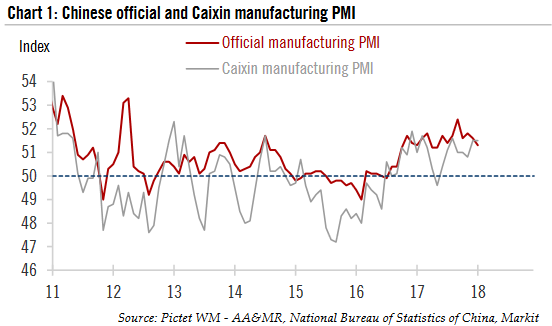

| China’s official manufacturing purchasing manager index (PMI) came in at 51.3 in January, down slightly from December (51.6). The Markit PMI (also known as the Caixin PMI) stayed at 51.5, the same as in the previous month (Chart 1).

The official non – manufacturing PMI rose slightly to 55.0 in January from 44.8 the previous month. The official composite index, which is a weighted average of the manufacturing and non – manufacturing indices, remained unchanged at 54.6 in January. |

Chinese official and Caixin manufacturing PMI, 2011 - 2018(see more posts on China Caixin Manufacturing PMI, China Manufacturing PMI, ) |

| These mixed PMI figures suggest that growth momentum in the Chinese economy, particularly in the manufacturing sector, may have moderated somewhat in the early weeks of 2018, although the service sectors have been fairly stable.

Several points in the latest PMI reports are worth highlighting. First, the new export orders sub – index declined quite significantly in January, to 49.5, after having risen strongly(to 51.9) in December (Chart 2). In our view, this drop can largely be explained by seasonal factors such as Christmas orders. Typically, the new export orders sub – index would rise in December due to holiday orders and then decline in January . In the period of 2006 to 2017, the average decline of this sub – index in January was 1.3 points. |

New export orders sub - index and y - o - y growth in Chinese exports, 2012 - 2018(see more posts on China Exports, ) |

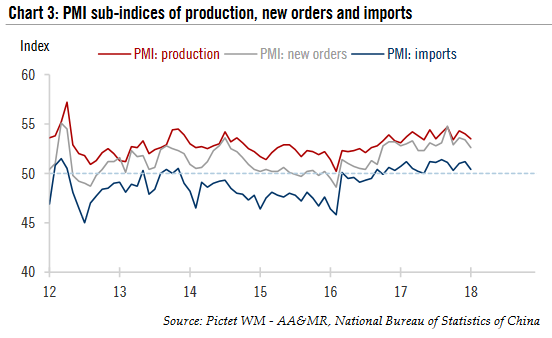

| Second, domestic demand is showing continued signs of slowdown. Specifically, the PMI sub – indices of production, new orders and imports, which capture the changes in domestic demand, all softened in January. The decline in the imports sub – index is consistent with recent trade data. In December 2017, Chinese imports of several key commodities decelerated quite notably on a year-over-year (y-o-y) basis. For example, Chinese imports of crude oil declined by 7.4% y-o- y in December, imports of iron ore by 5.4%, and imports of copper by 8.2%. |

PMI sub - indices of production, new orders and imports, 2012 - 2018 |

Tags: China Caixin Manufacturing PMI,China Exports,China Manufacturing PMI,Macroview,newslettersent