Monthly Archive: June 2022

Quarterly Bulletin 2/2022

Report for the attention of the Governing Board of the Swiss National Bank for its quarterly assessment of June 2022. The report describes economic and monetary developments in Switzerland and explains the inflation forecast.

Read More »

Read More »

Risk Appetites Improve Ahead of the Weekend

Overview: Equities are higher and bonds lower as the week's activity winds down. Asia Pacific markets rallied, paced by more than 2% gains in Hong Kong and South Korea.

Read More »

Read More »

Confederation and SNB facilitate exchange of Ukrainian currency at Swiss commercial banks

Together with the Federal Department of Finance (FDF) and Swiss commercial banks, the SNB has developed a solution to enable individuals with protection status S to exchange Ukrainian banknotes for Swiss francs up to a limited amount.

Read More »

Read More »

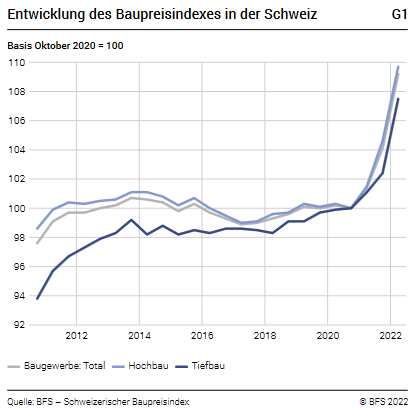

Construction prices rose by 4.9% in April 2022

The construction output price index recorded a rise of 4.9% between October 2021 and April 2022, reaching 109.2 points (October 2020 = 100). This result reflects an increase in building and civil engineering prices. Year on year, construction prices increased by 7.7%.

Read More »

Read More »

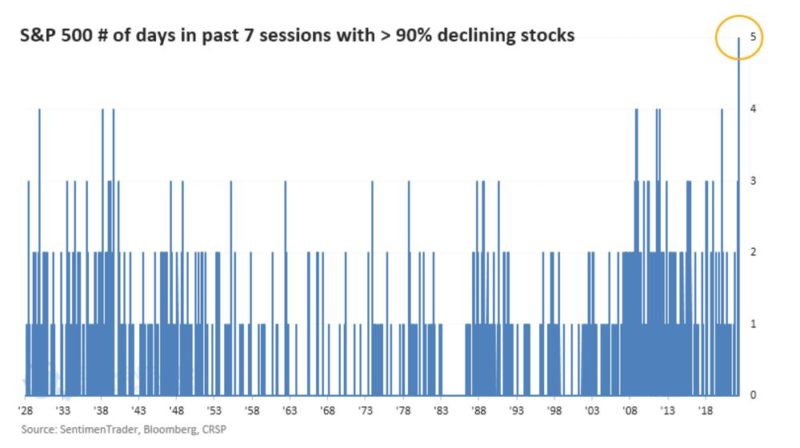

Market Pulse: Mid-Year Update

Note: This update is longer than usual but I felt a comprehensive review was necessary. The Federal Reserve panicked last week and spooked investors into the worst week for stocks since the onset of COVID in March 2020. The S&P 500 is now firmly in bear market territory but that is a fraction of the pain in stocks and other risky assets.

Read More »

Read More »

Musical Chairs in Washington, D.C.

Republicans are licking their chops over the Federal Reserve’s ostensible plans to raise interest rates aggressively in the months ahead to combat soaring prices. They view a coming big recession as a grand opportunity to win control over Congress in the upcoming November elections.

Read More »

Read More »

Alpine rail tunnel and suburban train services to get boost

The government has presented plans for an upgrade of the country’s railway network, including an additional Alpine tunnel in western Switzerland. About CHF720 million ($745 million) have been set aside to upgrade the Lötschberg base tunnel and other regional projects near Zürich and Geneva in the next decade.

Read More »

Read More »

Tether wird neuen Stablecoin rausbringen

Tether hat bekanntgegeben, dass man schon im Juli einen neuen Stablecoin launchen wird. Dieser wird mit Britischen Pfund gedeckt sein. Damit folgt man der Strategie, die Tether bereits zuvor dazu veranlasste, einen Cryptocoin namens MXNT herauszubringen – dieser wird durch Mexikanische Pesos gedeckt.

Read More »

Read More »

Johnson’s Ability to Lead Tories into Victory at Risk with Today’s By-Elections

Overview: Asia Pacific equities were mixed. Gains were recorded in China, Hong Kong, Australia, and India, among the large markets, while Japan was mostly flat and South Korea and Taiwan shares fell.

Read More »

Read More »

Switzerland to ease exchange of Ukrainian currency in line with EU

Refugees with a special legal status will be able to exchange a limited amount of Ukranian banknotes for Swiss francs. The Swiss government on Wednesday announced that adults with a protection S status may exchange one amount of up to 10,000 hryvnia – the equivalent of CHF300 ($310.50) at selected branches of the two main Swiss banks, UBS and Credit Suisse.

Read More »

Read More »

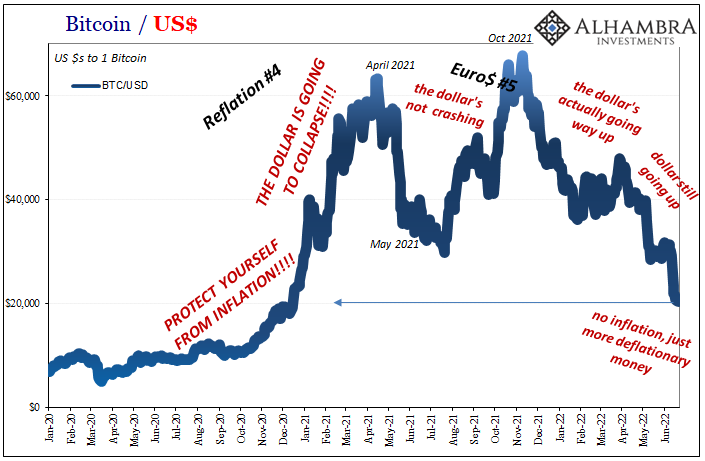

Everything Hitting The Global (eurodollar) Wall

Over the weekend, Bitcoin tumbled again. Reaching an ultra-ugly low of $17,641 (before retracing back above $20k), even the self-styled premier digital “store of value” has thrown in the towel. As I wrote last week, winter isn’t coming it is here.

Read More »

Read More »

SNB-Entscheid treibt Hypozinsen auf Zehnjahreshoch

Hypotheken sind bereits massiv teurer geworden. (Bild: Shutterstock.com/Michael Dechev)Die Inflation und die Leitzins-Erhöhung durch die Schweizerische Nationalbank (SNB) am 16. Juni 2022 (investrends.ch berichtete) haben Auswirkungen auf den Hypothekarmarkt.

Read More »

Read More »

Personalbestand in der Bankbranche nimmt zu

Der Anteil der weiblichen Beschäftigten in der Schweizer Bankbranche bleibt mit knapp 38% im Vergleich zum Vojahr unverändert. (Bild: Shutterstock.com/Fizkes)Wie die am Donnerstag veröffentlichte Publikation "Die Banken in der Schweiz" der Schweizerischen Nationalbank (SNB) zeigt, stieg der Personalbestand bei den Banken in der Schweiz um 619 Beschäftigte in Vollzeitäquivalenten auf 90'577 (+0.7%; 2020: 89'958).

Read More »

Read More »

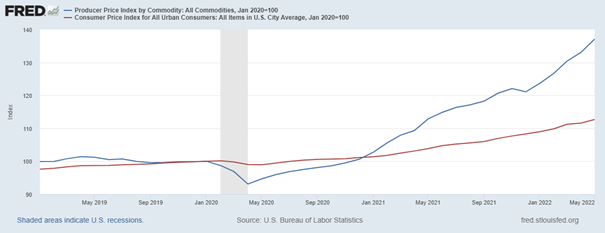

The Great Crash of 2022

We are now well past the corona crisis of 2020, and most of the restrictions around the world have been repealed or loosened. However, the long-term consequences of arbitrary and destructive corona policies are still with us—in fact, we are now in the middle of the inevitable economic crisis.

Read More »

Read More »

Risk Appetites are Fickle

Overview: Yesterday’s strong US equity gains failed to carry over into today’s session. Japanese and Australian shares fared the best among the large Asia Pacific market, with the Nikkei off less than 0.4% and the ASX off less than 0.25%.

Read More »

Read More »

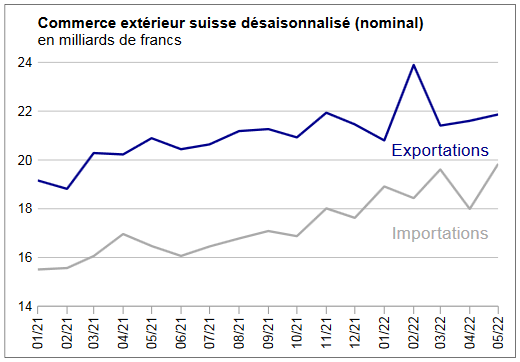

Swiss Trade Balance May 2022: surge in imports towards a level record

In May 2022, Swiss foreign trade strengthened in both directions of traffic: seasonally adjusted exports increased by 1.2% while imports jumped by 10.3%. The latter thus confirmed their upward trend despite strong fluctuations. Due to the different pace of growth at the outflow and the inflow, the trade balance surplus stood at CHF 2.0 billion.

Read More »

Read More »

ZKB-Ökonomen senken Konjunkturprognose für die Schweiz

Neu wird für 2022 mit einem Wachstum des Bruttoinlandprodukts (BIP) von 2,7 Prozent nach bisher 3,0 Prozent gerechnet und für 2023 mit einem solchen von 1,5 Prozent nach 1,7 Prozent, wie aus einer am Dienstag veröffentlichten Publikation hervorgeht.

Read More »

Read More »

The Difference Between a Forecast and a Guess

Every forecast or guess has one refreshing quality: one will be right and the rest will be wrong. What's the difference between a forecast and a guess? On one level, the answer is "none": the future is unknown and even the most informed forecast is still a guess.

Read More »

Read More »