updated July 4,2012

This page inside our macro data menu contains global PMIs compared with the main risk indicators S&P500, Copper, Brent and AUD/USD as of the day after most PMIs came out.

JP Morgan’s Global PMI:

| Month | Manu factur. | Services | Com posite | Michigan Consumer Confidence | S&P 500 | Copper | Brent Oil | AUD/ USD | Reference date |

|---|---|---|---|---|---|---|---|---|---|

| August 2013 | 51.7 | 56.1 | 55.2 | 82.1 | 1645 | 3304 | 115.70 | 0.9053 | Sep 3, 2013 |

| July | 50.8 | 54.9 | 54.1 | 85.1 | 1703 | 3168 | 108.93 | 0.8903 | August 2, 2013 |

| June | 50.6 | 51.3 | 52.9 | 84.1 | 1615 | 3176 | 105.85 | 0.9116 | July 3, 2013 |

| May | 50.6 | 53.7 | 53.1 | 84.5 | 1640 | 3297 | 99.92 | 0.9750 | June 3, 2013 |

| April | 50.4 | 52.1 | 51.9 | 76.4 | 1582 | 3126 | 102.85 | 1.0253 | May 3, 2013 |

| March | 51.2 | 53.2 | 53.1 | 77.6 | 1554 | 3354 | 107.17 | 1.0424 | April4,2013 |

| February | 50.8 | 53.3 | 53.0 | 73.8 | 1525 | 3508 | 110.08 | 1.0202 | March4,2013 |

| January | 51.5 | 53.4 | 53.3 | 71.3 | 1503 | 3658 | 113.46 | 1.0427 | Feb4,2013 |

| December 2012 | 50.2 | 54.8 | 53.7 | 74.5 | 1461 | 3700 | 111.42 | 1.0481 | Jan 5, 2013 |

| November | 49.7 | 54.9 | 53.7 | 82.7 | 1407 | 3656 | 110.92 | 1.0432 | Dec 3 |

| October | 49.2 | 52.1 | 51.3 | 82.6 | 1423 | 3557 | 105.75 | 1.0338 | Nov 3 |

| September | 48.9 | 54.0 | 52.5 | 78.3 | 1437 | 3775 | 108.07 | 1.0231 | Oct 3 |

| August | 48.1 | 52.3 | 51.1 | 74.3 | 1406 | 3485 | 108.07 | 1.0239 | Sep 3 |

| July | 48.4 | 52.7 | 51.7 | 72.3 | 1361 | 3307 | 106 | 1.0465 | Aug 2 |

| June | 48.9 | 50.6 | 50.3 | 73.2 | 1357 | 3466 | 97 | 1.0230 | Jul 2 |

| May | 50.6 | 52.5 | 52.1 | 79.3 | 1263 | 3289 | 98 | 0.9640 | Jun 3 |

| April 2012 | 51.4 | 52.0 | 52.3 | 76.4 | 1402 | 3782 | 116 | 1.0260 | May 2, 2012 |

| September 2011 | 49.9 | 52.6 | 52.0 | 55.7 | 1123 | 3132 | 102 | 0.9634 | Sep 2, 2011 |

| February 2011 | 57.8 | 59.3 | 57.0 | 77.5 | 1331 | 4498 | 115 | 1.0127 | Mar 2, 2011 |

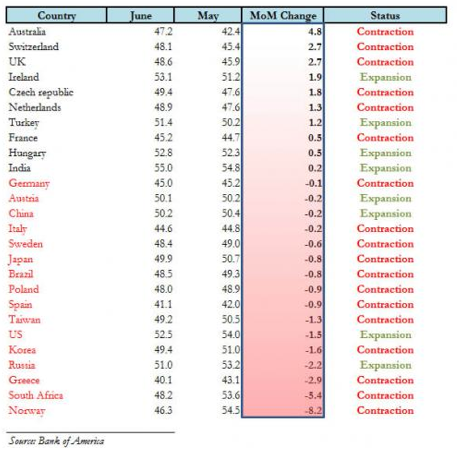

Detailed Manufacturing PMIs:

June:

July 2:

S&P500 1357

Copper 3466

Brent 97

AUDUSD 1.023

Positive change/negative change ratio: 10:17

Expansion/Contraction ratio: 8:19

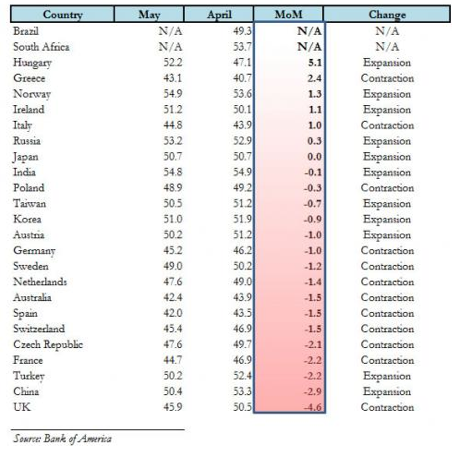

May:

June 3:

S&P500 1263

Copper 3289

Brent 98

AUDUSD 0.964

Positive change/negative change ratio: 6:16

Expansion/Contraction ratio: 12:13

Recent trends:

Services PMIs in Germany and the UK followed weak Manufacturing PMIs.

US house prices see an upwards trend, whereas the ISM Manufacturing PMI goes south. Even if historically housing led the US out of the recessions, this time it is no help: Home prices took a lagging profit of the strong winter NFPs. In times of balance sheet recession, housing cannot save the US economy. Negative equity may cause supply problems and higher prices. After the next probably negative NFP house prices will go down again. More reasons why the housing recovery hopes are overdone here.

Which indicators are the most leading ones

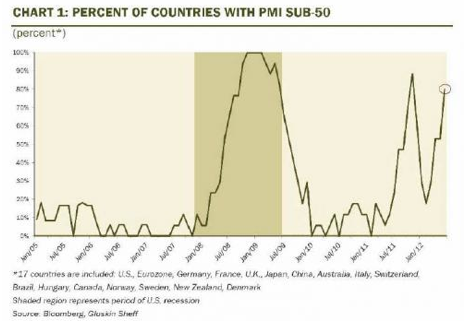

Manufacturing PMIs are considered to be the most leading and important economic indicators. They are often driven by exporters, especially in countries with strong trade balances and currencies, whereas Services PMIs are determined by local consumers. In most countries they follow the Manufacturing PMIs with a delay of some months.

During a global downturn or slowing (like now), the Services PMIs might be stronger than the Manufacturing PMIs. Examples are Germany and the UK, where Services PMIs (June: 49.9 and 51.3) are higher than Manufacturing PMIs (June: 45.0 and 48.6). Generally Services PMIs show less volatility.

For the US, however, we consider the ISM Services PMI (“the Non-Manufacturing PMI”) and the Chicago Manufacturing PMI to be the most leading indicators.

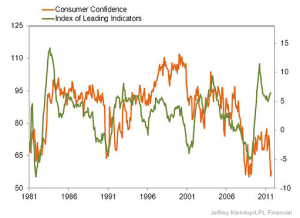

The ISM Non-Manufacturing PMI reflects the US consumer sentiment better than the University of Michigan or Conference Board indicators.

In September/October 2011 the Non-Manufacturing PMI was in positive territory whereas both consumer sentiment numbers saw very bad values. Stock prices were down because they often correlate more with consumer sentiment and less with leading indicators. Commodities are more strongly correlated with leading indicators. As suggest by the leading indicators, the US came later into a recovery phase, thanks to cheaper (gas) prices.

The Chicago PMI is strongly associated with the Chicago car producers. The indicator often ticks upwards after a strong fall of gas prices, like seen recently. The ISM Manufacturing PMI (here on Bloomberg) follows the Chicago PMI, often with a lag of one month. As opposed to the Chicago PMI, that reflects the US consumer demands for cars, the ISM Manufacturing PMI depends more strongly on global demand and exports.

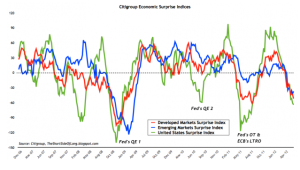

The Citibank Economic Surprise Index compares economic data with investor expectations. It turned upwards from October 2011 on, when data was actually better than what investors expected. Currently (and similarly one year ago) it is the opposite, data is worse than investor expectations, the index heads south. More on seasonality effects and the implications for the SNB can be found here.

Further Links

Manufacturing PMIs historically:

History of JP Morgan Composite PMIs

Are you the author? Previous post See more for Next post

Tags: Brent Oil,Composite PMI,franc,Gold,JP Morgan,negative equity,Oil & Commodities,PMI,Purchasing Manager,sector balances,Surprise Index,Swiss National Bank,U.S. Chicago PMI,U.S. ISM Manufacturing PMI,U.S. ISM Non-Manufacturing PMI