|

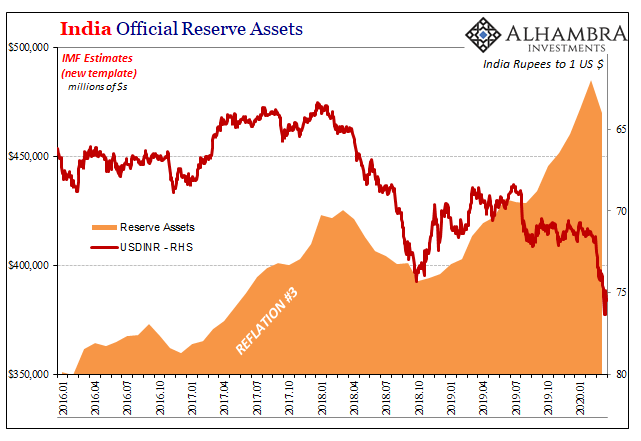

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark. Over the last several crisis-filled weeks, officials in India have been fighting against a “sudden” and shocking plummet in the rupee. The other side of that is, of course, the rising dollar which, contrary to convention, is an indication of severe global monetary strain. |

India Official Reserve Assets, 2016-2020 |

| QE’s matter less in the offshore shadows than they do in truth on the NYSE.

Trying to rescue the rupee before it did any further damage to the Indian economy already being rocked by the government’s COVID-19 response, RBI has been furiously selling and swapping its stockpile for rupees on the currency market. On March 12, India’s central bank described the situation quite correctly:

|

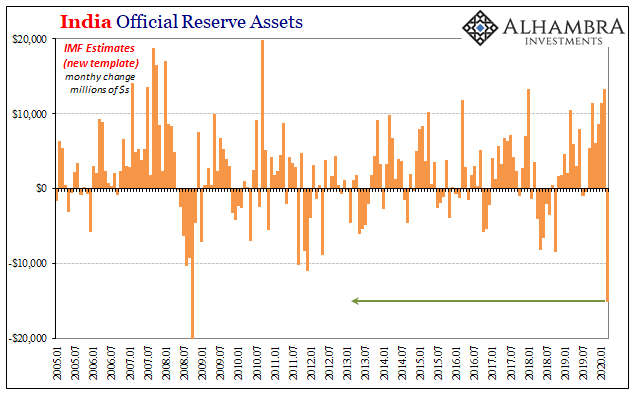

India Official Reserve Assets, 2005-2020 |

To handle the situation, an initial $2 billion was offered to be swapped for a 6-month term. As usual with these kinds of emergency maneuvers, the central bank reassured market participants (on both sides) of its so-called dry powder.

Seventeen billion in reserves later and the rupee is just moving up a tiny bit from a record low. The massive dollar swing in March had absolutely pummeled national systems all over the world – even though the Fed’s dollar swaps were open and active the whole time. Just not with India. Or many other countries. In fact, it wasn’t until March 19 that standing swap agreements between the Federal Reserve and the Bank of Canada, Bank of England, European Central Bank, Bank of Japan, and Swiss National Bank were augmented by temporary (6-month) arrangements with the central banks of Australia, Brazil, Denmark, South Korea, Mexico, New Zealand, Norway, Singapore (monetary authority), and Sweden. |

Federal Reserve: H.10 Foreign Exchange Rates, 2013-2020 |

No India. No China. For everyone else? ¯_(ツ)_/¯.

Not that it would have made much difference. For the first time in more than two decades, Norway’s central bank, Norges Bank, is rumored to have entered the currency market for kroner – the day after the Fed expanded its swap line list to include that particular central bank. Like the rupee, Norway’s currency has rebounded from its pummeling, but why?

Is it because of coordinated central bank activities including those listed here? Or is the recent relative calm the result of the world having watched global eurodollar banks survive and get past the mid-March bottleneck?

While most people are being led to believe it is the former, central bankers always quick to claim credit for the smallest of changes, there are growing concerns even among supranational monetary officials about just this problem. What if there is another wave of accentuated dollar liquidity mismatching lying just over the horizon?

And more like when rather than if.

Late last week, on Thursday, the relatively new managing director for the IMF, Kristalina Georgieva, participated in one of those emergency conference calls among the G-20 world leaders that happen during times like these – when the Fed says it is doing a lot and yet conditions across global markets demand these emergency calls crop up anyway.

Releasing a statement afterward, Georgieva, who took over from Christine Lagarde last year, issued the standard official reassurance.

We have a considerable, $1 trillion strong, financial capacity to place in their defense, working closely with the World Bank and other International Financial Institutions (IFIs).

And then promptly admitted she had asked that the IMF’s emergency lending fund be doubled – to $500 billion. Why?

The day after the G-20 call, last Friday the IMF’s managing director held another one with the fund’s International Monetary and Financial Committee. At this second emergency call Ms. Georgieva confessed:

We have seen an extraordinary spike in requests for IMF emergency financing – some 80 countries have placed requests and more are likely to come. Normally, we never have more than a handful of requests at the same time.

That was just the beginning of the bad news. “Our current estimate for the finance needs of emerging markets is $2.5 trillion – a lower- end estimate for which their own reserves and domestic resources would not be sufficient.”

The world’s dollar problem is expected, by these same officials who time and again get everything wrong, to go nuclear. The combination of the structural short with dislocations in economy and, more impressively, the global monetary system, as we suggested last week, is potentially piling up the world’s dollar shortage into total GFC1 territory. As a lower-end estimate.

And we aren’t even there yet.

Thus, the challenges are more than enormous – starting with the IMF and the whole official response apparatus. To be frank, these people are idiots stuck in 1950’s-era thinking. They have no idea how to contain one marginal problem let alone dozens of them all at once.

Need everyone be reminded of Argentina? When that bailout completely fell apart last year, then-IMF director Christine Lagarde, already in the process of being failed upward to the ECB, came clean from the perfect safety and security of her new gig:

The Argentine economic situation has proved to be incredibly complicated and I dare say that many of those involved, including us, underestimated a bit, when we started with the Argentine authorities building the program.

Underestimated “a bit.” The real skill of any top central banker or monetary official has nothing to do with technical proficiency, rather it’s the political ability to downplay the most obvious of failures. Which is more easily accomplished when they got lost on a long list of so many big ones.

What really happened is the IMF got its clock cleaned by a global dollar system it doesn’t much understand.

And that was just Argentina. Give the fund $2.5 trillion (what it is requesting) borrowing capacity for eighty Argentina’s?

Yeah, that’s going to bring the eurodollar system back online. An exponentially greater call at the global IMF emergency dollar window combined with Jay Powell’s ham-handed handled overseas dollar swaps. I feel so much better already!

The only thing these Economists truly appreciate is what’s at stake. As Kristalina Georgieva told the G-20 reps last Thursday:

How deep the contraction and how fast the recovery depends on the speed of containment of the pandemic and on how strong and coordinated our monetary and fiscal policy actions are. emphasis added

SH$%. You can hear the reaction in India and around the rest of the world from here.

Full story here Are you the author? Previous post See more for Next post

Tags: Argentina,Bonds,Christine Lagarde,currencies,dollar,economy,EuroDollar,Federal Reserve/Monetary Policy,global dollar short,global dollar shortage,IMF,India,Markets,newsletter