|

After raising the specter of a rebound stall, the idea before limited to Japan and Germany was abruptly given further weight today by US jobless claims numbers. For the first time since the peak at the end of March, the weekly tally of initial filings increased from the prior week. The estimate for the week of July 18, 2020, came in at 1.41 million, more than the revised estimate of 1.31 million the week of July 11. |

Global PMIs & Sentiment, 2017-2020 |

| Second derivatives matter, of course, and a potential durable change in it for this particular statistic isn’t being taken lightly. Reopening was supposed to lead to an unfettered rebound, the “V” which can’t be a “V” unless it takes the smallest amount of time to get where it’s going (better than even, in the best case).

The claims figures actually suggest a turnaround toward the wrong direction that may actually be in its second week; the improvement in the week of July 11 was minimal from the week of July 4 (seasonally-adjusted). Therefore, growing prospects of a US economic stall to add to the list of evidence for one globally. Synchronized still, it would seem (which doesn’t argue for COVID as the direct cause). |

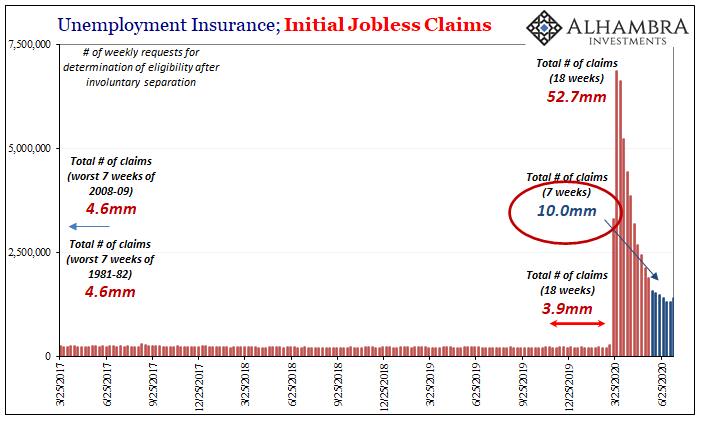

Unemployment Insurance, Initial Jobless Claims, 2017-2020 |

| But it’s not the turnaround that should be your primary concern. It is concerning, no doubt, but more so where, at what nominal level this stalling out seems to be taking place. At around 1.4 million, OH SH%&.

We’d be alarmed enough if this had happened at a lower claims “altitude”, if, fulfilling the promise of an actual “V”, initial jobless claims had dropped down to something more like a normal week; anywhere close to a normal week. Even having fallen below the same level of prior records, that would’ve been one thing. But what we’re seeing here is totally unprecedented. |

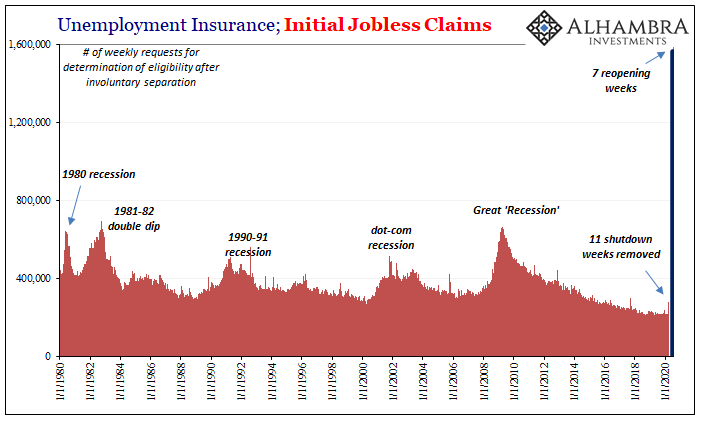

Unemployment Insurance, Initial Jobless Claims, 1980-2020 |

If the economy got caught up in a second wave of whatever after having closed in on a normalized labor market then there’d be some realistic scenarios where the further economic processes might not have worked out so badly (though still slim possibilities) At this level, though, to add more labor market destruction on top of what had continued to be historically immense?

I think what we’re seeing here is more recession, economic factors; though it could definitely be shutdowns, non-economic factors; or both. Why I think it’s the first one is the background behind what’s been going on. In other words, because the economy was weak to begin with, Euro$ #4 and a globally synchronized downturn before all these other things got started, businesses were already sapped and tapped out to a significant degree.

Things were already stretched, limiting the amount of cushion therefore the amount of time to be able to withstand the worst elements.

These marginal businesses might’ve been able to hang on for a few more months even after what happened in March. But they’d have done so with the promise of time, meaning getting things at least realistically moving closer to normal in weeks rather than months (let alone, realistically, years).

But as this economic destruction drags on, at some point those stuck in this sort of economic limbo are going to have no choice but to start throwing in the towel and kicking off the self-reinforcing stuff of more purely economic recession.

And it’s not just small mom and pop bars and restaurants clinging by the thinnest threads to “V”-shaped hopes. Earlier this month, for example, United Airlines issued a statement to its staff announcing as many as 36,000 layoffs yet to come:

The reality is that United simply cannot continue at our current payroll level past October 1 in an environment where travel demand is so depressed. And involuntary furloughs come as a last resort, after months of company-wide cost-cutting and capital-raising.

An extreme example, sure, but not on a different spectrum from so many others in its own industry as well as those other industries all over the economy. Cash preservation, cutting costs, the only priorities end up being bare minimal survival.

This, I think, pretty well sums up both the frightening elevation of jobless claims as well as the prospects for their upward turn in the wrong direction. This thing isn’t done, another shoe, the larger of the pair, still dangling like the Sword of Damocles over every last corner of the global economy still waiting to be dropped.

Full story here Are you the author? Previous post See more for Next postTags: currencies,economy,Featured,Federal Reserve/Monetary Policy,Initial Jobless Claims,jobless claims,Markets,newsletter,Unemployment