Investors still have not found solid footing this year. Equity markets have continued to sink, even though China's equities advanced. Bond markets are mostly firmer, with the US 10-year yield seemingly being drawn back toward 2.0%. Oil prices are little changed, after Brent slipped to marginal new lows. There is much talk about the Iranian sanctions being lifted as early as Monday.

The US dollar itself is mixed. The yuan weakened about 0.25%. The renewed pressure so new widening of the onshore and offshore yuan.

The euro is the strongest of the majors, rising to almost $1.0940 in the European morning. It is poised to move higher. The ostensible reason was the report suggesting that many ECB officials do not support more policy action now.

Yet this is hardly news. The ECB moved in December. It may not have been as much as many had expected, but it still delivered a rate cut and extended the asset buying program. It would not be the ECB's way to change policy again without taking time to understand the impact of its past action.

Instead, we suggest sales of European equities and the unwinding of short euro hedges, coupled with the triggering of stops may offer a better explanation. The euro flirted with the lower end of the range yesterday near $1.08 and when this held, late shorts were caught in weak hands. On the upside, the $1.0970-$1.1010 will likely offer formidable resistance.

The dollar is steady to slightly higher against the Japanese yen. This is notable because the usual drivers, like the slippage in US rates, weakness in equities, and the general risk-off mode would typically bolster the yen. The greenback held JPY117.30 in Asia and pushed to JPY118.20 by early European activity.

Sterling continues to trade heavily, though it has thus far remained above the multi-year lows set on Tuesday near $1.4350. The Bank of England meets. The focus is on whether McCafferty abandons his lone dissent. The minutes, which are released at the same time, are expected to be dovish. There is headline risk, but we suspect that the pendulum of expectations has already swung to push a rate hike out until the end of the year at the earliest. We suspect that market has discounted a great deal of bad news for sterling and a bounce is near.

With uncertainty about policy intentions in China, concerns about commodity prices, and the general risk off attitude, perhaps it is not so surprising that Australian dollar has shrugged off a favorable employment report. The Ausise is off 0.4% today. The low, so far (as the intraday technicals warn of continued downside risks) has been $0.6910. It is the lowest level since the multi-year low was set in early September just below $0.6900.

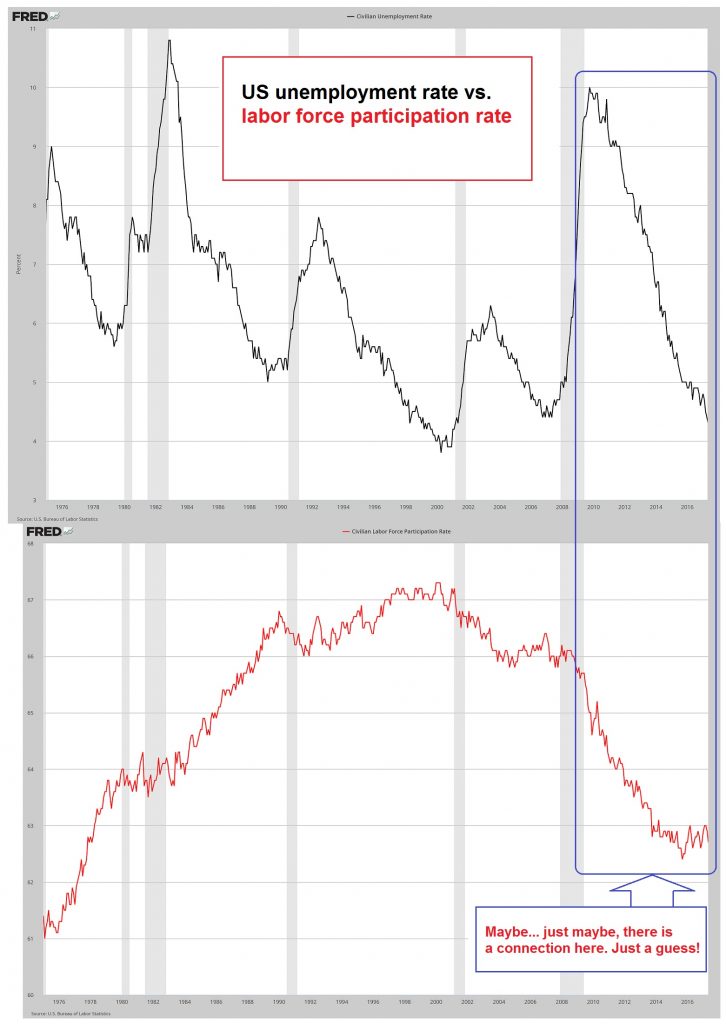

For the record, the 1k job loss was a result of a slightly larger fall in part-time jobs (-18.5k) than increase in full-time positions (+17.6k). The November series was revised to show that Australia grew a revised 47.3k full-time jobs (from 41.6k). The 0.2 percentage point decline in the participation rate, however, to 65.1%, only managed to keep the unemployment rate steady at 5.8%. This will play into economists' suspicions that Australian jobs data have some methodological quirks.

Adding to investors’ anxiety was the terrorist strike in Jakarta. Reports indicate at least three explosions in a shopping district (Sarinah). The Islamic State was immediately identified as the likely culprits. Separately, the central bank met and cut its reference rate, as many expected, to 7.25% from 7.5%. The rate on overnight deposits was also cut 25 bp (to 5.25%) It is the first rate cut since early last year. The rupiah is off nearly 0.6%.

It is interesting to note that although the South Korea central bank left rates on hold, the Korean won has fallen more than the rupiah and is off about 0.8%, making it the weakest Asian currency today. Korea's central bank did cut its forecasts for growth and inflation. This appears to lay the groundwork for a cut later in Q1.

Tags: U.S. Participation Rate