| With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

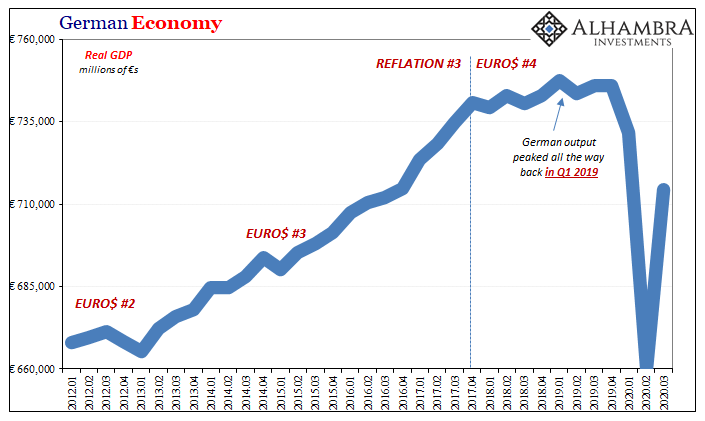

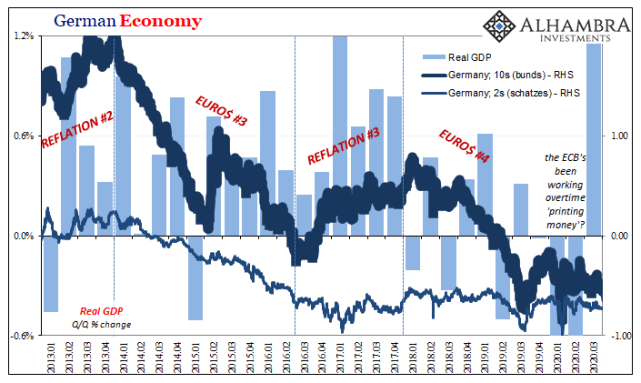

Either way, Europe gets at it first. In 2018, what had been planned to be an auspicious year supposedly delivering the long-awaited worldwide recovery (globally synchronized growth!), that January it had instead started out with Europe already in big trouble – especially Germany, the Continent’s engine for growth. Right away, contraction (with revised GDP estimates showing how the German system plunged right into a minus during those first three crucial months of 2018). The US economy managed to avoid only the timing, not the Europeans’ fate; the fantasy of inflation, acceleration, and rate hikes was turned around by mid-year before being crushed once and for all after October 2018 (global Euro$ landmine). The following year, last year, was much more synchronized. There would be no decoupling, as some attempted to claim, since the eurodollar makes sure every time – that’s what does the synchronizing in each direction (the mainstream only pays attention to this during reflation). The only variations by geography are “when” and “just how bad.” Thus, the COVID-recession in Europe somehow preceded COVID by a good long while. In some places like Germany, the contraction had begun an entire year beforehand (real GDP topped out there in Q1 2019). A compelling argument in favor of an unbroken Euro$ #4. And if there’s not yet a Reflation #4, what do we make of Q3 2020? |

German Economy, 2012-2020 |

| Recent GDP growth rates are making it sound better than it is. Just like in the US, the Europeans reported their initial Q3 estimates last week, too, and they were outwardly equally as enthusiastic. And that enthusiasm was equally artificial as well as equally underwhelming and overtaken in context.

By the numbers: real GDP in Germany declined by a massive -33.8% (Q/Q) annual rate in Q2, yet bounced back by a gigantic +37.2% in Q3. Yet, the net result both down then up is that German output (as estimated by real GDP) remained lower by 4.2% from Q3 2019, while off 4.4% from the (eurodollar) cycle peak registered six quarters, a year and a half ago all the way back during the first three months of last year. |

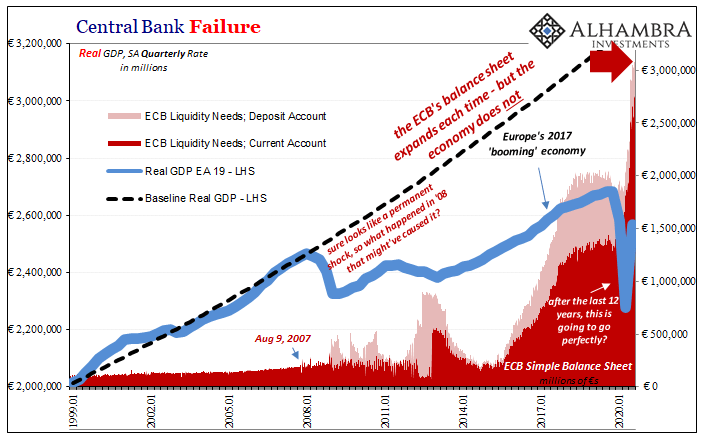

European Economy, 2004-2020 |

| And while 4.4% doesn’t sound like much, not compared to those thirties being thrown around, that’s an enormously painful gap. It’s one shared all over Europe, pretty much like a Great “Recession” Part 2: |

Central Bank Failure, 1999-2020 |

|

Fret not, says Christine! Like Jay Powell at the Federal Reserve, Christine Lagarde over at the ECB has “printed” so much “money” it’s downright biblical this “flood” of bank reserves. In just the central bank’s two main accounts, the deposit and current, the cumulative total now reaches above €3 trillion where once several hundred billion had been standard practice. And also like her American counterpart, Ms. Lagarde is more and more flummoxed by the lack of anything resembling inflationary pressures. She shouldn’t be confused; Europe, as anywhere else in the world where QE and its like have been tried, has seen this very disconnect time and again. |

|

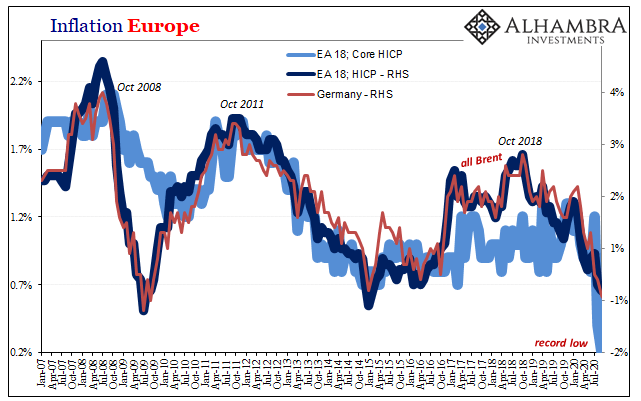

| If money printing always leads to inflation, and it does, yet there is no inflation… |

Inflation Europe, 2007-2020 |

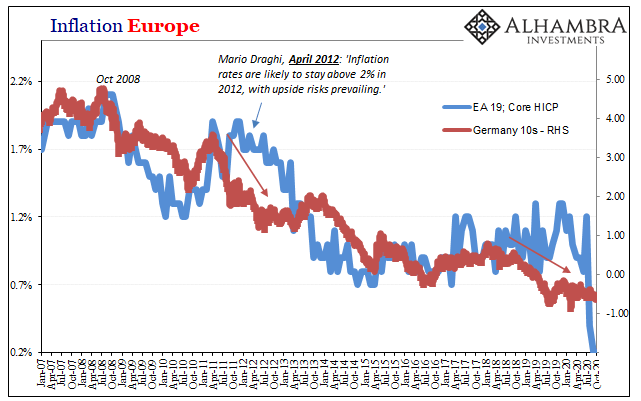

Inflation Europe, 2007-2020 |

|

| Given this very different reality, it makes 2020 heading into 2021 in reality much less assured. So much for that monetary guarantee.

The ECB’s balance sheet expands/explodes each and every time monetary and financial trouble (like that seen “somehow” globally during March 2020) shows up, but that’s the sum total of the monetary policy contribution: a visible increase in central bank accounts without, curiously, an increase in either rates of economic growth or consumer prices. These three things really should go together, but there’s only ever the first one (central bank reserves), the one we don’t really need. From this, we can picture a European bond market that, also like its American counterpart, isn’t overly thrilled by Christine nor Jay’s constant antics. |

Inflation Europe, 2007-2020 |

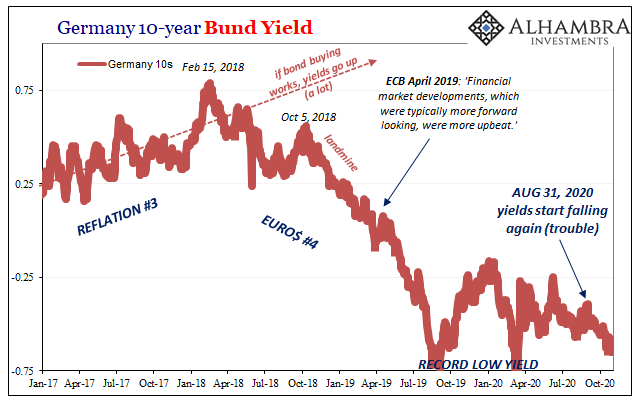

| QE’s never lead to growth nor inflation, so why would sovereign bond markets price both growth and inflation via higher and higher yields?

They wouldn’t; and so they haven’t. The interest rate fallacy bears out across all these dimensions: geography, GDP, HICP, and lower and lower rates worldwide. Tight money, the only consistency here no matter what level of trillions whichever central bank loads up on its balance sheet for public consumption (fairy tale). The BOND ROUT!!!! is written in stone by the financial media on both sides of the Atlantic without regard to such decades of experimentally-validated results. Why? They just aren’t the results a competent technocracy would produce. When cheerleading, blame the results, I guess, rather than the destructive failures of the technocracy. |

German Economy, 2013-2020 |

Germany 10-year Bund Yield, 2017-2020 |

|

| More to the recent point: German yields have been sinking (again) since around – stop me if you’ve seen this before – the end of August. It seems near every chart (save one, and I’ll get to that later) experiences/demonstrates the severe importance of around August 27.

Gigantic numbers in Q3, but no inflation, no BOND ROUT!!! and only, from an American perspective, the hope that the US economy can decouple and keep going while German-led Europe maybe halts its upturn way, way too soon. What all these things are suggesting is the same thing we’ve already examined in the American data. There was a bunch of artificial contributions during Q3 which aren’t being, and aren’t expected to be, much more or last too much longer than that. The underlying shape of the private economy is highly impaired. |

US Stocks & German Bunds, 2020 |

Thus, there’s not much reaction to huge GDP anywhere. What follows it? Europe’s looking dark again, so what might that mean about what the US economy is able to do over the next few quarters? Decouple would be nice, but, again, it never happens.

This is why the “V” narrative has so dramatically changed. Despite real GDP figures in Europe as well as America that far outperformed even the most optimistic hopes, and in raw numerical form (Q/Q rates) can make it seem like everything’s back to even, it’s simply not the case nor is Q3 the final end to the ugly affair.

Is the world done with globally synchronized Euro$ #4?

With bunds rising steadily in price since August along with relatively sideways to higher dollar against the euro and almost everything else (and lower inflation expectations across-the-board; oil prices, too, despite huge global production cuts), Q3’s already, while the US Presidential election is about to be, in the past. It’s the future what (still) worries everyone.

Full story here Are you the author? Previous post See more for Next postTags: bank reserves,bond yields,Bonds,Bunds,Christine Lagarde,CPI,currencies,ECB,economy,Europe,Featured,Federal Reserve/Monetary Policy,Germany,hicp,inflation,interest rate fallacy,Interest rates,Markets,money printing,newsletter,real GDP,stocks