What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

My very first day on the job, as an intern my first boss told me to prepare myself. I was embarking on a career in the most absurd industry humanity had ever conceived. It didn’t take me very long to see that he was right.

What made it absurd, and makes it still today along with everything it touches, is that same lack of interest in the basics behind all the “miracles.” Adam Smith said the capitalist economy’s invisible hand was a magical wonder strong enough to withstand lack of scrutiny over the details in between; and he was right.

This, however, is something different. The Greenspan put is to Adam Smith as astrology is to Karl Popper.

It was the monolithic belief in the modern central bank which forestalled any investigation of the deeper layers behind the façade. Alan Greenspan’s Fed would move a single money rate, one out of many, around a quarter point here or there and then…

Magic happened. Or it was purported to have happened because everyone said so. Don’t ask questions, kid, stocks always go up. And if they don’t the maestro will be there.

It was a compelling fairy tale for 1994. How any of it survived past 2008 is another miracle. The central bank was so effective that it kept a 60% market decline from being 70%? Sure, millions upon millions of workers all over the world were thrown out of work because of a radical dollar shortage globally, but losses on subprime mortgages were kept to the hundreds of millions!

The Federal Reserve is no central bank and certainly not a dollar one. Most if not all central banks aren’t that, either, they are, at best, bank authorities. There’s a difference. A big one.

Most people don’t know what it is, thus the Greenspan put survives in all its various forms. Wim Duisenberg had happened to be the president of the European Monetary Institute when it was converted into the European Central Bank, so even if there was an otherwise reason I doubt there’d have been a Wim “put” in Europe anyway.

And he was followed by Jean-Claude Trichet, the Frenchmen who put the Greenspan in disaster. While American central bankers under Ben Bernanke were cautiously celebrating their self-adjudicated success in the immediate aftermath of Bear Stearns in March 2008, Trichet was at the same time raising rates in Europe to head off the October 2008 boom.

Only, it ended up being the wrong sort of boom than Jean-Claude’s models had been predicting.

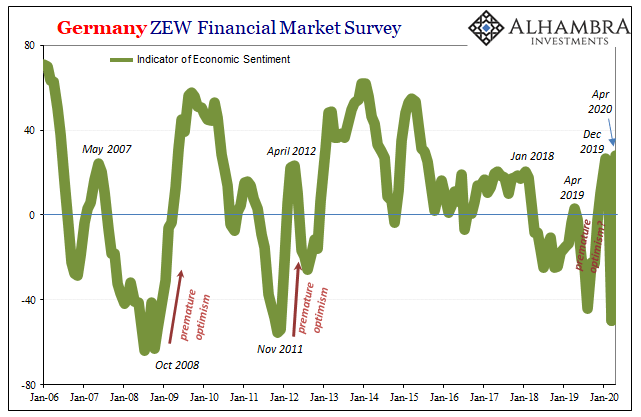

And yet, despite bungling so bad, when the chips were down most Europeans clung to Europe’s central bank as some sort of realistic lifeline. In October 2008, for example, Germany’s ZEW survey showed tremendous pessimism as even stock markets melted down worldwide.

Beginning in November, however, a surge in optimism. At -63 on October 14, 2008, just as the stock rout was ending, in four months it was nearly back at zero again. And it didn’t matter that there’d end up being another wave of global liquidations leading to another wave of bank nationalizations across the Continent. Those Germans were increasingly optimistic about Europe as well as Germany.

|

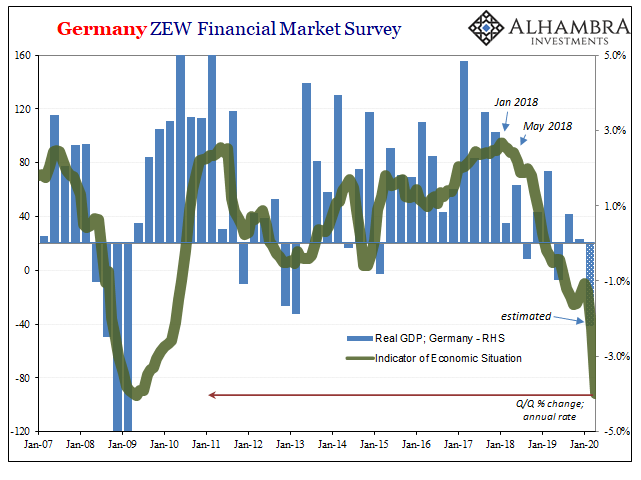

All because a “somehow” Global Financial Crisis finally sprung the monetary wizards from their slumber. It stood in stark contrast to the ZEW’s other surveyed component, the current situation. While the panel respondents were growing happy about how hyper-active central banks were sure to guide the economy into a fruitful future in very short order, the economic reality on the ground was very different. In October 2008, the ZEW Situation index was -35.9, down from -1 in September. And it would only get worse from there. While sentiment picked up, the situation completely deteriorated, captured by this other number falling to -92.8 by May 2009 (below). The millions of unemployed Germans and Europeans laid off in between standing in stark opposite to the optimism about monetary “stimulus.” Then there was the “small” matter of no recovery afterward, which in Europe featured first Jean-Claude Trichet raising rates again in 2011 followed closely by yet another “unforeseen” nasty recession in 2012. |

Germany ZEW Financial Market Survey, 2006-2020 |

| The ZEW? Same damn thing; optimism in sentiment sparked late in 2011 as Mario Draghi was brought in to unleash a “flood” of “liquidity” in the form LTRO’s and a hyper-active OMP program, neither of which did anything to arrest or shorten the devastating second European economic contraction.

What made this business of financial services so absurd is the same thing that makes ZEW respondents so sentimentally crazy; the unexamined belief in monetary “stimulus.” Pavlov could only have dreamed of such an effectively conditioned response. Which brings us to April 2020. You probably can guess what happened already. The ZEW released its report for the current month today, a month which now features negative oil prices along with collapsed curves and continuing financial “irregularities” all over the world. Four weeks into extreme monetary “stimulus” and nothing yet stimulated…except the ZEW sentiment index. Having dropped as low as -44.1 in August 2019 during the inverted curve “scare”, restarted QE in Europe in September pushed German sentiment upward all the way to +26.7 by last December – even as the European economy pushed to brink of recession already. |

Germany ZEW Financial Market Survey, 2007-2020 |

| Shoved over it in 2020, sentiment fell at first and then plummeted with everything else in March. From -49.7 last month, not much improvement was expected for April. Instead, the ZEW reports +28.2, an increase of 78 points in a single month, the same month when use of the word depression finally receives little pushback.

At the same time, of course, the ZEW situation index crashed to just about even to the lowest point of the Great “Recession.” From -9.5 in January, -15.7 in February, you nodded along in agreement with March’s -43.1 and today have no qualms with the -91.5 for April, a little over a point off the prior low registered in May 2009. That track seems entirely reasonable given, oh, everything else. One big reason why is how Europeans have seen this all before, just like we have in America. Yet, there are those, even some of the same people, who fall for the puppet show every time; it doesn’t matter what a central bank does, so many people don’t want to know the specifics because at times like these it’s comforting to be wrapped up in a fairy tale. There are those who will claim the jump in sentiment is simply the expected “V” shape forming, the other side of a short-term, non-economic disruption aided massively by hyperactive central banking. |

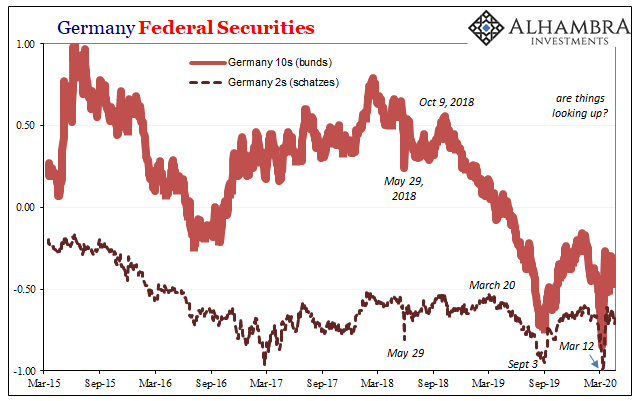

Germany Federal Securities, 2015-2020 |

| Perhaps, but on what reasonable basis should we realistically believe in such an outcome? History as well as common sense dictates heavy caution when it comes to the monetary puppet show as well as the uninquisitive spectators who line up time and again to watch it and report back on how awesome it was.

Never very effective about accomplishing anything of substance, but it makes many feel warm and fuzzy as the system disintegrates around them. The greatest trick central bankers ever pulled off was in making the world believe they all work at a central bank. Even today, with all that’s happened in the last dozen years, reinforced last month, that’s the convention. If only it was just financial services that would be humanity’s primary example of the absurd. |

. |

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,currencies,ECB,economy,EuroDollar,Europe,Federal Reserve/Monetary Policy,Germany,global dollar shortage,Mario Draghi,Markets,Monetary Policy,newsletter,QE,sentiment,stimulus,ZEW