The new year hasn’t gotten off to a great start for growth stocks or any of the other speculative assets that have drawn so much attention over the last couple of years. Bitcoin is down 25% since the beginning of 2022 and almost 50% from its high in November. Anyone who bought at the lows after the onset of COVID is still pretty darn happy, up over 400%. Even if you bought at the beginning of 2021, you’re still up nearly 20% which is pretty good until you take into account the volatility. If you bought just about any other time in 2021, you’re probably nursing some losses right now. But Bitcoin isn’t relevant for most investors who might have a small – hopefully very small – allocation in their portfolios. We’re a conservative shop and so our allocation to crypto is zero but we certainly pay attention to what is going in the space because if bad things happen there it could well spill over to things we do own. In a bear market, one sells what one can not what one wants and liquidity in crypto seems highly selective. The point is that the riskiest parts of the markets have taken the biggest hits in this correction. That’s pretty darn normal, the only difference being what those riskiest parts are. And bitcoin is not even close to the worst performing thing in the crypto space. To be honest, I saw a list over the weekend of various crypto assets and how they’ve performed and I didn’t recognize half of them. All I can say is “ouch”. |

|

| But the large cap growth stocks are certainly of concern for most investors, if for no other reason than the outsize portion of the large cap indexes they occupy. At the end of 2021, the top ten holdings in the S&P 500 represented 30% of the index and traded for an average of 44 times earnings and 12 times sales. Valuation is a lousy timing tool but it is a wonderful measure of risk, something a lot of people have learned anew since the beginning of the year. 9 of those top 10 stocks have underperformed the index so far this year, the lone holdout being Berkshire Hathaway. The next best performer is United Health and it isn’t coincidence that those were the two cheapest stocks in the group. The correction to date hasn’t really changed the risk level much. The top 10 still represent 28% of the index but they do trade now for a mere 37 times earnings. What is more interesting in my opinion is that 7 of the 10 did outperform the S&P 500 growth index. The damage to that index and the NASDAQ has been done by their lesser members. If the top 10 start to join the laggards, the effect on the index could get ugly quickly.

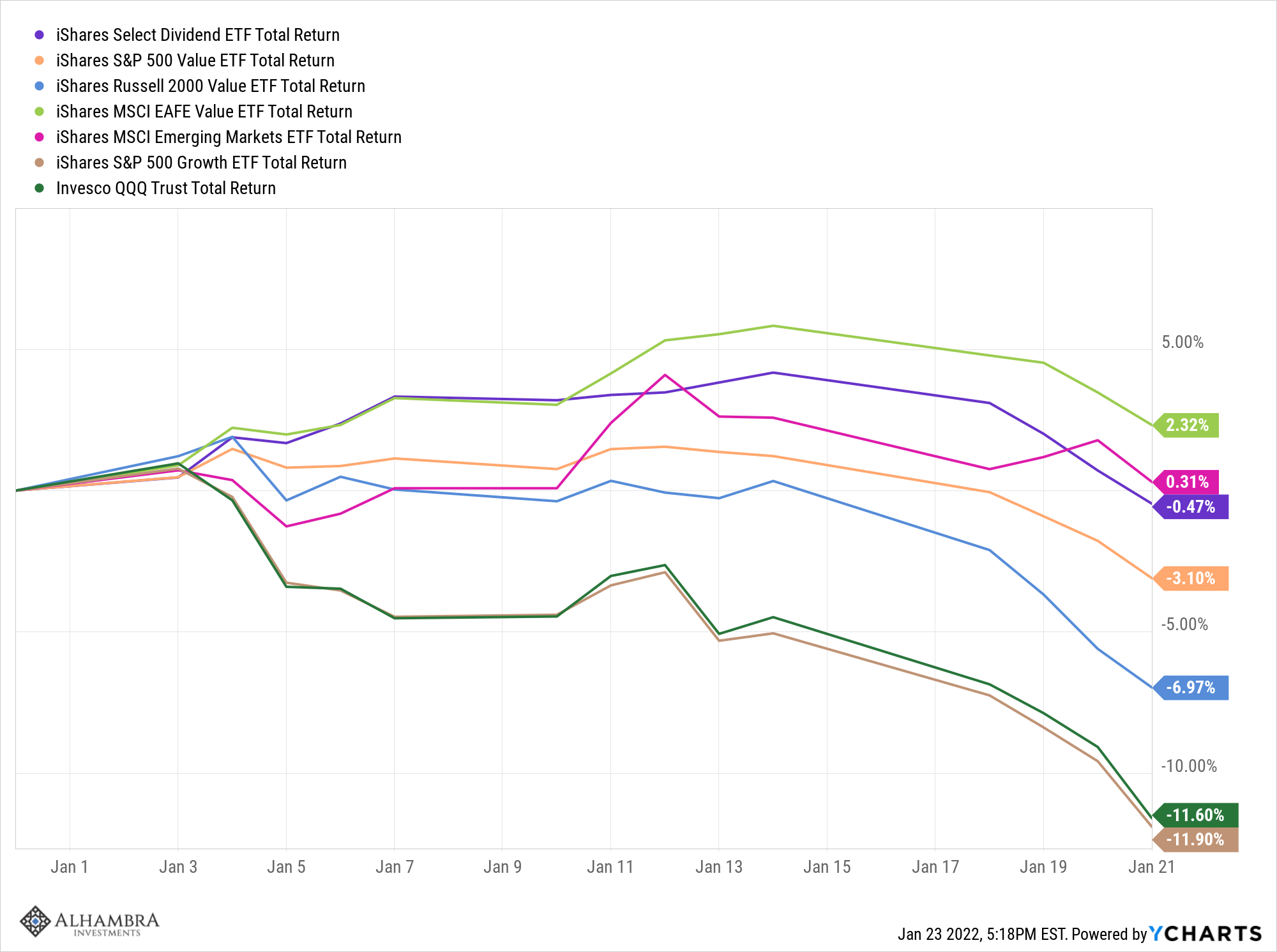

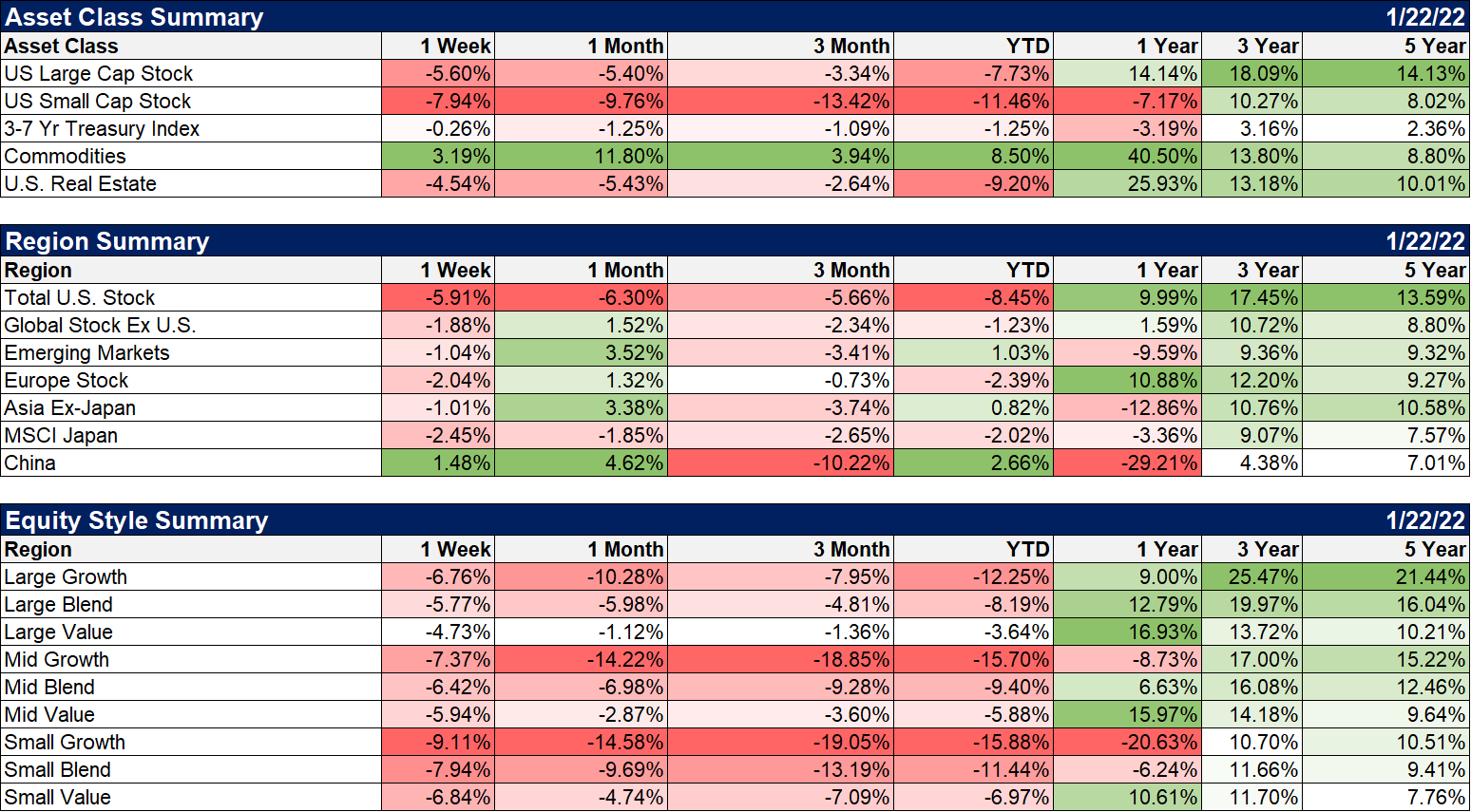

Overall, the correction or selloff (the S&P 500 hasn’t reached official correction territory of down 10%) has been mostly about the US growth stocks. Value stocks, dividend stocks and foreign stocks have all outperformed the S&P 500 so far this year. That may or may not continue I suppose and value investors should probably be careful not to celebrate what may be just another false start like so many others over the last decade. But for now, they are doing what we expect them to do in a selloff. |

|

| Full disclosure: Alhambra and/or its clients own DVY, IVE, IWN, EFV and EEM. As I discussed in our year end review, we made a decision as a firm to not buy these large growth stocks and so IVW and QQQ are not a part of our portfolios.

So, I guess the question is whether it is time, according to Warren Buffet’s pithy saying, to get greedy. I got asked that, in one form or another, just about every day last week which makes me think the answer is probably no. There are other reasons but this market was driven by sentiment – greed – on the way up and this correction is being driven by emotion – fear – as well. And there just doesn’t seem to be enough of it yet to make a durable bottom. Retail traders are driving the indexes up early in the day and institutions are selling it in the afternoon. You probably want to stick with the big boys for now. For sure, there are technical metrics I watch that are getting close to bottom readings. We monitor the % of stocks above their 200 day moving average in various indexes and for the NASDAQ, it is approaching buy territory at about 17%. For comparison purposes that indicator hit 7 in the 2020 bear market, 10 in the late 2018 selloff and 11 in the big volatility selloff in early 2016. Lesser corrections have stopped at higher levels but once you get this far down, it usually goes on down to at least low double digits. So, by that measure, the NASDAQ may be getting close to at least a trading bottom. The same figure for the S&P 500 though is still 53%, indicating that the damage to that index is not nearly as dire as the NASDAQ. For those same prior selloffs the S&P indicator fell to 3%, 11% and 18% so if we’re going to get down that far, we have a long way to go. |

|

| We also watch put/call ratios for an indication of sentiment. When fear is rampant, put buying expands (which also drives the volatility (VIX) index as well) and call buying shrinks. Unfortunately, we aren’t at levels I associate with a lot of fear. The equity only put/call ratio ended the week at 0.82 which shows some fear but also that there are still more calls than puts being bought. I would expect to see a ratio over 1 before we find a bottom. The index ratio ended the week at 1.63 which also shows some fear but that ratio generally gets over 2 at bottoms. The VIX shows a similar picture of rising fear but not at levels I associate with bottoms. The VIX ended the week at almost 29 but corrections – if that’s what this is – usually see levels at least in the 30s while 40s and 50s are pretty common:

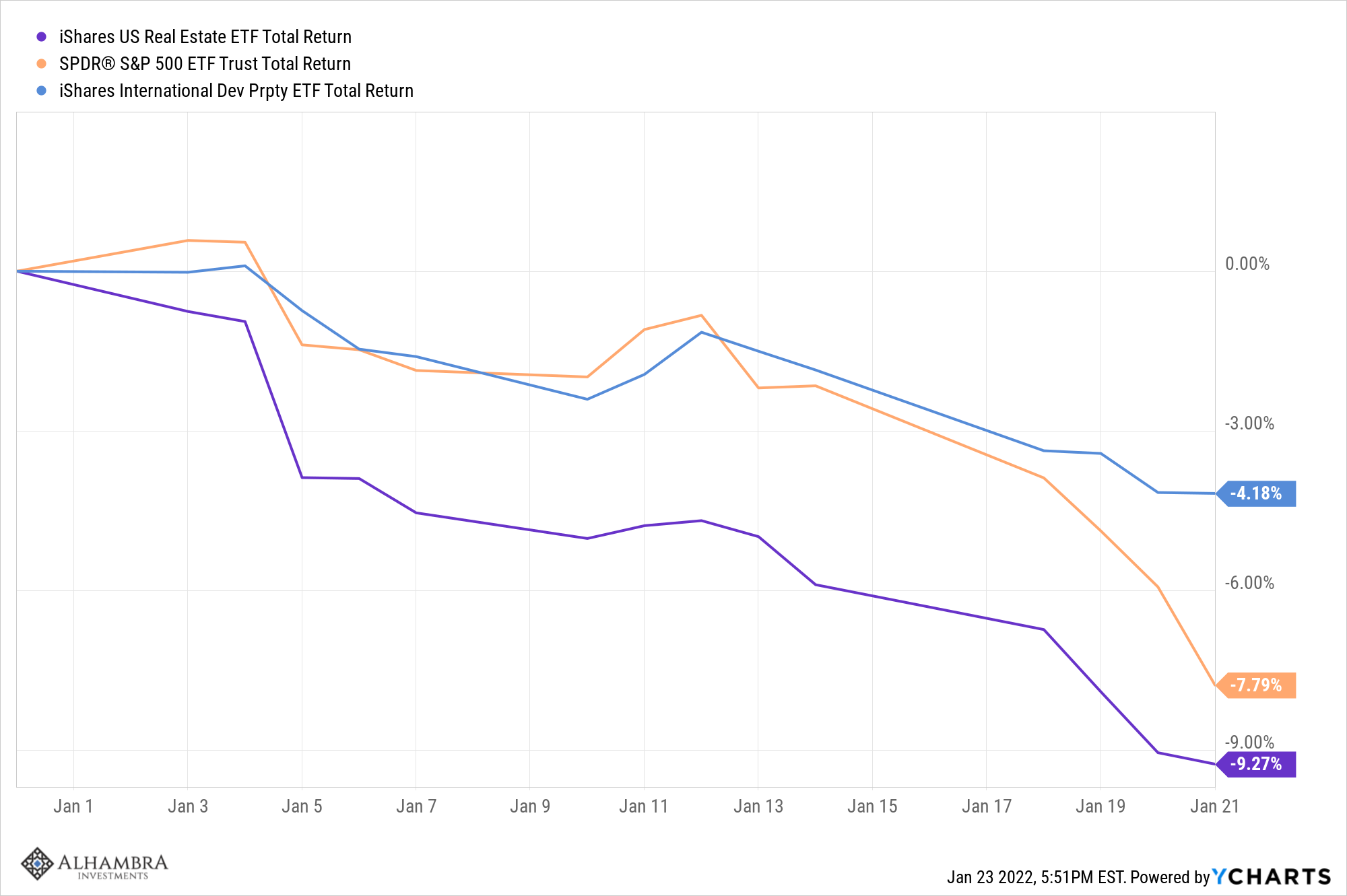

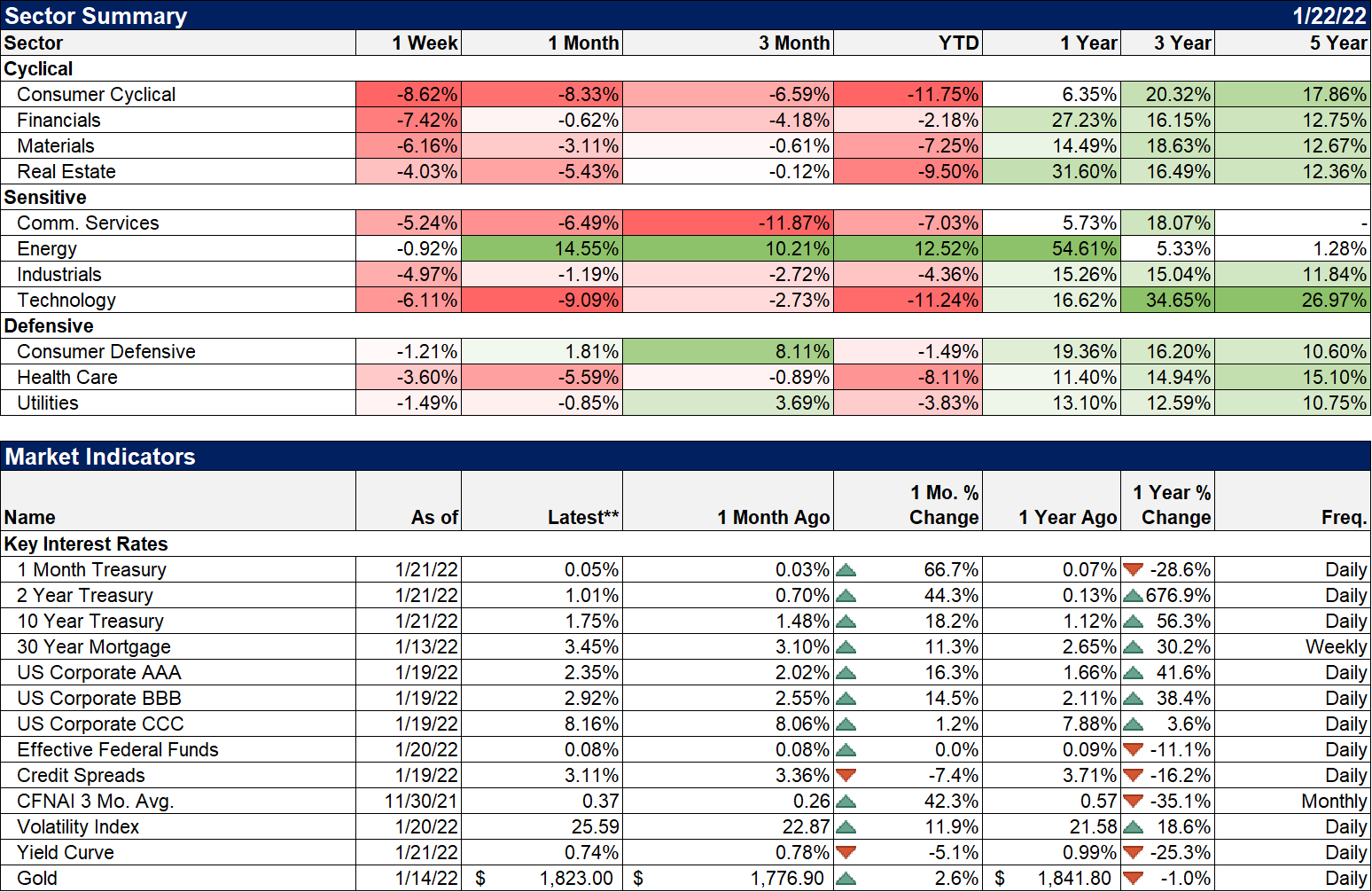

Another indication that fear is rising is that the VIX futures curve did invert briefly last week with front month futures trading higher than three months out. But it didn’t last through the big options expiration on Friday so, again, things are not at an extreme. For diversified investors, the correction hasn’t caused too much harm yet. REITs are underperforming the S&P 500 YTD but still holds a better than 10% advantage year over year. And for those who diversified outside the US, foreign real estate is outperforming: Note: Alhambra and/or its clients own IYR and WPS. Commodities have also lessened the blow from the stock side of the portfolio with the indexes higher year to date. While crude oil has gotten most of the attention, the rally is actually across multiple commodities from corn to platinum to copper. |

|

| Note: Alhambra and/or its clients own DJP, GSP, PDBC as well as some commodity related mutual funds.

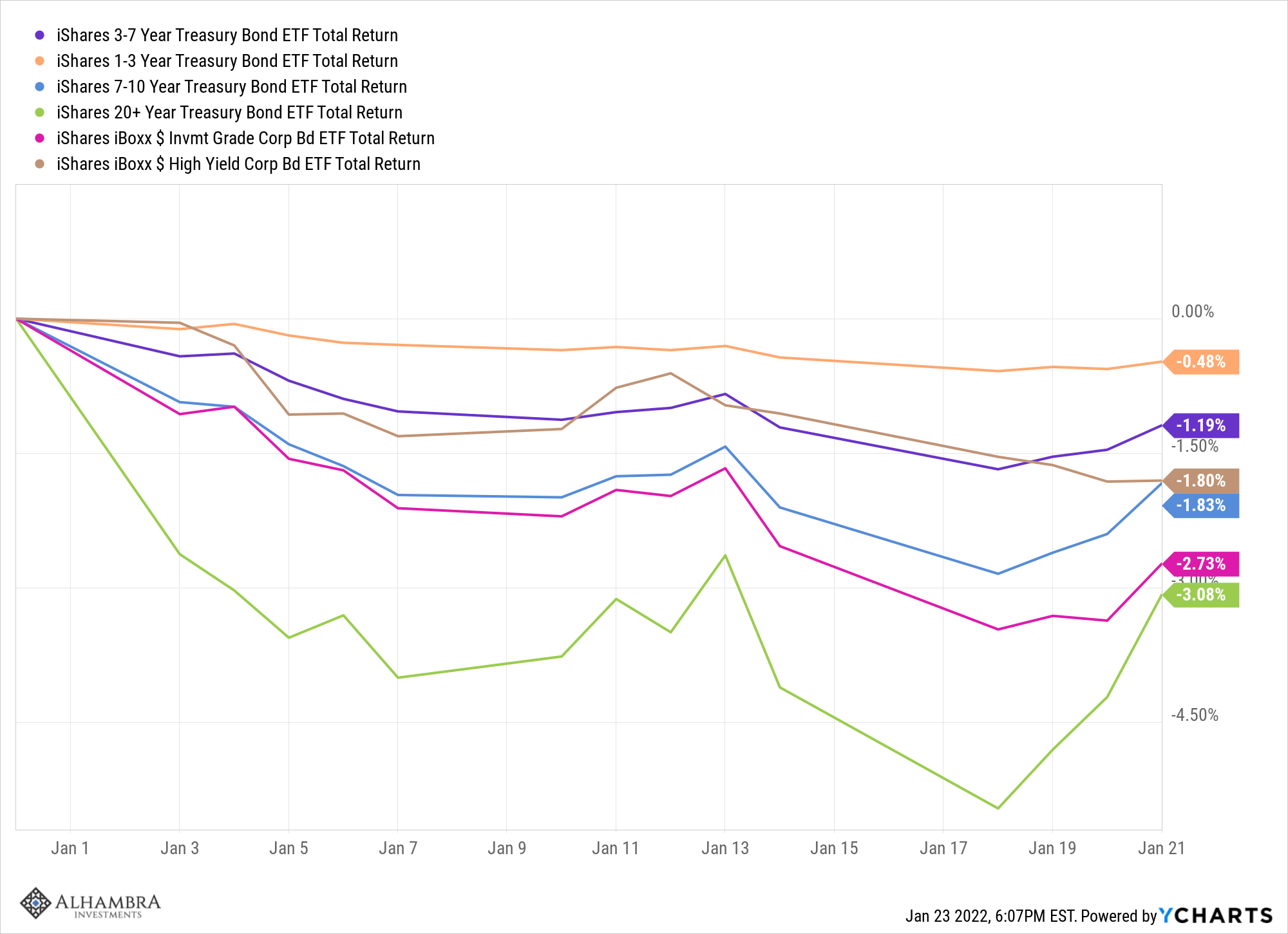

Gold is one commodity that isn’t up on the year and it has lagged the general commodity index badly over the last year. That is exactly what we expect in a rising rate environment and why we’ve been underweight vs our strategic target. Note: Alhambra and/or its clients own IAU and GLD. Bonds also haven’t been any help in our portfolios although we’ve kept duration shorter than our strategic allocation in a rising rate environment. Interest rates are in an uptrend (bond prices down) although they did fall back some at the end of last week. From a trading perspective, it appears that bonds are due for some kind of bounce from oversold. If stocks keep selling off that would make this even more likely. But as a long time trader it doesn’t feel like a big opportunity right now so I’d probably start with a small position and more limited duration (say IEF over TLT). (If you are so inclined; we don’t give advice here and you shouldn’t take trading/investment advice from a blog in any case. We do offer free portfolio reviews; click here ) |

|

| Note: Alhambra may have positions in all these bond ETFs.

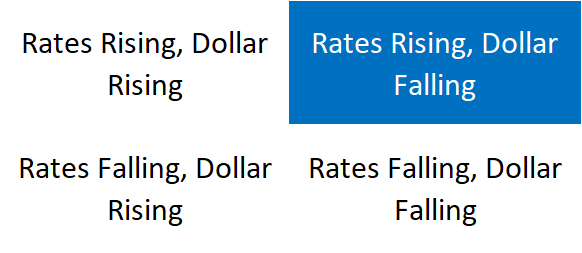

It is this rise in rates since the beginning of the year that is at the crux of this selloff in my opinion. It appears to be fear that the Fed will do too much, repeat their mistake of the last hiking cycle, but I think it is way too early to make that kind of call. The fear seems to be that the Fed is hiking into a slowing economy and will kill the recovery. Personally, I think that implies way more power than the Fed actually has but what I think doesn’t really matter much. It is the perception of the majority that matters in markets and their fear is obvious. A highly valued market just means the downside is greater than it would be from a lower level. Our investment process monitors various market and other indicators as an early warning for recession. We depend on Jeff Snider for more nuanced information but big changes to the portfolio are only triggered when our indicators are flashing recession. We don’t have any of those at present. Credit spreads are near their lows so credit markets don’t show any stress yet. The yield curve is flattening but still positively sloped. The dollar is in a mild, short term downtrend. The weekly economic index is weakening but still positive. Having said that, this market is quite a bit different than anything I’ve ever seen. The extent of the rally since the spring 2020 bottom has been stunning and merely returning to a more normal trend would require quite a bit more selloff than we’ve had so far. It may be that’s where we’re headed but we probably won’t know that until we see the character of the rally when this selling wave is over. If this really is THE top we are likely to see rallies along the way that can be sold. That has been the case in all the bear markets I’ve experienced and this one probably won’t be different. Some of the best short term rallies in the history of the market have come during bear markets. One of the things that gives me pause though is the degree of margin debt prior to this selloff. That combined with a lot of inexperienced investors may make this correction more of a straight line affair. |

|

| The economic environment hasn’t changed with rates rising and the dollar in a short term downtrend.

Asia ex-Japan, Emerging markets and China are the major indexes up so far YTD. The perception seems to be that the EM index is up because of the China bounce but I would point out that the Latin American ETF is actually up quite a bit more (+5.97% YTD). That is mostly Brazil, up 6.6% YTD. By the way, if you are really going to take Warren Buffett’s maxim to heart, China is the place everyone loves to hate and Latin America isn’t far behind after electing several socialists recently. There seems to be widespread fear that Lula will get back in office but I have my doubts about that. And besides, Brazil performed pretty well the last time he was President. (Note: I personally own the Latin American ETF, ILF and our clients own EEM and EMXC.) You can see the outperformance of value in the chart below but outperform doesn’t mean “up” as you can see. |

|

| Value was still down last week across all market caps.

Energy is the only sector up on the year but even the oils couldn’t go up last week. |

So far, this is nothing more than a garden variety correction (and not even that for the S&P 500). Will it get worse? You know I hate trying to predict the future but my guess is yes. The Fed meeting next week could offer some short term relief if they acknowledge the slowdown from the omicron wave. But if that does happen, bonds are probably the better play as a weaker economy isn’t a great reason to be buying stocks. But stocks would probably respond positively as well, at least in the short term. If that does happen don’t forget how you were feeling last week. If this minor bit of selling gave you heartburn you probably need to rethink your asset allocation. If this bothered you wait until we have one of those 2 or 3 year grinding bear markets like we did back at the turn of the century. Do you really want to feel that lousy about your portfolio for that long?

Joe Calhoun

Note: I’m no longer going to post the economic data from the previous week. It’s redundant considering how much we post about the economy on the blog.

Full story here Are you the author? Previous post See more for Next post

Tags: Alhambra Portfolios,Alhambra Research,Bonds,China,commodities,Copper,Crude Oil,currencies,Emerging Markets,Featured,Gold,growth stocks,Interest rates,Latin America,Market Sentiment,Markets,newsletter,Palladium,Real Estate,REITs,S&P 500,stock market,stocks,treasuries,valuations,value stocks,VIX,Volatility