Swiss FrancThe euro has appreciated by 0.23% to 1.0896 CHF. |

EUR/CHF - Euro Swiss Franc(see more posts on EUR/CHF, ) |

FX RatesAs the market heads into the weekend, the US dollar is trading softer as it consolidates. It is within yesterday’s ranges against the major currencies but the Japanese yen. The dollar has made a dramatic recovery against the yen. It traded near JPY108.80 in the middle of the week and pushed through JPY111 in late in the Tokyo morning. The greenback is above its 20-day moving average against the yen for the first time in a month. It is not clear what triggered the dollar’s recovery. There is some thought that the driver is Japanese investors taking advantage of the yen’s strength to step up their foreign bond buying. US 10-year yields, to which the dollar-yen exchange rate is sensitive, has recovered from the midweek dip to 2.10%. However, at 2.17%, the yield is still off by three basis points on the week. There are large options that expire at 10:00 am ET today. There are 1.9 bln euros of a $1.1150 strike that will be cut. There are an additional 3.3 bln euros struck at $1.12 and another 2.7 bln euros at $1.1250 strikes. There are $2.5 bln linked to a JPY112 strike that rolls off today. There is about GBP1.1 bln tied to options struck between $1.2740 and $1.2760. The CAD1.3250 strike has $790 mln expiring today and another $850 mln in CAD1.3295-CAD1.3300 strikes. Lastly, the $0.7615 strike has A$427 mln being cut today. |

FX Daily Rates, June 16 |

| The BOJ meet and as widely expected kept its full complement of unorthodox policies intact. It is clear from the central bank meetings over the past two weeks that the BOJ intends to lag behind the other major central banks. This has been our conviction, but it was strengthened by Governor Kuroda’s comments. He was reluctant to talk much about the exit except to note that such a discussion is premature and could lead to confusion.

At the 10-year mark, the US premium narrowed about seven basis points this week. German yields rose. US yields fell. At 186 bp, the US premium is the smallest since May 26, which itself was the least since in seven months. It is difficult for the dollar to gain traction when the premium is shrinking. Resistance ahead of the weekend is seen in the $1.1200-$1.1235. That said, as we noted yesterday, the euro’s technical tone has weakened as short-term operators have grown frustrated with the euro’s inability to take out $1.13. The dollar is not finding nearly the same traction against the euro as it has against the yen. European interest rates are rising, and this has eroded the US premium. Consider that the German two-year yield is up nine basis points this week, while the US is flat. The German yield is at it highest since last November. The US premium has fallen below 200 bp for the first time since late May. After two Fed hikes this year, at 198 bp, the premium is three basis points above where it finished 2016. The three dissents at the Bank of England was surprising, and this sent sterling higher. Nevertheless, many, including ourselves, doubt that with a backdrop of political uncertainty, weakness in earnings and a pullback by consumers, a rate hike is unlikely. In fact, we suspect price pressures will ease as the 8% decline in sterling last June drops out of year-over-year comparisons. |

FX Performance, June 16 |

Eurozone |

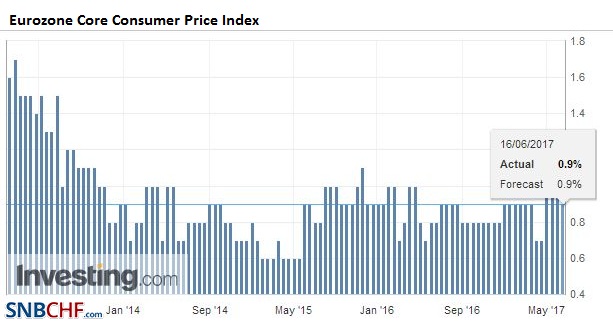

Eurozone Core Consumer Price Index (CPI) YoY, May 2017(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

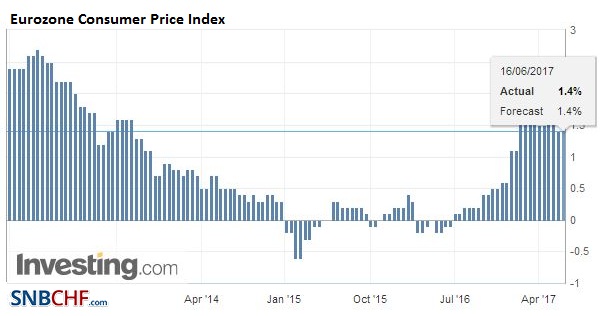

Eurozone Consumer Price Index (CPI) YoY, May 2017(see more posts on Eurozone Consumer Price Index, ) Source: Investing.com - Click to enlarge |

|

United statesThe US reports May housing starts and permits and the University of Michigan’s consumer sentiment preliminary June reading.

|

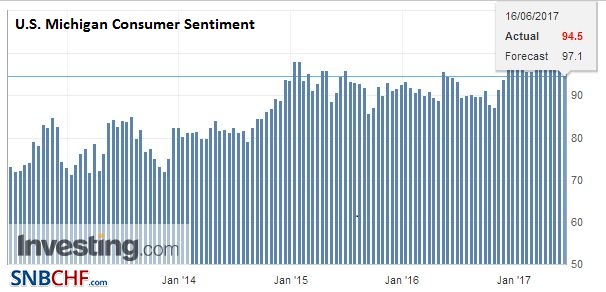

U.S. Michigan Consumer Sentiment, June (flash) 2017(see more posts on U.S. Michigan Consumer Sentiment, ) Source: Investing.com - Click to enlarge |

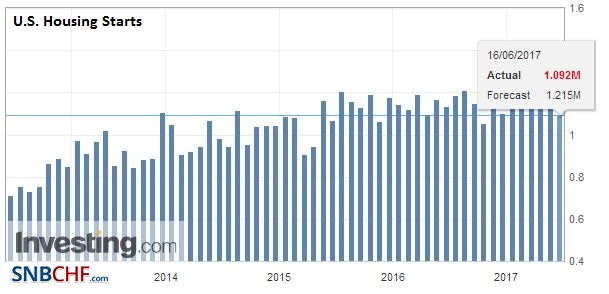

| Housing starts have fallen for two months and in three of the first four months of the year. A modest 4% bounce is expected. If so, starts would rise to 1.22 mln, which would be best since February. Permits, a leading indicator are also expected to recover from April’s weakness. |

U.S. Housing Starts, May 2017(see more posts on U.S. Housing Starts, ) Source: Investing.com - Click to enlarge |

Arguably the most important component of the University of Michigan’s report the measure of long-term inflation expectations. It has been flat for three months at 2.4%, just above the historic low in December of 2.3%. The market’s response may be asymmetrical; more sensitive to a weaker than a stronger number.

The US political situation has not lifted. Developments have shifted attention from the Senate investigation to the Justice Department’s special counselor. It seems clear that the investigation into Russia’s attempt to influence the US election and efforts to the cover-up of what has yet to be shown to be criminal will take several months at least to get closure. One of the fears investors have is the political maelstrom bogs down the legislative agenda. It may, but at this stage in the process, the key issues, like health care reform, tax reform, lifting the debt ceiling and renewed spending authorization is not so much in the executive branch, but in Congress. There is progress in committees that is not making it to the front pages of the press.

France

The news stream is light as the weekend approaches. The second round of the French parliamentary elections will take place Sunday. Macron’s new party is expected to cut a large swathe of the middle of the French political spectrum. As we noted, both of Macron’s predecessors, Sarkozy and Hollande, campaigned as reformers only to see their programs frustrated. It is hoped that Macron’s experience can be different if he has such a strong parliamentary position. However, the resistance to Sarkozy and Hollande was not so much in parliament as in the broader society, including trade unions and rent-seeking interests.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Price Index,Eurozone Core Consumer Price Index,FX Daily,newslettersent,U.S. Housing Starts,U.S. Michigan Consumer Sentiment