Why not let the accused also sit in the jury box? The answer seems rather obvious. While maybe the truly honest man accused of a crime he did commit would vote for his own conviction, the world seems a bit short on supply of those while long and deep offering up practitioners of pure sophistry in their stead.

These others when faced with irrefutable evidence of their guilt opine endlessly, obliquely about how “it’s complicated.”

See, though, it’s actually not.

We’ve been led to believe that the utterly simple is too dense and esoteric for our limited intelligence to handle.

|

Better, then, to leave it to our betters. If they say they’ve done the job, then we must take them at their word. Only they would know for sure, and we can be assured of it because they say so.

Pretty impressive, huh? The above was written and released over the weekend, contained within the European Central Bank’s latest issue of its Economic Bulletin (Issue 5/20). I mean, who’s going to argue with all that? Bam. Except, it’s a whole lot of words to say basically just one thing: COVID QE (PEPP) was successful because it lowered – especially after the June “recalibration” where the ECB panicked even more – medium and long-term rates. Yeah, this again. |

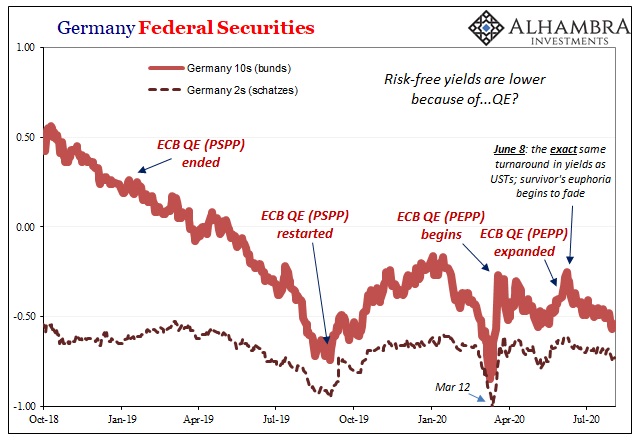

Germany Federal Securities, 2018-2020 |

| Let’s give these people the benefit of the doubt anyway. We’ll assume that what was written in the latest bulletin is actually true; that PEPP and then June’s expanded PEPP both responsible for the decline in yields pictured above. No, it wasn’t the matching June 8 turn in the global bond market, especially for UST’s I wrote about last week. Chalk this up to Christine Lagarde’s wise stewardship, flawless technical proficiency, and unchallenged execution!

Even when we do so, guess what? We still find out that the most effective, absolute biggest mover in risk-free yields across Europe is…the ECB. Not buying bonds, mind you, but in everything it has done up to and including that. Those periods in between when the ECB says the European economy is recovering and accelerating because of the last thing it did – only to find out after a spell that it didn’t work and the next “big” thing that surely will is about to be undertaken. Yields sink as the central bank cannot stop the economy from continuously being pinned down. QE and outright bond buying was just the last in a long string of “brilliant” ideas, like LTRO’s, that never once accomplished their actual, stated, promised goals (recovery, as the word actually means). |

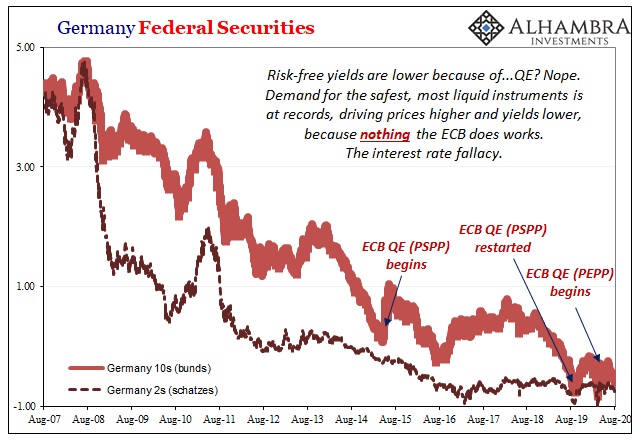

Germany Federal Securities, 2007-2020 |

| Even when assuming this most recent “lowering of yields” had been accomplished by PEPP it still isn’t very impressive, though, even less so when you place it in the context of the last almost thirteen years. Giving it every benefit of every doubt, and it’s still so awfully insignificant.

It’s the corollary to what I write every time a new QE is uncorked – if you have to do it more than once, or change the terms along the way, it didn’t work and certainly was never “quantitative.” The fact that ECB policymakers will have you and everyone believe that low risk-free yields are their doing given what you see above is akin to putting the most dishonest and heinous criminal in the jury box alone by himself to inappropriately render what truly is a momentous, incredibly crucial verdict. |

Central Bank Failure, 1999-2020 |

It is disgusting, and it’s certainly not all that complex. Who killed bond yields? The ECB surely did, just not in a righteous fit of intentional self-defense of the European and global economy. Rather, through such gross negligence and dereliction there’s really no other possible way to make any sense of this; sophistry substituted for the mountain of evidence which only begins with a rational reading of yield history.

In lieu of common sense, however, the guilty will use a whole lot of those impressive sounding words to obfuscate instead of argument, while very much counting otherwise on the favorable rulings of the judge (politicians) who lets this charade go on and on because the judge also knows that if the truth ever got out they’d be right there in the defendant’s chair with the central bankers.

Like gold and the persistent squeeze of the US dollar, bond yields worldwide sink not because monetary policy is in danger of being overly successful with purchases, but because the most sophisticated and aware market participants realize the chances of that happening are slimming down toward none yet again.

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,Bunds,Christine Lagarde,currencies,ECB,economy,Featured,Federal Reserve/Monetary Policy,Germany,interest rate fallacy,Interest rates,lsap,Markets,newsletter,QE,Yield Curve