Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing. The bane of the logistical supply-side snafu-ing, it has been container redistribution mucking the goods economy up.The recent and sharp decline in container rates, according to Freightos, is because China’s been closed down by Xi’s pursuit of his madman persona. With Shanghai locked up, freight just hasn’t been able to move.

Asia – US West Coast rates fell 18% this week to $11,455/FEU and are 28% lower than at the start of the lockdown in late March. Though this sounds suspiciously more like a demand problem than one of supply restriction, shippers confidently expect a (short run) rebound in container rates as the Chinese loosen up and let goods flow again; “Most in the industry are expecting pent up demand to send a surge of ocean exports towards destination ports like LA/Long Beach when manufacturing in Shanghai rebounds.” If this was true, why wouldn’t container rates be rising already? |

|

| Here’s a thought: what if retailers and wholesalers in the US have instead used the Shanghai mess to just cancel orders? Hey, since you all are closed anyway, just don’t bother. Save us the fuss.

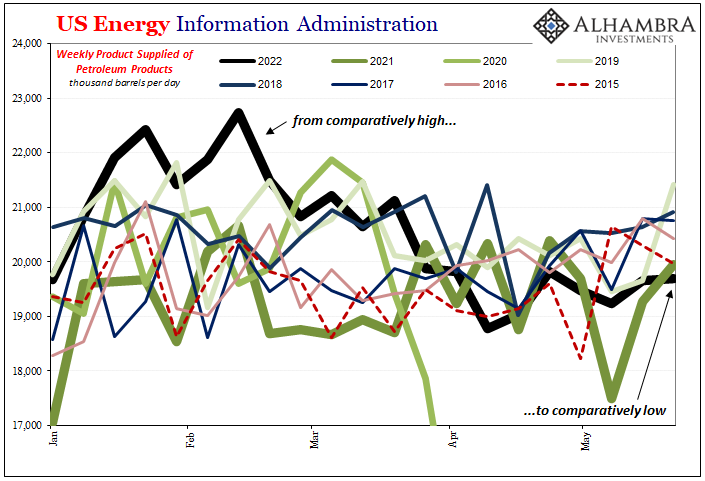

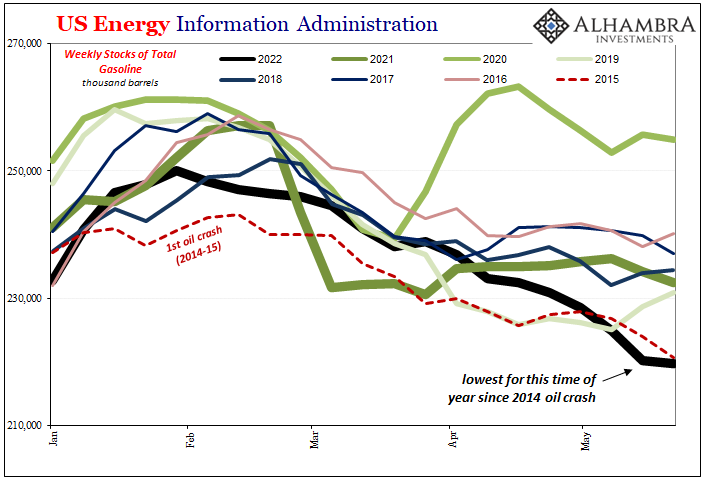

We all heard from Target and Walmart about consumers. They aren’t buying much high value stuff at least not from these big boxers, though anecdotes are spreading among other retailers, too. In fact, maybe the biggest story when it comes to specifically US demand (though it’s not different in Europe, Japan, or the rest of Asia) is its ongoing, very open destruction. High gasoline prices have recently gone higher still, a new record this week, even as Americans have already substantially scaled back driving (and also transporting goods, as well as people). According to the US Energy Information Administration, gasoline “supplied” (an industry term for how much the energy sector supplied to satisfy actual user demand) remained at its lowest level since 2013 for this time of year. This is supposed to be the start of peak driving season, and so far of May 2022 only May 2020 experienced less gasoline demand. As you can see below, the amount supplied should have started higher by now, only it hasn’t this year; the deviation has only gotten worse. With gasoline predicted to continue rising, demand will only be more suspect going forward. The same is true of all petroleum products, too. |

|

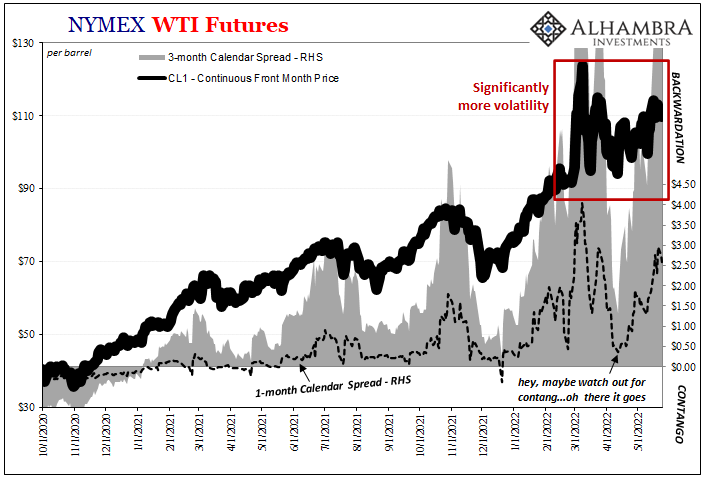

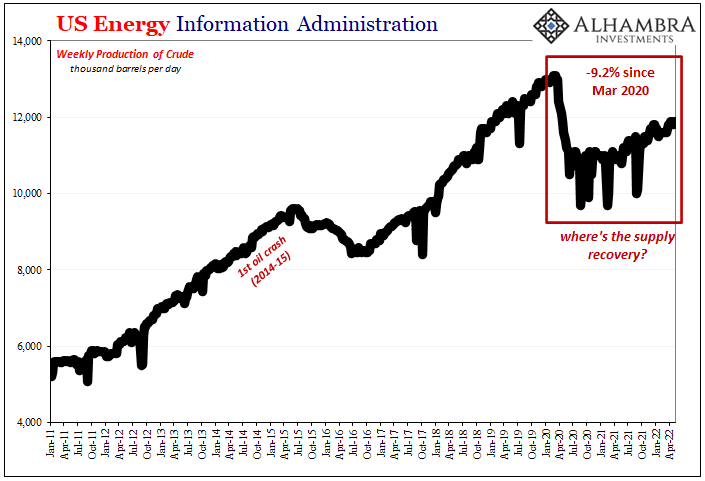

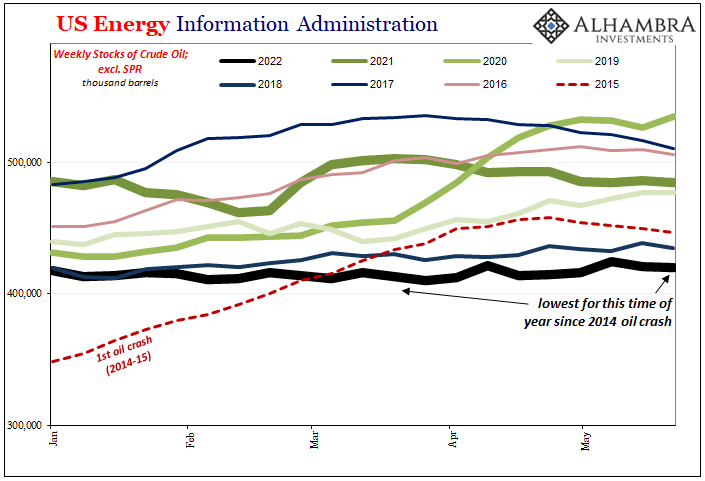

| So far as the market for crude oil is concerned, none of this appears to be concerning in it. Prices remain very firm, and the WTI futures curve as steep in backwardation as ever. For however questionable demand has become, or might still become, attention remains fixed upon lack of supply – amplified by the ever-present Russian threat to cut off energy from Europe, thereby stripping global markets of even more product.

As it is here in the US, despite dropping demand, crude and gasoline stocks are even lower. Therefore, prices and curve steepness. |

|

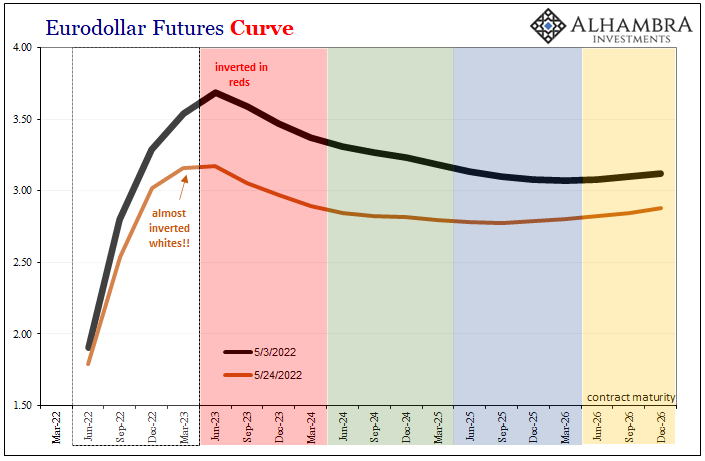

| But if we’re thinking beyond strictly oil prices and the oil market, it is this key measure of falling demand that should headline all commentary. There is a reason why the rest of financial (and money) markets are positioning the way they have.

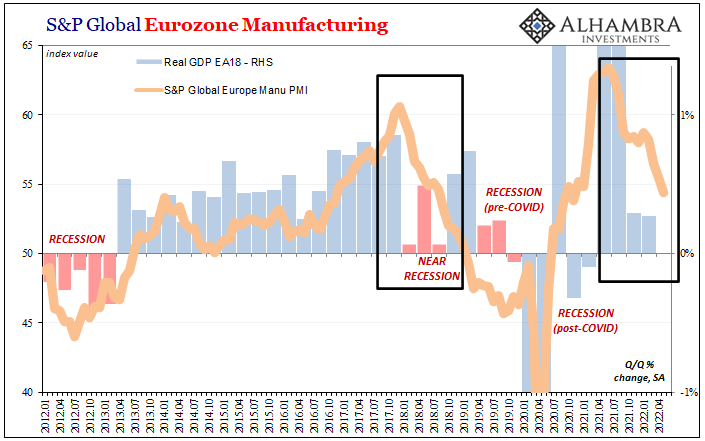

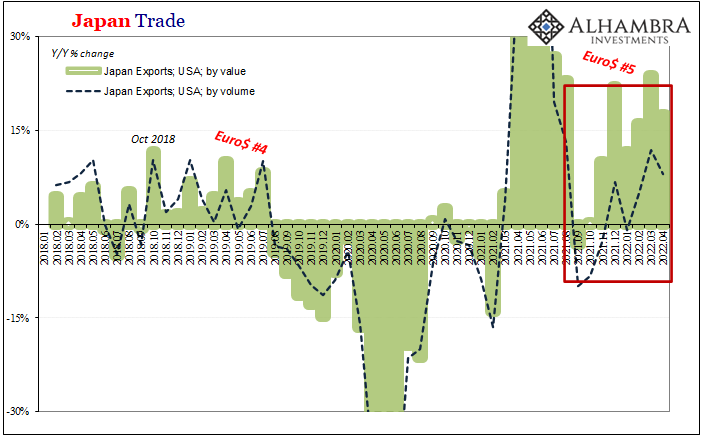

Rate hike rejection is all about the potential for a global drop-off way beyond mere domestic gasoline or oil usage. If Americans suddenly can’t drive as much, then, like Target and Walmart have reported, they aren’t buying as much leaving the goods economy already bloated with increasingly scarce storage capacity (warehouse availability is at a record low already) and no need to make and ship more of the same from China. |

|

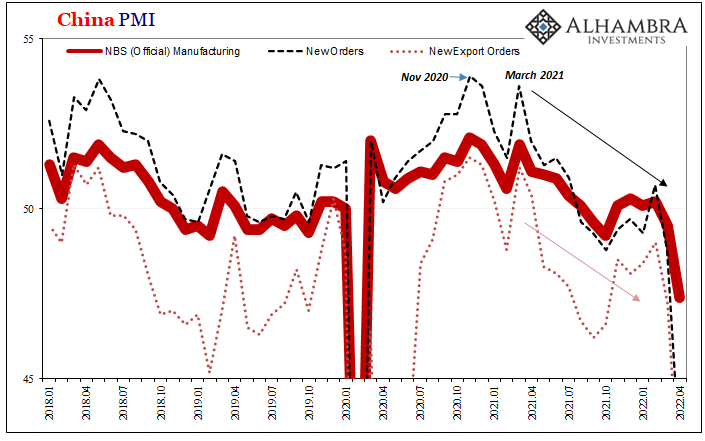

Freight rates just might be coming down, maybe staying down this time because oversaturated US traders have used the Shanghai fiasco to begin adjusting their own supply chain stuffing. And if you’re already moving to cancel China, maybe give the Japanese or European a call, too. Forget it, Japan Inc. We’re all filled up here, European manufacturer. The bullwhip does work in various ways, in addition to inventory liquidations. We’ll have more inventory data tomorrow with the release of the advanced wholesale inventory figures (expected to show another +2% m/m increase). When you look at the various Chinese PMIs, for example, the plunge in new orders especially among export orders is at least consistent with that idea. According to China’s NBS, the New Export Order index for its Manufacturing survey crashed to 41.6 in April (from already falling pre-lockdown 47.2 in March, down from 49.0 in February). It isn’t expected to rebound much for May (we won’t know until the data is released next week). Again, lockdowns are blamed. Maybe it’s all just being demanded. |

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,China,commodities,Crude Oil,currencies,economy,Featured,Federal Reserve/Monetary Policy,gasoline,Inventory,Markets,newsletter,OIL,oil production,WTI,wti futures curve