Monthly Archive: May 2022

Bitcoin Crash sorgt für Panik im Markt

Der Support bröckelte in den vergangenen Tagen weiter, so dass Bitcoin erst unterhalb von 30K wieder stabil wurde – der Markt reagierte mit Panik. Doch es gibt auch gute Nachrichten, die man erkennt, wenn man sich die langfristigen Daten des BTC-Preises ansieht. Bitcoin News: Bitcoin Crash sorgt für Panik im MarktAktuell ist der Bitcoin nur noch 28.400 US-Dollar wert. Ein neues Jahrestief vom Wochenanfang wurde damit nochmals unterboten. Doch die...

Read More »

Read More »

Dollar and Yen Surge

Overview: Global equities are bleeding lower. Several large markets in the Asia Pacific region, including Hong Kong, Taiwan, and India are off more than 2%. Japan and Australian bourses fell by more than 1.5%.

Read More »

Read More »

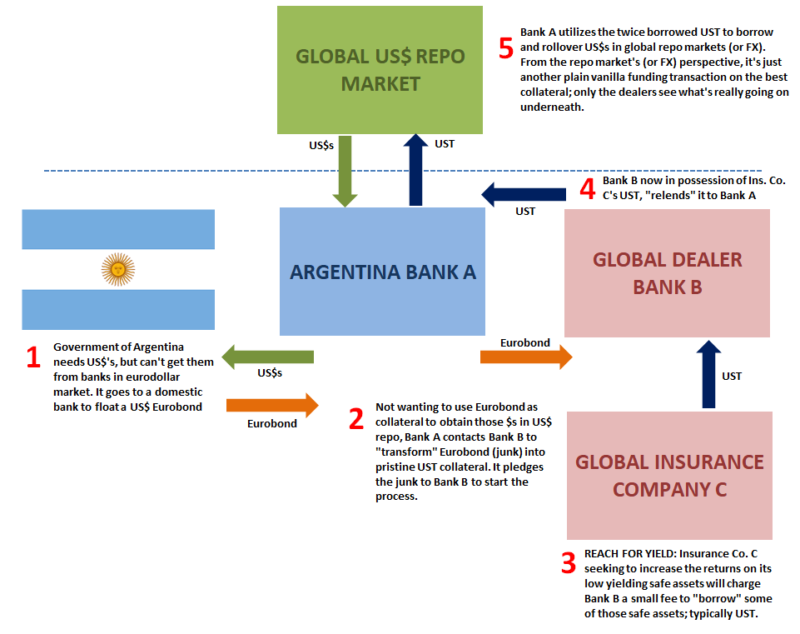

Eurobonds Behind Euro$ #5’s Collateral Case

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat.

Read More »

Read More »

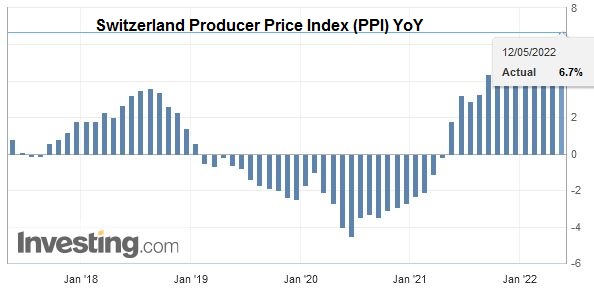

Swiss Producer and Import Price Index in April 2022: +6.7 percent YoY, +1.3 percent MoM

The Producer and Import Price Index increased in April 2022 by 1.3% compared with the previous month, reaching 108.4 points (December 2020 = 100). Higher prices were seen in particular for petroleum products as well as for basic metals and semi-finished metal products.

Read More »

Read More »

Student Loans and Government Subsidies: Another Government “Benefit” Creates Financial Chaos

The origins of the federal student loan program are well documented and follow a similar trajectory to most government subsidy programs in American history.

Read More »

Read More »

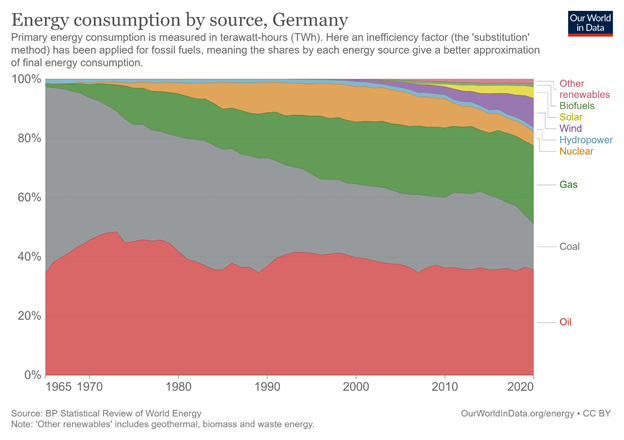

Lighting the Gas under European Feet: How Politicians and Journalists Get Energy So Wrong

“We live in a time where few understand how things get made. It is fine to not know where stuff comes from, but it isn’t fine to not know where stuff comes from while dictating to the rest of us how the economy should be run." —Doomberg

Read More »

Read More »

Greenback Softens Ahead of CPI

Overview: It appears that investors have become more concerned about growth prospects and less about inflation in recent days. The US 10-year yield that had flirted with 3.20% at the start of the week is now around 2.93%.

Read More »

Read More »

Rothbard Explains The Failure of the “New Economics”

For most people, economics has ever been the "dismal science," to be passed over quickly for more amusing sport. And yet, a glance at the world today will show that we pass over economics at our peril.

Read More »

Read More »

The Chinese Slowdown: Much More Than Covid

The most recent macroeconomic figures show that the Chinese slowdown is much more severe than expected and not only attributable to the covid-19 lockdowns. The lockdowns have an enormous impact. Twenty-six of 31 China mainland provinces have rising covid cases and the fear of a Shanghai-style lockdown is enormous.

Read More »

Read More »

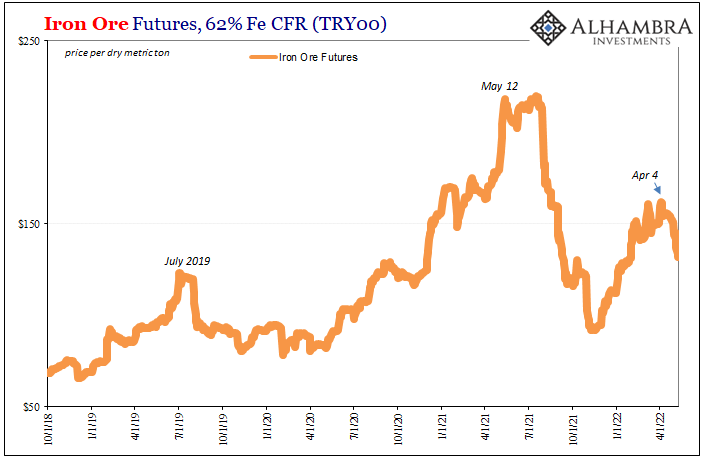

Industrial Synchronized Demand

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

No Rest for the Weary

Overview: Risk appetites are improving on the margin. Asia Pacific stocks still fell after the sharp losses on Wall Street on Monday. Still, China, Taiwan and Indian equities traded higher. Europe's Stoxx 600 is snapping a four-day 6.5%+ slide and is up around 1.2% in late European morning turnover.

Read More »

Read More »

Bitcoin Preis stürzt ab

Bereits zum Ende der letzten Woche gab es einen klaren Preisabsturz des BTC. Doch zu Beginn der Woche setzte sich der Trend fort und führte den Bitcoin sogar zwischenzeitlich wieder unter 30.000 US-Dollar. Der Support bröckelte, fand sich jedoch heute Morgen wieder bei knapp oberhalb von 30K. Bitcoin News: Bitcoin Preis stürzt abMit dem jüngsten Preisabsturz purzelte der Gesamtmarkt auf ungefähr 1,5 Billionen an Wert. Damit hat der Cryptomarkt...

Read More »

Read More »

Weekly View – Unsettled

Last week’s 50 bps Fed rate hike was not a surprise. Indeed, Fed chairman Jerome Powell’s assertion that a 75 bps hike had not been actively considered was enough to spark a stock rally. But it proved short-lived, with markets quickly returning to their fears about inflation.

Read More »

Read More »

Will the Pentagon Induce Russia to Use Tactical Nukes in Ukraine?

For the past 25 years, the Pentagon has moved inexorably toward admitting Ukraine into NATO, which would then permit the Pentagon to install its nuclear missiles in Ukraine — that is, on Russia’s border.

Read More »

Read More »

Recent price rises only the beginning, says Swiss consumer association

Food, energy and housing costs are rising in Switzerland and consumers are beginning to change their spending habits. So far inflation in Switzerland has been moderate with annual inflation of 2.5%. However, according to FRC, a consumer association in French-speaking Switzerland, recent price rises are only the beginning, reported RTS.

Read More »

Read More »

What Happens When Complexity Unravels?

Those glancing at the appearances will be assured all is well and it will all sort itself out. Those who look behind the screen will move away as fast as they can. When finances tighten, there are two choices: cut expenses or increase revenues. Monopolies, cartels and governments can increase revenues by increasing taxes or the price of goods and services because users /customers / taxpayers have no alternative.

Read More »

Read More »

Contrary to What Some Economists Claim, the Fed Can’t Give the Economy a “Neutral” Rate of Interest

On April 19, 2022, at the Economic Club in New York, the Chicago Federal Reserve Bank president Charles Evans said the Fed is likely to lift by year end its federal funds rate target range close to the neutral range of between 2.25 to 2.50 percent. Furthermore, on April 21, 2022, Fed chairman Jerome Powell corroborated this by stating that the Fed wants to raise its benchmark rate to the neutral level.

Read More »

Read More »

Forget What the “Experts” Claim about Deflation: It Strengthens the Economy

For most experts, deflation is bad news since it generates expectations for a continued decline in prices, leading consumers to postpone the purchases of present goods, since they expect to purchase them at lower prices in the future. Consequently, this weakens the overall flow of current spending and this, in turn, weakens the economy.

Read More »

Read More »

War in Ukraine – Week 10

This is Liza. She is 15 years old. After her town got shelled and two people got injured she volunteered to drive them to get some medical help, because no one else would. First she got through mines on the road, then Russian soldiers shot at the car, injuring both of her legs. But she kept driving until the car stopped. Fortunately, they got picked up by our guys, and this brave little girl and her passengers are recovering right now.

Read More »

Read More »

Stop organic farming to help future food crisis, says Syngenta boss

Erik Fyrwald, the CEO of the Swiss agrochemicals group Syngenta, has called for an end to organic farming to avoid a worsening food crisis. The president of the Swiss Small Farmers’ Association meanwhile dismissed his arguments as “grotesque”.

Read More »

Read More »