| The price of silver has just spiked up about $2.00—that’s about 10%.

All the usual suspects have been calling for silver to skyrocket. With some amusement, we have been watching ads from a guy known for savvy junior mining stock investments, who has been calling for gold to go up for a while. And recently, silver. Anyways, the silver trend is obvious. Coming after a long bear market, with many bull traps aka short-lived spikes in the price, and now with central banks committing more Acts of Printing than ever before, and with gold already having gone up near its high in USD and breaking out to new highs in many other currencies, a bull market in silver would seem to make sense. The technicals for silver look good, too. Finally, it should be noted that the gold-silver ratio recently made an all-time (as in forever) high well over 120 to 1. This is an all-time low in the price of silver, as measured in gold (the proper way to measure it, really). So it is logical that silver should move up. So what does Monetary Metals have to say? We could say, well, if a stock picker is going to publish macroeconomic calls, then perhaps we publishing our junior mining stock picks? Or, instead of that, we should just show the chart that everyone wants to see. The high-resolution picture of the silver price overlaid with the silver basis. |

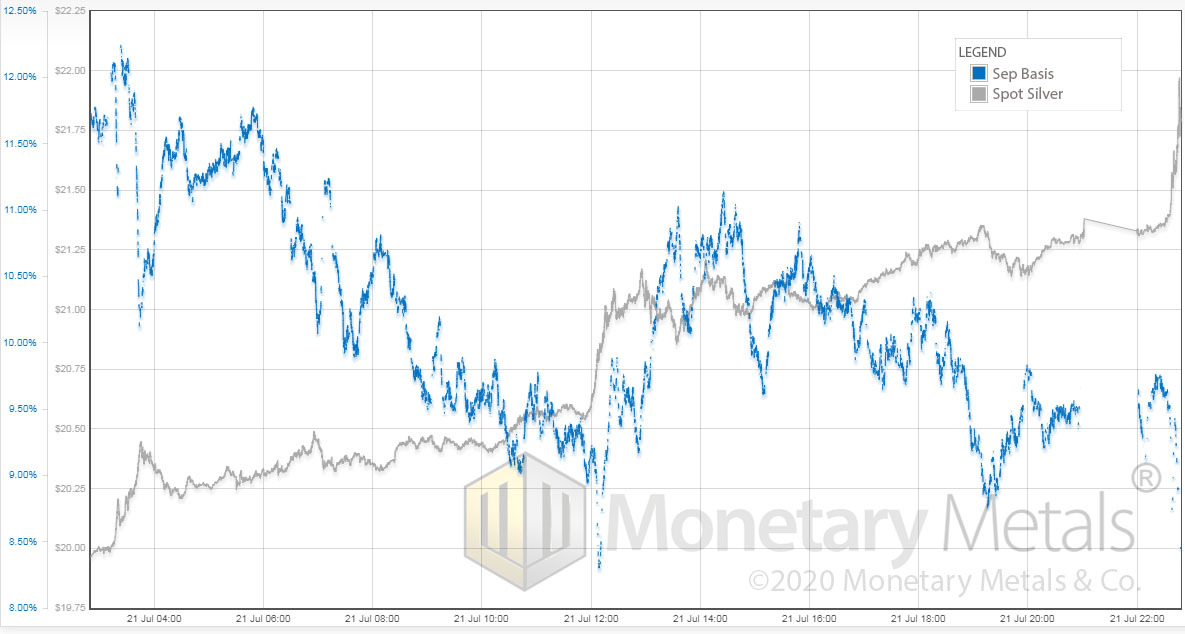

Silver price vs Silver Basis |

This is a rare sighting. Perhaps not as rare as Sasquatch or Nessie. But rare nonetheless.

We refer to a day with rising price and falling basis. That means as the price increased, the basis decreased. As silver went from $20 to $22, the basis went from 11.6% to 8.5%.

Basis = Future(bid) – Spot(ask)

Leaving aside all of our fancy theory as to why this indicates falling abundance—that is, there was less silver metal available to the market at the end of the day at $22 than there was at the start of the day at $20—this action shows something simpler and obviouser.

The price of spot moved up closer to the price of the futures contract (the futures price is still quite a bit higher than the spot price). This tells us that the buying which drove the price up so much was…

…buying of physical metal.

It is worth mentioning that, with the market makers still notable by their absence, the basis is very high and the move down was very big. This does not alter the above conclusion, that the buying was buying of physical metal. It just means that the absolute numbers of basis and change in basis should not be taken to mean the same thing as they would if they had occurred a few years ago.

This is a pretty good signal that a bull market may be returning to silver. Let’s watch the basis and price action closely and see how it develops, before we join the pack by taking a straight edge to a price chart starting at March and drawing a line up and to the right, to pick a price target.

Nomination for the Board of Governors of the Federal Reserve

We read the news today that Judy Shelton has been approved by the Senate Banking Committee. This means that the full Senate can vote whether or not to approve her.

She is not liked in many quarters in Washington. Unlike President Trump’s pick for the other vacant seat (Christopher Waller), the vote on Dr. Shelton fell along strict party lines.

The reason for the antipathy is that she has promoted heretical ideas, dangerous ideas. Ideas about gold, and about a gold-backed Treasury bond. She has said that the US should return to a gold standard (though, alas, she has more recently called for the Fed to cut interest rates).

Given the entire theory developed by Keith Weiner, and our very raison d’etre, we feel we should comment on the prospect of Shelton joining the Fed. We should also disclose that Keith knows Judy, and has discussed gold bonds with her.

The Friedmanites and Keynesians who populate the Fed have the same stale, old ideas. We have remarked many times that their only debate is whether to centrally plan our economy based on discretion or whether to centrally plan our economy based on rules. And within the latter camp, the choice of rules is limited to targeting one or more of: inflation, unemployment, GDP, and the quantity of dollars.

Our opinion is that Dr. Shelton has some new and better ideas.

We make no prediction as to the politics she may encounter at the Fed. But there is a more fundamental problem. The Fed is a central planning agency. Its nature cannot be changed. And there is no good way to do central planning. There is no such thing as a good central plan.

We will not join the chorus cheering for her appointment. This is not because we don’t like her. If a person with a reputation for good ideas joins an organization with a reputation for central planning, it is the latter reputation that will survive.

Some might criticize us, and demand if we don’t care to minimize the harm inflicted by the Fed. Isn’t it better to have good people at the Fed, than bad?

To which we reply: we trust the Fed well enough to keep working towards its true purpose. Forget GDP and inflation and unemployment. The job of the central bank is to enable the government and its cronies to borrow more, more cheaply. And this includes keeping them solvent. We trust the Fed will do what it needs to do to the quantity of dollars and the interest rate. And to buy whatever securities it needs to buy, to stave off the insolvency of any financial intermediary it cares about.

In other words, it will keep the capital-consuming machine going as long as it can, heedless of the consumption of capital. This will hold true with or without Dr. Shelton.

We wish her the best, but this does not alter our view of the Fed one iota. Or our mission to revive the gold standard, by paying interest on gold and silver to everyone.

© 2020 Monetary Metals

Full story here Are you the author? Previous post See more for Next postTags: Basic Reports,Featured,inflation,newsletter,silver