| The payroll report for the month of October 2020 was a very good one. This shouldn’t be surprising, perfect BLS publications appear with regularity even during the most challenging of circumstances. Headlines and underneath, everything looked fine last month.

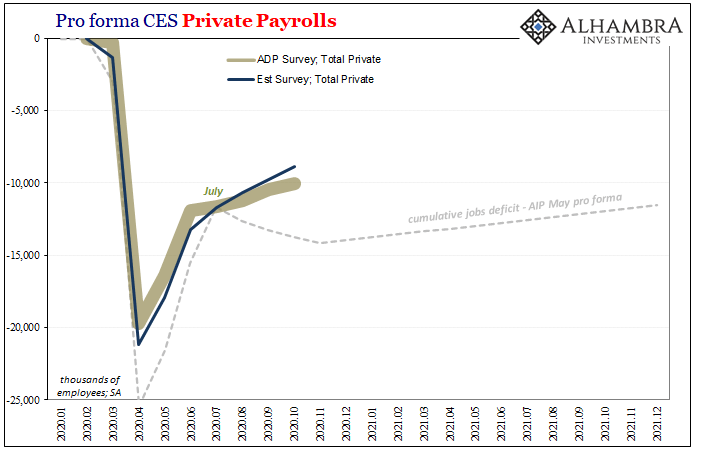

It wasn’t perfect, however, and it’s the same things that leave it short of perfection which are entirely too familiar for this last decade of the occasional perfect payroll publication. Meaning, yes, highlighting the unemployment rate. Usually, it’s the Establishment Survey which shines when the BLS puts out the good ones. That used to mean somewhere around +250k payrolls, an occasional +300k, which only seemed awesome by comparison to an economy normalized to far too little economic progress. “At least it wasn’t worse” isn’t the same thing as organic growth. This one for October was +638k. That’s the first part which wasn’t perfect. It was good in that it was better than what other data had suggested happened last month. The Private payrolls within that Establishment Survey figure had gained more, rising a little better than 900k (compared to +365k ADP). Out of context, these seem huge. Given what’s happened in 2020, they actually do indicate the same thing that the ADP series already has – as well as jobless claims: |

Pro forma CES Private Payrolls, 2020-2021 |

| The rebound has slowed, and is still slowing through October, though given the two estimates above it’s not clear by just how much. Because that’s the only difference, and it extends to the full Establishment Survey, the post-June slump is further corroborated by what’s otherwise a good month.

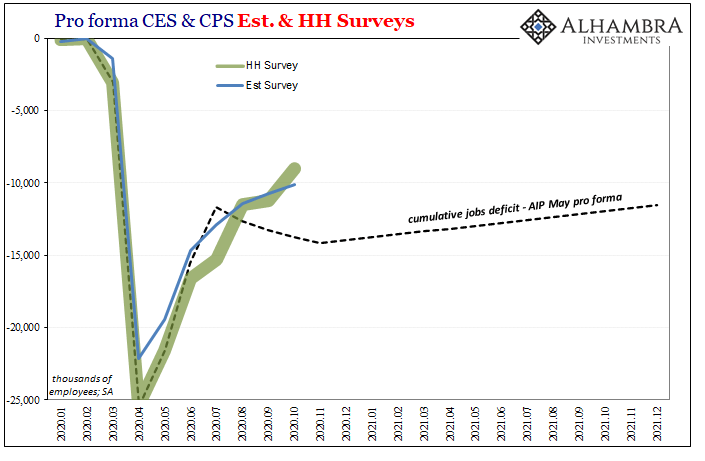

Most of the positive juice from it relies on the Household Survey, the one which gives us the unemployment rate. Here the number of employees jumped by 2.2 million after having barely budged in September. Always volatile, even the HH number represents a slowdown from the early reopening phase; if you use a rolling 2-month average, that average over the last five months has trended: +4.4mm (June); +3.1mm; +2.6mm; +2.0mm; and, +1.3mm (October). Not quite perfect, still good. |

|

| The underlying which deducts so much from perfect is the other part of the unemployment rate ratio. Once more, the familiar divergence between the top and the bottom; or, between the one labor pool (getting out from under non-economic shutdown) and the other (sunk by the economic damage).

After indicating yesterday that the non-economic euphoria of reopening had faded sufficiently so as to better expose the longer run economic damage in the background, the BLS estimates bely that notion if only slightly. Yes, HH Survey jumped but as has become typical since October 2008 the unemployment rate drops faster due to the overall size of the labor force which hasn’t. |

|

| Rather, the labor force has clearly stalled out.

Even in 2020, shades of the same frustrating participation problem. Way less than perfect, these two again at odds: |

|

| So is marked the boundaries for what’s shaping up to be this extended rebound slowdown. At the upper limit is the unemployment rate, as always, indicating alone there maybe hasn’t been one. But we know from too much experience the false signals this sends; even the Federal Reserve after relying near exclusively on the unemployment rate as the one mainline economic datapoint in its favor has finally been forced (not voluntarily, mind you) to come to terms with what can only be the inaccuracy of the ratio.

Therefore, what’s left is what we’ve been saying, leaving for us just these relatively small differences in gradation. |

Pro forma CES Private Payrolls, 2020-2021 |

| The economy’s reopening rebound has been and probably still is decelerating. Given the somewhat varied degree of it across all these numbers, we just don’t know for sure by how much.

It’s enough, though, that markets are trading sideways rather than presumed reflation. Doubts that can only persist by a more honest read of the labor market. The good payroll numbers are good in the sense that it wasn’t worse. At the other end of the spectrum, jobless claims and labor participation, these hint instead at an economy closer to stalling out. |

Pro forma CES Private Payrolls, 2020-2021 |

| Even the differences between ADP’s estimates for private employment and the BLS’s aren’t really much different at all.

As the man once said, déjà vu all over again. A really good payroll report amplified by the fast falling unemployment rate which suggests one thing, while everything else falls in line with quite another.

|

CPS Household Survey, 1995-2020 |

| Thus, in Friedman’s terms, if inflation is a function of conditions in the actual monetary system, and the true monetary system is not the same thing as monetary policy, then mistaking monetary policy for monetary conditions will end up making central bankers chase their own tail round and round and round.

For all those bond shorts piled up in the UST futures market, the words you’re missing are “slack” and “shadow”; the same which have been missing from all those constant predictions of rising inflation. The quickness of the unemployment rate, like the same from 2014 to 2019, has been deemed the fool’s gold it always was even as it seemed to corroborate the mainstream view that inflation, therefore economic recovery and acceleration, was always just around the corner. It wasn’t. Is something (meaningfully) different this time with the sixth QE? With the unemployment rate and rest of the labor numbers diverging for exactly the same reasons? Everything else, including the occasional good to perfect payroll reports, argued steadfastly against this. October 2020’s does, too. The labor force most of all; it really may not be so easy to put everything back together once it gets broken. This was the lesson which should have been learned after the first time we went through something like this. If the inflation scenario has any chance whatsoever, it will have to be the first time the unemployment rate’s been useful since before the Great “Recession.” That’s the only one now indicating close to a sufficiently quick turnaround. Outside of that, the good payroll numbers only manage to further evidence the one thing inflation, like the economy, really didn’t need this summer. It’s a slowdown for sure. And that’s not good. |

CPS Household Survey, 2003-2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: currencies,economy,employment,establishment survey,Featured,Federal Reserve/Monetary Policy,household survey,jobs,Labor Market,Markets,newsletter,payrolls,QE,unemployment rate