|

Auto sales in 2019 ended on a skid. Still, the year as a whole wasn’t nearly as bad as many had feared. Last year got off on the wrong foot in the aftermath of 2018’s landmine, with auto sales like consumer spending down pretty sharply to begin it. Spending did rebound in mid-year if only somewhat, enough, though, to add a little more to the worst-is-behind-us narrative which finished off 2019. That’s the version that is being described, Jay Powell’s underlying labor market strength supporting everything to bring it all back from the brink. What seems to be happening, however, is the sharper slowdown may have been pushed into 2020 instead. A question of timing perhaps more than depth. Looking at it from the perspective of the auto industry, it isn’t following the resurgent economy script. The numbers automakers have been publishing for December, and therefore total year sales, are not the sort that make you think things are getting better. All three of the formerly Big 3 US carmakers reported sharper declines in Q4 than expected (GM -6.3%, FCA -0.2%, Ford -1.3%). It was worse, apparently, for the imports. Much worse. Toyota down 6% in December (year-over-year), Honda -12%, and Nissan -15.9%. Jonathon Smoke, Chief Economist of Cox Automotive, in seeing the figures admitted:

|

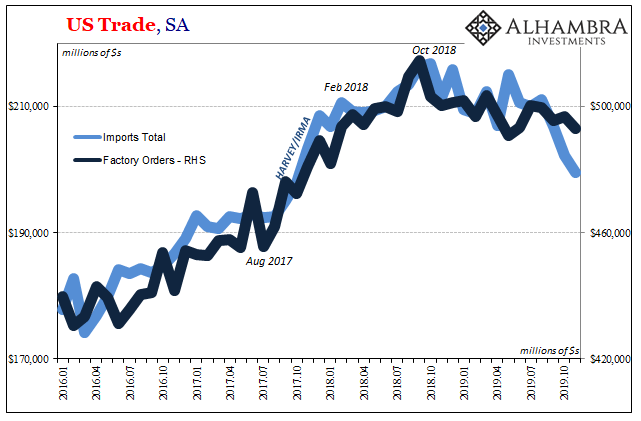

US Trade, SA 2016-2019 |

| Mr. Smoke, and the sales numbers, especially the way they ended the year, are at odds with Jay Powell’s version of a more resilient and buoyant economic condition.

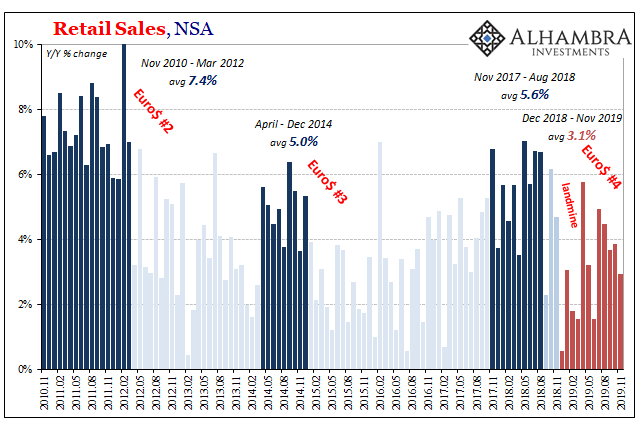

The way car sales are leaning is pretty much consistent with the actual data. If you look elsewhere outside of the unemployment rate and the one payroll report for November, from retail sales to imports to production sentiment things are trending downward – still. |

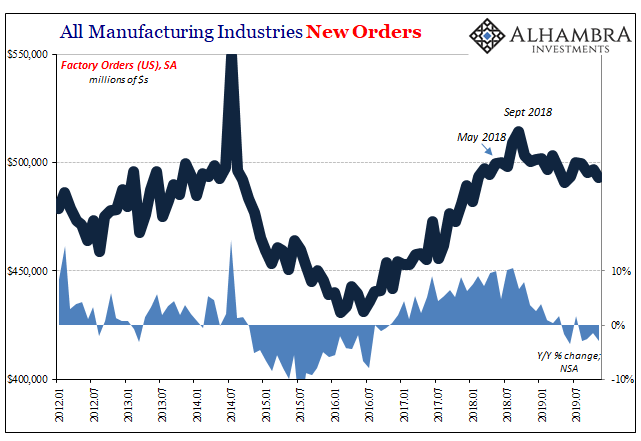

All Manufacturing Industries New Orders, 2012-2019 |

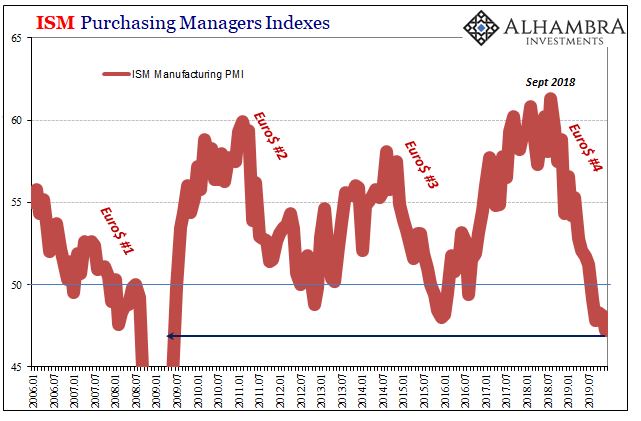

ISM Purchasing Manager Indexes, 2006-2019 |

|

| US imports have fallen rather sharply over the last several months, as noted earlier. The domestic factory sector’s nascent decline also appears to be picking up its pace. The Census Bureau also reported today that in addition to falling demand for foreign goods there must be the same going on for those produced inside the United States, too.

Factory orders declined for the fourth month in a row during November, making it six out of the last seven months. The 6-month average is now down to -1.9%, the worst since November 2016. It is still widely believed that the manufacturing and goods economy doesn’t amount to all that much, or enough of a proportion that it will mean anything more significant going forward. |

ISM Purchasing Manager Indexes, 2017-2019 |

| The service sector is believed relatively healthy and untouched by “whatever” it is plaguing global trade and manufacturing.

The data suggests otherwise. Even the ISM’s Non-Manufacturing PMI, which quite predictably rebounded in its latest number for December, released today, is clearly following behind what’s taking place in industry more broadly. It continues to follow: dollar, trade, manufacturing, all the rest. |

ISM Purchasing Manager Indexes, 2008-2019 |

| That would suggest if this manufacturing recession continues onward into 2020, including a potentially sharper downturn in autos (as well as retail overall), then services might inevitably lag and follow. It isn’t holding everything else up from the downward pressures in the goods economy, it is being dragged lower into the same sort of uncertain mess.

Even Jay Powell is saying so. His view instead is predicated on the “unexpected” downturn in manufacturing to turn itself around because he believes, or says, it was all due to “transitory” factors that will either dissipate on their own or will be shoved aside by his mid-cycle rate cut adjustment. But like 2018’s boom that never really boomed, at some point this purported rebound has to actually rebound; the data to match the idea. That doesn’t appear to be happening, especially when looking at the latest figures on imports and retail sales. The slowing continues to slow, not crash, with December’s OEM results in auto sales punctuating a disappointing end to 2019. The economy, especially where it is leading, still appears to be leaning in the wrong direction. As expected, for one more time the mythical second half rebound proved to be a myth. The question now is what happens during the first half of 2020? Which one was it that has been delayed; the rebound, or the full weight of the downturn? |

Retail Sales, NSA 2010-2019 |

Full story here Are you the author? Previous post See more for Next post

Tags: Auto Sales,currencies,economy,exports,factory orders,Federal Reserve/Monetary Policy,global trade,imports,manufacturing,Markets,newsletter,U.S. ISM Manufacturing PMI,U.S. ISM Non-Manufacturing PMI