The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new dollar gains.

Investors already accept that the US economy appears to have accelerated in Q2, but the kind of sustained growth Administration officials suggested and assumed (3.0%-4.0%) remains elusive. Many, including ourselves, are watching late-cycle evidence accumulate. Meanwhile, price prices have increased recently, as factors the Fed had warned were transitory depressants fade. Yet, the core PCE deflator is not accelerating. In April, it was 1.8% above year-ago levels. Last April, it was up 1.6%. The 12-month moving average stands at 1.5%. A year ago, it stood at 1.8%. It is surreal to say it, but it is almost as if the Great Moderation, characterized by longer and flatter business cycles remains intact, except for the Great Financial Crisis.

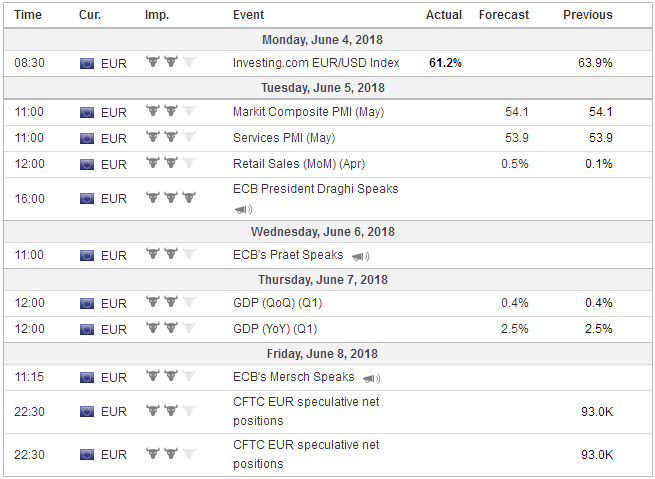

EurozoneThe eurozone economies lost momentum this year and the second release of Q1 GDP figures this will contain details that will shed light on what happened. We argue that there are three forces at work: 1) Q4 17 survey readings were exaggerated, 2) poor weather and other transitory factors, 3) some real cyclical slowing. That suggests that the May composite PMI that the flash says fell to 541., the lowest since last November, will the near-term low. We expect a recovery in April German factory orders and industrial output that will likely be reported will lend credence to our hypothesis. In April 2017, German industrial production was 3.3% above year-ago levels. This week’s report may show it 3.6% above year-ago levels this past April. It averaged a 5.6% pace last year, and 8.0% in Q4, illustrating our broader interpretative points. |

Economic Events: Eurozone, Week June 06 |

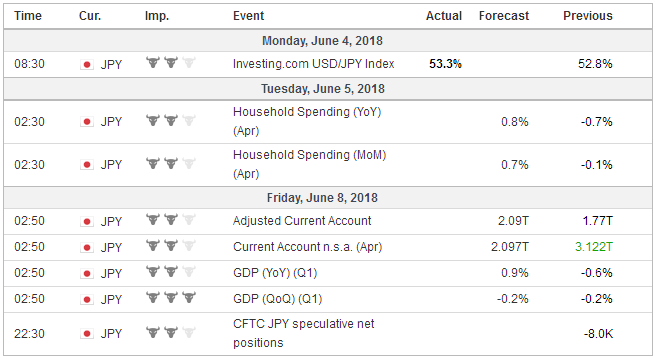

JapanIf the Bank of Japan’s unexpected announcement before the weekend that it was reducing the amount of 5-10-yr JGBS that it was buying (JPY430 bln vs. JPY450 bln) hardly caused a stir in the markets, then it is hard to expect the week’s data to have much impact. The broader takeaway point is that the Japanese economy appears to have returned to growth after contracting in Q1. The 10-year yield rose less than one basis point in response and finished slightly lower on the week. The dollar rose 2/3 of a percent against the yen before the weekend, the most since April 23. Trade tensions will eclipse the economic data and may even threaten to make them moot. There is talk in Washington that Trump may announce the US will pull out of NAFTA this week, ahead of the G7 Summit. What is seen as US provocations on trade was going to isolate it at the G7 meeting in any event, and the statement from the G7 finance ministers and central bank meeting that end on June 2 underscores this point. An exit from NAFTA would be seen as an escalation and risks disrupting economic activity in all three countries and boosting volatility in the capital markets. |

Economic Events: Japan, Week June 06 |

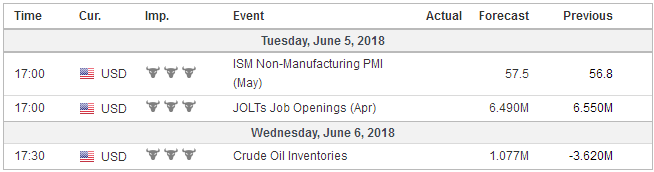

United StatesIn the domestic political calculus, recent polls suggest that the Democrats have lost some momentum and that while gains are possible, securing both chambers of Congress is less likely. A decision may have been made that elevated trade tensions are better than new agreements for the President’s base. The ultimatum on the sunset clause, which both Canada and Mexico have consistently rejected, seemed designed to elicit the response it got. The sunset clause that ends the agreement in five years without each country providing new affirmation undermines the longer-term stability for business and investors that the continental treaty offers. The US also appears to be preparing another blow. The Trump Administration has launched an investigation, again on national security grounds, US auto and auto part imports. Perhaps it risks being cynical, but the outcome is thought to be a foregone conclusion. However, if steel from Canada (which accounts for around half of US steel imports) and Italy can be a threat to US national security, surely anything can be. Reports suggest the Administration is considering a 25% duty on auto imports, and a possible ban on luxury German autos. Share prices of Volkswagen, Daimler, and BMW fell after the press reports. Resist the temptation to cherry-pick individual tariffs. Tariff schedules have to be understood in their entirety, and what count is the average tariff, and that was negotiated as the terms of WTO membership. For example, it is widely reported that the US has a 2.5% tariff autos, the EU has a 10% levy, and China 25%. But to compare the US and China is to compare a market economy and a non-market economy. China cannot have it both ways but nor can its critics. What is often left out of such discussions is that the US has a 25% tax on imported SUVs and light trucks. |

Economic Events: United States, Week June 06 |

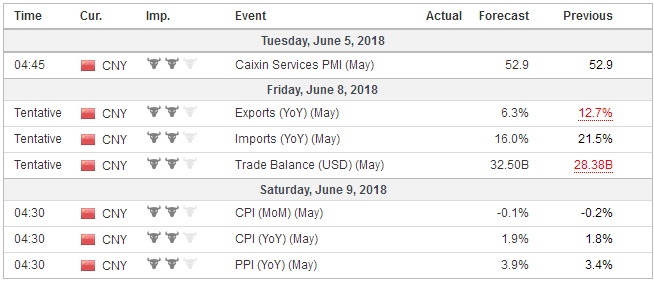

ChinaThe US insulted China by announcing it was going forward with the tariffs on $50 bln of its goods in retaliation for the intellectual property right violations in between rounds of talks. This seemed to prevent an agreement from the latest round of negotiations that took place in Beijing in recent days. The risk to investors is that the US sacrifices a non-zero sum game to secure the benefits of a zero-sum game. A non-zero sum approach is to focus on getting China to open up more of its markets faster and strengthen the rules of engagement (e.g., intellectual property rights, extend capital account convertibility, etc.). Zero-sum gains could be had by getting China to simply concede to buy more US goods and services. The US has demanded a $200 bln reduction China’s bilateral surplus. If this were to result in China buying more US goods and services, it is as if the US got given roughly a 2% share of the Chinese economy. There are uncanny parallels between this and the way that the UK or France, or Germany got concessions from the Chinese emperors in the 19th-century. If China reduces the bilateral trade surplus by $200 bln, isn’t it likely that US suppliers displace others countries rather than China’s economy grows 2 percentage points more a year on top of the 6.7%-7.0% pace it has reported for the past three years? |

Economic Events: China, Week June 06 |

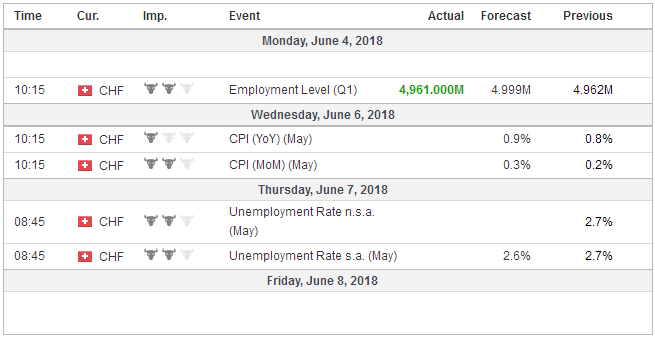

Switzerland |

Economic Events: Switzerland, Week June 06 |

Many accounts in the traditional and social media used Marx’s 200th birthday to express disapproval and attribute all the atrocities of and human suffering in the Soviet Union and China to his work. Regardless of what one thinks the merits of such arguments, Lenin offered a quip that illustrates another potential risk of the US strategy: “Capitalists will sell us the rope with which we will hang them.”

Freed of the ideological fetters, the trade implication is that the focus of increased US exports should not be on what has been tipped, agriculture and energy. These are raw materials that China will use its now corn and soy-fed labor (disintermediated by livestock) to add value to some things (e.g., raw materials, assemble semi-finished goods) and send the final goods to the US–generating unfavorable terms of trade for the US, even if its negotiators are successful. To avoid this, the US focus needs to be on higher value-added goods.

European political drama reached a climax last week. Spain has a new coalition government. While there are some uncertainties, none of the main parties in Spain are anti-EMU or want to challenge the EC as may be the case in Italy. The Spanish economy is among the strongest in the eurozone, though it has lost some momentum this year.

After operatic turns, Italy has a new government, the first populist-nationalist government in Europe. As we saw at the end of last week, investors will be sensitive to comments from the new officials. Many of the new ministers do not have such experience that would have prepared them for the exactitudes of markets and the media. There are bound to be some hiccups.

The risk is not that the new government announces plans to leave the EMU or EU. That is clumsy and a naive scenario. More likely the Italian government makes demands on the EC and enacts policies, such as rolling back the retirement age, that brings it into direct conflict.

We think that the market underestimates the flexibility in the system especially under a somewhat different political configuration in Europe. This change includes Macron in France and the changes in the Germany government and finance ministry). The spate of electoral results also may have given a righteous scare to the elites. The EC is proposing a 30 bln euro loan facility planned for countries hit with economic shocks. It is smaller in scope and size than Macron had proposed last year, but it shows movement even at a time when the EU budget post-Brexit is hotly contested.

We have also argued that while Italy’s banks are still burdened with bad loans, many observers repeat the same old cant and do not appreciate the progress that has been and continues to be made. Reforms have made it easier for banks to sell-off portfolios of bad loans, for example. Often media reports do not take into account the loan loss provisions that have been amassed, or that the NPLs often have a residual value or the collateral does. Moreover, the Renzi government did pass a number of financial and economic reports that have also helped.

Ironically, the bank that is the chief concern at the moment is not Italian or from the periphery in Europe. Instead, it is the largest bank in the largest creditor country in Europe Deutsche Bank was downgraded by S&P (to BBB+), and the shares fell to record lows. US authorities have put the bank’s US arm on a watchlist because it is thought that some of its problems may threaten its survival.

Merkel and Draghi are reportedly meeting Monday. The same set of rules (Bank Recovery and Resolution Directive) that makes it difficult for the Italian government to provide support to its banks makes limit what Germany can do as well. We suspect that nothing stirs the creative juices of policymakers quite like the risks that Deutsche poses. Europe has to be careful of repeating its original sin–fudging the rules for a core country that sets a precedent for others.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CAD,$CNY,$EUR,$JPY,MXN,newslettersent