|

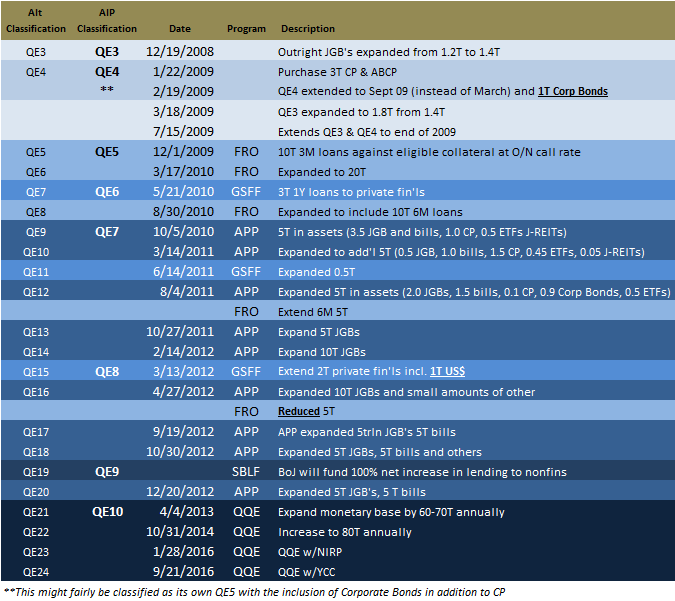

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way. Starting with the fact QQE remains ongoing approaching its seventh birthday. Over here in the real world, if you have to keep doing it there’s no way you can claim it was effective. Well, you can claim such a thing but normally you’d be laughed out of respectable society. One part of QQE was the extra “Q”, the idea that the Japanese central bank wouldn’t be limited by either quantities or qualities in seeking out asset purchase targets. BoJ had bought ETF’s before, but this would be different; at least that was the allegation. And it was in the narrowest sense. At times, these central bankers haven’t been able to restrain themselves intervening via ETF’s in the stock market. The last six months have apparently been one of those times. BoJ Governor Haruhiko Kuroda earlier this week told Japanese lawmakers that monetary authorities had bought an oddly specific ¥2.04 trillion in ETF’s going back to last October. He also testified to Japan’s Parliament that this was somehow both “appropriate” and counted as “support” to markets as well the economy. I don’t see anything in the reports, however, as to whether he was chased out of the government chamber by angry parliamentarians throwing rotten vegetables perhaps chairs at him as he fled. Which only demonstrates the nature of this game. |

Japan Machine Tool Orders, 2010-2020 |

| The Nikkei 225 stock index had been around 22,000 in October 2019 and had spun up only to around 24,000 by the middle of December. Last quote at the time of this writing was 19,400 and sinking.

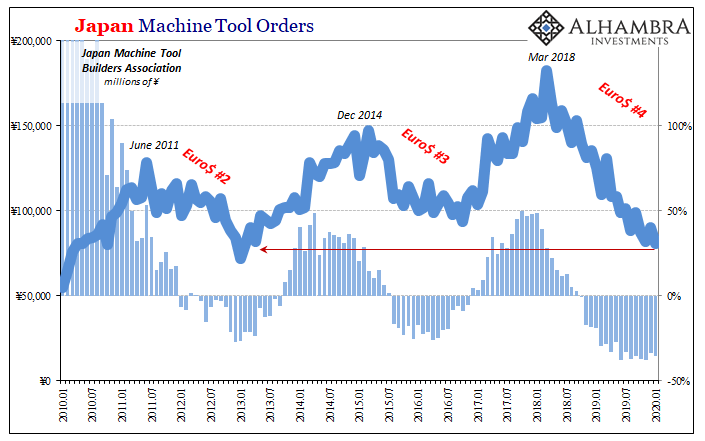

How about economic support? Somehow, QQE’s recent record in Japan’s economy is even worse than Kuroda’s fiction about ETF’s. Everyone knew the economy would take its lumps from the VAT tax hike which took place last October 1 (thus, BoJ’s buying spree). Not like this, though. Let’s start with machine orders because they demonstrate really well how the economic and market forces plaguing Japan come from the outside; explaining the irrelevance of central bank policy as not being central at all. As I wrote about a month ago, how the manufacturers of “mother machines” are faring is an important clue as to how the global economy is. And it is a global economy, According to Japan’s Machine Tool Builders Association, things haven’t been this bad since 2009. New orders for these primary industrial products have been falling at a better than 30% rate for eight straight months (through January 2020). |

Japan Industrial Production, 2009-2020(see more posts on Japan Industrial Production, ) |

| It had been expected, because Jay Powell said so, that these would begin to show a turnaround in the latest data.

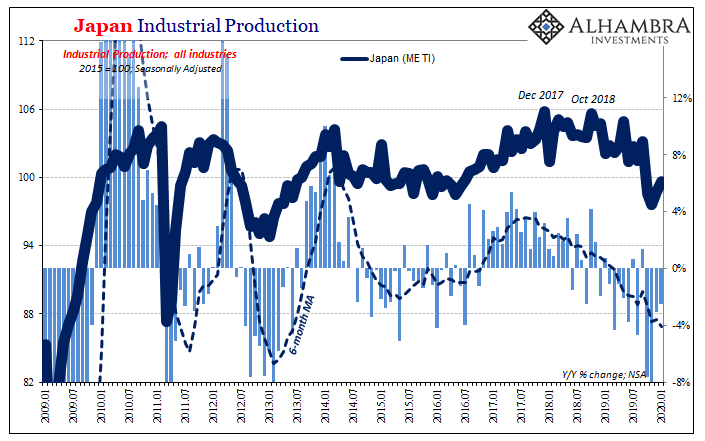

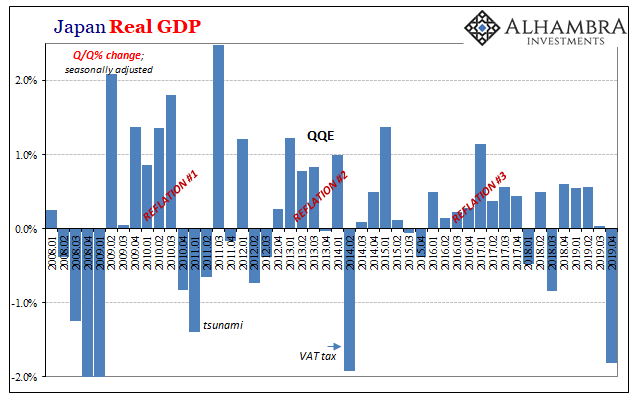

Nope. Rather than rising as hoped, orders fell even further to the lowest level in seven years. As illustrated by these peaks, Japan’s economy conforms to eurodollar “cycles” regardless of where, when, and how the Bank of Japan expands its balance sheet. As you can see, the (latest) downturn in Japan began a very long time ago – way back at the beginning of 2018. The same exact pattern is observed elsewhere in the main economic accounts. Industrial Production continues its same trend, falling on a year-over-year basis. It had been expected that after an initial setback due to consumers pulling forward demand in front of the tax hike that Japanese industry would quickly settle back in. Instead, the plunge afterward was far, far greater than anticipated while the rebound has been far, far less. So much less – even though Kuroda has been “appropriately” “supporting” the economy since October. Unsurprisingly, then, Japan’s Cabinet Office has been made to revise GDP substantially downward. The new figures show that in Q4 real output decreased by 1.81% (quarter-over-quarter) rather than the -1.61%. Moreover, Q3 GDP was recalculated to have grown by just 0.03% over Q2. It may have avoided the technical definition of recession, by just 3 pips, but Japan’s situation beginning before the virus, before the tax hike, before “trade wars” (if anyone still remembers those) warranted substantial aid. Instead, more QQE. |

Japan Real GDP, 2008-2019 |

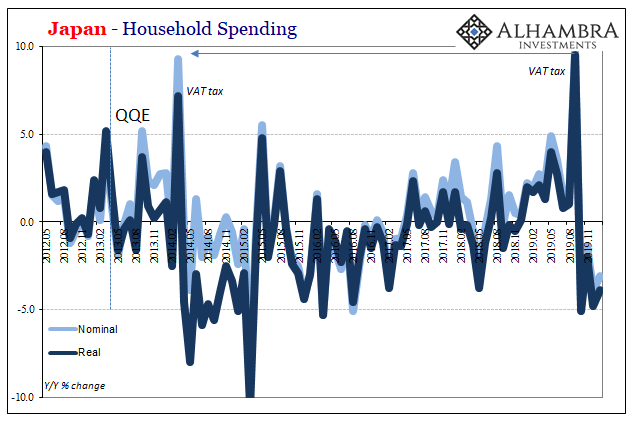

| Bearing the brunt of all these negative factors combining into one big pile of negativity is, as always, Japan’s beleaguered consumers. When reported Household Spending surged in September 2019, rising by nearly 10% (real), the highest on record, you knew it was a very bad sign.

If the Japanese people were that willing to pull forward purchases just to save a few percent in taxes, that’s not an indication of a healthy environment. Quite the contrary, it projects obvious fragility – which, contrary to what the man always says in public, is likely why Kuroda turned up the “support” when he did. |

Japan Household Spending, 2012-2019 |

| Again, like IP it was expected that HH spending would take a hit post-hike, but not like this. In real terms, spending continues to declined at levels way too consistent with 2014. In the latest data for January 2020, meaning the downside lingers onward into this year, nominal spending fell by 3.1% year-over-year (-3.9% real) after declining by 3.9% in December.

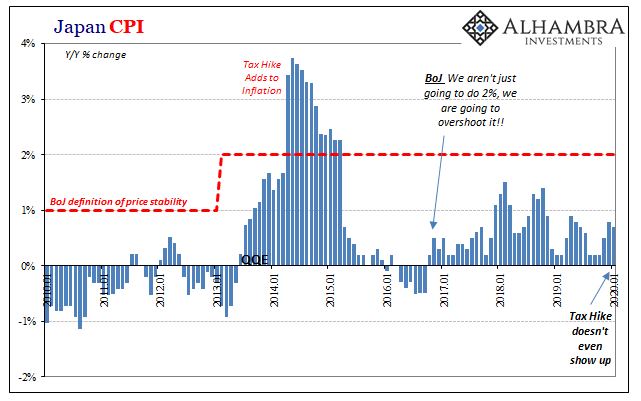

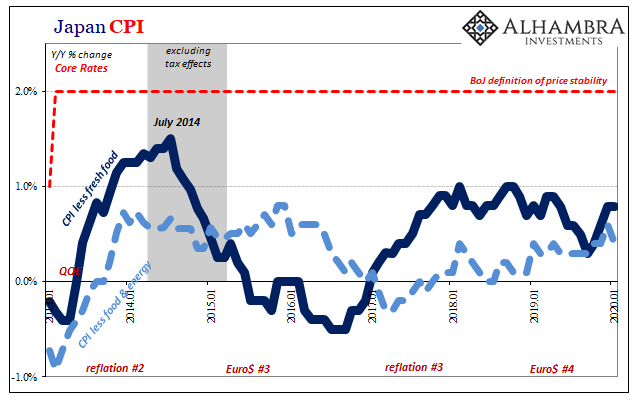

Yet, policymakers are outwardly puzzled by the inability of QQE and all its forms of balance sheet expansion to generate the inflation number being targeted. As part of its launch process, Kuroda’s Bank of Japan actually raised it beginning in February 2013. From 1% to 2% because, he wanted everyone to know, 1% was easy. Done deal. QQE was going to be so effective that 2% was a better reflection of how absolutely certain it was going turn everything around and how awesome that would make Japan’s economy. |

Japan Consumer Price Index, 2010-2020(see more posts on Japan Consumer Price Index, ) |

| He should have stuck with 1%, at least then BoJ would’ve hit its number on seven occasions during 2017-18. It wouldn’t have been because of QQE or anything at the BoJ, but at least he could’ve taken credit for what little expansion Reflation #3 transitorily had allowed the global economy and therefore Japan.

Before Euro$ #4 really took over. |

Japan Consumer Price Index, 2014-2020(see more posts on Japan Consumer Price Index, ) |

| Japan’s economic tragedy, still unfolding, isn’t just a human interest story, one of how much any people will tolerate for such incompetence leading to misery. In many ways, the relevant portion is that incompetence.

Confronted with a global situation spiraling out of control, the Federal Reserve (and likely the ECB) is going to be buying asset classes other than government debt. Several Fed officials have already floated stock purchases as a trial balloon. It will happen; that much is the only part guaranteed. Anyone expecting big things from it, however, need only look at Japan, especially recent Japan, to dispel their temporary insanity. Central bankers’ collective insanity, on the contrary, knows no bounds. That much we’ve learned from the Japanese example, too. |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of Japan,Bonds,CPI,currencies,economy,Federal Reserve/Monetary Policy,Haruhiko Kuroda,household spending,industrial production,inflation,Japan,Japan Consumer Price Index,Japan Industrial Production,Markets,newsletter,QE,QQE,real GDP,stocks