of Prussia. Prussia waged war against Denmark, Austria and France, and defeated all of them. Bismarck then unified the independent German states, city-states, bishoprics and principalities partly by annexation and partly by negotiation. Once Germany was unified, he was appointed “chancellor of the empire”. It was as though he was finally promoted to a post beyond his competence, in line with the Peter principle. First he embarked on the so-called Kulturkampf, aiming to undermine the power of the Catholic Church. The Church fought back by entering into a powerful political alliance with the Center Party. Bismarck abandoned the effort when he realized that secularists were using it to attack religion in general and that he would need the Center Party’s cooperation. Shortly after Germany’s unification, Europe was struck by an economic depression (incidentally, the term “crash” was coined when stocks cratered on the Vienna stock exchange in 1873). Bismarck immediately ensured that the depression would get worse by introducing tariffs in order to “protect” German industry. As the economic downturn predictably intensified, the popularity of socialism increased markedly. Bismarck responded by banning all socialist organizations and literature in 1878, which utterly failed to quell the rise of the socialists. In a renewed effort to undermine support for them, Bismarck introduced the welfare state in the 1880s, which 140 years later is in the process of bankrupting all of Western civilization. Do we have anything good to say about the man? Yes, we do. In contrast to his time as Prussia’s prime minister, he eschewed war as chancellor of the empire. In fact, he did everything in his power to preserve peace in Europe – it was by far his greatest concern. One year before his death he darkly predicted: “One day a great European War will come out of some damned foolish thing in the Balkans.” |

|

| The liberal and illiberal elites are still trying to figure it out: Isn’t that what Hillary was planning? The Obama team – like the Bushes and Clintons before it – had already run up impossible bills at taxpayers’ expense and offered all manner of unaffordable benefits.

Now, explained former Fed Chairman Alan Greenspan in his private conversation with us here in Baltimore a few days ago, entitlements are out of control. The system set up by German Chancellor Otto von Bismarck in the 19th century is going broke in the 21st. After the French Revolution, the elites of Europe realized they had to make peace with “the people.” This they did, with Bismarck taking the lead, by promising people more in “social welfare” benefits than they paid in taxes. The difference between what they paid and what they got would come from two sources. First, it would come from the rich, who would pay higher rates. Second, it would come from the next generation. According to this chart, entitlement spending plus interest expenses will consume all tax revenues by 2033. A similar estimate made in 2007 predicted that this point would only be reached in 2052. The above is the most recent estimate we could find in chart form, but it is outdated already: more recent estimates are pointing to 2025, a mere 8 years from now. In other words, as of 2025, every cent of discretionary government spending will have to be borrowed (or printed by the Fed). Unfortunately, this is definitely a credible forecast. Consider a few data points: from 1790 to 1913, government spending averaged just 3% of GDP; government was but a footnote in most people’s lives. After a large spike in WW1, spending declined sufficiently to return to this long term average by 1930. Alas, then came the depression, and FDR came to power. Today government spending stands at approx. 26% of GDP (still a lot lower than in most of Europe, which is facing similar problems). Every fifth US citizen is dependent on the government, not including government employees. Between 1962 and 2011, the “index of government dependence” has soared from around 12 points to 332 points. Between 1965 and 2010 real GDP grew 2.7 times, while entitlement spending soared 10.6 times (the “war on poverty” began in 1964 and the relentless decline in poverty in evidence previously almost immediately came to a screeching halt, vividly illustrating the fundamental boondoggle qualities of this program; in fact, it is probably the greatest government boondoggle in history). According to CBO projections (which tend to err on the side of optimism, since they inter alia fail to account for economic busts and rising interest rates), mandatory spending will reach a towering $7.4 trillion in 2032, while discretionary spending will amount to around $2 trn., for close to $9.4 trillion in total government spending. No hints were provided as to how exactly GDP and government revenues will magically triple in just 15 years. It seems that contrary to Keynes’ famous bonmot, we are not “all dead in the long run”; instead the long run is about to catch up with us. |

Entitlements to consume all taxes 1970 - 2050 |

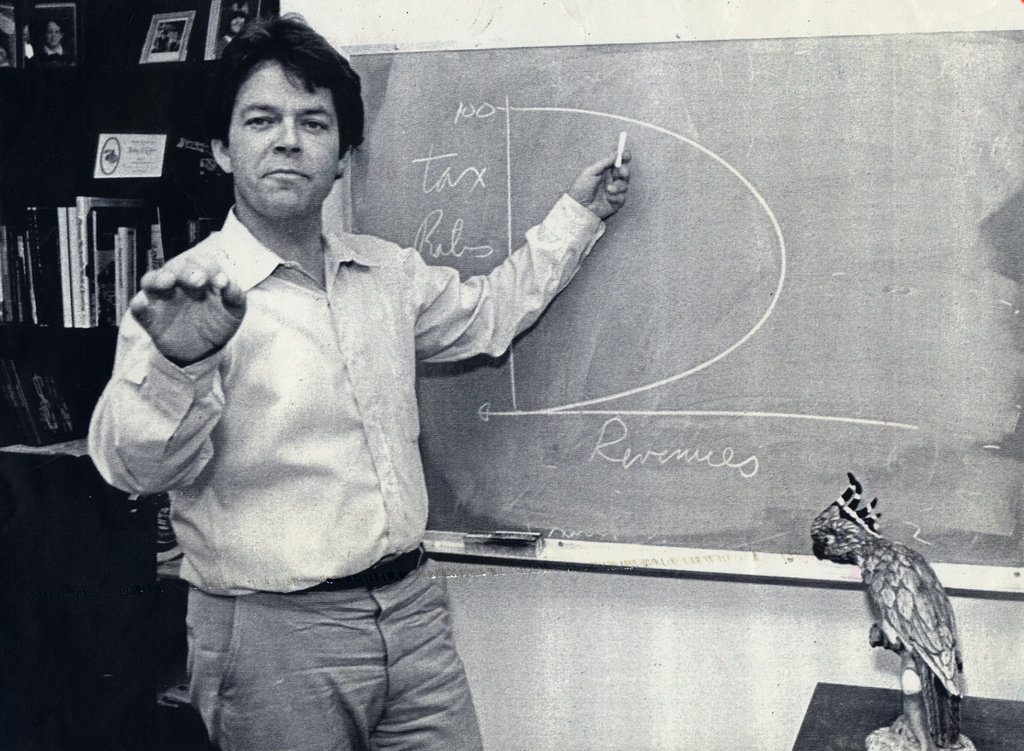

Goldilocks RateAs to the first, the elites ran into a problem. They were the “rich.” They didn’t want to raise taxes on themselves! And along came economist Arthur Laffer with a handy theory explaining why they shouldn’t. Laffer claimed there was a “Goldilocks” rate – not too high, not too low – at which the feds would collect the maximum amount of revenue. A 100% marginal tax rate discouraged the rich from earning more money. A 0% marginal rate left the government with no revenue. The ideal rate must lie somewhere in between. He undoubtedly had the right idea in principle, even though there exist no smooth “curves” in the real world of human action. Nevertheless, it seems glaringly obvious that rapaciously high tax rates will destroy economic incentives, which will invariably lead to lower economic growth and hence lower government revenues as well. Entrepreneurs will waste a great deal of time and effort on how to best avoid taxes, rather than focusing on how to best serve their fellow men with cheaper, better or new products and services. Some people will be unnecessarily tempted to break the law, as tax evasion will be promoted as well. Excessively high taxes are definitely an all-around lose-lose proposition. |

|

| Besides, there really aren’t that many rich people after all. And they tend to be hard to pin down. “The art of taxation,” former French Finance Minister Jean-Baptiste Colbert had explained in the 17th century, “consists of plucking the goose to get the most feathers with the least amount of squawking.”

The rich tended to squawk. And since they were also the elite who controlled the system, their squawks were backed by campaign cash… their pain was felt… and tax rates at the top were brought down. The presumed optimal tax rate, here in Baltimore at least, is right in the middle, between all and nothing – at 50%. The second source of revenue was the more important one. From 1850 until today, each successive generation was reliably richer and bigger than the one before it. For example, according to The Wall Street Journal, in 1970, 92% of 30-year-old Americans earned more than their parents at the same age. But that source of funding is drying up. The Journal was reporting on a new study undertaken by Harvard, Stanford, and the University of California. The same study found that only about half of 30-year-olds today earn more than their parents. In other words, this generation has made no financial progress compared to the previous one. And taking just men, the situation is worse: Out of 10 30-year-old men, only four earned more than their fathers in 2014. French bureaucrat Jean-Baptiste Colbert, minister of finance under Louis XIV. Colbert was the father of mercantilism – he erroneously believed trade to be a zero-sum game, in which one party is always fated to lose what the other party gains (this misguided idea informs politics to this day). His main goal in life was to increase the power of the State. He eagerly went about obtaining as much tax revenue as possible and brought artists and intellectuals under almost complete state control (they were supposed to focus exclusively on serving the sun king and his interests). Colbert’s success as a “goose-plucker” made him a rich man; while allegedly serving the public by ruthlessly oppressing it, he amassed a huge personal fortune. |

|

Headed for BankruptcyThese results are based on government statistics, which we don’t trust for a minute. So, we will do our own calculation, reduced to the simplest terms. A working man needs a pickup truck. How many hours of work does he need to buy one? In 1970, the basic pickup cost 948 hours of work at the prevailing wage at the time. By 2016, it took 1,190 hours of shoulder-to-the-wheel labor to buy it – 25% more. It should be no surprise that the hours of work a median wage earner needs to put in to buy a basic pickup truck have increased by 25%. There are a great many studies presenting statistics on growing wealth disparities and the stagnation of median household incomes (note that all such statistics have to be taken with a grain of salt. The economy cannot be precisely “measured”). The chart above is an updated version of a chart that appeared in a lengthy study by the left-leaning “Economic Policy Institute”. We added the remark about Nixon, the gold exchange standard and fiat money to it. Guess how many times the following terms are mentioned in the study: “gold”; “fiat money”; “credit expansion” and “money supply”. If you guessed “zero”, you are exactly right. As is the rule with such studies, the monetary system seems to be off limits and is simply not discussed, never mind questioned. The central planners overseeing it rate a brief mention, but the only criticism that is offered is that the Fed allegedly “prioritized low rates of inflation over low rates of unemployment in recent decades” – in other words, monetary policy wasn’t loose enough! This is the by far most absurd thing the authors of the study could have possibly said about the Fed’s role in promoting inequality. Mind, we don’t even agree with the notion that inflation and employment are inversely correlated – this idea has been debunked ages ago, and neither sound theory nor empirical data support it in any way. It is nothing but an article of faith. By contrast, the non-neutrality of money, which results from the manner in which newly created money enters into and spreads through the economy, and the associated effects of money supply expansion on the distribution of wealth have been ascertained by sound, logical economic reasoning. These things have been known for centuries, but admitting to their validity would ultimately force economists to bite the hand that feeds most of them. Hence, crickets. Luckily we don’t depend on said hand, which has the not inconsiderable advantage that we are free to give voice to sound economic theory. Incidentally, quite a few fairly comprehensive missives on inequality penned both by ourselves and other authors have been published here in the past (see for instance “Modern-Day Social Engineers and Wealth Inequality”; more articles on the topic can be found by Googling “acting man, inequality” or “acting man, wealth and income inequality”). |

Disconnect between productivity and typical worker's compensation, 1948 - 2013 |

Few people realize that Bismarck’s model of government is already headed for bankruptcy. The U.S. federal debt will top $20 trillion this month. Over the next decade – if there are no tax cuts and no spending increases – it will rise to $30 trillion.

So far, the money still flows to the baby boomers. And the evidence of impending doom is hidden by record-low lending rates.

But the feds are no longer counting on the next generation to make the welfare state work; they’re sending the bills to a future generation that has not even been born yet. What they will do when they get the bill, no one knows.

“I don’t know how this is going to end,” Dr. Greenspan told us gloomily. None of this was probably obvious to the average Trump voter. And maybe not even to Citizen Trump. But it will be soon.

Charts by: Heritage Foundation, Economic Policy Institute

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Economy,On Politics