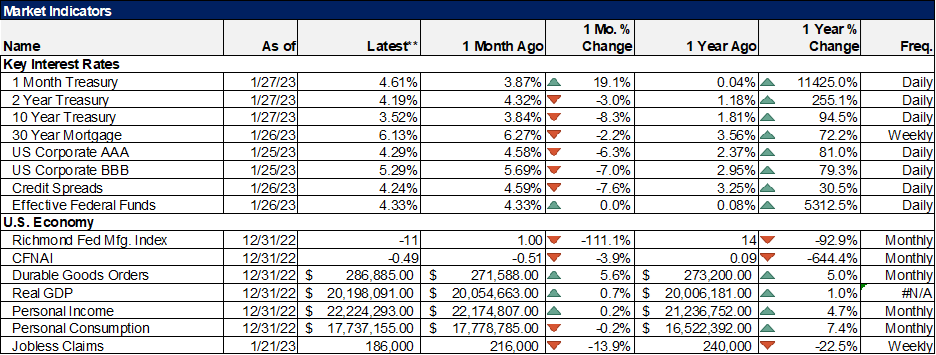

The Fed meets this week and is widely expected to raise the Fed Funds rate by 0.25% to a range of 4.5% – 4.75%. The market has factored in a small probability that they do nothing and leave rates alone, but they’ll probably do what’s expected because they’ve spent the last couple of months preparing the markets for exactly this outcome. If you’re looking for drama, you’ll probably need to look somewhere else this week.

Stock markets have started the year strong based on the belief that the Fed is nearly done punishing the economy – causing pain to use Jerome Powell’s formulation. I don’t think the Fed has actually caused all that much pain but it surely isn’t from a lack of trying. Price rises are moderating and my guess is that they would be today if the Fed had done absolutely nothing. That isn’t to say that rates didn’t need to rise because certainly holding short-term rates at such ridiculously low levels is not healthy for a modern economy.

But I think we’d all be better off if the Fed had never manipulated rates so low to begin with. The fact they’ve corrected their mistake doesn’t absolve them of making it in the first place. Likewise quantitative easing and tightening. The Fed itself has struggled to explain the exact impact of QE on markets and the economy but they have persisted in it for over a decade in the apparent belief that doing something – even if they don’t understand it – is better than letting the economic chips fall where they may.

What exactly did the Fed accomplish by continuing to buy Treasuries and MBS until March of last year? The Fed’s balance sheet has shrunk by roughly a half trillion dollars since peaking in April of last year. That takes the balance back to where it was in October of 2021, roughly 16 months ago. Is the economy the same today as it would have been had they stopped their purchases at that time? What additional good did they expect to generate from that extra half trillion? Did they get it? I don’t know the answers to those questions but more importantly, neither does the Fed. One thing I’m certain of is that the Fed’s serial interventions in markets have changed people’s behavior and not for the good.

We have become a nation of gamblers, everyone trying to hit it big. Sports broadcasts are now dominated by commercials for gambling. Once upon a time, you had to “know a guy” to be able to put down a wager on your favorite team. Now you can bet on how many points they score in the second quarter and you only need a “smart” phone. If you don’t hit the big one gambling on sports, the state has another great game you can play with the potential payoff in the hundreds of millions of dollars. If that doesn’t work, Wall Street has invented any number of new instant satisfaction games. Have you heard about 0DTE options? No reason to wait around for weeks or months to find out if you won because these babies expire today! That’s right, these are 0 days to expiration options.

Wall Street has even managed to turn ETFs, which were supposed to just be better index funds, into objects of speculation. They started with inverse ETFs for those who couldn’t figure out where the short button was in their trading app. But that wasn’t enough excitement so they applied a little borrowed money and voila, leveraged ETFs – 1X, 2X, 3X – which only track their underlying index from day to day and the issuers warn should only be used for short-term trades. As if they really give a horse’s patoot.

But that wasn’t exciting enough so now they’ve moved on to ETFs that trade a single stock. ETFs were invented to provide broad, diversified exposure to certain markets or sectors but are now non-diversified trading vehicles for one stock. Why not just trade the actual stock? In a word, leverage. If you’re wondering why you wouldn’t just use a margin account, well you must have missed the diversification of counterparties. What’s that you ask? Suffice it to say that a single stock ETF isn’t an ETF that holds one stock. No, that wouldn’t make anyone any money, certainly not the firms that sponsor these things, which is all they really care about. A single stock ETF enters into swap agreements with multiple counterparties who will pay the daily return of the underlying security, minus fees and expenses of course. So, they’re diversified! Here we are in the early 21st century and the big innovation on Wall Street is the virtual bucket shop.

If the Fed has spent the last nine months “tightening” monetary policy, why is this kind of activity still ubiquitous? Why are hundreds – thousands? – of worthless cryptocurrencies still trading? How would our economy be performing today if all this capital dedicated to purely speculative activities – gambling – was instead directed to more productive activities? I don’t usually spend a lot of time blaming the Fed for whatever ails the economy but I have no doubt that they have pushed the average American to take actions they wouldn’t have taken in the absence of the Fed’s easy money policies. And it works both ways. There are investors who have spent the last decade or more scared to death that the economy is about to fall off another cliff like it did in 2008. They’ve accepted negative real returns for years to avoid something potentially worse that didn’t come to fruition. And there are the gamblers who decided that getting rich was the only thing that mattered including how you accomplished it. They had plenty of role models in the top 1% and the Fed’s cheap money to take their shot at joining them.

The economy is in a cyclical downswing that includes a moderation of the price hikes that have plagued us for the last 2 years. Whether this slowdown ultimately turns into a recession is something I can’t predict although the slowdown to date has been pretty mild. Despite the fact that the Fed’s rate hikes had little to do with the slowdown, they’ll get credit for killing inflation – for now. But if we don’t end the easy money policies, which very much includes fiscal policy by the way, we’ll ultimately get another dose of rising prices. The rising prices next time may well include a falling dollar too, in which case it will be a lot harder to kill than this outbreak.

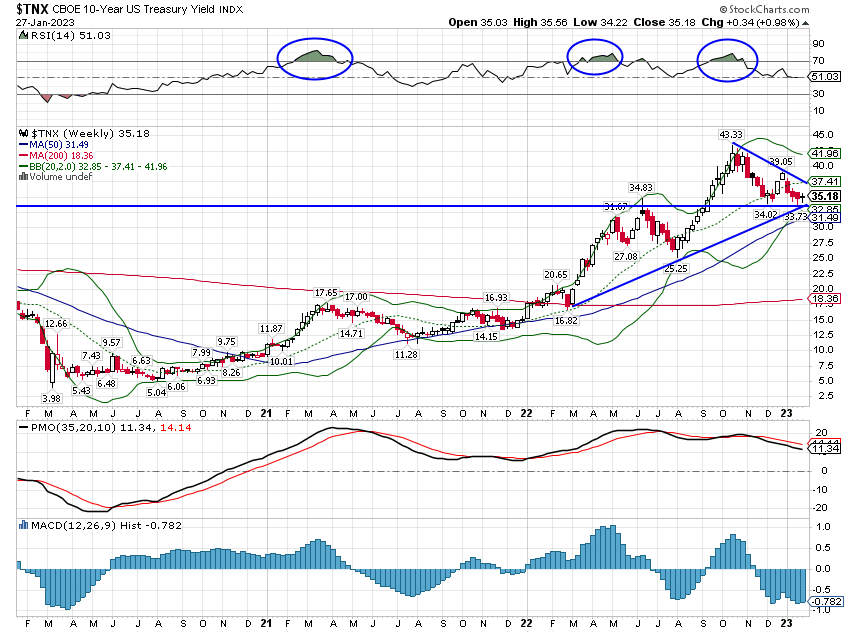

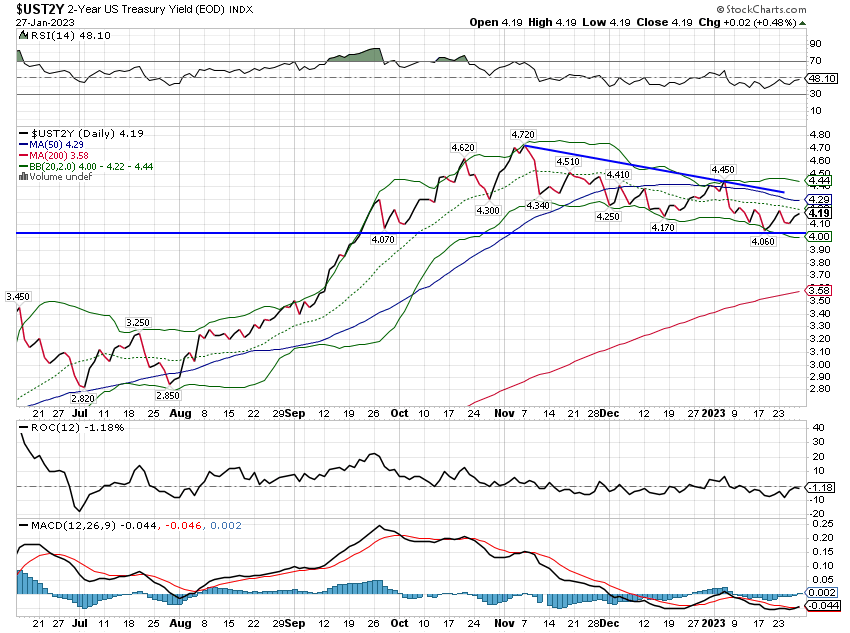

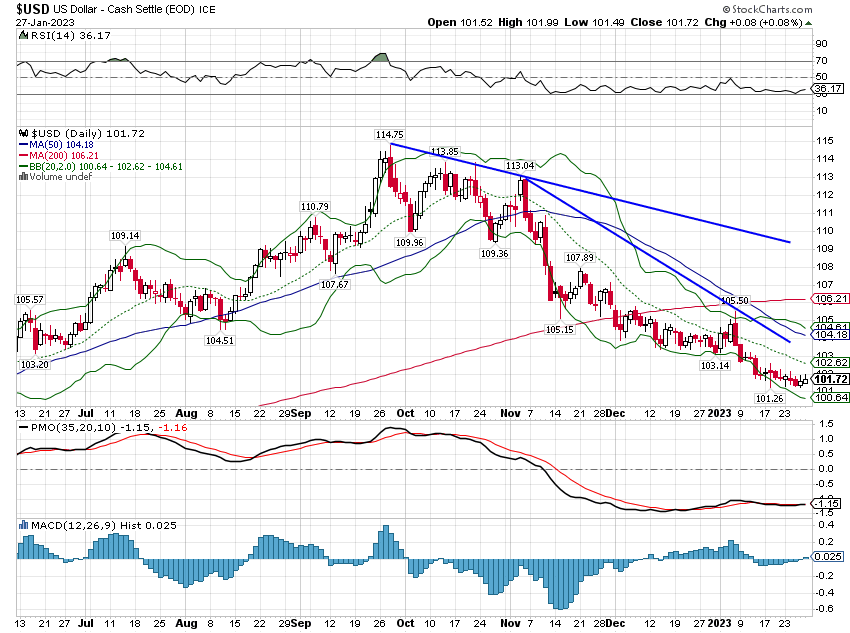

EnvironmentThe 10-year Treasury yield and the US dollar continue to mark time at critical, pivotal levels. |

|

| The 10-year and 2-year Treasury yields are essentially unchanged since late September as investors await more information about the economy. The data last week cleared up exactly nothing. | |

| The Q4 ’22 GDP report released last week confirmed – again – what I’ve been saying for over a year now, mainly, that the goods economy is slowing while the services economy is continuing to recover. Goods consumption did add to Q4 GDP but it contributed just 18% of the total gain with the rest coming in services. It wasn’t a particularly robust quarter with inventory investment and net exports accounting for a good portion of the gain, but the economy did grow a little over 2% for the full year despite the negative Q1 and Q2 rates.

The dollar was also very quiet last week as investors await some kind of clue about the future course of the global economy. There is a developing consensus that the Chinese re-opening will be very positive for global growth but it may not be – probably isn’t – so simple. Renewed Chinese demand could just end up raising prices as much as demand. |

|

| One thing to note here is that the consensus seems to be that both of these are going to break lower. It is interesting that large speculators have been increasing their short positions in bonds even as they’ve rallied over the last few months. Don’t be surprised if rates and the dollar both break higher from here. | |

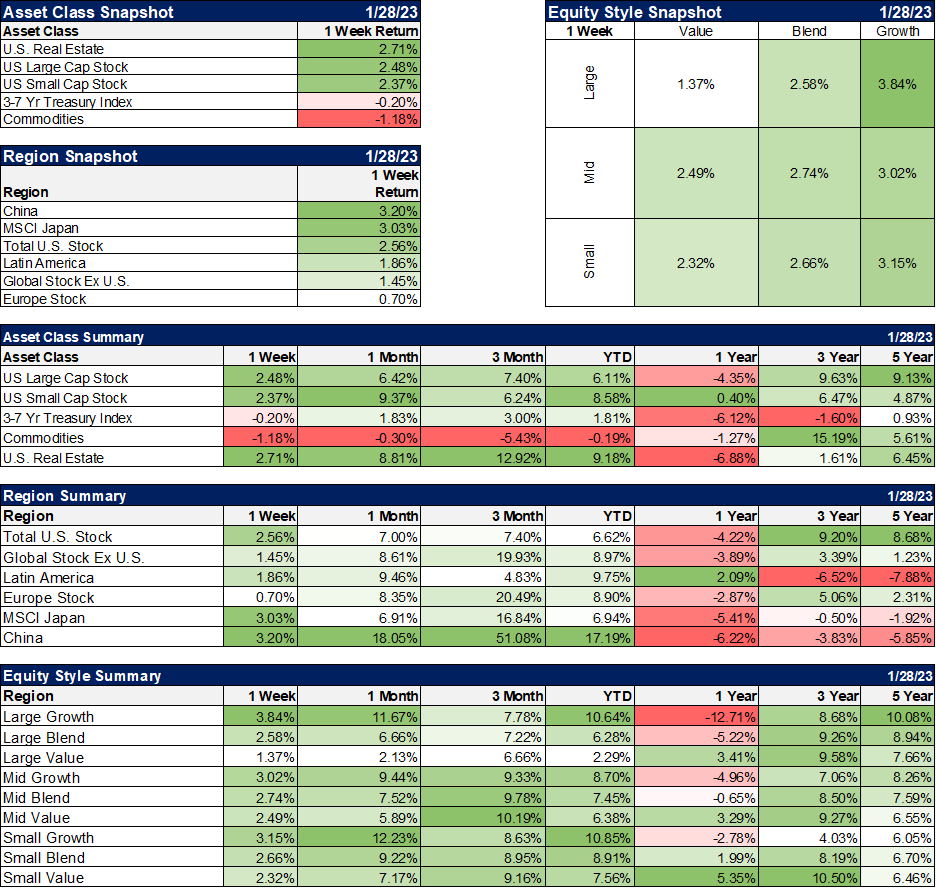

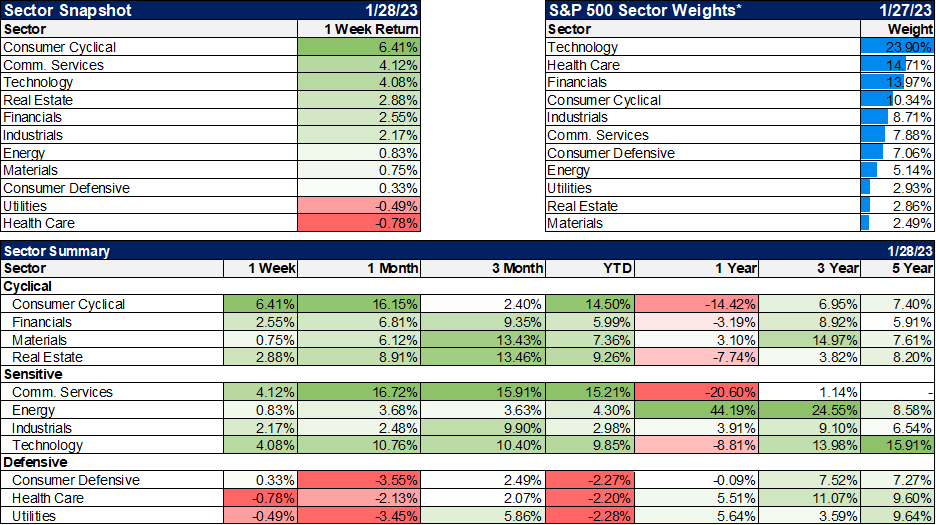

MarketsReal estate led the way up last week while bonds and commodities both suffered minor declines. International markets were also higher with both China and Japan outperforming the US markets. Europe, which has been the darling of markets this year took a breather but still managed to close in the green. Year-over-year, losses in stocks have moderated considerably in the new year. Growth indexes are still down – large cap still down double digits – year over year but value is up and is now also ahead of growth in the 3-year column. Earnings season is underway and so far it is decidedly underwhelming. The majority of companies are reporting better than expected revenue and earnings but the beat rate is less than the 1,5 and 10-year average. In addition, the amount by which companies are besting estimates is quite low at just 1.5%. That is way below the 1-year (+4.5%), 5-year (+8.6%), and 10-year (+6.4%) averages. Interestingly though. consumer discretionary stocks are beating by the most (+8.5%) with materials a close second (+7.3%). The worst sector so far is industrials where companies are reporting lower than expected earnings overall (-3.2%). One is tempted to see this as an indication that the slowdown we’ve already experienced is coming to an end. Better-than-expected demand today may well mean more production tomorrow. |

|

| On a sector basis, cyclicals and – again this week! – communication services were the biggest winners. The cyclicals are the same as the consumer discretionary referenced above and includes companies like Nike, Tesla, Home Depot, Starbucks, Target, etc. The two worst performers were both defensive – health care and utilities. Consumer discretionary and communication services also happen to be the worst year-over-year sectors in terms of earnings growth in the S&P 500, both showing declines around 20%. Investing is almost always counterintuitive. | |

Economic IndicatorsThere still isn’t much in the economic data or the market pointing to near-term recession. If anything I think you can start to make a case for recovery. The final reading for University of Michigan consumer sentiment rose again but at 64.9 is still fairly low. Inflation expectations are moderating and current conditions also continue to improve. We also saw a rise in new and pending home sales last week which appears to be a response to lower mortgage rates. We know the economy slowed pretty precipitously at the end of 2022. We see it in the Conference Board’s leading indicators which are signaling recession right now. And we also see it in the Chicago Fed National Activity Index which finally calculated both November and December numbers last week. At -0.49 the index indicates the economy is growing below trend but not quite yet recessionary. A reading of 0 is growth at trend and it usually takes a reading on the 3-month average of -0.7 or less to signal recession. The 3-month average is now -0.33. More interesting yet is what caused the index to fall recently. Of the -0.49 reading in December, -.043 was in the production category which is entirely unsurprising given the ongoing inventory correction. No other category contributed more than -0.07 to the total reading. |

|

I do not put the full blame on the Fed for the speculative nature of our economy. There are numerous causes that are non-economic. I have my ideas about what those might be and I’m sure you have yours. But it is the Fed that provides the hospitable environment in which speculation can thrive. And until we end that, we will continue to suffer the consequences. Financial fraud always thrives in times of easy money and today is no different. There are always stories of great luck and ones of great tragedy. Boom and bust, rinse and repeat. This isn’t new and it has never ended well.

I think it is likely that we get past the current market turmoil without much more – or any more – damage. But the next round won’t be as easy. It is high time we started conducting monetary policy in a more conservative fashion.

Full story here Are you the author? Previous post See more for Next postTags: Alhambra Portfolios,Alhambra Research,Bonds,commodities,currencies,earnings,economy,Featured,Federal Reserve/Monetary Policy,federal-reserve,inflation,Markets,Monetary Policy,newsletter,QE,QT,Quantitative Easing,Real Estate,recession,stocks,US dollar