| The 4% Rule Is Dead. A recent article by Shawn Langlois via MarketWatch pointed out this sobering fact but is one we have discussed previously. Retirees have long counted on being able to retire on their assets and take out 4% each year. However, a little more than 20-years later, the “death of the withdrawal rate” has arrived. What should retirees do now?

As noted by Shawn:

The idea of the 4% rule originally suggested that once retired, the portfolio allocation is shifted to ultra-safe Treasury bonds. |

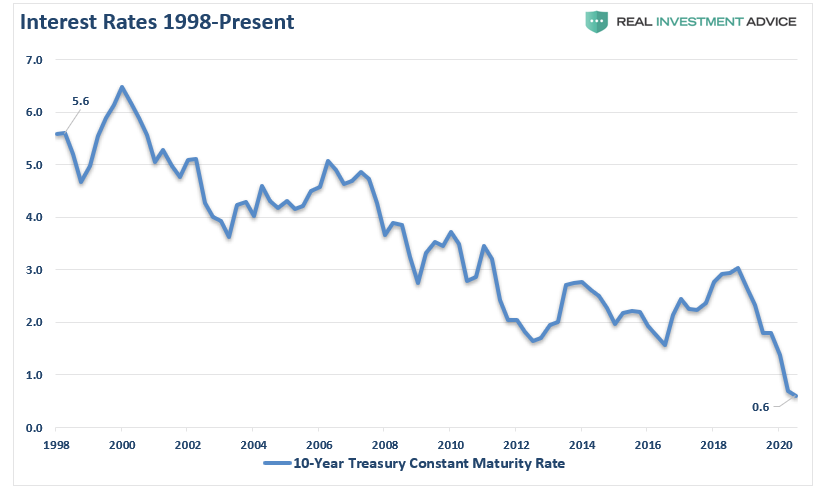

Interest Rates, 1998 - 2020 |

| Such an allocation shift provided for the income required to live on, plus a Government guarantee of the principal.

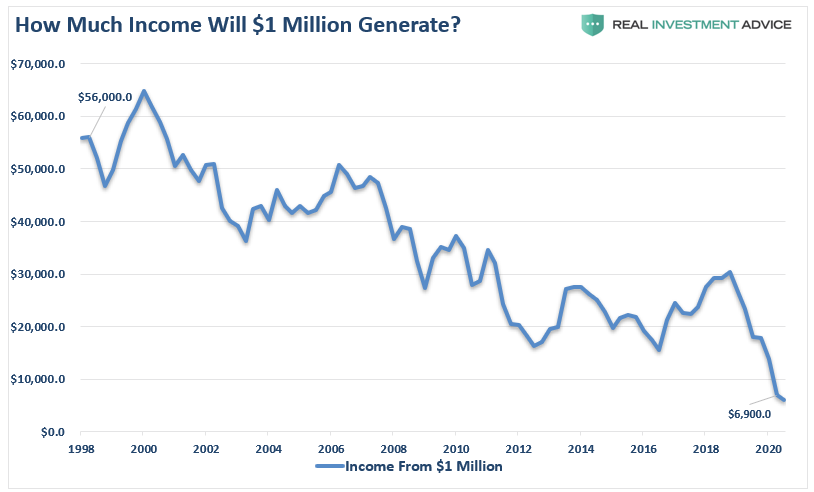

Here’s the problem. When the 4% rule was put into place, Treasury yields were 5%. Today, they are closing in on 0.5%. This is a massive problem for retirees today. As shown, $1 million will no longer generate a $50,000 income for retirement. Today, it is just $6900/year. |

How Much Will 1 million Generate, 1998 - 2020 |

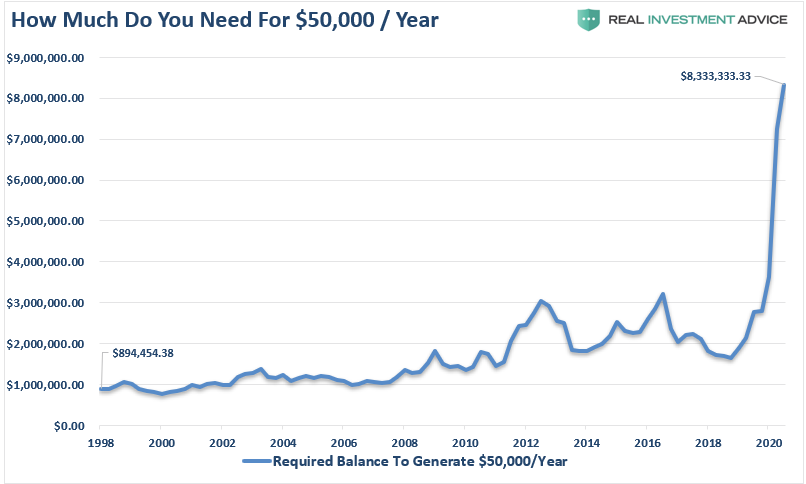

| Even more shocking has been the speed of the change. In 2016, it took roughly $5 million to generate $50,000/year. Just 4-years later, that number has skyrocketed to over $8 million. |

How Much do you need for 50000 per year, 1998 - 2020 |

| For both young savers, and boomers approaching retirement, the challenges of planning for retirement today are daunting. |

The Next Bear Market Is Coming |

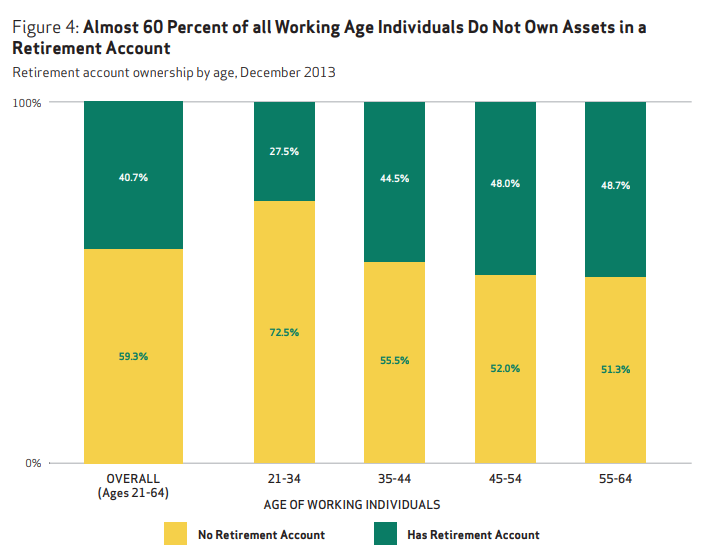

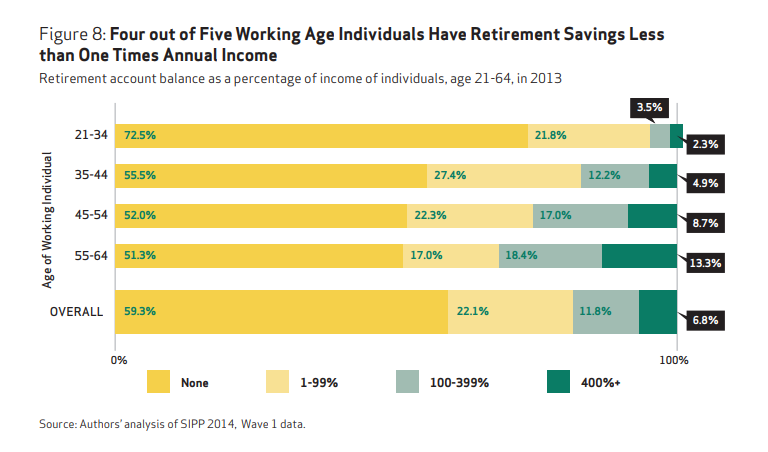

Problem #1: Very Few People Have $8 MillionWhile it is nice to think that throwing a few shekels into the market will magically turn into millions, the reality is far different. As discussed in “Why Are Boomers So Broke,” after two of the greatest bull markets in U.S. history during their lifetime, the savings statistics are depressing. For many reasons, individuals simply don’t save money. Currently, almost 60% of ALL WORKING-AGE individuals DO NOT own assets in a retirement account. |

No/Has Retirement Account |

| However, it’s actually more dismal than that. The typical working-age household has ZERO DOLLARS in retirement account assets. Importantly, “baby boomers” who are nearing retirement had an average of just $40,000 saved for their “golden years.”

Lastly, only 4-0ut-of-5 working-age households have retirement savings of less than one times their annual income. This does not bode well for the sustainability of living standards in the “golden years.” |

Savings Balance |

According to the study by MagnifyMoney:

You can’t get to $8 million if you can’t save to start with. |

Newsletter Banner |

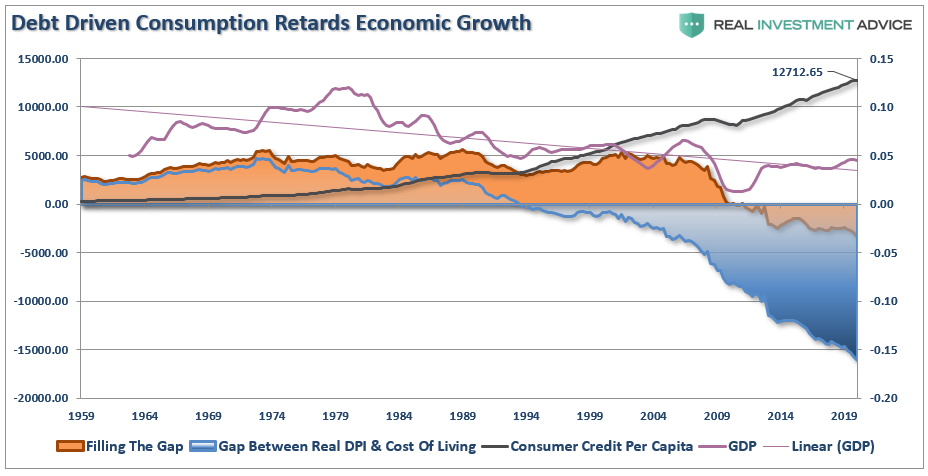

Problem #2: Can’t Save For RetirementThe ability of people to save money has become substantially more problematic. I showed the following chart recently, which illustrates the gap between income, savings, and the cost of living.

|

Debt Consumption GDP GAP, 1959 - 2019 |

When viewing the “saving problem” from this perspective, it is easy to understand the survey responses from Kiplinger and Personal Capital. Americans said the biggest roadblocks to saving for retirement were:

While the Fed keeps inflating stock markets, the “trickle-down” effect has yet to occur. |

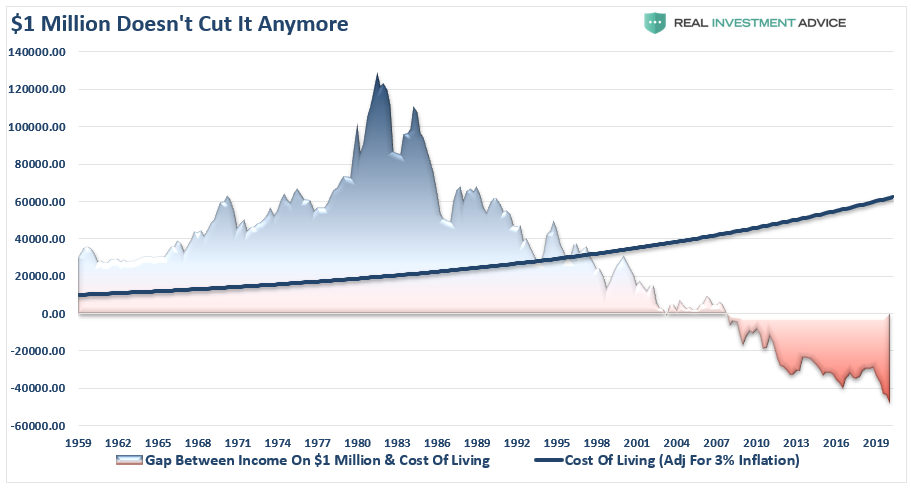

Million Doesnt Cut It Anymore, 1959 - 2019 |

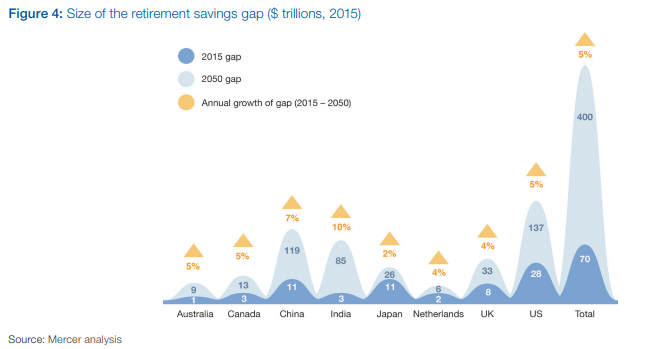

Problem #3: Don’t Forget The InflationIn 1980, $1 million would generate between $100,000 and $120,000 per year while the cost of living for a family of four in the U.S. was approximately $20,000/year. Today, there is about a $50,000 shortfall between the income $1 million will generate and the cost of living. This is just a rough calculation based on historical averages. However, the amount of money you need in retirement is based on what you think your income needs will be when you get there. For most, there is a desire to live a similar, or better, lifestyle in retirement. However, over time our standard of living will increase with respect to our life-cycle stages. Children, bigger houses to accommodate those children, education, travel, etc. all require higher incomes. (Which is the reason the U.S. has the largest retirement savings gap in the world.) |

Savings Gap, 2015 - 2050 |

| If you are in the latter camp, like me, a “million dollars ain’t gonna cut it.” |

Subscribe YOUTUBE |

n is 23 years old and earns $40,000 a year.

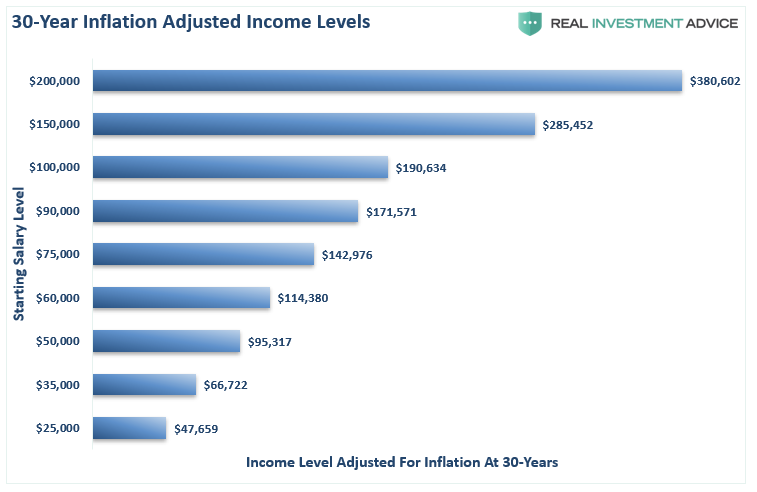

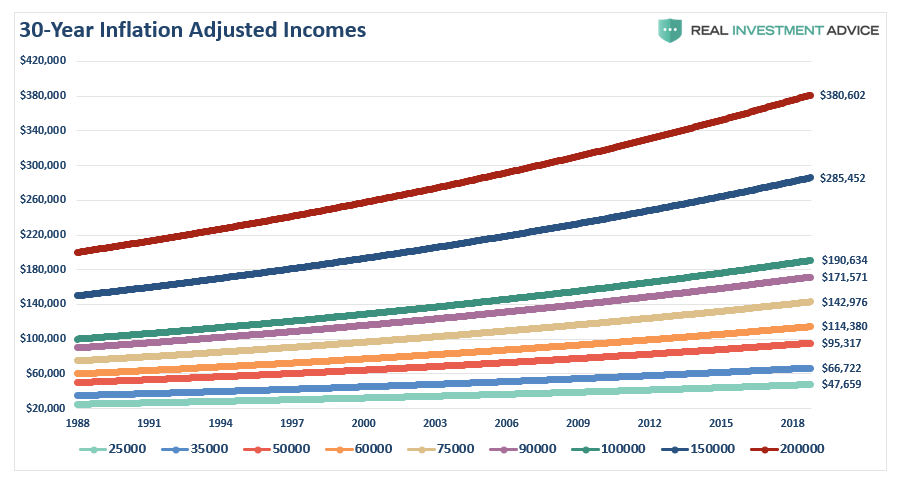

That pretty straightforward math. IT’S ENTIRELY WRONG. The living requirement in 44 years is based on today’s income level, not the future income level required to maintain the current living standard. Look at the chart below and select your current level of income. The number on the left is your income level today and the number on the right is the amount of income you will need in 30-years to live the same lifestyle you are living today. The Inflation-EquationThis is based on the average inflation rate over the last two decades of 2.1%. However, if inflation runs hotter in the future, these numbers become materially larger. Here is the same chart lined out. The chart above exposes two problems with the entire premise:

|

30-Year Inflation Adjusted Income Levels |

lass=”pf-content”>

Start Rethinking Your PlanThe analysis above reveals the important points individuals should consider in their financial planning process:

|

30-Year Inflation Adjusted Incomes, 1988 - 2018 |

| y of people working well into their retirement years.

|

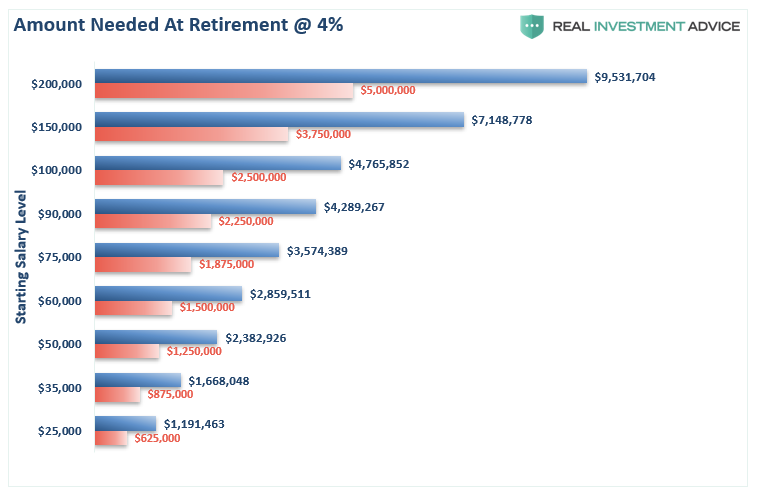

Amount Needed To Fund Retirement |

Start Rethinking Your PlanThe analysis above reveals the important points individuals should consider in their financial planning process:

Investing for retirement, no matter what age you are should be done conservatively and cautiously with the goal of outpacing inflation over time. This doesn’t mean you should never invest in the stock market, it just means that your portfolio should be constructed to deliver a rate of return sufficient to meet your long-term goals with as little risk as possible. |

RIAPRO Dont Invest Alone Banner |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,Investing,newsletter