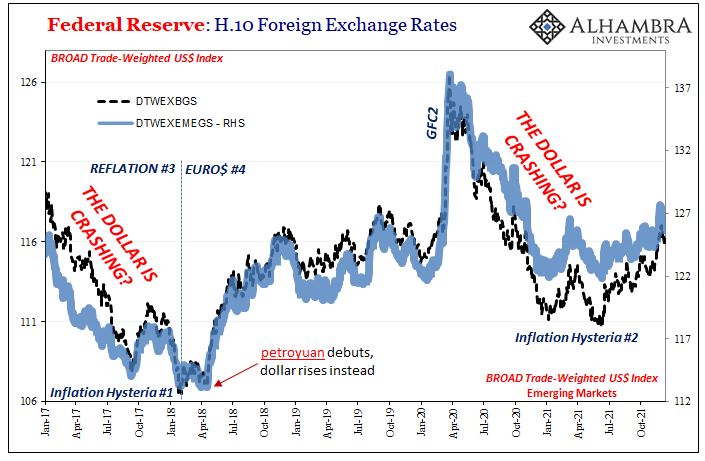

| A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike. Basically, the Fed had “printed” too much “money” and the Chinese playing some “long game” were purportedly ready at any moment to snatch the role of world reserve by manipulative force from the out-to-lunch Americans.

Those two came to a head early in 2018 when CPIs began to modestly rise at the same time China debuted its so-called petroyuan. Setting aside its utterly botched launch, when oil futures contracts denominated in CNY were finally set up and running, everyone called it a game-changer, a profound upset to the world order that had been predicted time and time again. The dollar was toast, it was going down. And yet, almost from the day China turned the petroyuan on, the dollar’s been higher ever since. Hardly anyone today remembers this because, well, it wasn’t a game changer or anything close to one because in the grand scheme of real global money it was at most a curiosity. Those who claimed otherwise had only betrayed their lack of knowledge and appreciation for what a reserve currency is, and actually must do (to understand better, read this instead). The mystique behind the petroyuan was built upon the likewise fictional account of the petrodollar. You hear this latter term quite frequently even though it isn’t “a thing”; not in any real-world sense. |

|

| I’ve probably spent more time researching and uncovering historical facts about the global monetary order than maybe any other person around (I’ve got to a get a life), and you know what term I’ve never come across in the mountains of research I’ve uncovered?

Yeah, petrodollar. This was a post facto invention of those who have either a political or financial ax to grind or product/narrative to sell you. The fact that largely Middle Eastern nations who trade oil on the global markets end up buying US Treasuries is no political conspiracy in any way, shape, or form. It is simply how this particular reserve regime works. No sexy spy thriller filled with intrigue, just the mundane monetary basics. Was there some grand collusion which led the Chinese to sell basically every manufactured item for modern life in US dollars, run up huge merchandise as well as financial surpluses, and then reinvest those proceeds in US Treasuries, too? Of course not, and China’s is an order of magnitude greater. This is just how it all goes in the eurodollar system. On the contrary, these oil contracts in CNY betrayed the same eurodollar not petrodollar basis as I wrote just before they arrived in early 2018:

The eurodollar system remains not because it is better, or even that it works, rather because there is no realistic alternative to it. And the “it doesn’t work” part is already fourteen and a half years old. As I had finished the above article, “In other words, replacing the eurodollar is a Herculean task. The Chinese surely wish ‘we’ had started in 2008.” The reason the Chinese and much of the world might have wanted – and have said so over the years – to try something else is how broken down the reserve system had become. This, contrary to that same petroyuan hype agenda, did not mean a hyperactive Fed printing too many dollars; what broke down was how there have been not enough and the deflationary, depressionary consequences spread globally (this is a reserve currency, after all) don’t go as unnoticed outside the US. |

|

| There are, therefore, two main points of contention here: first, the eurodollar continues unchallenged; and, second, it has malfunctioned in a way that’s opposite of the inflation-4-eva, dollar-to-zero theories postulated by those who point to their creation the petrodollar as some kind of massive fracture potential in the system to make it all seem more plausible than it is.Like all of these reserve currency issues, you don’t have to take my word for it.

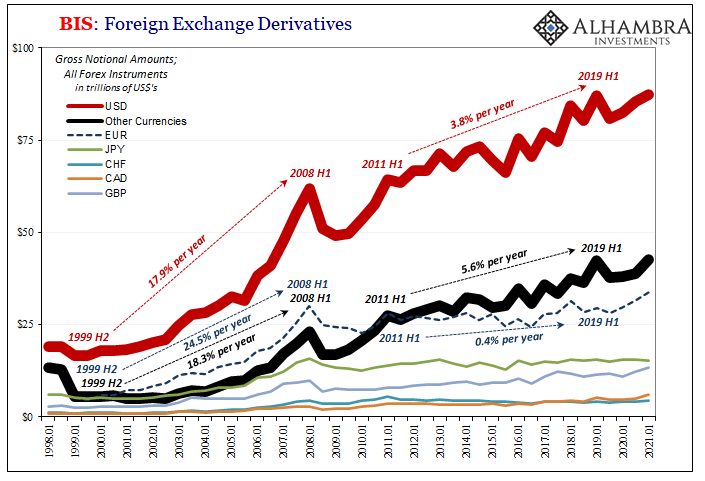

Let’s start with some data: The BIS keeps track of bank derivative books from all over the world, aggregating this highly crucial data given how the global monetary system is, in fact, global. As of the first half of 2021 (the latest data; BIS publishes derivatives in six-month intervals), the supranational agency says there was a total of $102.5 trillion gross notional foreign exchange (forex) outstanding; trillion with a “T.” Why or how can there be this much? What’s the point of so many? I’ll get to that later. First, notice that the biggest, by far, currency denomination is US$. In the 2010’s, beginning with the first half of 2011 (not random coincidence), the rate of change changed so that the growth in US$ forex derivatives (red line) seriously underperformed the second largest category of “other” (black line). As you probably have already surmised, “other” is a mixed proxy for other currencies which includes China’s yuan. Therefore, the much faster pace in growth of forex derivatives in “other” currencies is as CNY is used more and more. So, the data – at first – does seem to suggest the Chinese are eating the dollar’s lunch and taking over. But that’s not what the data is telling us at all. |

|

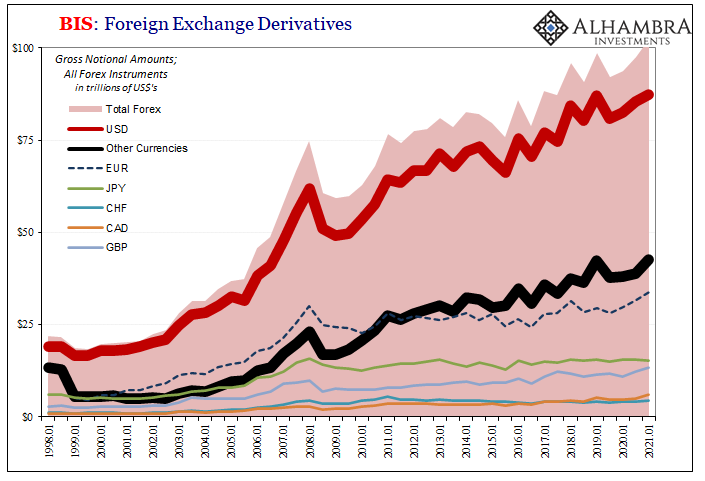

| You may already have noticed, too, how the math doesn’t seem to add up right; I just told you above that the BIS puts total forex at $102.5 trillion. Doing some quick arithmetic, how can that be if US$ total is $87.3 trillion, there are $42.6 trillion in “other”, and those forex contracts in euros add a further $33.7 trillion? Throw in another $15.4 trillion in yen-denominated forex, and we are way past $102.5 trillion with the smaller currencies still to account.

To make sense of the math, or the chart shown immediately above, you first have to remember Dufey and Giddy and what I said about the useful scholarship of the past, none of which had mentioned “petrodollar.” From their paper written in 1981:

|

|

| The result is that the Eurodollar is the only full-fledged external money in existence; other Eurocurrencies are often simply Eurodollars linked to forward exchange contracts. emphasis added

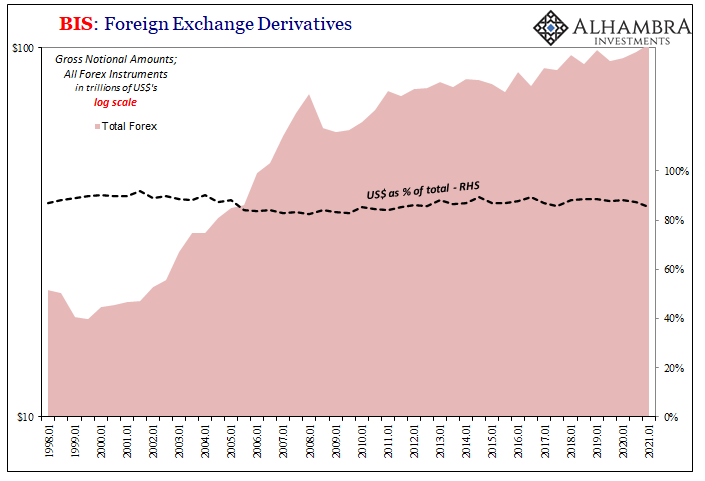

Their deep examination written more than forty years ago provided far more and far more valuable insight than anything written, said, or populating financial media and mainstream discourse today. And the evidence for it is exactly what you see above. In other words, the CNY forex embedded within the “other” forex category isn’t out-dueling the US$, instead it is handily beating out the euro to have become the primary currency on the other side of global forex that still moves through the US$ (eurodollar). The eurodollar contracts are as Dufey and Giddy told you four decades ago; on the other side of both CNY contracts as well as euro, indeed, all, or nearly all, of those above, that is the US$ because that is what a reserve currency must do and must be! In a word, it is the ultimate intermediary. What’s probably as remarkable as it is globally frustrating, then, is just how consistent the US$ (eurodollar) is on being the opposite side of almost the entire tens and now hundred trillions in forex contracts written and outstanding around the world. And this is just a crude proxy using raw BIS data. Other BIS data has indicated that upwards of 95% of all financial transactions are US$ denominated on one side or both of forex. Furthermore, as the same institution very belatedly had “discovered” in 2017 (footnote dollars):

|

Many deals take place in the cash market, through loans and securities. But foreign exchange (FX) derivatives, mainly FX swaps, currency swaps and the closely related forwards, also create debt-like obligations. For the US dollar alone, contracts worth tens of trillions of dollars stand open and trillions change hands daily. And yet one cannot find these amounts on balance sheets. This debt is, in effect, missing.

Though these only exist in outside data or in the footnotes of bank accounting forms, this is money in every functional sense and these are very real “dollars” that get used in the real economy regardless if or how anyone on the outside accounts for them – or doesn’t.

In one sense, no, it isn’t missing; it only is missing from the official interpretations of the global monetary system which is one reason why the myth of the petrodollar has been able to run wild unchallenged.

And yet, the money is missing if in the functional sense, too, beyond the grasp of the BIS (though not its data). The charts I posted above already describe a eurodollar system unrivaled in any meaningful or functional sense that at the same time they also show the same system had stopped working a long time ago.

Before 2008, these derivatives like any number of related monetary (TIC) and financial accounts (Z1) for the reserve regime had been expanding exponentially – you see this very clearly above. Then, suddenly, they all abruptly ended that surge and never started back up again – which you can also see very clearly.

What happened at this inflection was no one-off, temporary “subprime mortgage” crisis. It could not have been.

This is only the tip of the proverbial iceberg. Forex currency is a good place to start, but there’s even more to it lurking in these shadows.

What these derivatives are really about is the true guts, the inner workings of the eurodollar global reserve system. It is a ledger-based system and because it is, it prioritizes the balance sheet capacities of those who have been keeping this ledger, the bookkeepers and their pens.

Jay Powell like Ben Bernanke before him has no role in it no matter how many alphabet soup of programs the Fed throws together at the last minute or how much in bank reserves as a byproduct. And if you think Uncle Sam can steal the throne of King Dollar by whipping out his enormous checkbook, wait until you see what else is also missing and how much. China, well, they don’t even want the responsibility.

The data like the historical record is crystal clear. The eurodollar is unchallenged and it remains this way even though it so obviously stopped working in required capacities more than fourteen years ago. This is the real basis for global monetary discontent. In light of all this and more, no wonder the petroyuan ended up no greater than a curious little footnote.

Again, you don’t have to take my word for it. But should you want to, and go a little further, there’s a Part 2 (and eventually a Part 3 which should finally put bank reserves in their proper place).

Full story here Are you the author? Previous post See more for Next postTags: $CNY,Bonds,China,currencies,Derivatives,economy,EuroDollar,eurodollar system,Featured,Federal Reserve/Monetary Policy,Foreign Exchange,Forex,Markets,money,newsletter,reserve currency