Monthly Archive: May 2022

T-bills Targeted Target

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like...

Read More »

Read More »

Russland will Cryptocoins als legales Zahlungsmittel akzeptieren

Legal sind Cryptocoins bereits in Russland, doch als legales Zahlungsmittel – wie in El Salvador – werden Bitcoin und Co. von Moskau nicht deklariert. Doch dies könnte sich auch aufgrund der aktuellen geopolitischen Lage schon bald ändern. Crypto News: Russland will Cryptocoins als legales Zahlungsmittel akzeptierenDurch den Ausschluss Russlands aus dem internationalen Bankensystem wurde offenbar eine Kettenreaktion ausgelöst, die Russlands Suche...

Read More »

Read More »

SNB’s Jordan: Inflation will temporarily rise above target then fall quickly

We take into account the higher inflation rates abroad when deciding monetary policy. We are ready to intervene in FX when necessary. Negative rates and currency interventions necessary for SNB to meet its mandate.

Read More »

Read More »

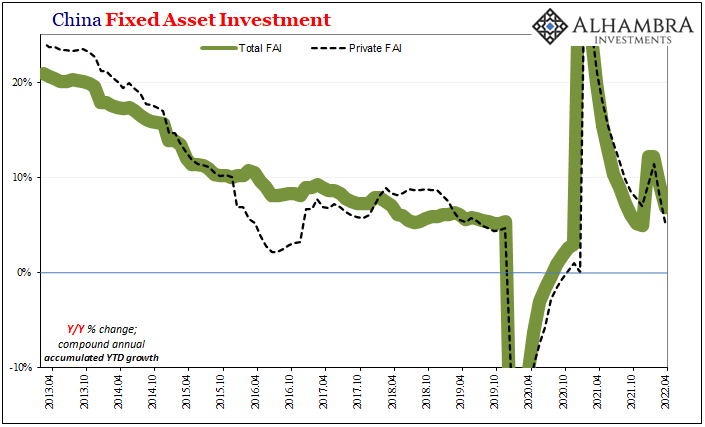

Synchronized Not Coronavirus

There is an understandable tendency to just write off this weekend’s disastrous Chinese data as nothing more than pandemic politics. After all, it has been Emperor Xi’s harsh lockdowns spreading like wildfire across China rather than any disease (why it has been this way, that’s another Mao-tter).

Read More »

Read More »

Germany’s Scholz and NATO’s Stoltenberg to attend Davos WEF meeting

German Chancellor Olaf Scholz and NATO Secretary General Jens Stoltenberg will be among the leaders at the annual World Economic Forum (WEF) meeting in Davos, which starts on Sunday after a two-year hiatus due to the Covid-19 pandemic.

Read More »

Read More »

The Fallacy of Collectivism

According to the doctrines of universalism, conceptual realism, holism, collectivism, and some representatives of Gestaltpsychologie, society is an entity living its own life, independent of and separate from the lives of the various individuals, acting on its own behalf and aiming at its own ends which are different from the ends sought by the individuals.

Read More »

Read More »

It’s Time for America to Ditch NATO

In the first episode of this new podcast, Ryan McMaken and Zachary Yost discuss NATO, Turkey, Russia, and why the USA needs to leave it all behind.

Read More »

Read More »

“Real innovation and progress happen beyond Big Tech” – Part II

Interview with Bernd Rodler – Part II of II

Claudio Grass (CG): A lot people still consider it safer to go with a huge, established corporation, thinking these solutions would be more reliable and robust, especially for business applications. What is your take on this view?

Bernd Rodler (BR): This is a perfectly understandable view, at least from the standpoint of a manager applying the „cover your a…“ strategy. Who can blame him if the SAP...

Read More »

Read More »

Noninterventionism Is Not Isolationism: The US Government Should Stop Arming Ukraine

Proponents of arming Ukraine against Russia call critics "isolationists" as a pejorative term. But these "entangling alliances" have a history of sad endings with tragic results.

Original Article: "Noninterventionism Is Not Isolationism: The US Government Should Stop Arming Ukraine"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Crude Contradictions Therefore Uncertainty And Big Volatility

This one took some real, well, talent. It was late morning on April 11, the crude oil market was in some distress. The price was falling faster, already down sharply over just the preceding two weeks. Going from $115 per barrel to suddenly less than $95, there was some real fear there.But what really caught my attention was the flattening WTI futures curve.

Read More »

Read More »

Switzerland grew more cereals in 2021

In 2021, the area under cereals (146 400 ha) increased by 3% compared with 2020, while that under potatoes (-2%) and sugar beet (-8%) decreased. The number of farms (48 864) fell further, while organic farming continued to grow.

Read More »

Read More »

The Russo-Ukrainian War: A New Opportunity for Demagogues to Destroy Freedoms at Home

Politicians thoroughly enjoy times of war. Periods of bellicosity are when the most power-hungry members of the political class indulge in their most depraved political fantasies.

Read More »

Read More »

44 Länder treffen sich in El Salvador

El Salvador ist zum Pilotprojekt für die internationale Finanzwelt geworden. Nachdem das kleine Land Bitcoin als legales Zahlungsmittel eingeführt hat, ist es nicht nur im Internet berühmt geworden, El Salvador ist auf dem Radar vieler Länder aufgetaucht – mit großem Interesse verfolgt man, wie sich der BTC im Land entwickelt. Nun wollen insgesamt 44 Länder vor Ort sehen, wie El Salvador Bitcoin in sein Finanz- und Wirtschaftssystem eingebunden...

Read More »

Read More »

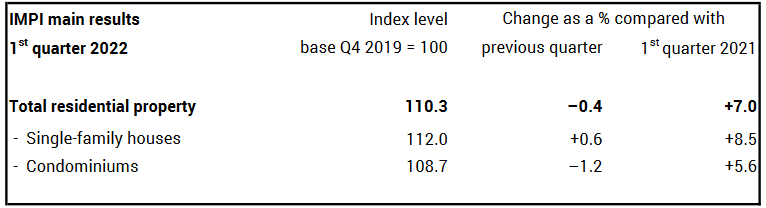

Residential property prices fell by 0.4% in 1st quarter 2022

The Swiss residential property price index (IMPI) fell in the 1st quarter 2022 compared with the previous quarter by 0.4% and reached 110.3 points (4th quarter 2019 = 100). Compared with the same quarter of the previous year, inflation was 7.0%. These are some of the results from the Federal Statistical Office (FSO).

Read More »

Read More »

Checking In On Five Long-Term Cycles

The decline phase of S-Curves can be gradual or a cliff-dive. Way back in 2007 I charted five long-wave cycles that I reckoned consequential: 1. Public debt (accumulating federal deficits)

2. Inflation 3. Oil (energy) 4. Interest rates 5. Speculative fever

Read More »

Read More »

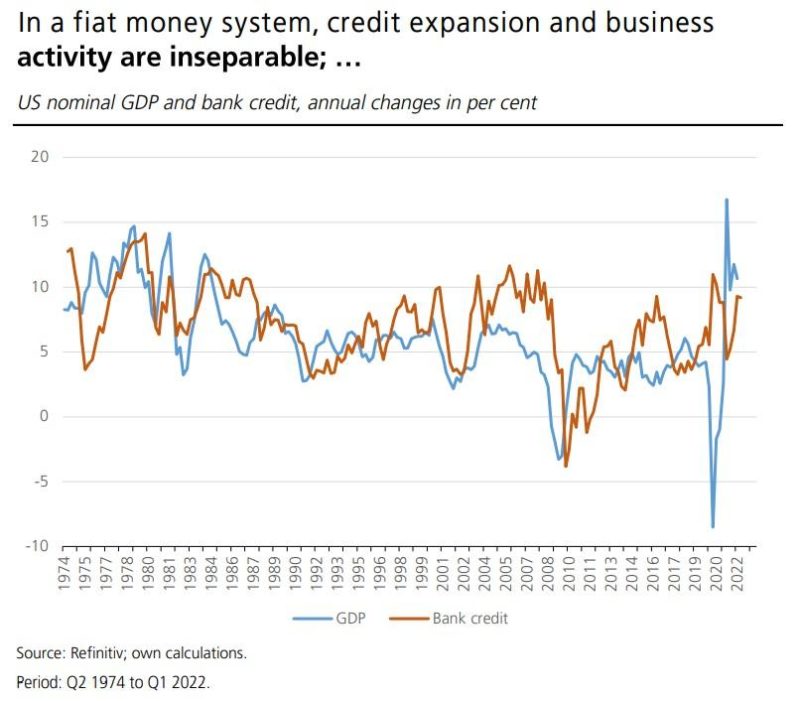

Federal Reserve Policies Aimed at Creating Price Stability Bring About Economic Instability

For most economists and politicians, the role of central bank authorities is to make the economy as stable as possible. What do they mean by economic stability? Economic stability refers to an absence of excessive fluctuation, so an economy with constant output growth and low and stable price inflation is likely to be regarded as stable.

Read More »

Read More »

Freedom and Sound Money: Two Sides of a Coin

It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of right.

Read More »

Read More »

“Real innovation and progress happen beyond Big Tech”

Interview with Bernd Rodler – Part I of II

Those who know me and who have read my writings before will be very well aware of how important the topic of decentralization is to me and to my way of looking at the world, at our societies and our economies. I truly believe that there is no future to be had, at least not one that respects human dignity, should we continue down this same path of top-down control, mindless conformity and blind obedience...

Read More »

Read More »

Curveballs in the Housing Bubble Bust

All these curveballs will further fragment the housing market. Oh for the good old days of a nice, clean housing bubble and bust as in 2004-2011: subprime lending expanded the pool of buyers, liar loans and loose credit created speculative leverage, the Federal Reserve provided excessive liquidity and the watchdogs of the industry were either induced (ahem) to look away or dozed off in a haze of gross incompetence.

Read More »

Read More »